A Medicare Part D deductible is the amount you must pay each year for your prescription drugs before your Medicare Part D Prescription Drug Plan begins to pay its share of your medications that are covered. This is for a calendar year and resets every January 1.

Full Answer

What is the Medicare Part D prescription drug deductible for 2019?

Yearly deductible for drug plans. This is the amount you must pay each year for your prescriptions before your Medicare drug plan pays its share. Deductibles vary between Medicare drug plans. No Medicare drug plan may have a deductible more than $480 in 2022. Some Medicare drug plans don't have a deductible.

What is the Medicare Part D deductible in 2021?

Apr 16, 2020 · This is for a calendar year and resets every January 1. The 2020 maximum deductible set by CMS is $435, however, insurers can set their deductible below the limit. According to research by the Kaiser Family Foundation, 86% of stand-alone Part D prescription drug plans have an annual deductible. Of those, 69% use the $435 maximum established by CMS.

What happens when you reach your Medicare Part D deductible?

Summary: The Medicare Part D deductible is the amount you pay for your prescription drugs before your plan begins to help. In 2021, the Medicare Part D deductible can’t be greater than $445 a year. You probably know that being covered by insurance doesn’t mean you can always get services and benefits for free.

What is a Medicare drug plan deductible?

Mar 09, 2021 · Medicare sets the standard deductible every year. In 2021, that’s $445. Plans can have no deductible or any amount up to the standard amount. A plan determines which medications are subject to its...

How do plan D deductibles work?

The deductible is the amount a beneficiary must pay for covered drugs before the plan starts to pay. The full cost of the drug determines how much a beneficiary must pay when the plan has a deductible. In other words, one pays the full cost for drugs subject to a deductible until the designated amount is met.Mar 9, 2021

What is the Part D donut hole for 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.Oct 1, 2020

What is Part D catastrophic coverage?

Catastrophic coverage: In all Part D plans, you enter catastrophic coverage after you reach $7,050 in out-of-pocket costs for covered drugs. This amount is made up of what you pay for covered drugs and some costs that others pay.

How do deductibles work for Medicare Part D?

Deductible phase Most Medicare part D plans have a deductible, or a certain amount of money before the plan kicks in. So, that means you'll pay 100% of your prescription costs until you reach your deductible.

How do I avoid the Medicare Part D donut hole?

Five Ways to Avoid the Medicare Part D Coverage Gap (“Donut Hole”...Buy generic prescriptions. Jump to.Order your medications by mail and in advance. Jump to.Ask for drug manufacturer's discounts. Jump to.Consider Extra Help or state assistance programs. Jump to.Shop around for a new prescription drug plan. Jump to.Jun 5, 2021

Is the donut hole going away in 2021?

The donut hole ends when you reach the catastrophic coverage limit for the year. In 2022, the donut hole will end when you and your plan reach $7,050 out-of-pocket in one calendar year.

What are the 4 phases of Medicare Part D coverage 2021?

If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.Oct 1, 2021

Can I switch Medicare Part D plans anytime?

If you want to switch to a Part D plan or a Medicare Advantage plan that has earned Medicare's highest quality rating (five stars) — if one is available in your area — you can do so once at any time of the year, except for one week (Nov.

Do Part D plans have an out-of-pocket maximum?

Medicare Part D, the outpatient prescription drug benefit for Medicare beneficiaries, provides catastrophic coverage for high out-of-pocket drug costs, but there is no limit on the total amount that beneficiaries have to pay out of pocket each year.Jul 23, 2021

What is the deductible for Medicare Part D in 2021?

$445 a yearSummary: The Medicare Part D deductible is the amount you pay for your prescription drugs before your plan begins to help. In 2021, the Medicare Part D deductible can't be greater than $445 a year. You probably know that being covered by insurance doesn't mean you can always get services and benefits for free.

Do all Part D plans have a deductible?

This is the amount you must pay each year for your prescriptions before your Medicare drug plan pays its share. Deductibles vary between Medicare drug plans. No Medicare drug plan may have a deductible more than $480 in 2022.

What is the deductible for Medicare Part D in 2022?

$480What is the Medicare Part D Deductible for 2022? The maximum deductible for Part D is $480 in 2022.Mar 23, 2022

Do I Need A Medicare Part D Plan?

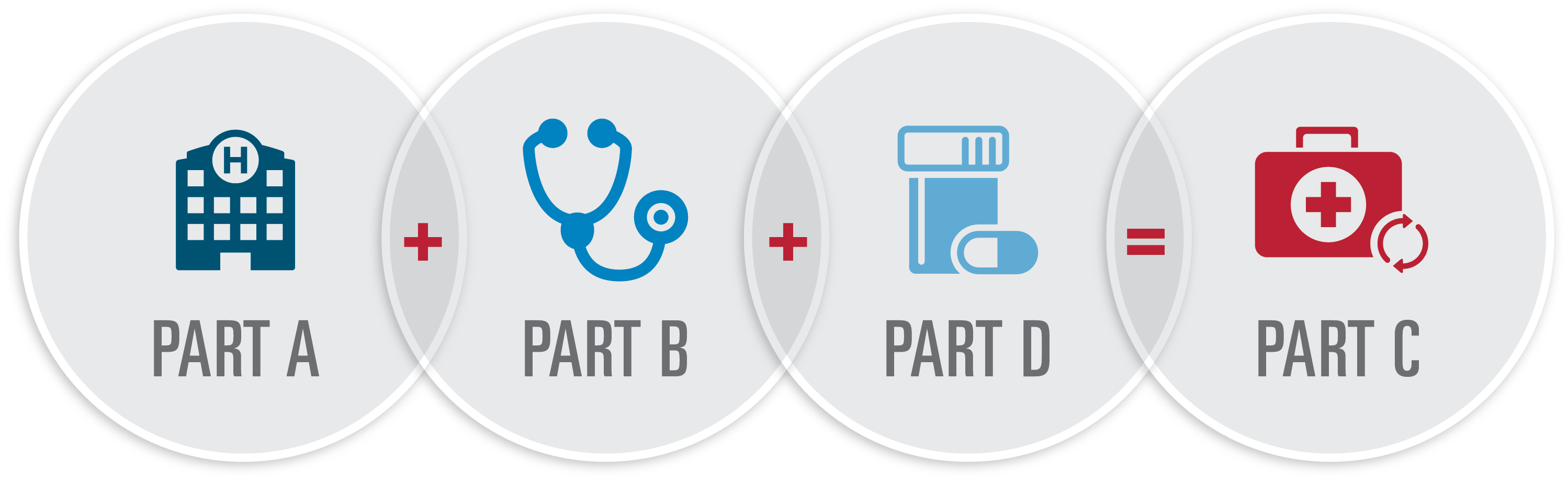

If you have Original Medicare (Part A and Part B) and want prescription drug coverage for prescription drugs you take at home, you will likely have...

What Is The Medicare Deductible For A Medicare Part D Plan?

A Medicare deductible is the amount you must pay each year for your prescription drugs before your Medicare Part D Prescription Drug Plan begins to...

How Else Do Stand-Alone Medicare Part D Plans differ?

Unlike Medicare Part D deductibles, Medicare doesn’t set a dollar limit for Medicare Part D premiums. Your plan sets the amount for your monthly pr...

How much is Medicare Part D 2020?

According to 2020 eHealth research, the average deductibles for stand-alone Medicare Part D plans in the study increased from $335 in 2019 to $405 in 2020.*. Some Medicare Part D plans have $0 deductibles, which means you are only responsible for a set copayment or coinsurance amount when you pick up your prescription drugs.

What are the tiers of Medicare Part D?

Medicare Part D plan prescription drug tiers are usually set such that the lower the tier number , the less expensive the drug, as in the following example:: Tier 1: preferred generic, generally the lowest cost tier. Tier 2: generic, generally cost more than tier 1. Tier 3: preferred brand, generally cost more than tier 2.

What is deductible in Medicare?

You may have various out of pocket costs with Medicare insurance, including copayments, coinsurance, and deductibles. “Deductible” is a common term in insurance. Generally the lower the deductible, the less you are responsible for paying out-of-pocket before your insurance coverage kicks in.

What is tier 5?

Tier 5: specialty tier, generally cost more than tier 4. Tier 6: select care drugs. If you only take generic prescription drugs, for example, you may not be subjected to the deductible in certain plans.

How much is the Medicare deductible for 2021?

Medicare sets the standard deductible every year. In 2021, that’s $445. Plans can have no deductible or any amount up to the standard amount. A plan determines which medications are subject to its deductible. In many plans, that’s Tiers 3, 4 and 5 drugs. The deductible applies to drugs the plan covers.

What is deductible in insurance?

The deductible is the amount a beneficiary must pay for covered drugs before the plan starts to pay. The full cost of the drug determines how much a beneficiary must pay when the plan has a deductible. In other words, one pays the full cost for drugs subject to a deductible until the designated amount is met.

What is EOB in Medicare?

In each month you get prescriptions, the plan sponsor will send a monthly prescription summary, which is an explanation of benefits (EOB).

Is Medicare Part D deductible?

Medicare Part D prescription drug coverage can cause confusion, and much of that starts with the deductible, which is the first of the Part D drug coverage payment stages. Confusing yes, but the inherent hazards of the deductible, those with financial implications, can be avoided with some factual information.

What is a prescription deductible?

A prescription deductible is a form of cost-sharing. If your plan has a deductible, you must first pay a predetermined amount out of pocket before your health insurance plan will begin to pay for covered services and products. The total amount of your deductible (and whether it is combined for medical and prescription) will vary by plan.

How many gold and platinum tier plans have separate deductibles?

If you are shopping on the Marketplace, many gold- and platinum-tier plans will offer separate deductibles. In 2019, 48% of gold plans and 54% of platinum plans offered separate deductibles.

How much is Joe's deductible?

Joe’s health plan has a combined deductible of $3,000. He has purchased $250 in prescriptions and spent $2,750 on a minor surgery covered by his plan, which he paid for out of pocket. Joe’s deductible has been met for any medical or prescription purchase he makes in this plan year. He will only have to pay $10 for each refill of the regular, generic prescription he takes.

Does Extra Help lower Part D deductibles?

While Extra Help does not lower Part D prescription deductibles, it does lower premiums for many seniors. If you need prescription coverage (as most of us do) but cannot afford Part D premiums, consider applying for Extra Help.

Is prescription deductible easy to compare?

At a glance, prescription deductibles may be easy to compare, but there are more complicated plan features you should also know about. HealthMarkets’ resource center filled with content just for you. Learn more about health insurance by reading our articles online, or get one-on-one guidance from a local Medicare agent.

Do prescriptions have to be covered by a deductible?

Usually, once this single deductible is met, your prescriptions will be covered at your plan’s designated amount. This doesn’t mean your prescriptions will be free, though. You may still have to pay some form of cost-sharing, even after a deductible is met.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

What happens when you reach your Part A or Part B deductible?

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

What is 20% coinsurance?

In this instance, you’d be responsible for 20% of the bill under Part B. Medicare would then cover the other 80%. The coinsurance amount you pay is 20% of the amount Medicare approved. This approved amount is the maximum amount your healthcare provider is allowed to charge you for an item or service. If you refer back to your broken arm example.

How much is a broken arm deductible?

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

What is Medicare Supplement?

Medicare Supplement, or Medigap, insurance plans are sold by private insurance companies to help pay some of the costs that Original Medicare does not. They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. Medicare Advantage. An alternative to Original Medicare, a Medicare ...

What is Medicare Advantage?

Medicare Advantage. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage. Most MA plans will have an annual out-of-pocket maximum limit. Extra Help Program. Finally, the Extra Help program is something low-income Medicare ...