Full Answer

What drugs are covered in Part D?

- Oral cancer drugs: Medicare helps pay for some oral cancer drugs you take by mouth if the same drug is available in injectable form or the drug is a prodrug ...

- Oral anti-nausea drugs: Medicare helps pay for oral anti-nausea drugs used as part of an anti-cancer chemotherapeutic regimen if they’re administered before, at, or within 48 hours of chemotherapy or ...

- Self-administered drugs in hospital outpatient settings: Medicare may pay for some self-administered drugs, like drugs given through an IV. ...

What plans are available for Medicare Part D?

- Monthly premiums

- Annual deductible (maximum of $445 in 2021)

- Copayments (flat fee you pay for each prescription)

- Coinsurance (percentage of the actual cost of the medication)

What are the requirements for Medicare Part D?

- Prior to the individual’s initial period of entitlement for Medicare Part D

- Prior to the effective date of the individual’s enrollment in the employer’s prescription drug plan

- Upon any change in the employer’s prescription drug coverage as creditable or non-creditable

- Annually, on or before October 15 of each year

- Upon an individual’s request.

What drugs are excluded from Part D plans?

What drugs are excluded from Part D plans? There are many drugs that no Medicare plans will cover under the Part D benefit, based on national Medicare guidelines. Drugs for anorexia, weight loss, or weight gain (i.e., Xenical®, Meridia, phentermine HCl, etc.) Drugs that promote fertility (i.e., Clomid, Gonal-f, Ovidrel®, Follistim®, etc.)

Can I add Medicare Part D at anytime?

Keep in mind, you can enroll only during certain times: Initial enrollment period, the seven-month period that begins on the first day of the month three months before the month you turn 65 and lasts for three months after the birthday month.

How long do I have to enroll in Medicare Part D?

7 monthsFor people who are new to Medicare, the Initial Enrollment Period (IEP) for Part D is 7 months long. It begins 3 months prior to the month you become eligible for Medicare Part A or B, includes the month you become eligible and ends 3 months later.

Is there a grace period for Medicare Part D?

The Centers for Medicare and Medicaid Services (CMS) have implemented safe-guards to protect Medicare beneficiaries who inadvertently missed a Medicare Part D premium payment and require Medicare plans to contact plan members about the unpaid premiums and provide "a consistent grace period of no less than two (2) ...

How do I submit Medicare Part D?

Contact your doctor or supplier, and ask them to file a claim. If they don't file a claim, call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. Ask for the exact time limit for filing a Medicare claim for the service or supply you got.

What is the main problem with Medicare Part D?

The real problem with Medicare Part D plans is that they weren't set up with the intent of benefiting seniors. They were set up to benefit: –Pharmacies, by having copays for generic medications that are often far more than the actual cost of most of the medications.

What are the 4 phases of Medicare Part D coverage?

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.

Is Medicare Part D optional or mandatory?

Medicare drug coverage helps pay for prescription drugs you need. Even if you don't take prescription drugs now, you should consider getting Medicare drug coverage. Medicare drug coverage is optional and is offered to everyone with Medicare.

What is the cost of Part D Medicare for 2022?

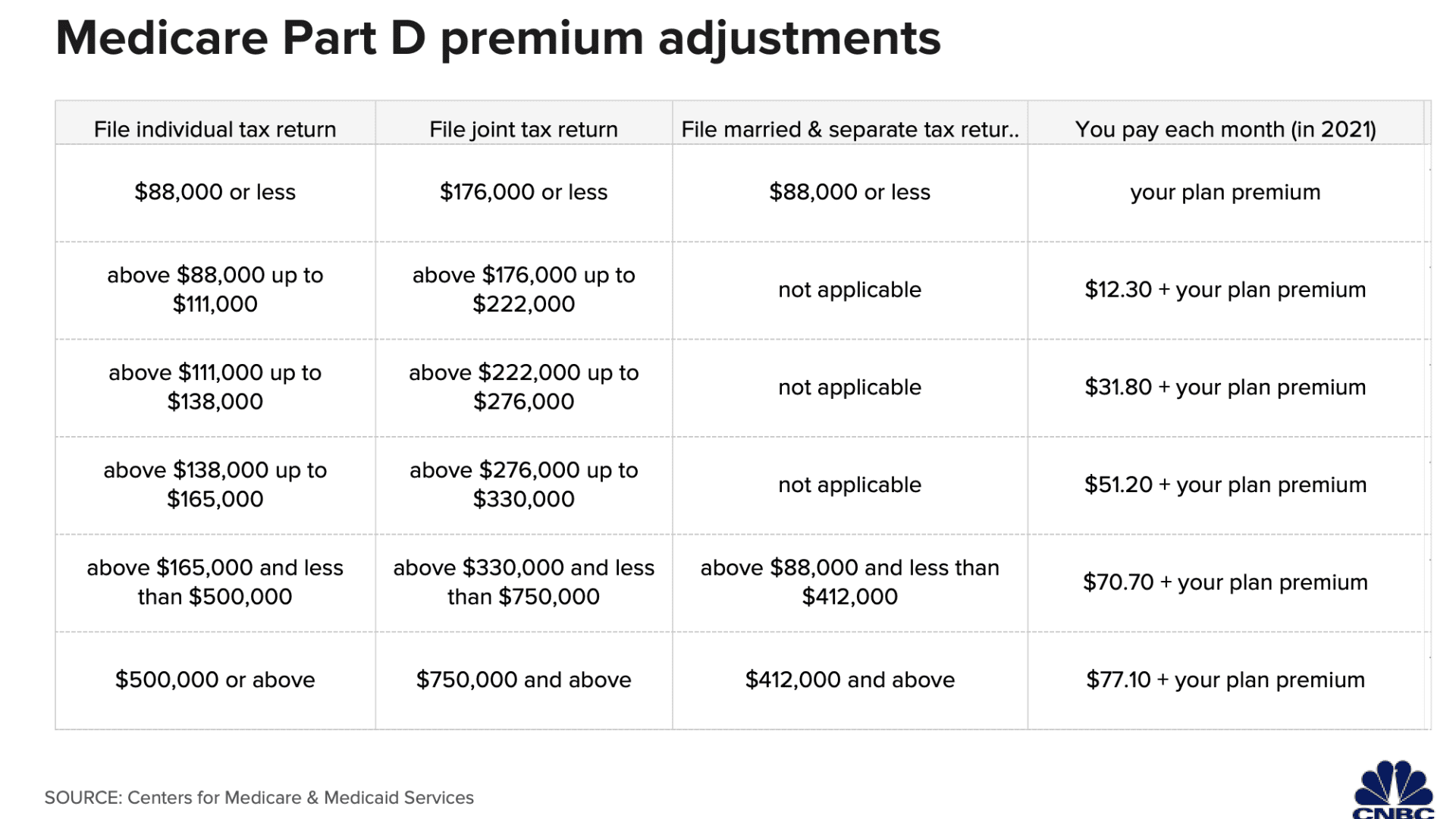

$33Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.

Why was my Medicare Part D Cancelled?

Why was my Medicare plan coverage cancelled? Your Medicare Part D prescription drug plan (PDP) or Medicare Advantage plan (MA, MAPD, or SNP) coverage can be cancelled because of changes to the Medicare plan or because of something that you have done (or not done).

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Does Medicare Part D cover prescriptions?

Medicare Part D, the prescription drug benefit, is the part of Medicare that covers most outpatient prescription drugs. Part D is offered through private companies either as a stand-alone plan, for those enrolled in Original Medicare, or as a set of benefits included with your Medicare Advantage Plan.

How long does Medicare Part D penalty last?

Since the monthly penalty is always rounded to the nearest $0.10, she will pay $9.70 each month in addition to her plan's monthly premium. Generally, once Medicare determines a person's penalty amount, the person will continue to owe a penalty for as long as they're enrolled in Medicare drug coverage.

Who Needs to Sign up for a Medicare Part D Plan?

As you can see in the example above, the Part D penalty can be significant. With Part D premiums (for 2018) starting at around $15 in most states, most people find it beneficial to have at least minimal Part D coverage when they start with Medicare, even if their medication needs are non-existent.

What is Medicare Part D?

Medicare Part D is the part of Medicare that covers prescription drugs. “Original” Medicare (Part A and Part B) does not provide any coverage for prescription drugs. All prescription drug coverage for Medicare beneficiaries is provided through Medicare Part D ( How to Compare Part D Plans ). So, the question we often get from people turning 65 ...

How Much is the Medicare Part D Late Enrollment Penalty?

The Medicare Part D Late Enrollment Penalty is calculated based on how long you have been without creditable prescription coverage. In other words, your penalty is applied when you enroll in a prescription plan. If you wait longer, the penalty will be higher. The penalty is 1% per month that you don’t have a plan. The 1% per month is multiplied by the “national base beneficiary premium” – for 2018, this is $35.02.

What happens if you don't sign up for Medicare Part D?

What Are the Implications of Not Signing up for Part D When You Are First Eligible? First and foremost, Medicare has a “late enrollment penalty” for not signing up for Part D when you are first eligible. For many people, this initial eligibility is when you turn 65 and start Medicare. In this situation, you have an initial election period ...

How much is the penalty for not having a Medicare plan?

The penalty is 1% per month that you don’t have a plan. The 1% per month is multiplied by the “national base beneficiary premium” – for 2018, this is $35.02. For example, if you turned 65 in April of 2015, have no other drug coverage, and enrolled in a Part D plan to start 1/1/18, your penalty would start after your initial election period expired ...

How long does Medicare Part D last?

In this situation, you have an initial election period to choose a Part D plan that lasts for seven months – the month you turn 65 plus three months on each side of the turning 65 month.

How long do you have to sign up for a Part D plan?

In this situation, you have two months after the group coverage ends to sign up for a Part D plan.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

When does Medicare start?

A general enrollment period (Jan. 1 to March 31 each year), if you missed your deadline for signing up for Medicare (Part A and/or Part B) during your IEP or an SEP. In this situation Medicare coverage will not begin until July 1 of the same year in which you enroll.

When is open enrollment for Medicare?

The annual open enrollment period (Oct. 15 to Dec. 7 each year) when you can join a drug plan for the first time if you missed your deadlines for your IEP or a SEP, or switch from original Medicare to a Medicare Advantage plan, or switch from one Medicare Advantage plan to another, or switch from one Part D drug plan to another.

What happens if you don't sign up for Part D?

If you fail to sign up during one of these time frames, you face two consequences. You will be able to enroll in a Part D plan only during open enrollment, which runs from Oct. 15 to Dec. 7, with coverage beginning Jan. 1. And you will be liable for late penalties, based on how many months you were without Part D or alternative creditable coverage since turning 65, which will be added to your Part D drug premiums for all future years.

What happens if you don't enroll in Medicare?

Failing to enroll within this time period, also known as the initial enrollment period, means that you may face a late enrollment penalty if you choose to add Part D coverage at a later date. Although this penalty is added only after adding Part D coverage following the initial enrollment period, it may stick around for the duration of your Medicare enrollment even if you choose to remove Part D coverage in the future .

Why is Medicare important?

Enrolling in Medicare is an important step for many people in protecting their health and their finances as they age. The Medicare program assists millions of seniors and certain individuals with qualifying disabilities, and without Medicare, some Americans would struggle to afford the cost of healthcare and related expenses.

When is the best time to sign up for Part D?

If you don’t have creditable drug coverage or health insurance from a current employer, the best time to sign up for Part D is during your 7-month initial enrollment period (IEP) to avoid penalties. Under your IEP, you have a 7-month window that opens 3 months before you turn 65 and closes at the end of the 3rd month following your birthday month.

What do you need to know before enrolling in a Part D plan?

The most important preparation you can do before finding a Part D plan is recording information about your medications.

How does dosage affect Part D?

Your dosage can affect your final cost or enact certain plan restrictions depending on the Part D plan. The frequency of the medication. The number of pills you take also affects the cost, so double check how often you take your medication and write it down. Once you have these recorded, you’ll be able to compare plans, apples-to-apples.

How long does it take to reply to a 401(k) plan?

Once you’ve applied, the plan has 10 calendar days to reply in one of three ways:

Is eligibility.com a DBA?

Content on this site has not been reviewed or endorsed by the Centers for Medicare & Medicaid Services, the United States Government, any state Medicare agency, or any private insurance agency (collectively "Medicare System Providers"). Eligibility.com is a DBA of Clear Link Technologies, LLC and is not affiliated with any Medicare System Providers.

Is Medicare Part D a good program?

Although Medicare is not without its faults, one thing is clear: Medicare Part D has been a successful program. With nearly 70% of all beneficiaries enrolled in Part D, this optional add-on to Original Medicare is a popular way to lower drug costs. 1. But before diving into the deep end of Part D plans, you’ll want to perform due diligence ...

What is Medicare Part D?

Medicare Part D is the part of Medicare that helps Medicare beneficiaries pay for some or all of their prescription drug costs. Part D plans are offered by private insurance companies as stand-alone prescription drug plans. When you sign up for a Part D plan, you pay a monthly premium to your insurance carrier and in return, you receive access to retail prescription drugs at a more affordable price.

What Happens if I don’t enroll in a Part D plan when I’m first eligible?

If you miss your Initial Enrollment Period or decide to delay Part D enrollment, you will have to pay a late enrollment penalty for each month you went without prescription drug coverage unless you

Do I need to enroll in the same Medicare plan as my spouse?

There is no need to join the same Medicare Part D plan as your spouse. Medicare is an individual health plan, there are no joint plans. When choosing a Part D plan it is important to consider your individual health needs. While one plan may work well for you, it may not work for your spouse.

Low Income Subsidy Questions

I have both Medicare and full Medicaid coverage. Do I need to apply for extra help to pay for Medicare prescription drug coverage? No. The “extra help” is a subsidy that people with Medicare and Medicaid automatically qualify for without having to complete an application.

How To Check Your Medicare Application Online

If you applied for Medicare online, you can check the status of your application through your Medicare or Social Security account. You can also visit the Check Enrollment page on Medicare.gov and find information about your enrollment status by entering your:

How Does Medicare Part D Work

Medicare Part D covers prescription drugs that you use at home. Chemotherapy drugs and other medications that are administered intravenously are covered by Medicare Part B.

Example Of Medicare Part D

Daniel is a veteran considering whether to opt into Medicare Part D. As an older American, Daniel is already covered by Medicare for various medical expenses. However, some of his prescription medications are not covered by Medicare, causing him to look for additional coverage.

Do You Have To Sign Up For Medicare At Age 65

Are you required to sign up for Medicare when you turn 65? The answer is more than just a simple yes or no. Be sure to find out when you should sign up so that you dont face a late enrollment penalty or a lapse in coverage.

How To Cancel Medicare Easy Pay

If you need to change your Medicare Easy Pay bank account, address, or any other information, resubmit your Medicare Easy Pay form but select the change option.

Can I Delay Enrollment In Part D Coverage

If you didnt enroll in prescription drug coverage either through a PDP or a Medicare Advantage plan during your initial open enrollment window and then you enroll during an open enrollment period in a future year, theres a late enrollment penalty that will be added to your premium .

When do you need to sign up for Medicare?

If the employer has less than 20 employees: You might need to sign up for Medicare when you turn 65 so you don’t have gaps in your job-based health insurance. Check with the employer.

What happens if you don't sign up for Part A and Part B?

If you don’t sign up for Part A and Part B, your job-based insurance might not cover the costs for services you get.

Do I need to get Medicare drug coverage (Part D)?

You can get Medicare drug coverage once you sign up for either Part A or Part B. You can join a Medicare drug plan or Medicare Advantage Plan with drug coverage anytime while you have job-based health insurance, and up to 2 months after you lose that insurance.

What is a Medicare leave period?

A period of time when you can join or leave a Medicare-approved plan.

Do you have to tell Medicare if you have non-Medicare coverage?

Each year, your plan must tell you if your non-Medicare drug coverage is creditable coverage. Keep this information — you may need it when you’re ready to join a Medicare drug plan.

Does Medicare work if you are still working?

If you (or your spouse) are still working, Medicare works a little differently. Here are some things to know if you’re still working when you turn 65.

Do I need to sign up for Medicare when I turn 65?

It depends on how you get your health insurance now and the number of employees that are in the company where you (or your spouse) work.