How and when to enroll in Medicare Part B?

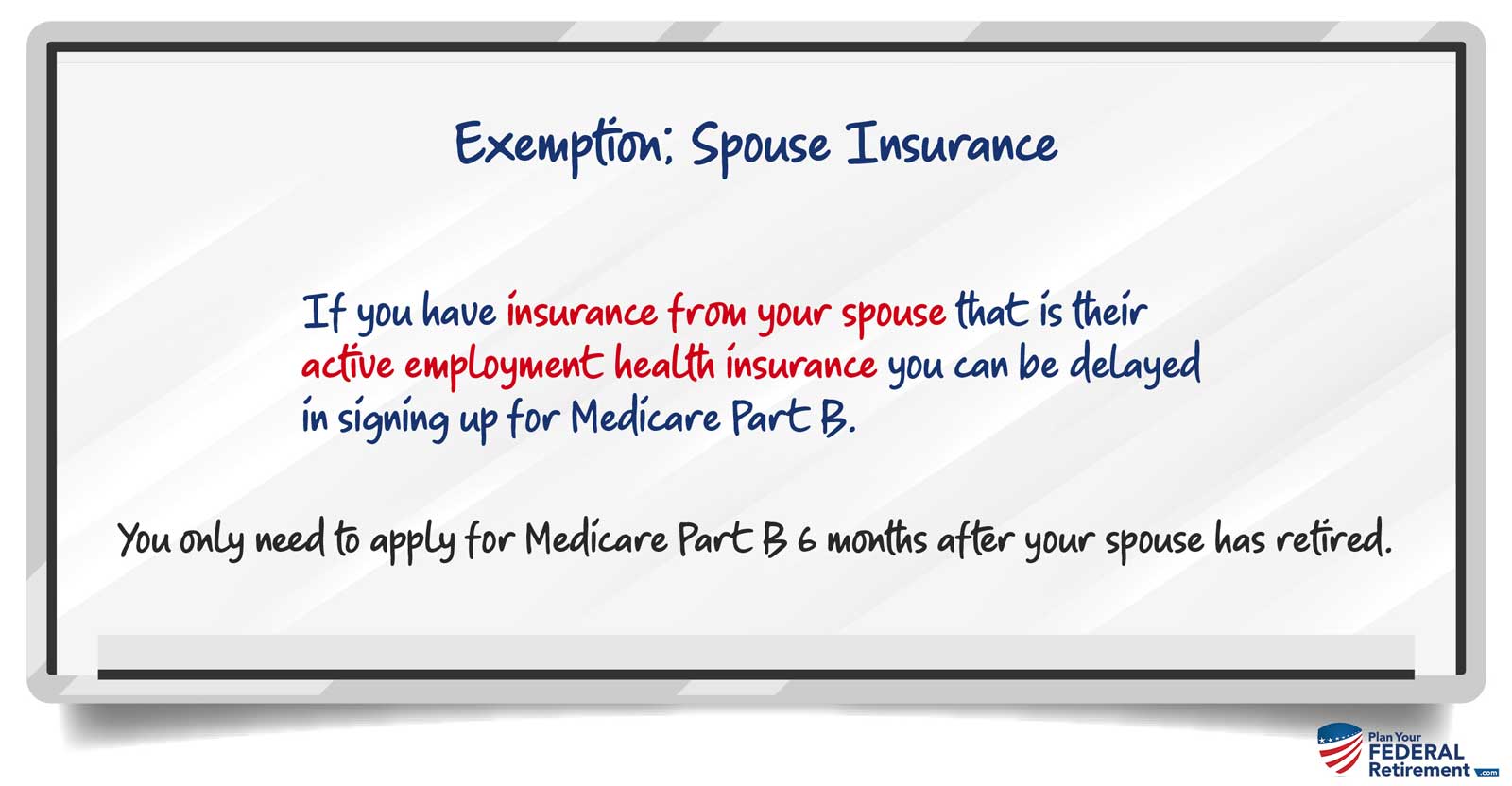

or did not sign up when you applied for Medicare, but now want Part B. • If you want to sign up for Part B during the General Enrollment Period (GEP) from January 1 – March 31 each year. • If you refused Part B during your IEP because you had group health plan (GHP) coverage through your or your spouse’s current employment. You may sign up during

When do I have to enroll in Medicare Part B?

You have a seven-month initial period to enroll in Medicare Part B. The seven months include the three months prior to your 65th birthday, the month containing your 65th birthday and the three months that follow your birthday month. If you turn 65 on March 8, then you have from December 1 to June 30 to enroll in Medicare Part B. If you delay enrollment, then you have to wait until the next general enrollment period begins. For Medicare Part B, you have from January 1 through March 31 to enroll.

What age do you have to sign up for Medicare?

The standard age for Medicare eligibility has been 65 for the entirety of the health insurance program, which debuted in 1965. These days, fewer people are automatically enrolled in Medicare at age 65 because they draw Social Security benefits after 65. If you do not receive Social Security benefits, you will not auto-enroll in Medicare.

When is open enrollment for Medicare B?

The annual open enrollment period occurs every year from October 15 to December 7. It's the one time of year most seniors can make changes to their existing plan. Even if you are satisfied with your current provider, you'll still want to review your coverage. Here are a few tips to help you make a good decision based on your individual situation:

Does Medicare automatically sign you up for Part B?

Medicare will enroll you in Part B automatically. Your Medicare card will be mailed to you about 3 months before your 65th birthday. If you're not getting disability benefits and Medicare when you turn 65, you'll need to call or visit your local Social Security office, or call Social Security at 1-800-772-1213.

Is Part B mandatory on Medicare?

Part B is optional. Part B helps pay for covered medical services and items when they are medically necessary. Part B also covers some preventive services like exams, lab tests, and screening shots to help prevent, find, or manage a medical problem. Cost: If you have Part B, you pay a Part B premium each month.

What happens if I don't sign up for Medicare Part B when I turn 65?

If you miss your 7-month Initial Enrollment Period, you may have to wait to sign up and pay a monthly late enrollment penalty for as long as you have Part B coverage. The penalty goes up the longer you wait. You may also have to pay a penalty if you have to pay a Part A premium, also called “Premium-Part A.”

Can I choose the start date for Medicare Part B?

You can't always pick the date you want to start Part B coverage because the start date depends on what type of enrollment period you sign up in and when during the enrollment period you apply.

How do I avoid Medicare Part B premium?

Four ways to save money on your Medicare Part B premiumsSign up for Part B on time. ... Defer income to avoid a premium surcharge. ... Pay your premiums directly from your Social Security benefits. ... Get help from a Medicare Savings Program.

What happens if I don't want Medicare Part B?

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B.

Does Medicare Part B premium change every year based on income?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

Can you have Medicare and employer insurance at the same time?

Yes, you can have both Medicare and employer-provided health insurance. In most cases, you will become eligible for Medicare coverage when you turn 65, even if you are still working and enrolled in your employer's health plan.

How do I defer Medicare Part B?

There are two ways to defer Part B: If you have already received your Medicare card, follow the instructions on how to send the card back. If you keep the card, you are keeping Part B and will pay Part B premiums. Call the Social Security Administration.

Does Medicare Part B have to start on the first of the month?

Part B (Medical Insurance) Generally, you're first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65. (You may be eligible for Medicare earlier, if you get disability benefits from Social Security or the Railroad Retirement Board.)

How do I add Part B to my Medicare online?

To do this, you can complete form CMS-40B (Application for Enrollment in Medicare – Part B [Medical Insurance]) and CMS-L564 (Request for Employment Information) online.

How do I add Part B to my Social Security?

Fill out Form CMS-40B (Application for Enrollment in Medicare Part B). Send the completed form to your local Social Security office by fax or mail. Call 1-800-772-1213. TTY users can call 1-800-325-0778.

You Always Need Part B If Medicare Is Primary

Once you retire and have no access to other health coverage, Medicare becomes your primary insurance. While Part A pays for your room and board in...

You Need Part B to Be Eligible For Supplemental Coverage

Medigap plans do not replace Part B. They pay secondary to Part B.Part B works together with your Medigap plan to provide you full coverage. This m...

Do I Need Medicare Part B If I Have Other Insurance?

Many people ask if they should sign up for Medicare Part B when they have other insurance. At a large employer with 20 or more employees, your empl...

Enrolling Into Part B on A Delayed Basis

If you have delayed Part B while you were still working at a large employer, you’ll still need to enroll in Part B eventually. When you retire and...

Do I Need Medicare Part B If I’M A Veteran?

Some people have 2 different coverages that they can choose independent of one another. Federal employees who can opt to use their FEHB instead of...

Most Common Mistakes Regarding Part B

The most common mistake we see is from people who confuse Part B and Medigap. Just this week, a reader on our Facebook page commented that she was...

Answer a few questions to find out

These questions don’t apply if you have End-Stage Renal Disease (ESRD).

Do you have health insurance now?

Are you or your spouse still working for the employer that provides your health insurance coverage?

When do you get Medicare Part B?

Most people get Medicare Part B (Medical Insurance) when they turn 65. If you didn't sign up for Part B then, now's the time to decide if you want to enroll. During Medicare's General Enrollment Period (January 1–March 31), you can enroll in Part B and your coverage will start July 1.

How to apply for Part B?

Signing up for Part B is easy—apply by March 31. Fill out a short form, and send it to your local Social Security office. Call Social Security at 1-800-772-1213. TTY users can call 1-800-325-0778. Contact your local Social Security office. If you get benefits from the Railroad Retirement Board, contact your local RRB office to sign up for Part B. ...

Is it important to enroll in Part B?

Deciding to enroll in Part B is an important decision. It depends on the type of coverage you have now. It’s also important to think about the Part B late enrollment penalty—this lifetime penalty gets added to your monthly Part B premium, and it goes up the longer you wait to sign up.

What happens if you don't get Part B?

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B.

How much is the penalty for Part B?

Your Part B premium penalty is 20% of the standard premium, and you’ll have to pay this penalty for as long as you have Part B. (Even though you weren't covered a total of 27 months, this included only 2 full 12-month periods.) Find out what Part B covers.

How long does it take to get Medicare?

Learn how to make sure they have health insurance once you’re enrolled. Medicare eligibility starts at age 65. Your initial window to enroll is the seven-month period that begins three months before the month of your 65th birthday and ends three months after it. Seniors are generally advised to sign up on time to avoid penalties ...

When do you get Medicare if you leave your job?

In that case, you’ll get an eight-month special enrollment period to sign up for Medicare if and when you leave your job or your employer stops offering coverage. It will start the month after you separate from your employer, or the month after your group health coverage ends – whichever happens sooner.

What happens if you don't sign up for Medicare?

Specifically, if you fail to sign up for Medicare on time, you’ll risk a 10 percent surcharge on your Medicare Part B premiums for each year-long period you go without coverage upon being eligible.

Do you have to double up on Medicare?

No need to double up on coverage. Many seniors are no longer employed at age 65, and thus rush to sign up for Medicare as soon as they’re able. But if you’re still working at 65, and you have coverage under a group health plan through an employer with 20 employees or more, then you don’t have to enroll in Medicare right now.

Does Medicare pay for Part A?

That said, it often pays to enroll in Medicare Part A on time even if you have health coverage already. It won’t cost you anything, and this way, Medicare can serve as your secondary insurance and potentially pick up the tab for anything your primary insurance (in this case, your work health plan) doesn’t cover.

Signing up for Medicare might make sense even if you have private insurance

Jeffrey M. Green has over 40 years of experience in the financial industry. He has written dozens of articles on investing, stocks, ETFs, asset management, cryptocurrency, insurance, and more.

How Medicare Works

Before diving into how Medicare works with your existing health coverage, it’s helpful to understand how it works on its own. Medicare has four main parts: A, B, C, and D. You can also purchase Medicare supplement insurance, known as Medigap.

Medicare Enrollment Periods

Medicare has a few enrollment periods, but the initial enrollment period may be the most important. This is when you first become eligible for Medicare. And if you miss the deadline to sign up for Parts B and D, you could face expensive penalties .

How Medicare Works If You Have Private Insurance

If you have private insurance, you may want to sign up for Parts A, B, D—and possibly a Medicare Advantage plan (Part C) and Medigap, once you become eligible. Or not. There are reasons both for and against. Consider how the following types of coverage work with Medicare to help you decide.

Primary and Secondary Payers

Your Medicare and private insurance benefits are coordinated, which means they work together. Typically, a primary payer will pay insurance claims first (up to plan limits) and a secondary payer will only kick in for costs not covered by the primary payer.

Frequently Asked Questions (FAQs)

No, you can delay signing up for Medicare without penalty, as long as you are covered by another type of private insurance. Generally, if you are eligible for premium-free Part A, you should still sign up for it, even if you have additional private insurance coverage. 18