How much will my Medicare premiums be?

Sep 14, 2020 · The Medicare Advantage and Part D payment policies for 2022, discussed in both Part I and Part II of the Advance Notice, will be finalized in the 2022 Rate Announcement published no later than April 5, 2021. For a fact sheet on Part I of the 2022 Advance Notice, please visit: https://www.cms.gov/newsroom/fact-sheets/2022-medicare-advantage-advance …

How much is the standard Medicare premium?

Apr 01, 2022 · Our 2022 Medicare Open Enrollment Guide will walk you through enrollment dates, tips for choosing a plan, and more. When is Medicare open enrollment? Medicare open enrollment – also known as Medicare’s annual election period – runs from October 15 …

When are Medicare premiums deducted from Social Security?

You enroll in Part B for the first time in 2022. You don’t get Social Security benefits. You’re directly billed for your Part B premiums. You have Medicare and Medicaid, and Medicaid pays your premiums. (Your state will pay the standard premium amount of $170.10 in 2022.) 2022 Medicare Costs

How to calculate Medicare premiums?

Jul 01, 2020 · Once you sign up for the Medicare Advantage during this time, note that the coverage will start January the next year; for instance, by enrolling in October 2021, your coverage will take effect on January 1st, 2022. How Medicare Advantage Works with Other Healthcare Plans Medicare Advantage plan is only compatible with Original Medicare.

When can I change my Medicare plan for 2022?

During the annual open enrollment period (October 15 – December 7), you can make a variety of changes, none of which involve medical underwriting: Switch from Medicare Advantage to Original Medicare or vice versa.Apr 1, 2022

Is Medicare expected to increase 2022?

Those who have paid Medicare taxes for 30 to 39 quarters will see their Part A premium increase to $274 per month in 2022 (up from $259 per month in 2021). And those with fewer than 30 quarters worth of Medicare taxes will likely see a jump from the current rate of $471 in 2021 to $499 in 2022.Jan 4, 2022

What is the proposed Medicare premium for 2022?

$170.10Medicare's Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program's history, the Centers for Medicare & Medicaid Services (CMS) announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.Nov 15, 2021

What is the monthly cost for Medicare in 2022?

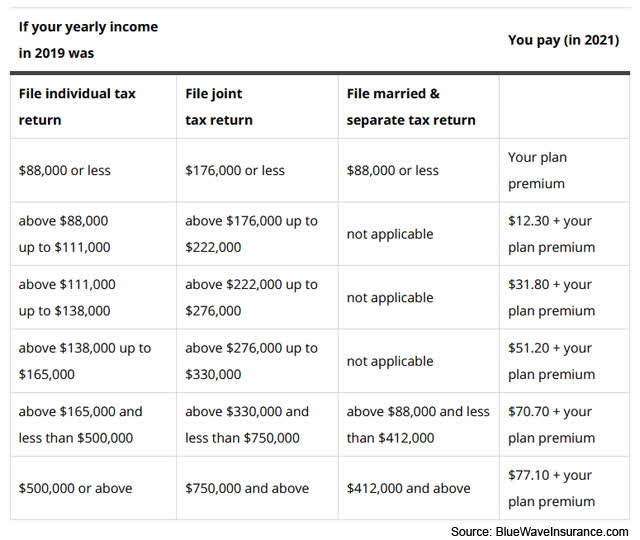

For most people, the cost of Medicare Part B for 2022 is $170.10 per month. This rate is adjusted based on income, and those earning more than $91,000 will pay higher premiums. For high-earners, the cost of Medicare Part B is based on your adjusted gross income (AGI) from your previous year's taxes.Mar 18, 2022

Will Social Security get a raise in 2022?

Social Security and Supplemental Security Income (SSI) benefits for approximately 70 million Americans will increase 5.9 percent in 2022. Read more about the Social Security Cost-of-Living adjustment for 2022. The maximum amount of earnings subject to the Social Security tax (taxable maximum) will increase to $147,000.

Will Social Security get a $200 raise in 2022?

The 2022 COLA increases have been applied to new Social Security payments for January, and the first checks have already started to hit bank accounts. This year, the highest COLA ever will be applied to benefits, with a 5.9% increase to account for rampant and sudden inflation during the pandemic.Jan 22, 2022

What changes are coming to Social Security in 2022?

To earn the maximum of four credits in 2022, you need to earn $6,040 or $1,510 per quarter. Maximum taxable wage base is $147,000. If you turn 62 in 2022, your full retirement age changes to 67. If you turn 62 in 2022 and claim benefits, your monthly benefit will be reduced by 30% of your full retirement age benefit.Jan 10, 2022

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What will the Medicare Part B deductible be in 2022?

$233 inMedicare Part B Premium and Deductible The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

How much is deducted from Social Security for Medicare?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.Nov 24, 2021

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

Is Medicare premium based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

When is Medicare open enrollment?

Medicare open enrollment – also known as Medicare’s annual election period – runs from October 15 through December 7 each year. (Although Medicare’...

What plan changes can I make during the Medicare open enrollment period?

During the Medicare open enrollment period, you can: Switch from Original Medicare to Medicare Advantage (as long as you’re enrolled in both Medica...

How do I enroll in Medicare Advantage?

To join a Medicare Advantage Plan, you will need to have Original Medicare (Part A and Part B) coverage and live in an area where an Advantage plan...

When can I enroll in Medicare Part D?

The first opportunity for Medicare Part D sign up is when you’re initially eligible for Medicare – during the seven-month period beginning three mo...

How do I enroll in a Medicare Supplement (Medigap) plan?

During your initial Medigap enrollment period (the six months starting with the month you’re at least 65 years old and enrolled in Medicare A and B...

What are the changes to Medicare Advantage Plans in 2022?

Medicare Advantage Plans in 2022 Changes are: Better telehealth services offered to the patients. The initial coverage limit has been updated by Part D of Medicare along with donut hole closing. People suffering from renal diseases (end-stage) can now register for Advantage Plans.

How much is Medicare Advantage 2021?

However, we can help you determine the average costing of the Medicare Advantage in 2021. An advantage plan in the year 2021 was at $140. The plans can have a premium as low as $0 and can jump to $300 or even more in some cases. The above prices included just the monthly premium that you’ll have to pay.

What is Medicare Supplement Plan?

The supplement plans are specifically meant to help seniors cover the gaps which Part B and A of Medicare could not cover. And this is what makes seniors opt for supplement plans. Medicare mandates the Advantage plans to offer coverage as Part B and Part A offer.

How old do you have to be to enroll in Medicare Advantage?

If you want to register for Advantage plans, you first have to qualify for the Original Medicare. In most cases, you should be at least 65 years of age or older. And if you’re not clear on the eligibility criterion, you can contact us to get your queries answered.

Why are Advantage plans so popular?

The Advantage plans are popular and are highly opted for by seniors. It’s because such plans are not only economical but offer decent coverage too. Seniors no longer need to sign up for multiple plans to increase their coverage. Its because the advantage plans offer benefits offered by a few plans combined.

What is Plan F?

Plan F retained the top spot as it offered 100% coverage for all the gaps left in Medicare. It means if you were enrolled in Plan F, you could visit almost any doctor who accepts Medicare and walk out without paying anything, which means:

When will end stage renal disease be eligible for Medicare Advantage?

Enrollment of individuals with End-stage renal disease into Advantage plans in 2022. This one is another significant change brought about by CMS. According to this change, people with end-stage renal diseases can register for the Medicare advantage in the year 2022.

When will Medicare open enrollment start in 2022?

Medicare open enrollment for 2022 coverage starts on October 15, 2021, and continues through December 7. Learn how you can change your Medicare coverage outside of the fall open enrollment period.

How much will Medicare cost in 2021?

The standard Part B premium for 2021 is $148.50 per month. The increase in the Part B premiums was limited by the short-term government spending bill that was signed into law on October 1, 2020. The Part B premium for most enrollees was $144.60/month in 2020, and the spending bill capped the increase for 2021 at a quarter of what it would otherwise have been. Earlier in 2020, the Medicare Trustees Report had projected a Part B premiums of $153.30 per month for most enrollees in 2021. The actual price that people pay can also also be limited by the Social Security cost of living adjustment (COLA) that beneficiaries receive, but the 1.3% COLA for 2021 was adequate to allow the full standard Part B premium to be deducted from most beneficiaries’ Social Security checks.

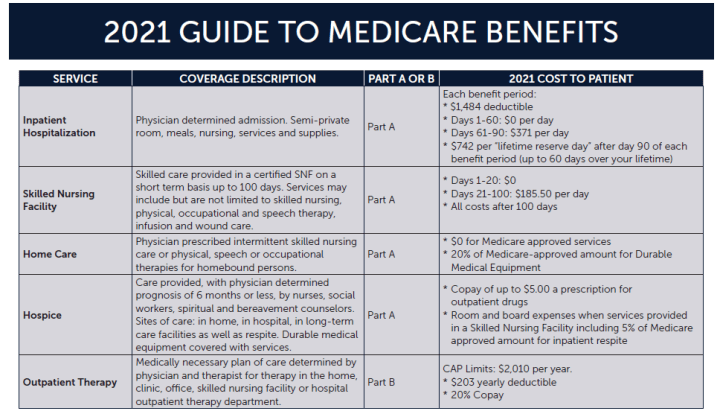

How much is coinsurance for skilled nursing in 2021?

After the first 20 days, your skilled nursing facility coinsurance in 2021 is $185.50 per day for days 21-100 (after that, Medicare no longer covers skilled nursing facility charges, so you’ll pay the full cost). Supplemental coverage, including Medigap plans, is designed to pay the Part A coinsurance on your behalf.

What is Medicare's general enrollment period?

Medicare’s general enrollment period is for people who didn’t sign up for Medicare Part B when they were first eligible, and who don’t have access to a Medicare Part B special enrollment period. It’s also for people who have to pay a premium for Medicare Part A and didn’t enroll in Part A when they were first eligible.

What is the Medicare Advantage Plan 2021?

$7,550 is the upper limit; the average Medicare Advantage plan tends to have an out-of-pocket cap below the maximum that the government allows.

How much is Part A coinsurance for 2021?

2021 Part A coinsurance: $371 per inpatient day (days 61-90 in the benefit period for which the deductible applied; up from $352 per day in 2020) $742 per inpatient day for day 91 and beyond during the benefit period (up from $704 per day in 2020).

When does Medicare coverage take effect?

If you enroll during the general enrollment period, your coverage will take effect July 1. Learn more about Medicare’s general enrollment period. Back to top.

How to open enrollment for Medicare?

Medicare Open Enrollment 2022 1 Enrolling in a Medicare Advantage Plan and leaving Original Medicare 2 Switching from one Medicare Advantage to a different plan 3 Leaving a Medicare advantage plan to return to Original Medicare and a Medigap plan 4 Changing your Part D drug plan

Where do you get Medicare Advantage?

You only receive full benefits if you go to the hospitals, clinics, pharmacies and doctor’s offices where your insurance company is accepted. Each Medicare Advantage plan is sold by an insurance company, and these companies have agreements with healthcare facilities in their state or across the country.

Does Medicare Advantage cover dentists?

Medicare Advantage plans often include benefits for checkups. This can cover you for visits to the dentist, optometrist, audiologist and your general practitioner.

Do Medicare Advantage plans come with drug coverage?

You are guaranteed all this benefits no matter how much or how little you pay for your Advantage plan. Most Advantage plans come with a drug coverage plan on top of all that, called Medicare Part D. This will help you out with the cost of generic drugs as well as name brand drugs.

Does Medicare have the same coverage as Advantage?

No matter which of the many Advantage plans you choose from, you can count on certain medical benefits being included. This is going to be true even of Advantage plans in 2022, as no changes to the benefits are expected to occur. Medicare announces any changes to its medical benefits for its plans, and even though Medicare does not sell Advantage plans, it does decide what their basic benefits will be.

Will Medicare prices increase in 2022?

Some years, the price increases may be minor. We can’t say for sure how much the prices will increase by for the year 2022, but we do expect a small increase from most of the insurance companies.

Will enrollment change in 2022?

Enrollment should not change at all for 2022. Any changes to the enrollment process would be announced well ahead of time, and while there is still time before 2022 roll around, we don’t expect the enrollment process to undergo any changes by then.

What is the effective payment rate for 2022?

In the rule’s Advance Notice, CMS estimated that the effective payment growth rate for 2022 would be 4.55%, but that jumped to 5.59% in the final rule, resulting in a 4.08% increase in revenue. This is a good sign for MA organizations, indicating that CMS is not expecting a significant cost rebound after the major drop due to deferred or foregone care.

What is the MA contract year for 2022?

The 2022 MA contract year will be the first-time individuals with end-stage renal disease (ESRD) will be allowed to enroll in a plan. Although increasing membership is the goal of every MA organization, ESRD is a very expensive condition to manage. The average beneficiary with ESRD cost $67,116 in 2016 compared to $10,182 per beneficiary without the condition. Another report showed that costs for members with ESRD exceeded MA benchmarks in nearly 46% of metropolitan areas. MA organizations need to ensure going into their contract bidding process for 2022 that they have the most accurate and timely data available on new members with ESRD to avoid unanticipated financial losses.

What percentage of Medicare beneficiaries use telehealth?

Among the many other designations, 2020 may be known as the year everyone used telehealth, including seniors. Sixty percent of Medicare beneficiaries with a regular provider reported access to telehealth appointments. This adoption rate is likely to increase given that 82% of seniors also report that they have high-speed Internet access and 91% of Medicare Advantage plan members report at least somewhat favorable telehealth experiences.

What is RxHCC in MA?

The Part D Hierarchical Condition Category (RxHCC) model was updated in the 2022 final rule and may impact MA organizations’ bottom lines. For example, the risk score calculations will be based on 2017 diagnoses paired with 2018 drug data, each updated by three years. Like the RAF score, the RxHCC will be based solely on encounter data, which may be lacking for most organizations due to the delayed or foregone care. Regardless, estimates show an across-the-board risk score decrease for RxHCC, which means reduced revenue for MA organizations on drug costs. However, plans can expect to recover those losses in the coming year as more beneficiaries resume in-person care.

Will the RAF score increase in 2022?

Although payment growth will be higher than expected in 2022, this revenue increase may be offset for some payers due to changes in the risk adjustment factor (RAF) score calculation. As announced years ago, in 2022, the RAF score will be 100% based on data from the Encounter Data System (EDS) and fee-for-service claims instead of a blend of encounter data and Risk Adjustment Processing System (RAPS) data.

Will Medicare change in 2022?

Medicare Advantage plan changes coming for 2022. The greatest uncertainty is members’ health status , which could impact MA organizations’ bidding submission process for 2022. Fortunately, fully vaccinated members are likely to resume in-person care this year, which means MA plans can expect a more consistent and reliable stream ...

When will the ACA open enrollment end?

In every state, open enrollment for ACA-compliant 2021 health coverage for individuals and families started on November 1 and ended on December 15, 2020. | Image: Alex from the Rock / stock.adobe.com.

When is the enrollment window for Medicaid in Washington?

Washington: February 15 to May 15. Some of these enrollment windows are available to anyone eligible to use the marketplace, including people who already have a plan and would like to pick a different one (that’s the approach that HealthCare.gov is using). Others only apply to people who are currently uninsured.

What is the role of a health insurance navigator?

The health insurance Navigator role was created for the purpose of providing impartial education and outreach about the exchanges and exchange health plans, helping applicants determine whether they qualify for subsidies or Medicaid, and assisting them in the enrollment process. Standards and regulations for the Navigator program are outlined in 45 CFR 155.210 and CFR 45 155.215.

How much is the ACA penalty?

The ACA’s federal individual mandate penalty has been $0 since the start of 2019, and that will continue to be the case in 2021. People who are uninsured will not face a penalty, unless they’re in a state that has its own individual mandate and a penalty for non-compliance.

What is SEP in health insurance?

If you have a qualifying event during the year, you’ll have access to a special enrollment period (SEP). Qualifying events include marriage (assuming at least one spouse already had coverage prior to the marriage), the birth or adoption of a child, loss of other minimum essential coverage, or a permanent move to a new geographical area where the available health plans are different from what was available in your prior location (assuming you already had coverage prior to your move).

How many states will have the Marketplace in 2021?

It’s available in every state that uses HealthCare.gov, which includes 36 states as of 2021.

When is the enrollment period for the Biden administration?

To address the ongoing COVID pandemic, the Biden administration announced a special enrollment period that began February 15, 2021, and continued through August 15, 2021 (this is an extended deadline; it was originally scheduled to end in May 2021).

What is Medicare Part D 2021?

Medicare Part D costs include the initial deductible, initial coverage limit, out-of-pocket threshold, and the coverage gap, also known as the donut hole.

How much is the deductible for Part D in 2021?

The initial deductible for Part D is $445 in 2021. In 2022, the initial deductible will be $480.

How much does Medicare Part D cost?

The average premium for Medicare Part D is around $40 a month. The premiums do vary by location and plan. Medications that fall on the higher tiers attract higher coinsurance costs and co-payments compared to those on the lower tiers.

What is the Medicare donut hole?

The coverage gap is known as the donut hole. It begins once you reach your Medicare Part D costs plan’s initial coverage limit and ends when you spend a total of $6,550. Part D enrollees will receive a 75% discount on the total cost of their brand-name drugs purchased while in the donut hole. The 75% discount paid by the brand-name drug ...

How much discount do you get for a brand name drug?

The 75% discount paid by the brand-name drug manufacturer will apply to get out of the donut hole. For example: if you reach the donut hole and purchase a brand-name medication with a retail cost of $100, you will pay $25 for the medication, and receive $95 credit toward meeting your total out-of-pocket spending limit.

What are not covered prescriptions?

Not Covered Prescriptions: Drugs for cosmetic purposes. Medicines for anorexia, weight gain, or weight loss. Drugs meant to relieve colds and coughs. Medications for erectile dysfunction. Individual outpatient drugs. Over-the-counter medications. Minerals or vitamin drugs except those noted in the formulary.

Do you have to pay a coinsurance for Medicare Part D?

If you receive extra help paying your Part D Medicare costs. One major cost that you should consider is the monthly premium. Stand-alone Part D policies and Medicare Advantage policies have a monthly premium. Other than the monthly premiums, you may have to pay an annual deductible and a co-payment/coinsurance.