Once you and your Medicare Part D Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs through prescription drug insurance premiums. Part D was originally propo…Medicare Part D

What is Medicare Part D gap coverage?

There are four parts to the Medicare program:

- Part A, which is your hospital insurance

- Part B, which covers outpatient services and durable medical equipment (Part A and Part B are called Original Medicare)

- Part C, or Medicare Advantage, which offers an alternate way to get your benefits under Original Medicare

- Part D, which is your prescription drug coverage

What is part D coverage gap?

Tips for Navigating the Part D Coverage Gap

- Plan ahead by estimating your annual drug costs and how you will handle paying for your medications if you do enter the Part D coverage gap stage.

- Talk with your doctor and pharmacist about lower-cost drug alternatives.

- Explore options for getting your prescriptions that may offer discounted prices.

What is Plan D coverage gap?

What is the Medicaid ‘coverage gap’ and who does it affect?

- Expansion is optional, and some states continue to say no. ...

- American Rescue Plan provides additional funding to entice holdout states to expand Medicaid. ...

- Medicaid eligibility varies depending on where you live. ...

- The coverage gap: No realistic access to health insurance. ...

- Possible solutions if you’re in the coverage gap. ...

How does doughnut hole coverage gap work?

- If you have a Medicare Prescription Drug Plan that covers you specifically for the donut hole stage.

- You have another prescription drug coverage plan from a union or employer that pays for a percentage of your prescription costs.

- You use generic brands or don’t take a lot of prescription drugs.

What will the donut hole be in 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.

How do I avoid the Medicare Part D donut hole?

Here are some ideas:Buy Generic Prescriptions. ... Order your Medications by Mail and in Advance. ... Ask for Drug Manufacturer's Discounts. ... Consider Extra Help or State Assistance Programs. ... Shop Around for a New Prescription Drug Plan.

What stage is the donut hole?

Stage 3Stage 3—Coverage Gap Most Medicare drug plans have a Coverage Gap (also called the “donut hole”). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the Coverage Gap, and it doesn't apply to members who get Extra Help to pay for their Part D costs.

How long does the Medicare Part D donut hole last?

When does the Medicare Donut Hole End? The donut hole ends when you reach the catastrophic coverage limit for the year. In 2022, the donut hole will end when you and your plan reach $7,050 out-of-pocket in one calendar year.

Does the donut hole reset each year?

While in Catastrophic Coverage you will pay the greater of: 5% of the total cost of the drug or $3.95 for generic drugs and $9.85 for brand-name drugs. You will remain in the Catastrophic Coverage Stage until January 1. This process resets every January 1.

What is the Medicare donut hole for 2022?

$4,430You enter the donut hole when your total drug costs—including what you and your plan have paid for your drugs—reaches a certain limit. In 2022, that limit is $4,430.

Can you avoid the donut hole?

If you have limited income and resources, you may want to see if you qualify to receive Medicare's Extra Help/Part D Low-Income Subsidy. People with Extra Help see significant savings on their drug plans and medications at the pharmacy, and do not fall into the donut hole.

Do all Medicare Part D plans have a donut hole?

All Medicare Part D plans follow the same drug phases. Every prescription coverage plan involves the gap known as the donut hole. Will I enter the donut hole if I receive Extra Help? Those who get Extra Help pay reduced amounts for their prescriptions throughout the year, so they are unlikely to reach the donut hole.

What are the 4 phases of Part D coverage?

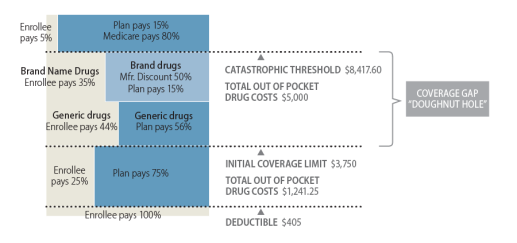

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.

How much is the donut hole for 2022?

$4,430In a nutshell, you enter the donut hole when the total cost of your prescription drugs reaches a predetermined combined cost. In 2022, that cost is $4,430.

How do I get out of the donut hole?

In 2020, person can get out of the Medicare donut hole by meeting their $6,350 out-of-pocket expense requirement. However, there are ways to receive assistance for funding prescription drugs, especially if a person meets certain low income requirements.

Does Medicare Part D have a maximum out-of-pocket?

Medicare Part D plans do not have an out-of-pocket maximum in the same way that Medicare Advantage plans do. However, Medicare Part D plans have what's called a “catastrophic coverage” phase, which works similar to an out-of-pocket maximum.

What is a Medicare donut hole?

The Medicare donut hole is a gap in coverage that some Medicare beneficiaries may experience at some point during their plan year. The good news? You can save money by knowing how to avoid it and what do to once you’re in it.

How much is the Medicare donut hole for 2021?

The Medicare donut hole for 2021 starts once you hit $4,130 in out-of-pocket prescription drug costs, and it extends to $6,550. If your prescription drug spending reaches $6,550 in 2021, you’ll have catastrophic coverage for the rest of the year.

What is the Medicare coverage gap in 2021?

After you and your drug plan have combined to spend a set amount for the prescription drugs covered by your plan ($4,130 in 2021), you move into the center of the donut (i.e., the hole) which is your Medicare coverage gap. While you’re in the donut hole coverage gap, you’re responsible for 25% of your prescription drug costs for both brand name ...

How many stages of Medicare Part D coverage?

Basically, there are four Medicare Part D coverage stages you need to understand. Your first Medicare Part D coverage phase can be represented by the left side of the donut ring. On this side of the donut, you pay the entire amount for your prescription drugs until you meet your deductible (assuming your plan has one, but not all Part D plans do). ...

How much is a 2021 deductible?

The good news is that once you meet your deductible ( which can be no higher than $445 in 2021 though some plans may offer $0 deductibles) you move to your initial coverage period. If your plan features a $0 deductible, then your coverage starts in this phase.

When does the catastrophic coverage period end for 2021?

Finally, your policy period ends on December 31, ...

When did Medicare Part D start?

Previously, when Medicare Part D was first rolled out in 2007 and prior to the Affordable Care Act, beneficiaries paid 100% of drug costs while in the donut hole.

What is Medicare Donut Hole?

Summary. The Medicare donut hole is a colloquial term that describes a gap in coverage for prescription drugs in Medicare Part D. For 2020, Medicare are making some changes that help to close the donut hole more than ever before. Medicare Part D is the portion of Medicare that helps a person pay for prescription drugs.

How much does the insurance company add up to the donut hole?

The insurance company will add up what a person has paid out-of-pocket for medications in the donut hole. Once this total reaches $6,350, a person has crossed the donut hole. A person is now in the catastrophic coverage stage of their medication coverage.

What does closing the donut hole do?

Closing the donut hole can help a person reduce prescription drug costs. However, they will still be responsible for 25% of costs, once they reach the donut hole. If an individual has difficulty paying for medications, state, federal, and private organizations can assist. Public Health.

What was the Affordable Care Act in 2011?

2011: The Affordable Care Act required pharmaceutical manufacturers to introduce discounts of up to 50% for brand name drugs and up to 14% for generic drugs, making it easier for people to buy medications once in the donut hole. 2012‑2018: The discounts continued to increase. 2018: The Bipartisan Budget Act sped up changes to prescription drug ...

Why did the Donut Hole change?

The aim of these changes was to make drugs more affordable once a person reached the donut hole, which would encourage people to continue taking their medications and reduce the risk of a break in treatment . A person pays their co-payment for their prescription drugs, depending upon their drug plan.

What is Medicare Part D?

Medicare Part D is the portion of Medicare that helps a person pay for prescription drugs. A person enrolled in Medicare does not have to choose Medicare Part D. However, they must have some other prescription drug coverage, usually through private- or employer-based insurance. In this article, we define the donut hole and how it applies ...

Why do people stop taking drugs after reaching the donut hole?

The issue with the donut hole is that many people in the United States stop taking their medications upon reaching the donut hole because they cannot afford to pay the high costs for the drugs. They often have to pay thousands of dollars for prescription drugs until they cross this coverage gap.

What is a donut hole?

What is the Donut Hole? The Medicare Part D Donut Hole, or Coverage Gap, is one of four stages you may encounter during the year while a member of a Part D prescription drug plan. Specifically, the Donut Hole is the point in the year when your prescription benefits change because the total cost paid by you and the plan have reached ...

How to contact Medicare for copays?

If you qualify, you may receive help paying for your monthly premium and prescription drug copays. For more information, contact Medicare at 1-800-633-4227 (TTY 1-877-486-2048), the Social Security Office at 1-800-772-1213 (TTY 1-800-325-0778), or the Office of Medicaid Commonwealth of Massachusetts at 1-617-573-1770.

What tiers are deductibles?

The deductible counts toward any combination of drugs on Tiers 3, 4, and 5. You will not pay a separate deductible for each tier. After you pay the deductible, you will pay only your copay for Tier 3, 4, and 5 drugs.

Does Tufts Medicare have a Part D deductible?

All other plans do not have a Part D deductible. If you are a member of Tufts Medicare Preferred HMO Value Rx, Basic Rx, or Saver Rx plan: There is no deductible for drugs on Tier 1 and Tier 2. The is a deductible for drugs on Tier 3, Tier 4, and/or Tier 5.

Create an account and access our free 20 minute Medicare 101 video series

We cover all the basics you need to know and give you personalized information on enrollment dates.

Introduction

You may have heard of the term “Donut Hole” when referring to Medicare Part D. The Medicare Part D “Donut Hole” has historically been a coverage gap in Medicare Part D plans where you were responsible for a higher share of drug costs after your total drug costs reach a certain limit each year.

What are the Payment Stages of a Medicare Part D Plan?

Before we can explain the Medicare Part D Donut Hole, let us examine the four payment stages in a Medicare Part D plan.

What is the Donut Hole?

In the past, during the Stage 3: Coverage Gap phase, Medicare beneficiaries who reached the Coverage Gap, had to pay 100% (versus 25% today) of the cost for all their drugs. In other words, Part D plans did not help pay for costs during this stage, and there were no other discounts or other forms of support.

Is there still a Donut Hole?

No – starting in 2012, when the Affordable Care Act (ACA) was enacted, the government introduced discounts to help beneficiaries. People within the Medicare Part D donut hole were required to pay a smaller percentage of drug costs instead of 100%.

Can I still enter the Donut Hole?

Yes – while it is no longer really a “Donut Hole”; when your prescription drug expenses (consisting of your deductible, copayments, and coinsurance plus whatever your Medicare Plan D has paid) exceeds the initial coverage limit ($4,130), you will enter the Medicare Part D Coverage Gap.

Does the Donut Hole affect everyone?

No – if your prescription drug expenses that you and your plan pay do not exceed the annual limit ($4,130), you will not enter the Medicare Part D Donut Hole or Coverage Gap. However, everyone who exceeds this limit will automatically enter the Donut Hole or Coverage Gap phase.

How Is the Donut Hole Working?

The donut hole was closed for all drugs in 2020, which means that you have to bear twenty-five percent of your drugs’ cost when you hit the coverage gap. You have been responsible for a more significant proportion.

How Do I Get Out of the Donut Hole?

In all Part D contracts, after you pay $6,350 in out-of-pocket payments for the medications offered in 2020 (this number is just the amount you paid, not the actual cost of the drugs you and the plan paid); you leave the donut hole and hit catastrophic coverage.

What is the donut hole?

The term “donut hole” is a metaphoric reference to the coverage gap. The coverage gap is the third stage in Medicare’s four stage yearly progression of drug costs. If you reach the donut hole, you will pay 25% of the cost of both generic and brand-name drugs. This cost will continue until you reach the fourth stage, which is catastrophic coverage. ...

What are the stages of Medicare?

The Four Stages of Medicare Drug Coverage. Stage 1 is the yearly deductible: While in this stage, you pay the full cost of all covered drugs that have not been excluded from the deductible. Some plans exclude preferred and non-preferred generic drugs from the yearly deductible.

What is the cost of TROOP in 2021?

Stage 4 is catastrophic coverage: After your TrOOP costs reach $6,550 for 2021, you crawl out of the donut hole and enter catastrophic coverage. Because most people enter the donut hole late in the year, if at all, they never reach catastrophic coverage. In Stage 4, your insurance plan and Medicare will pay most of the cost ...

What percentage of generic drugs are paid for in stage 3?

While in Stage 3, you pay 25% of the cost of generic drugs which is counted toward the TrOOP. Medicare pays 75% of the cost of generic drugs and this amount is not counted toward the TrOOP. You pay 25% of the cost of brand-named drugs which is counted toward the TrOOP. The remaining 75% of the cost of brand-named drugs is discounted by ...

How much is the stage 2 drug limit for 2020?

This is an increase of $120 from $4,130 in 2020. Example: Jim takes one $100 generic drug. He pays a $10 copay, and the drug plan pays $90. The entire $100 counts toward the Stage 2 limit. Jim also takes a brand-named drug which costs $350. His copay is $45 and the drug plan pays the remaining $305.

What is stage 2 insurance?

Stage 2 is the initial coverage: During this stage, the plan pays its share, and you pay your share of the cost through copays and coinsurance. You stay in this stage until your year-to-date “total drug costs” (your payments plus any Part D Plan’s payments) total the initial coverage limit of $4,130 for 2021.

When will Jim's stage 2 drug cost be met?

Because Jim’s total drug cost is $450, he will meet the Stage 2 limit sometime in August, at which time he will enter the Stage 3 coverage gap often referred to as the donut hole. Stage 3 is the coverage gap or “donut hole”: You stay in this stage until your year-to-date True Out-Of-Pocket costs (TrOOP) reach a total of $6,550 for 2021 ...

What Is The Medicare Donut Hole?

The Medicare donut hole refers to the coverage gap phase in Part D coverage after your initial coverage period. Medicare Part D covers prescription drugs.

Understanding Medicare Donut Hole Coverage

It may sound like a treat to have with coffee, but the Medicare donut hole is not exactly sweet. In fact, Medicare donut hole coverage—and being stuck in it—can be incredibly frustrating, but we’re going to make getting a handle on this pesky coverage gap as painless as possible.

How Much Am I Responsible for During the Medicare Donut Hole?

You will be responsible for 25% of your drug costs while in the donut hole. It used to be more, but in 2020, a limit was set and now you won’t have to pay an excess of 25%.

Why Does the Medicare Donut Hole Even Exist?

Excellent question. The Medicare donut hole was created to encourage people to use generic drugs to keep payout costs low and reduce Medicare expenses at the program level.

How Do I Get Out Of The Medicare Donut Hole?

To get out of the Medicare donut hole, you have to spend $6,550 in out-of-pocket costs. This total is what you pay for drugs that are covered and some of the costs paid by others.

How much is the donut hole for 2020?

The donut hole for 2020 begins at $4,200. Ten months of a $425 retail drug adds up to $4,250, so you’ll be in the donut hole for November and December and the drug will cost more than $100 per month. Medicare drug stages reset yearly on January 1.

What is a donut hole?

The term donut hole is a metaphoric reference to the coverage gap in drug costs for Medicare recipients. The four stages of this yearly cycle are: Understanding what costs are applied during the different stages of the yearly Medicare cycle of drug coverage is paramount in lowering out-of-pocket costs. Medicare drug plans mask the true cost of ...

How to reduce out of pocket in stage 2?

Purchase your generic drugs and pay the cash price at a pharmacy that does not have your insurance information. Then, purchase your brand-name drugs at another pharmacy and pay the insurance copay amount. This strategy will reduce your out-of-pocket in Stage 2 and often keep you from falling in the Stage 3 donut hole.

What do you ask for at every appointment?

Samples: At every appointment and with every doctor, ask for samples of any drugs you have been prescribed. Many drug manufacturers provide doctors with a limited quantity of various drugs to promote their product. The doctor decides how much of the drug to give and to which patients, while supplies last.

Can a pharmacy use insurance?

It’s key to use a pharmacy that does not have your insurance information. If a pharmacy has your insurance information, the accounting department will apply your insurance coverage on record to acquire reimbursement – even for cash purchases.

Does Medicare cover copays?

Medicare drug plans mask the true cost of medications behind copays. Once in the donut hole, standard copays are no longer relative and you become responsible for 25% of the retail cost of drugs whether they are generic or brand name. For example: If your drug costs $425 per month at retail prices, it can land you in the donut hole after ...