Does Medicare Part B have to start on the first of the month?

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month. If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65.

Does Medicare Part B start automatically?

Medicare will enroll you in Part B automatically. Your Medicare card will be mailed to you about 3 months before your 65th birthday. If you're not getting disability benefits and Medicare when you turn 65, you'll need to call or visit your local Social Security office, or call Social Security at 1-800-772-1213.

How soon before I retire should I apply for Medicare Part B?

Generally, you're first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65. (You may be eligible for Medicare earlier, if you get disability benefits from Social Security or the Railroad Retirement Board.)

What is the grace period for Medicare Part B?

a 90 dayThis final rule changes the termination date for Supplementary Medical Insurance (SMI) (Part B) enrollees who fail to pay their Medicare Part B premiums. Presently, there is a 90 day grace period for the enrollee during which he or she may pay all overdue premiums and continue Part B coverage uninterrupted.

Are you automatically enrolled in Medicare Part A when you turn 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

How do you pay for Medicare Part B if you are not collecting Social Security?

If you have Medicare Part B but you are not receiving Social Security or Railroad Retirement Board benefits yet, you will get a bill called a “Notice of Medicare Premium Payment Due” (CMS-500). You will need to make arrangements to pay this bill every month.

How do I opt out of Medicare Part B?

To disenroll, you're required to submit a form (CMS-1763) that must be completed either during a personal interview at a Social Security office or on the phone with a Social Security representative. For an interview, call the Social Security Administration at 1-800-772-1213, or your local office.

How do I decline Medicare Part B?

Call the Social Security Administration at 800-772-1213 and ask if you can decline Part B without any penalties. Write down who you spoke with, when you spoke to them and what they said. should write a letter to the Social Security Administration declining Part B. Keep a copy of the letter for yourself.

Are Medicare Part B premiums going up in 2021?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.Jan 12, 2022

Does Medicare Part B pay for prescriptions?

Medicare Part B (Medical Insurance) includes limited drug coverage. It doesn't cover most drugs you get at the pharmacy. You'll need to join a Medicare drug plan or health plan with drug coverage to get Medicare coverage for prescription drugs for most chronic conditions, like high blood pressure.

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

You Always Need Part B If Medicare Is Primary

Once you retire and have no access to other health coverage, Medicare becomes your primary insurance. While Part A pays for your room and board in...

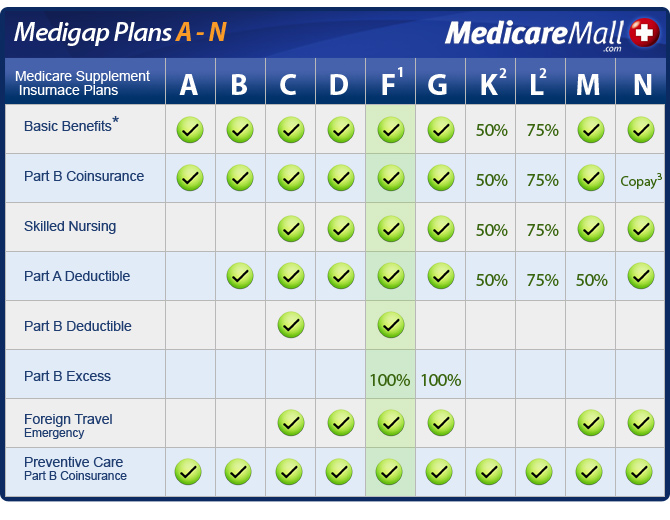

You Need Part B to Be Eligible For Supplemental Coverage

Medigap plans do not replace Part B. They pay secondary to Part B.Part B works together with your Medigap plan to provide you full coverage. This m...

Do I Need Medicare Part B If I Have Other Insurance?

Many people ask if they should sign up for Medicare Part B when they have other insurance. At a large employer with 20 or more employees, your empl...

Enrolling Into Part B on A Delayed Basis

If you have delayed Part B while you were still working at a large employer, you’ll still need to enroll in Part B eventually. When you retire and...

Do I Need Medicare Part B If I’M A Veteran?

Some people have 2 different coverages that they can choose independent of one another. Federal employees who can opt to use their FEHB instead of...

Most Common Mistakes Regarding Part B

The most common mistake we see is from people who confuse Part B and Medigap. Just this week, a reader on our Facebook page commented that she was...

How long do you have to enroll in Part B if you retire?

When you retire and lose your employer coverage, you’ll be given a 8-month Special Enrollment Period to enroll in Part B without any late penalty.

How much is Part B insurance?

Most people delay Part B in this scenario. Your employer plan likely already provides good outpatient coverage. Part B costs at least $148.50/month for new enrollees in 2020.

How much does Medicare pay for outpatients?

Your healthcare providers will bill Medicare, and Part B will then pay 80% of your outpatient expenses after your small deductible. Medicare then sends the remainder of that bill to your Medigap plan to pay the other 20%. The same goes for Medicare Advantage plans.

What happens if you opt out of Part B?

Be aware that if you opt out of Part B and then later decide to join, you will pay a Part B late penalty. You’ll also need to wait until the next General Enrollment Period to enroll, which means there could be a delay before your coverage becomes active. In my opinion, most Veterans should sign up for Part B.

Does Medigap replace Part B?

Medigap plans do not replace Part B. They pay secondary to Part B. Part B works together with your Medigap plan to provide you full coverage. This means you must be enrolled in Part B before you are even eligible to apply for a Medicare supplement.

Do you have to be enrolled in Part B for Medicaid?

When you are 65 or older and enrolled in Medicaid. All of these scenarios require you to be enrolled in Part B. Without it, you would be responsible for the first 80% of all outpatient charges. Even worse, your secondary coverage may not pay at all if you are not actively enrolled in Part B as your primary coverage.

Do you need Part B before you can enroll in Medigap?

Conclusion. To recap the important points in this article, most people need Part B at some point. When you enroll will depend on what other coverage you currently have when you turn 65. Also, Part B is not a supplement. You need Part B before you can enroll in Medigap or a Medicare Advantage plan.

What is the first form to get Medicare Part B?

The first for you need is the Part B enrollment form found here: Medicare Part B enrollment application . Another important form is for your (or spouse) employer to show that you have had coverage since you were first eligible for Medicare at age 65. This is to ensure no penalty is added to your monthly Part B premiums.

How long before you turn 65 can you apply for Medicare?

You can apply 3 months prior to turning 65, the month you turn 65, or 3 months after turning 65. Your Medicare Part B benefits will be effective the first day ...

What happens if you don't enroll in Medicare Part B?

If you have VA benefits and do not enroll for Part B during your initial enrollment period, you may be assessed the Part B premium penalty if you decide to enroll for Part B at a later date. Get the benefits you deserve when you turn 65 by enrolling in Medicare. To find out more information about enrolling in Medicare Part B, ...

How much is the penalty for not having Medicare Part B?

The penalty could be as much as 10% for each full 12-month period you did not have Part B and were eligible. Additionally, if you do not sign up for Medicare Part B during your Initial Enrollment Period and you do not have a Special Enrollment Period due to loss of group coverage, you will have to wait until the General Enrollment Period ...

How much is the Part B premium?

The standard monthly Part B premium in 2020 is $144.60 (up from $135.50 in 2019). 1 But how much you'll pay depends on your income. See below how the Part B premium is figured.

Where to drop off Medicare Part B?

Print these forms, get them filled out, and drop them off at your local Social Security office. The first for you need is the Part B enrollment form found here: Medicare Part B enrollment application .

Is eligibility.com a Medicare provider?

Eligibility.com is a DBA of Clear Link Technologies, LLC and is not affiliated with any Medicare System Providers.

When do you have to enroll in Medicare Part B?

When You Must Enroll in Medicare Part B. You may be required to get Medicare Part B even when you’re still working. There are two situations in which you must get Part B when you turn 65. If your employer has fewer than 20 employees. If you’re covered by a spouse’s employer, and the employer requires covered dependents to enroll in Medicare ...

When do dependents have to enroll in Medicare?

If you’re covered by a spouse’s employer, and the employer requires covered dependents to enroll in Medicare when they turn 65. If you’re not married but living in a domestic partnership and are covered by your partner’s employer health insurance.

How long does it take to enroll in Medicare if you lose your employer?

When you lose your employer coverage, you will get an 8-month Special Enrollment Period during which to enroll in Medicare Part B, and Part A if you haven’t done so already. You’ll also be able to enroll in a Medicare Advantage (Part C) plan or Part D prescription drug plan in the first two months of this period.

How much does Medicare Part B cost?

Part B is different. Unlike Part A, Medicare Part B has a monthly premium, which can cost $148.50 to $504.90 depending on income. It has a late enrollment penalty for anybody who enrolls without qualifying for a Special Enrollment Period.

Can you avoid Medicare if you file for Social Security?

PHIL: When you file for Social Security, by law you must receive Part A of Medicare. You can't avoid it. If you want to get Social Security benefits, you have to be enrolled in Part A.

Qualifying For Different Types Of Coverage

Medicare is a federal insurance program that helps pay medical bills from a fund to which users have contributed. It covers people 65 and older, people younger than 65 with certain disabilities and patients with end-stage kidney disease and other conditions requiring dialysis. Participants usually pay part of the cost.

Can I Select An Insurance Plan For My Medicare And Medicaid Benefits

If you are dual eligible, you are can enroll in a dual eligible special needs plan that covers both Medicare and Medicaid benefits. These plans may also pay for expenses that Medicare and Medicaid dont over individually, including over-the-counter items, hearing aids, and vision or dental care.

If I Have Other Health Insurance Do I Need Part B

65 Incorporated came across this question from a Medicare beneficiary.

Do You Need Medicare Part B

Ever wonder if you really need Medicare Part B? For most people over 65 the answer is: Yes, you need to enroll in Part B and you should do so when first eligible. If you miss your Part B deadline, you could be subject to penalties. Check out our Medicare deadline Calculator here

Medicare Part B Enrollment And Penalties

Medicare Part B is optional, but in some ways, it can feel mandatory, because there are penalties associated with delayed enrollment. As discussed later, you dont have to enroll in Part B, particularly if youre still working when you reach age 65.

Do I Need Medicaid If I Have Medicare

Medicaid and Medicare are the two largest publicly funded health programs in the country, with different missions that often overlap. Medicare provides health coverage to seniors and some individuals with disabilities. Medicaid covers adults and children who cannot afford insurance, or who have health care costs they cannot afford.

What The Part B Late Enrollment Penalty

If you do not have creditable coverage after you first become eligible for Medicare Part B, you incur a penalty that you will pay when you eventually do enroll in Part B.

How can I find out if my Medicare Part B application has been approved?

You can find out if your Medicare application was accepted by calling the Social Security office or by checking online at www.socialsecurity.gov.

How long does it take for a Medicare Part B application to be approved?

between 30-60 days If you have previously been a railroad employee, you can enroll in Medicare by contacting the Railroad Retirement Board, Monday – Friday, from 9:00 AM – 3:30 PM at 1-877-772-5772. Medicare applications generally take between 30-60 days to obtain approval.

Can I check my Medicare status online?

If you applied for Medicare online, you can check the status of your application through your Medicare or Social Security account. You can also visit the Check Enrollment page on Medicare.gov and find information about your enrollment status by entering your: ZIP code.

Can I check my SSN status online?

If you applied for Social Security benefits, or have a pending reconsideration or hearing request, you can check the status online using your free personal my Social Security account. If you don’t have an account, you can create one to see the following information about your claim: Date of filing.

How do I check my Medicare eligibility online?

Check Online for Free at Medicare.gov The Medicare website lists the general qualifications to get Medicare coverage. It also has resources to determine the applicant’s eligibility for Medicare.

How do I get my Medicare statement?

Log into (or create) your Medicare account. Select “Get your Medicare Summary Notices (MSNs) electronically” under the “My messages” section at the top of your account homepage. You’ll come to the “My communication preferences” page where you can select “Yes” under “Change eMSN preference,” then “Submit.”

How do I check the status of my Medicare card?

To check the status of card mailing in your state, go here: https://www.medicare.gov/newcard/. The map will show whether Medicare has sent new cards to your state. Once Medicare starts mailing cards to your state, it can take up to a month to receive the card.