Are railroad workers eligible for Medicare?

Jan 14, 2022 · You are eligible at age 65 if you receive or are eligible to receive railroad retirement or social security benefits. (Although the age requirements for some unreduced railroad retirement benefits have risen just like the social security requirements, beneficiaries are still eligible for Medicare at age 65.) If you are under age 65.--

When does Medicare Part A and Part B start for railroad retirement?

When people are eligible for either Social Security benefits or Railroad Retirement Benefits, they will qualify for Medicare due to age or disability. You may be turning 65 years old, or you may be under 65 and have a disability. If you are enrolling in Medicare as a current or former railroad worker, you’ll need to follow specific steps to enrollment in Medicare:

What is Medicare for railroad retirement annuitants?

May 01, 2019 · If a retired employee, or a family member, is receiving a railroad retirement annuity, enrollment for both Medicare Part A and Part B is generally automatic and coverage begins when the person reaches age 65.

What are the age requirements for railroad retirement benefits?

If you are not collecting Railroad Retirement benefits when you turn 65, you should contact your local RRB field office to enroll in Medicare. If you are under 65 and have a disability, you will have to fulfill different eligibility requirements to qualify for Medicare.

Why does railroad have their own Medicare?

Medicare offers coverage to railroad employees just as it does for people who have Social Security. The payroll taxes of railroad employees include railroad retirement and Medicare hospital insurance taxes.

Do seniors automatically get Medicare?

Medicare will automatically start when you turn 65 if you've received Social Security Benefits or Railroad Retirement Benefits for at least 4 months prior to your 65th birthday. You'll automatically be enrolled in both Medicare Part A and Part B at 65 if you get benefit checks.

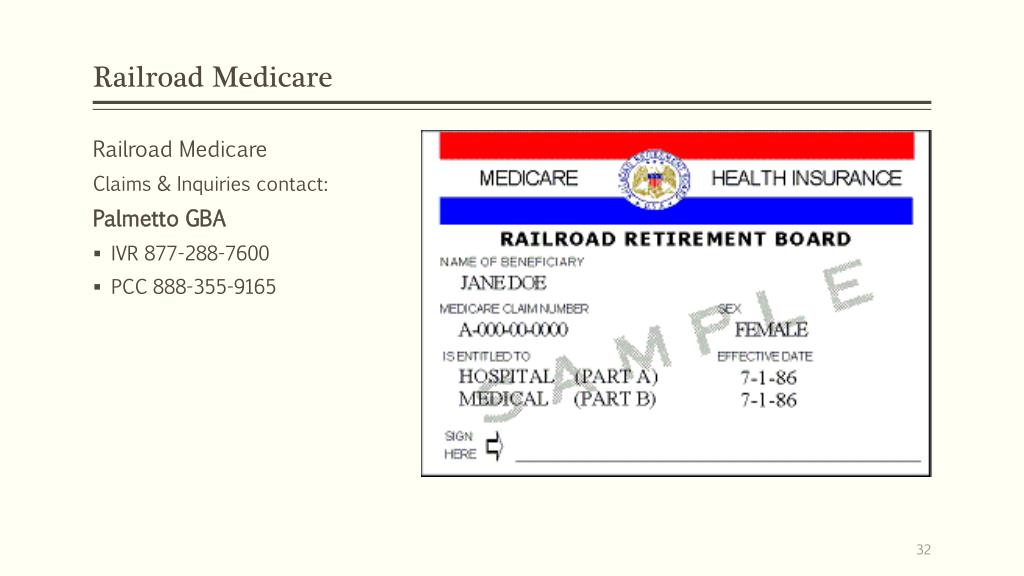

How do I know if I have railroad Medicare or regular Medicare?

The front of your Medicare card shows Medicare Health Insurance provided by the Railroad Retirement Board, instead of a Social Security Medicare card showing their toll-free phone number.

Do you get Medicare at 62 or 65?

Generally speaking, no. You can only enroll in Medicare at age 62 if you meet one of these criteria: You have been on Social Security Disability Insurance (SSDI) for at least two years. You are on SSDI because you suffer from amyotrophic lateral sclerosis, also known as ALS or Lou Gehrig's disease.

Do you automatically get Medicare with Social Security?

How Does Automatic Enrolling in Medicare Work? Most people who collect Social Security benefits automatically receive Original Medicare (Parts A and B) coverage once they're eligible. If you receive benefits through the Railroad Retirement Board (RRB), you'll receive the same Medicare coverage.Jan 20, 2022

How long before you turn 65 do you apply for Medicare?

3 monthsGenerally, you're first eligible starting 3 months before you turn 65 and ending 3 months after the month you turn 65. If you don't sign up for Part B when you're first eligible, you might have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B.

What is the average railroad retirement benefit?

The average age annuity being paid by the Railroad Retirement Board (RRB) at the end of fiscal year 2020 to career rail employees was $3,735 a month, and for all retired rail employees the average was $2,985. The average age retirement benefit being paid under social security was approximately $1,505 a month.

Is railroad retirement considered social security?

The Railroad Retirement Accounts cover Tier I and Tier II benefits that exceed Social Security.

Is railroad Medicare primary or secondary?

Railroad Providers - Medicare Secondary Payer (MSP)

Can I draw Social Security at 62 and still work full time?

You can get Social Security retirement or survivors benefits and work at the same time. But, if you're younger than full retirement age, and earn more than certain amounts, your benefits will be reduced. The amount that your benefits are reduced, however, isn't truly lost.

Does Medicare coverage start the month you turn 65?

For most people, Medicare coverage starts the first day of the month you turn 65. Some people delay enrollment and remain on an employer plan. Others may take premium-free Part A and delay Part B. If someone is on Social Security Disability for 24 months, they qualify for Medicare.

Can I get Medicare at age 63?

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or transplant).

Where is the railroad retirement board on my Medicare card?

Your Medicare card is similar to the new Medicare cards that all beneficiaries receive, with the exception that “Railroad Retirement Board” is printed in a red banner at the bottom of the card .

What happens if you receive a railroad retirement?

If you receive Railroad Retirement benefits or disability annuity benefits from the railroad at the time of eligibility for Medicare, you are automatically enrolled in Medicare Parts A and B by the RRB. After the RRB automatically enrolls you, you receive your Medicare card together with a letter from the RRB explaining ...

What is the RRB?

The RRB administers insurance and retirement benefits to all railroad workers in the country. Instead of getting retirement benefits from the U.S. Social Security Administration as other workers do, the RRB provides railroad workers and their families with retirement benefits, along with unemployment and sickness benefits, ...

Do you have to go through the Social Security Administration if you are employed by the railroad?

However, if you have end-stage renal disease (ESRD) and qualify for Medicare, you must go through the Social Security Administration even if you are employed by the railroad.

Does Medicare cover railroad employees?

Medicare offers coverage to railroad employees just as it does for people who have Social Security. The payroll taxes of railroad employees include railroad retirement and Medicare hospital insurance taxes.

What is Medicare for railroads?

The Federal Medicare program provides hospital and medical insurance protection for railroad retirement annuitants and their families, just as it does for social security beneficiaries. Medicare has the following parts: 1 Medicare Part A (hospital insurance) helps pay for inpatient care in hospitals and skilled nursing facilities (following a hospital stay), some home health care services, and hospice care. Part A is financed through payroll taxes paid by employees and employers. 2 Medicare Part B (medical insurance) helps pay for medically-necessary services like doctors' services and outpatient care. Part B also helps cover some preventive services. Part B is financed by premiums paid by participants and by Federal general revenue funds. 3 Medicare Part C (Medicare Advantage Plans) is another way to get Medicare benefits. It combines Part A, Part B, and sometimes, Part D (prescription drug) coverage. Medicare Advantage Plans are managed by private insurance companies approved by Medicare. 4 Medicare Part D (Medicare prescription drug coverage) offers voluntary insurance coverage for prescription drugs through Medicare prescription drug plans and other health plan options.

How to contact Medicare for railroad retirement?

General information on Medicare coverage for railroad retirement beneficiaries is available under Benefits (Medicare) or by contacting an RRB field office toll-free at 1-877-772-5772.

How is Medicare Part B financed?

Part A is financed through payroll taxes paid by employees and employers. Medicare Part B (medical insurance) helps pay for medically-necessary services like doctors' services and outpatient care. Part B also helps cover some preventive services. Part B is financed by premiums paid by participants and by Federal general revenue funds.

What is a PPO plan?

A PPO is a plan under which a beneficiary uses doctors, hospitals, and providers belonging to a network; beneficiaries can use doctors, hospitals, and providers outside the network for an additional cost. Under a Medicare Advantage Plan, a beneficiary may pay lower copayments and receive extra benefits.

How much is Medicare premium in 2019?

The standard premium is $135.50 in 2019. However, some Medicare beneficiaries will not pay this amount because of a provision in the law that states Part B premiums for current enrollees cannot increase by more than the amount of the cost-of-living increase for social security (railroad retirement tier I) benefits.

What is Medicare Advantage Plan?

Medicare Advantage Plans combine Medicare Part A and Part B coverage, and are available in most areas of the country. An individual must have Medicare Part A and Part B to join a Medicare Advantage Plan, and must live in the plan's service area.

What is the standard premium amount?

The standard premium amount applies to new enrollees in the program, and certain beneficiaries who pay higher premiums based on their modified adjusted gross income. Monthly premiums for some beneficiaries are greater, depending on a beneficiary’s or married couple’s modified adjusted gross income.

What Medicare Parts does RRB automatically enroll you in?

If you are receiving Railroad Retirement benefits or railroad disability annuity checks when you become eligible for Medicare, RRB should automatically enroll you in Medicare Parts A and B . You should receive your red, white, and blue Medicare card and a letter from RRB explaining that you have been enrolled in Medicare.

What to do if you are not collecting Railroad Retirement?

If you are not collecting Railroad Retirement benefits when you turn 65, you should contact your local RRB field office to enroll in Medicare. If you are under 65 and have a disability, you will have to fulfill different eligibility requirements to qualify for Medicare.

Does Medicare Part B get deducted from your check?

If you receive Railroad Retirement benefits or railroad disability annuity checks, your Medicare Part B premium should be automatically deducted from your check each month. If you do not qualify for premium-free Part A, it will also be deducted from your check.

When do you become eligible for Medicare?

Typically, you’ll become eligible when you turn 65 or reach your 25th month of receiving disability benefits. The main difference is that the RRB classifies disability differently than the SSA does, so check with a representative ...

How long do you have to enroll in Medicare if you have end stage renal disease?

Whether you become eligible for Medicare via age or disability, you’ll have seven months, called your Initial Enrollment Period (IEP), in which to enroll.

What is the RRB in 2020?

Licensed Insurance Agent and Medicare Expert Writer. June 15, 2020. Before the Social Security Administration (SSA) was formed, the Railroad Retirement Board (RRB) developed retirement, disability, and unemployment benefits for railroad workers who were hit hard by the Great Depression. Today, the RRB offers railroad workers a similar safety net.

What is the number to call a railroad retirement board?

Call a Licensed Agent: 833-271-5571. Due to COVID-19, the Railroad Retirement Board closed offices as of March 16, 2020. We’ll keep you updated on when offices reopen. In the meantime, visit RRB.gov to learn about your online self-serve options.

Does Medicare pay through the RRB?

Generally, your Medicare costs through the RRB will be the same as those paid by people who qualify for Medicare via Social Security. Just like workers outside the railroad industry, you’ll see Medicare deductions from your paycheck during your working years.

Does RRB have Medicare?

Today, the RRB offers railroad workers a similar safety net. RRB beneficiaries can tap into Medicare benefits, much like Social Security beneficiaries, with a few differences. If you are a railroad worker, learn what you can expect from Medicare in terms of eligibility, enrollment, costs, and health benefits—and how your RRB benefits differ ...

Do you pay Medicare Part D premiums through RRB?

If you add Medicare Part D, Medigap, or Medicare Advantage, you’ll pay additional premiums for these as well, but not through your RRB income checks. You’ll pay for each of these coverages separately, directly to the insurance company that provides each plan.

When can I disenroll from Medicare Advantage?

A: You can generally disenroll from a Medicare Advantage plan only during the Medicare open enrollment period of October 15-December 7, the Medicare Advantage Plan disenrollment period of January 1-February 14, or when you qualify for a Special Enrollment Period (SEP). For more information on SEPs, go to www.Medicare.gov.

What is the difference between Medicare Part B and Medicare Part B?

A: The only difference is that retired railroad beneficiaries have their Part B benefits administered by the Palmetto GBA Railroad Retirement Board Specialty Medicare Administrative Contractor (RRB SMAC) regardless of where they live. Members should be certain to advise providers of this when they receive treatment. Also, be sure to provide your Railroad Medicare card at time of service as the information on the card identifies you as a Railroad Medicare beneficiary to the provider.

Does Medicare cover dental implants?

A: In most cases, Medicare does not cover dental services, specifically, services related to the care, treatment, filling, removal, or replacement of teeth, or structures directly supporting teeth. This would include check-ups, cleanings, and dental devices (such as dentures, dental plates, dental implants, or bridges) as well as extractions or other procedures performed to prepare the mouth for dentures (including reconstruction of the ridge) or titanium implants.

Does Medicare cover injectable cancer drugs?

A: Only in limited instances will Medicare Part B provide for prescription drug coverage, such as for certain injectable cancer drugs or immunosuppressive drugs. All other Medicare benefits for prescription drugs require enrollment in a Part D Prescription Drug Program.

Do I need to sign up for Medicare Part B?

A: As an active employee covered under the active employee H&W Plan, you do not need to sign up for Medicare Part B. You should, however, sign up for Medicare Part A (for which there is no cost) to avoid any future Medicare enrollment problems. It is strongly recommended that you contact the Railroad Retirement Board three (3) months before you turn age 65 to start the Medicare enrollment process.

Can Medicare cards be similar?

A: This can easily happen as the two Medicare cards are very similar. The doctor’s office should pay close attention to the specific details printed on your Railroad Medicare card.

Does Medicare pay for hearing aids?

A: No, Medicare does not pay for hearing aids or hearing exams, when the purpose of the exam is to determine whether you need hearing aids or for fitting hearing aids.