When can I add Part B to my Medicare?

Feb 22, 2021 · Most people get Medicare Part B (Medical Insurance) when they turn 65. If you didn't sign up for Part B then, now's the time to decide if you want to enroll. During Medicare's General Enrollment Period (January 1–March 31), you can enroll in Part B and your coverage will start July 1. Deciding to enroll in Part B is an important decision.

When should I sign up for Medicare Part B?

Important: In most cases, if you don’t sign up for Part B when you’re first eligible, you’ll have to pay a late enrollment penalty for as long as you have Part B. Also, you may have to wait until the General Enrollment Period (from January 1 – March 31) to enroll in Part B and coverage will start July 1 of that year.

What are the requirements for Medicare Part B?

Jan 01, 2022 · I want to sign up for only Part A or both Part A & Part B. Once you’re eligible to sign up for Medicare (usually 3 months before you turn 65), you have 2 options: Sign up to get only Medicare coverage. Apply to start getting benefits from Social Security (or the Railroad Retirement Board).

What is the maximum premium for Medicare Part B?

Disabled individuals are automatically enrolled in Medicare Part A and Part B after they have received disability benefits from Social Security for 24 months. NOTE: In most cases, if someone does not enroll in Part B or premium Part A when first eligible, they will have to pay a late enrollment penalty. The Part B penalty is assessed for as long as the person has Part B.

Are you automatically enrolled in Medicare Part B?

Medicare will enroll you in Part B automatically. Your Medicare card will be mailed to you about 3 months before your 65th birthday. If you're not getting disability benefits and Medicare when you turn 65, you'll need to call or visit your local Social Security office, or call Social Security at 1-800-772-1213.

How soon before I retire should I apply for Medicare Part B?

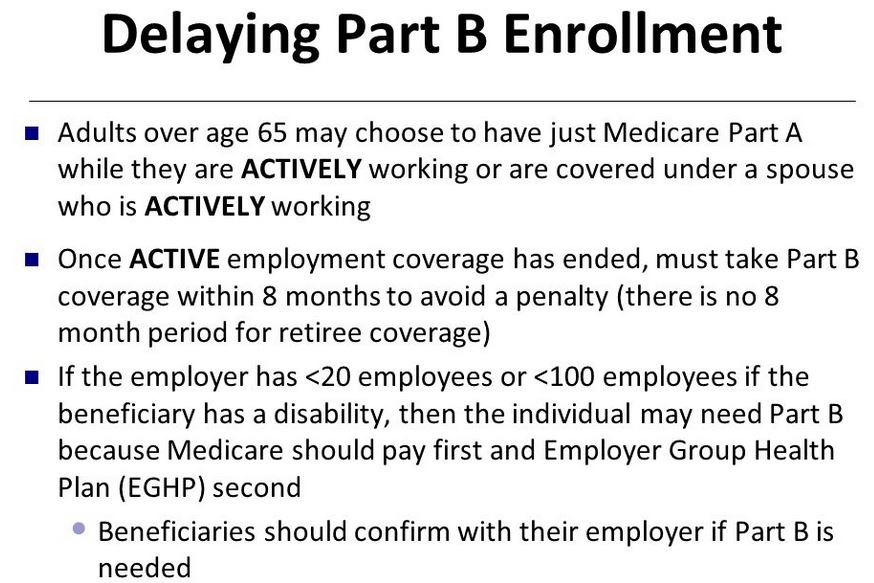

You should start your Part B coverage as soon as you stop working or lose your current employer coverage (even if you sign up for COBRA or retiree health coverage from your employer). You have 8 months to enroll in Medicare once you stop working OR your employer coverage ends (whichever happens first).

Does Medicare Part B have to start on the first of the month?

Part B (Medical Insurance) Generally, you're first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65. (You may be eligible for Medicare earlier, if you get disability benefits from Social Security or the Railroad Retirement Board.)

Are you automatically enrolled in Medicare Part A when you turn 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

How do I enroll in Medicare Part B?

Contact Social Security to sign up for Part B:Fill out Form CMS-40B (Application for Enrollment in Medicare Part B). ... Call 1-800-772-1213. ... Contact your local Social Security office.If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

What day of the month does Medicare coverage begin?

Your Medicare coverage generally starts on the first day of your birthday month. If your birthday falls on the first day of the month, your Medicare coverage starts the first day of the previous month. If you qualify for Medicare because of a disability or illness, in most cases your IEP is also seven months.

Does Medicare start the month of your birthday?

When your coverage starts If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65. (If your birthday is on the first of the month, coverage starts the month before you turn 65.)

Can I change my Medicare Part B start date?

As long as your age and enrollment period allows you to select September as your month to begin Part B coverage then you should be able to change your month of enrollment either by amending your application or by submitting a new Part B application form (https://www.cms.gov/Medicare/CMS-Forms/CMS-Forms/Downloads/CMS40B ...Jun 16, 2018

How do I know if I am automatically enrolled in Medicare?

You'll be automatically enrolled in Medicare Part A and Part B: If you are already getting benefits from Social Security or the Railroad Retirement Board. If you are younger than 65 and have a disability. If you have Lou Gehrig's disease, also called Amyotrophic Lateral Sclerosis, or ALS.Jan 28, 2020

Does Social Security automatically send you a Medicare card?

Medicare will automatically mail your new card to the address you have on file with Social Security. As long as your address is up to date, there's nothing you need to do!May 17, 2018

How do you pay for Medicare Part B if you are not collecting Social Security?

If you have Medicare Part B but you are not receiving Social Security or Railroad Retirement Board benefits yet, you will get a bill called a “Notice of Medicare Premium Payment Due” (CMS-500). You will need to make arrangements to pay this bill every month.

What does Part B cover?

Part B helps cover medically necessary services like doctors’ services, outpatient care, and other medical services that Part A doesn’t cover. Part B also covers many preventive services. Part B coverage is your choice. However, you need to have Part B if you want to buy Part A.

What is Part A insurance?

Part A helps cover your inpatient care in hospitals. Part A also includes coverage in critical access hospitals and skilled nursing facilities (not custodial or long-term care). It also covers hospice care and home health care. You must meet certain conditions to get these benefits.

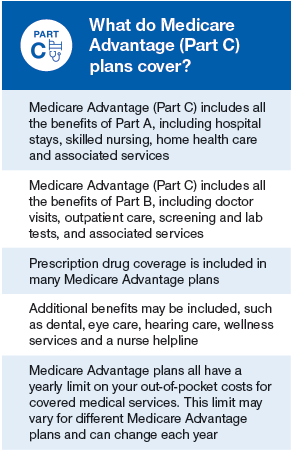

Does Medicare cover prescription drugs?

Medicare prescription drug coverage is available to everyone with Medicare. Private companies provide this coverage. You choose the Medicare drug plan and pay a monthly premium. Each plan can vary in cost and specific drugs covered. If you decide not to join a Medicare drug plan when you’re first eligible, and you don’t have other creditable prescription drug coverage, or you don’t get Extra Help, you’ll likely pay a late enrollment penalty. You may have to pay this penalty for as long as you have Medicare drug coverage.

Can I get medicare if I have SSI?

Getting SSI doesn’t make you eligible for Medicare. SSI provides a monthly cash benefit and health coverage under Medicaid. Your spouse may qualify for Medicare when he/she turns 65 or has received disability benefits for 24 months.

When do you have to be on Medicare before you can get Medicare?

Individuals already receiving Social Security or RRB benefits at least 4 months before being eligible for Medicare and residing in the United States (except residents of Puerto Rico) are automatically enrolled in both premium-free Part A and Part B.

How long does it take to get Medicare if you are 65?

For someone under age 65 who becomes entitled to Medicare based on disability, entitlement begins with the 25 th month of disability benefit entitlement.

How long do you have to be on Medicare if you are disabled?

Disabled individuals are automatically enrolled in Medicare Part A and Part B after they have received disability benefits from Social Security for 24 months. NOTE: In most cases, if someone does not enroll in Part B or premium Part A when first eligible, they will have to pay a late enrollment penalty.

What is the income related monthly adjustment amount for Medicare?

Individuals with income greater than $85,000 and married couples with income greater than $170,000 must pay a higher premium for Part B and an extra amount for Part D coverage in addition to their Part D plan premium. This additional amount is called income-related monthly adjustment amount. Less than 5 percent of people with Medicare are affected, so most people will not pay a higher premium.

What happens if you don't enroll in Part A?

If an individual did not enroll in premium Part A when first eligible, they may have to pay a higher monthly premium if they decide to enroll later. The monthly premium for Part A may increase up to 10%. The individual will have to pay the higher premium for twice the number of years the individual could have had Part A, but did not sign up.

How long does Medicare take to pay for disability?

A person who is entitled to monthly Social Security or Railroad Retirement Board (RRB) benefits on the basis of disability is automatically entitled to Part A after receiving disability benefits for 24 months.

What is MEC in Medicare?

Medicare and Minimum Essential Coverage (MEC) Medicare Part A counts as minimum essential coverage and satisfies the law that requires people to have health coverage. For additional information about minimum essential coverage (MEC) for people with Medicare, go to our Medicare & Marketplace page.

When do you get Medicare?

Some people are automatically enrolled in Medicare. If you are receiving benefits from Social Security or Railroad Retirement Board for at least four months before you turn 65, enrollment will occur automatically within a month of your turning 65. You should receive a red, white and blue Medicare card in the mail three months before your birthday. An exception is Puerto Rico, where Part A enrollment is automatic, but you need to sign up for Part B.

What is Medicare Part B?

Medicare Part B provides comprehensive insurance coverage for doctor visits and procedures, durable medical equipment and a variety of other services. Once you’ve signed up for Part B and are also enrolled in Part A, you may choose to enroll in a Medicare Advantage Plan, which often includes prescription drug insurance. Or you can stay with Original Medicare and purchase a Part D plan and a Medigap (supplemental) policy to help pay for the 20% of approved costs and other cost-sharing.

How much is the Social Security premium for 2021?

The standard part B premium for 2021 is $148.50 a month, 8 usually deducted from your Social Security check if you are receiving benefits.

How to contact Social Security about Part B?

Please contact Social Security at 1-800-772-1213 ( TTY 1-800-325-0778) if you have any questions. Note: When completing the forms: State, “I want Part B coverage to begin (MM/YY)” in the remarks section of the CMS-40B form or online application. If your employer is unable to complete Section B, please complete that portion as best you can on behalf ...

Do you have to leave home to sign up for Medicare Part B?

For many people, signing up for Medicare Part B doesn’t require you to leave the comfort of home. Please visit our Medicare Part B webpage if: You are already enrolled in Medicare Part A. You would like to enroll in Part B during the Special Enrollment Period.

What does Medicare Part A and B cover?

There are four total parts of Medicare: Medicare Part A, Part B, Part C, and Part D. However, the two main parts of Medicare are Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance). So what exactly does Medicare Part A and Part B cover?

Who qualifies for Medicare Part A and B?

With so many rules and regulations surrounding Medicare Part A and B, it can be difficult to understand who qualifies for Medicare Part A and Part B coverage. Generally, Medicare Part A and B are available for: people 65+, those under age-65 with disabilities, and those with End Stage Renal Disease. Let’s break that down.

Will I be enrolled in Medicare Part A and B automatically?

Some people will be enrolled in Medicare automatically, however some won’t. 6 Whether or not you qualify for automatic enrollment in Medicare is largely determined on whether or not you are already getting Social Security or Railroad Retirement Board benefits.

How long do you have to enroll in Part B if you retire?

When you retire and lose your employer coverage, you’ll be given a 8-month Special Enrollment Period to enroll in Part B without any late penalty.

How much is Part B insurance?

Most people delay Part B in this scenario. Your employer plan likely already provides good outpatient coverage. Part B costs at least $148.50/month for new enrollees in 2020.

How much does Medicare pay for outpatients?

Your healthcare providers will bill Medicare, and Part B will then pay 80% of your outpatient expenses after your small deductible. Medicare then sends the remainder of that bill to your Medigap plan to pay the other 20%. The same goes for Medicare Advantage plans.

What happens if you opt out of Part B?

Be aware that if you opt out of Part B and then later decide to join, you will pay a Part B late penalty. You’ll also need to wait until the next General Enrollment Period to enroll, which means there could be a delay before your coverage becomes active. In my opinion, most Veterans should sign up for Part B.

Does Medigap replace Part B?

Medigap plans do not replace Part B. They pay secondary to Part B. Part B works together with your Medigap plan to provide you full coverage. This means you must be enrolled in Part B before you are even eligible to apply for a Medicare supplement.

Do you have to be enrolled in Part B for Medicaid?

When you are 65 or older and enrolled in Medicaid. All of these scenarios require you to be enrolled in Part B. Without it, you would be responsible for the first 80% of all outpatient charges. Even worse, your secondary coverage may not pay at all if you are not actively enrolled in Part B as your primary coverage.

Do you need Part B before you can enroll in Medigap?

Conclusion. To recap the important points in this article, most people need Part B at some point. When you enroll will depend on what other coverage you currently have when you turn 65. Also, Part B is not a supplement. You need Part B before you can enroll in Medigap or a Medicare Advantage plan.

What is the primary payer for Medicare?

If the company you work for has 2 to 19 employees, then Medicare is the primary payer, which means that Medicare pays your medical claims first, and then your company’s health insurance plan pays its portion.

Do you have to be enrolled in Medicare if you are 65?

Many of the insurance companies assume that a 65-year-old member of the group health plan is enrolled in Medicare Parts A and B, and they pay claims as if the member were enrolled. Either you must enroll in Parts A and B to stay on the group health plan, or the premium is significantly higher if you are not enrolled.

Does California charge higher premiums for Medicare?

Some health insurance companies in California simply charge much higher premiums for enrollees age 65 and over without regard for enrollment in Medicare Part B. Learn about how to enroll in Medicare and a Med Sup plan.

Is Medicare the primary or secondary payer?

If the company you work for has 2 to 19 employees, then Medicare is the primary payer, which means that Medicare pays your medical claims first, and then your company’s health insurance plan pays its portion. If your employer has 20 or more employees, then Medicare is the secondary payer, and your group health plan pays your claims first.

Can my employer pay for my Medicare?

Important: Know that your employer can not induce you to enroll in Medicare (i.e., your employer can’t pay for your Medicare and Med Sup plan – nor can your employer pay you a bonus to enroll in Medicare.) If you chose to enroll in a Med Sup plan, you’ll have to pay the entire premium for Medicare and the Med Sup yourself.