When do you sign up for Medicare the first time?

The first thing to consider when enrolling in Medicare is whether or not you will be automatically enrolled. Individuals that are already collecting their Social Security income payments and have worked their 40 quarters to qualify for premium-free Part A, will automatically be enrolled starting the month they turn 65.

When is the earliest you can get Medicare?

- If you were born on January 1 st, you should refer to the previous year.

- If you were born on the 1 st of the month, we figure your benefit (and your full retirement age) as if your birthday was in the previous month. ...

- You must be at least 62 for the entire month to receive benefits.

- Percentages are approximate due to rounding.

When can I start getting Medicare?

You may apply for Medicare at any age if you meet one of the following criteria:

- your receive Social Security disability or Railroad Retirement Board (RRB) disability insurance

- you have specific medical conditions, such as amyotrophic lateral sclerosis (ALS) or end stage renal disease (ESRD)

- a family member is enrolled in Medicare

What age do you need to sign up for Medicare?

The standard age for Medicare eligibility has been 65 for the entirety of the health insurance program, which debuted in 1965. These days, fewer people are automatically enrolled in Medicare at age 65 because they draw Social Security benefits after 65. If you do not receive Social Security benefits, you will not auto-enroll in Medicare.

Are you automatically signed up for Medicare when you turn 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

What happens if you forget to sign up for Medicare at age 65?

The Part A penalty is 10% added to your monthly premium. You generally pay this extra amount for twice the number of years that you were eligible for Part A but not enrolled. For example, suppose that: You were eligible for Medicare in 2020, but you didn't sign up until 2022.

How many months before I turn 65 should I apply for Medicare?

3 monthsGenerally, we advise people to file for Medicare benefits 3 months before age 65. Remember, Medicare benefits can begin no earlier than age 65. If you are already receiving Social Security, you will automatically be enrolled in Medicare Parts A and B without an additional application.

Do I have to sign up for Medicare if I don't want it?

It is mandatory to sign up for Medicare Part A once you enroll in Social Security. The two are permanently linked. However, Medicare Parts B, C, and D are optional and you can delay enrollment if you have creditable coverage.

When should I sign up for Medicare to avoid penalty?

You can sign up later without penalty, as long as you do it within eight months after your other coverage ends. If you don't qualify to delay Part B, you'll need to enroll during your Initial Enrollment Period to avoid paying the penalty.

Can you have Medicare and employer insurance at the same time?

Thus, you can keep Medicare and employer coverage. The size of your employer determines whether your coverage will be creditable once you retire and are ready to enroll in Medicare Part B. If your employer has 20 or more employees, Medicare will deem your group coverage creditable.

Do I need to notify Social Security when I turn 65?

If I want Medicare at age 65, when should I contact Social Security? If you want your Medicare coverage to begin when you turn age 65, you should contact Social Security during the 3 months before your 65th birthday. If you wait until your 65th birthday or later, your Part B coverage will be delayed.

When should I apply for Social Security when I turn 66 and 2 months?

You can apply up to four months before you want your retirement benefits to start. For example, if you turn 62 on December 2, you can start your benefits as early as December. If you want your benefits to start in December, you can apply in August.

Will the Medicare age be raised to 67?

3 The retirement age will remain 66 until 2017, when it will increase in 2-month increments to 67 in 2022. Several proposals have suggested raising both the normal retirement age and the Medicare eligibility age.

Is Medicare optional?

Strictly speaking, Medicare is not mandatory. But very few people will have no Medicare coverage at all – ever. You may have good reasons to want to delay signing up, though.

Do you get Medicare if you are still working?

You can get Medicare if you're still working and meet the Medicare eligibility requirements. You become eligible for Medicare once you turn 65 years old if you're a U.S. citizen or have been a permanent resident for the past 5 years. You can also enroll in Medicare even if you're covered by an employer medical plan.

How much does Social Security take out for Medicare each month?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

What happens if you decline Medicare?

Declining. Late enrollment penalties. Takeaway. If you do not want to use Medicare, you can opt out, but you may lose other benefits. People who decline Medicare coverage initially may have to pay a penalty if they decide to enroll in Medicare later. Medicare is a public health insurance program designed for individuals age 65 and over ...

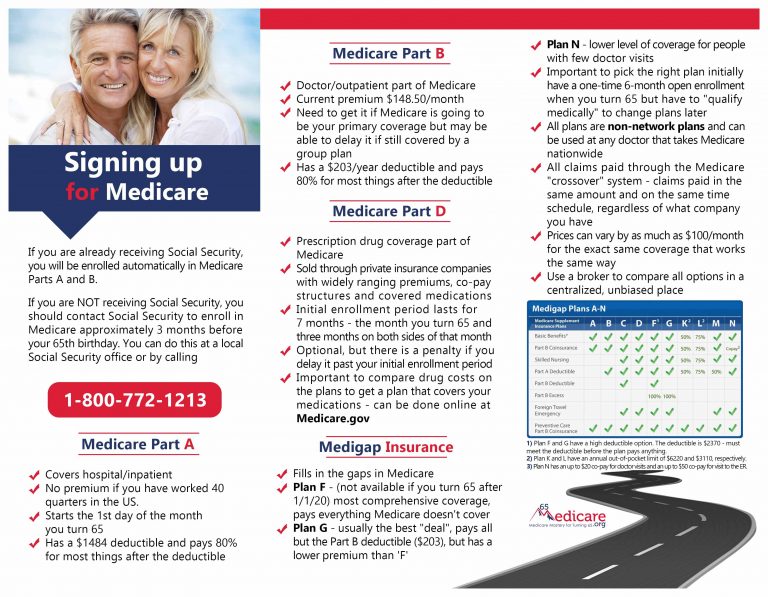

What is Medicare Part A?

Medicare is a public health insurance program designed for individuals age 65 and over and people with disabilities. The program covers hospitalization and other medical costs at free or reduced rates. The hospitalization portion, Medicare Part A, usually begins automatically at age 65. Other Medicare benefits require you to enroll.

What is the national base beneficiary premium for 2021?

In 2021, the national base beneficiary premium is $33.06 and changes every year. If you have to pay the penalty, the penalty amount will be rounded to the nearest $.10, and this amount will be added to your monthly Part D premium for the rest of the time you are enrolled.

Is there a penalty for not signing up for Medicare Part B?

If you choose not to sign up for Medicare Part B when you first become eligible, you could face a penalty that will last much longer than the penalty for Part A.

Does Medicare Advantage have penalties?

Medicare Part C (Medicare Advantage) is optional and does not have penalties on its own, but penalties may be included for late enrollment in the parts of Medicare included within your Medicare Advantage plan.

Is Medicare mandatory at 65?

While Medicare isn’t necessarily mandatory, it is automatically offered in some situations, and may take some effort to opt out of.

Is Medicare Part D mandatory?

Medicare Part D is not a mandatory program, but there are still penalties for signing up late. If you don’t sign up for Medicare Part D during your initial enrollment period, you will pay a penalty amount of 1 percent of the national base beneficiary premium multiplied by the number of months that you went without Part D coverage.

How long does it take to get Medicare?

Learn how to make sure they have health insurance once you’re enrolled. Medicare eligibility starts at age 65. Your initial window to enroll is the seven-month period that begins three months before the month of your 65th birthday and ends three months after it. Seniors are generally advised to sign up on time to avoid penalties ...

When do you get Medicare if you leave your job?

In that case, you’ll get an eight-month special enrollment period to sign up for Medicare if and when you leave your job or your employer stops offering coverage. It will start the month after you separate from your employer, or the month after your group health coverage ends – whichever happens sooner.

What happens if you don't sign up for Medicare?

Specifically, if you fail to sign up for Medicare on time, you’ll risk a 10 percent surcharge on your Medicare Part B premiums for each year-long period you go without coverage upon being eligible.

Do you have to double up on Medicare?

No need to double up on coverage. Many seniors are no longer employed at age 65, and thus rush to sign up for Medicare as soon as they’re able. But if you’re still working at 65, and you have coverage under a group health plan through an employer with 20 employees or more, then you don’t have to enroll in Medicare right now.

Does Medicare pay for Part A?

That said, it often pays to enroll in Medicare Part A on time even if you have health coverage already. It won’t cost you anything, and this way, Medicare can serve as your secondary insurance and potentially pick up the tab for anything your primary insurance (in this case, your work health plan) doesn’t cover.

Signing up for Medicare might make sense even if you have private insurance

Jeffrey M. Green has over 40 years of experience in the financial industry. He has written dozens of articles on investing, stocks, ETFs, asset management, cryptocurrency, insurance, and more.

How Medicare Works

Before diving into how Medicare works with your existing health coverage, it’s helpful to understand how it works on its own. Medicare has four main parts: A, B, C, and D. You can also purchase Medicare supplement insurance, known as Medigap.

Medicare Enrollment Periods

Medicare has a few enrollment periods, but the initial enrollment period may be the most important. This is when you first become eligible for Medicare. And if you miss the deadline to sign up for Parts B and D, you could face expensive penalties .

How Medicare Works If You Have Private Insurance

If you have private insurance, you may want to sign up for Parts A, B, D—and possibly a Medicare Advantage plan (Part C) and Medigap, once you become eligible. Or not. There are reasons both for and against. Consider how the following types of coverage work with Medicare to help you decide.

Primary and Secondary Payers

Your Medicare and private insurance benefits are coordinated, which means they work together. Typically, a primary payer will pay insurance claims first (up to plan limits) and a secondary payer will only kick in for costs not covered by the primary payer.

Frequently Asked Questions (FAQs)

No, you can delay signing up for Medicare without penalty, as long as you are covered by another type of private insurance. Generally, if you are eligible for premium-free Part A, you should still sign up for it, even if you have additional private insurance coverage. 18

Do You Have to Sign up For Medicare if You Are Still Working?

The most common reason for people not signing up for Medicare when they turn 65 is because they are still working. Because they’re still working, they’re likely covered under their employer’s health insurance plan and are also unlikely to be collecting Social Security retirement benefits.

Can I Get Social Security and Not Sign up for Medicare?

Yes and no. Medicare Part B is optional. If you’re automatically enrolled in Medicare Part A, you will be automatically enrolled in Part B and then given the option of opting out. You may still continue to receive your Social Security benefits without having Part B.

When is the Medicare enrollment period?

A “Special Election Period” – when you are losing group coverage as described above. The “Annual Election Period” – this period runs October 15 to December 7 each calendar year (plans take effect 1/1 the following calendar year) ...

What happens if you don't sign up for Medicare Part D?

What Are the Implications of Not Signing up for Part D When You Are First Eligible? First and foremost, Medicare has a “late enrollment penalty” for not signing up for Part D when you are first eligible. For many people, this initial eligibility is when you turn 65 and start Medicare. In this situation, you have an initial election period ...

What is the penalty for Medicare Part D late enrollment?

If you wait longer, the penalty will be higher. The penalty is 1% per month that you don’t have a plan.

What is Medicare Part D?

Medicare Part D is the part of Medicare that covers prescription drugs. “Original” Medicare (Part A and Part B) does not provide any coverage for prescription drugs. All prescription drug coverage for Medicare beneficiaries is provided through Medicare Part D ( How to Compare Part D Plans ). So, the question we often get from people turning 65 ...

How much is the penalty for not having a Medicare plan?

The penalty is 1% per month that you don’t have a plan. The 1% per month is multiplied by the “national base beneficiary premium” – for 2018, this is $35.02. For example, if you turned 65 in April of 2015, have no other drug coverage, and enrolled in a Part D plan to start 1/1/18, your penalty would start after your initial election period expired ...

How long does Medicare Part D last?

In this situation, you have an initial election period to choose a Part D plan that lasts for seven months – the month you turn 65 plus three months on each side of the turning 65 month.

How long do you have to sign up for a Part D plan?

In this situation, you have two months after the group coverage ends to sign up for a Part D plan.