When to apply for a Medicare Supplement plan Here's the quick answer: Most people should apply for a Medigap

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

What is the deadline for Medicare supplement?

Dec 12, 2019 · Medigap open enrollment begins when you sign up for Medicare Part B (at age 65) and lasts for six months. If you defer Part B coverage past age 65 because of health coverage from your employer, this six-month window would start whenever you sign up for Part B.

Is there open enrollment for Medicare supplements?

Sign up Most people get Medicare Part A (Hospital Insurance) and Part B (Medical Insurance) when first eligible (usually when turning 65). Answer a few questions to check when and how to sign up based on your personal situation.

How to enroll in Medicare if you are turning 65?

Feb 07, 2022 · Anyone who has Medicare Part A and Part B is eligible to apply for a Medicare supplement plan. However, you need to qualify for coverage with the private insurance company. When you first turn 65 and sign up for Medicare Part B, you have a Medigap open enrollment period that lasts six months.

Is there a deadline for Medicare supplemental insurance?

Jan 07, 2022 · In order to be eligible for Medicare, you must be: 65 years and older, or. An individual diagnosed with End-Stage Renal Cancer (ESRC), or. Disabled. Once becoming eligible for the program, you will be able to enroll and gain access to the services of both Medicare Part A …

Can you add a supplement to Medicare at any time?

What is the open enrollment period for Medicare supplement?

Which is true about Medicare supplement open enrollment?

Can I change Medicare supplement plans anytime?

Check when to sign up

Answer a few questions to find out when you can sign up for Part A and Part B based on your situation.

Check how to sign up

Answer a few questions to find out if you need to sign up or if you’ll automatically get Part A and Part B.

When coverage starts

The date your Part A and Part B coverage will start depends on when you sign up.

What is Medicare Supplement Insurance?

Medicare Supplement insurance is meant to limit unpleasant surprises from healthcare costs. Your health at age 65 may be no indicator of what’s to come just a few years later. You could get sick and face medical bills that devastate years of planning and preparation. Combine this with the fixed income that so many seniors find themselves on, ...

Does Medicare Supplement have the same coverage?

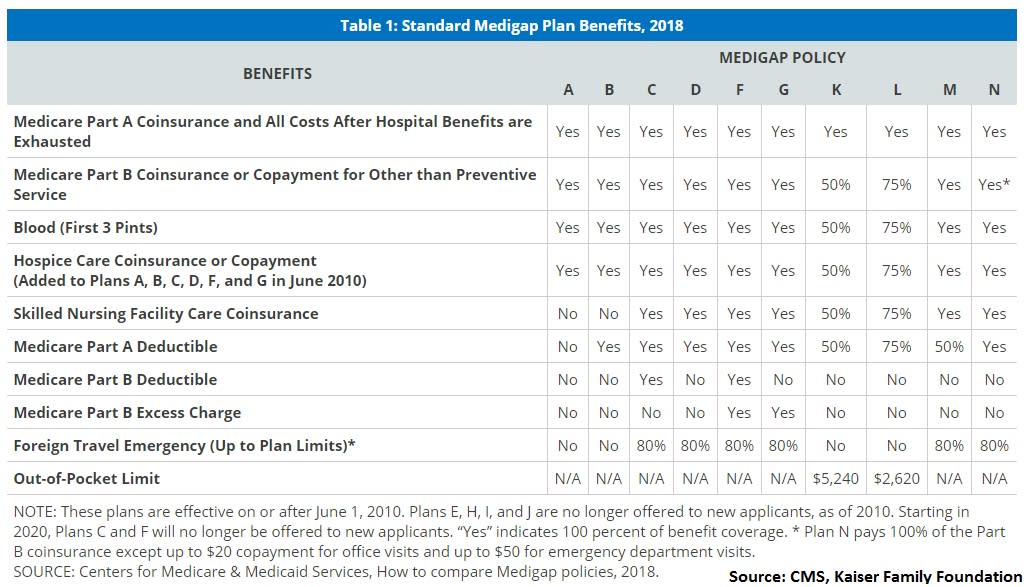

The federal government has standardized Medicare Supplement plans. You receive the same coverage no matter which insurance company sells you the Medigap plan. Premiums for the same policy can vary between insurance companies. But, only the quoted price and the reputation of the insurer will vary.

How much does Medicare Supplement cover?

Choosing Medicare Supplement insurance can help. It can cover up to 100% of out-of-pocket costs, depending on the plan. One out of every three Original Medicare beneficiaries — over 13 million seniors — have chosen to do so. 1.

Does Medicare cover prescriptions?

Original Medicare covers most hospital and doctor expenses. (It does not cover prescription drugs, although you can buy separate private drug plans.) The balance is left to you, with no cap on how high your out-of-pocket costs can go. Original Medicare allows you to see any doctor in the U.S. who accepts Medicare.

Does Medicare have a cap on out-of-pocket costs?

The balance is left to you, with no cap on how high your out-of-pocket costs can go. Original Medicare allows you to see any doctor in the U.S. who accepts Medicare. It provides excellent flexibility: it has no networks or referral requirements.

Does Medicare Advantage cover vision?

Medicare Advantage plans cap out-of-pocket expenses. Medicare Advantage is all-encompassing, even offering dental and vision coverage (Original Medicare does not). But, you are limited to its doctor network and need referrals to see specialists.

What is the deductible for Medicare Supplement 2020?

In 2020, the Part A deductible for hospitalization is $1,408 per benefit period and the Part B annual deductible is $198. 3. Medicare Supplement insurance is designed to help cover these out-of-pocket deductibles and coinsurance.

Do I need to have Original Medicare to apply for Medigap?

The short answer is yes. To have a Medigap policy, you must first have Medicare Part A and Part B. Your Medigap Open Enrollment Period begins on the first day of the month that you’re both 65 or older and enrolled in Medicare Part B.

Can I have a Medicare Supplement insurance plan with Medicare Advantage?

If you have a Medicare Advantage plan but are planning to drop it and sign up for Original Medicare, you can apply for a Medigap policy before your Medicare Advantage coverage ends. The insurer can sell you a Medigap policy if you verify that you are leaving the Medicare Advantage plan and will sign up for Medicare Part A and B.

What types of Medicare Supplement insurance plans are available?

Different Medigap policies may be available to you depending on your state. Insurance companies that sell Medigap don’t have to sell every plan. However, the insurance company must offer Medigap Plan A (which is not the same as Medicare Part A) if it offers any Medigap policy.

Does Medicare cover veterans?

As you know, Veteran benefits only apply to Veterans’ facilities and doctors. So, if you want to see a civilian doctor, Medicare can help with some of the costs. Having both Medicare and Veterans benefits gives you the opportunity to see a wide range of doctors and specialists. The Veterans Association recommends you enroll in Part A ...

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.