When can I add Part B to my Medicare?

when you applied for Medicare, but now want Part B. • If you want to sign up for Part B during the General Enrollment Period (GEP) from January 1 – March 31 each year. • If you refused Part B during your IEP because you had group health plan (GHP) coverage through your or your spouse’s current employment. You may sign up during

When should I sign up for Medicare Part B?

You should set up Part B to start the very next day after you lose your employer coverage. For example, if you know you will be retiring on June 30 th, you should enroll in Medicare Parts A and/or B to begin on July 1 st. When you activate your Part B, you will activate your 6-month Medicare supplement open enrollment window. This is your one opportunity to enroll into any Medigap plan without health questions.

What are the requirements for Medicare Part B?

for these:

- Most doctor services (including most doctor services while you're a hospital inpatient)

- Outpatient therapy

- Durable Medical Equipment (Dme) Certain medical equipment, like a walker, wheelchair, or hospital bed, that's ordered by your doctor for use in the home.

What is the maximum premium for Medicare Part B?

The standard monthly premium for Part B, which covers outpatient care and durable equipment ... or offers a different copay and an out-of-pocket maximum (a Medicare Advantage Plan). The Aduhelm situation highlights the ripple effect that expensive drugs ...

How soon should I apply for Medicare Part B before I retire?

Generally, you're first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65. (You may be eligible for Medicare earlier, if you get disability benefits from Social Security or the Railroad Retirement Board.)

Is Part B mandatory on Medicare?

Medicare Part B is optional, but in some ways, it can feel mandatory, because there are penalties associated with delayed enrollment. As discussed later, you don't have to enroll in Part B, particularly if you're still working when you reach age 65.

Do I automatically get Medicare Part B when I turn 65?

Medicare will enroll you in Part B automatically. Your Medicare card will be mailed to you about 3 months before your 65th birthday. If you're not getting disability benefits and Medicare when you turn 65, you'll need to call or visit your local Social Security office, or call Social Security at 1-800-772-1213.

How many months before I turn 65 should I apply for Medicare?

3 monthsGenerally, we advise people to file for Medicare benefits 3 months before age 65. Remember, Medicare benefits can begin no earlier than age 65. If you are already receiving Social Security, you will automatically be enrolled in Medicare Parts A and B without an additional application.

Can you add Medicare Part B at any time?

You can sign up for Medicare Part B at any time that you have coverage through current or active employment. Or you can sign up for Medicare during the eight-month Special Enrollment Period that starts when your employer or union group coverage ends or you stop working (whichever happens first).

What happens if I don't want Medicare Part B?

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B.

How soon before you turn 65 should you apply for Social Security?

You can apply up to four months before you want your retirement benefits to start. For example, if you turn 62 on December 2, you can start your benefits as early as December, and apply in August. Even if you are not ready to retire, you still should sign up for Medicare three months before your 65th birthday.

What do I need to do before I turn 65?

Turning 65 Soon? Here's a Quick Retirement ChecklistPrepare for Medicare. ... Consider Additional Health Insurance. ... Review Your Social Security Benefits Plan. ... Plan Ahead for Long-Term Care Costs. ... Review Your Retirement Accounts and Investments. ... Update Your Estate Planning Documents.

Can you have Medicare and employer insurance at the same time?

Yes, you can have both Medicare and employer-provided health insurance. In most cases, you will become eligible for Medicare coverage when you turn 65, even if you are still working and enrolled in your employer's health plan.

When should I apply for Social Security when I turn 66 and 2 months?

You can apply up to four months before you want your retirement benefits to start. For example, if you turn 62 on December 2, you can start your benefits as early as December. If you want your benefits to start in December, you can apply in August.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Can I drop my employer health insurance and go on Medicare?

You can keep your employer plan and sign up for Medicare Part A. You can keep your employer plan and sign up for Medicare Part A, and decide if you want to pick up B, D, and/or a Medigap Plan. Most people don't sign up for Parts B and D, because they have a monthly premium.

You Always Need Part B If Medicare Is Primary

Once you retire and have no access to other health coverage, Medicare becomes your primary insurance. While Part A pays for your room and board in...

You Need Part B to Be Eligible For Supplemental Coverage

Medigap plans do not replace Part B. They pay secondary to Part B.Part B works together with your Medigap plan to provide you full coverage. This m...

Do I Need Medicare Part B If I Have Other Insurance?

Many people ask if they should sign up for Medicare Part B when they have other insurance. At a large employer with 20 or more employees, your empl...

Enrolling Into Part B on A Delayed Basis

If you have delayed Part B while you were still working at a large employer, you’ll still need to enroll in Part B eventually. When you retire and...

Do I Need Medicare Part B If I’M A Veteran?

Some people have 2 different coverages that they can choose independent of one another. Federal employees who can opt to use their FEHB instead of...

Most Common Mistakes Regarding Part B

The most common mistake we see is from people who confuse Part B and Medigap. Just this week, a reader on our Facebook page commented that she was...

How to apply for Part B?

Signing up for Part B is easy—apply by March 31. Fill out a short form, and send it to your local Social Security office. Call Social Security at 1-800-772-1213. TTY users can call 1-800-325-0778. Contact your local Social Security office. If you get benefits from the Railroad Retirement Board, contact your local RRB office to sign up for Part B. ...

When do you get Medicare Part B?

Most people get Medicare Part B (Medical Insurance) when they turn 65. If you didn't sign up for Part B then, now's the time to decide if you want to enroll. During Medicare's General Enrollment Period (January 1–March 31), you can enroll in Part B and your coverage will start July 1.

Is it important to enroll in Part B?

Deciding to enroll in Part B is an important decision. It depends on the type of coverage you have now. It’s also important to think about the Part B late enrollment penalty—this lifetime penalty gets added to your monthly Part B premium, and it goes up the longer you wait to sign up.

What happens if you don't enroll in Medicare Part B?

If you have VA benefits and do not enroll for Part B during your initial enrollment period, you may be assessed the Part B premium penalty if you decide to enroll for Part B at a later date. Get the benefits you deserve when you turn 65 by enrolling in Medicare. To find out more information about enrolling in Medicare Part B, ...

What is the first form to get Medicare Part B?

The first for you need is the Part B enrollment form found here: Medicare Part B enrollment application . Another important form is for your (or spouse) employer to show that you have had coverage since you were first eligible for Medicare at age 65. This is to ensure no penalty is added to your monthly Part B premiums.

How much is the penalty for not having Medicare Part B?

The penalty could be as much as 10% for each full 12-month period you did not have Part B and were eligible. Additionally, if you do not sign up for Medicare Part B during your Initial Enrollment Period and you do not have a Special Enrollment Period due to loss of group coverage, you will have to wait until the General Enrollment Period ...

How long before you turn 65 can you apply for Medicare?

You can apply 3 months prior to turning 65, the month you turn 65, or 3 months after turning 65. Your Medicare Part B benefits will be effective the first day ...

How much is the Part B premium?

The standard monthly Part B premium in 2020 is $144.60 (up from $135.50 in 2019). 1 But how much you'll pay depends on your income. See below how the Part B premium is figured.

Where to drop off Medicare Part B?

Print these forms, get them filled out, and drop them off at your local Social Security office. The first for you need is the Part B enrollment form found here: Medicare Part B enrollment application .

Is Medicare Part B confusing?

Understanding the Medicare Part B enrollment process can be confusing. Depending on your situation, the requirements for enrollment can differ. Below, we review different ways in which you may want to enroll in Part B coverage.

What is the primary payer for Medicare?

If the company you work for has 2 to 19 employees, then Medicare is the primary payer, which means that Medicare pays your medical claims first, and then your company’s health insurance plan pays its portion.

Do you have to pay for Med Sup?

If you chose to enroll in a Med Sup plan, you’ll have to pay the entire premium for Medicare and the Med Sup yourself. The U.S. Department of Labor actually audits employers to see if they are violating this law.

Can my employer pay for my Medicare?

Important: Know that your employer can not induce you to enroll in Medicare (i.e., your employer can’t pay for your Medicare and Med Sup plan – nor can your employer pay you a bonus to enroll in Medicare.) If you chose to enroll in a Med Sup plan, you’ll have to pay the entire premium for Medicare and the Med Sup yourself.

Does California charge higher premiums for Medicare?

Some health insurance companies in California simply charge much higher premiums for enrollees age 65 and over without regard for enrollment in Medicare Part B. Learn about how to enroll in Medicare and a Med Sup plan.

Is Medicare the primary or secondary payer?

If the company you work for has 2 to 19 employees, then Medicare is the primary payer, which means that Medicare pays your medical claims first, and then your company’s health insurance plan pays its portion. If your employer has 20 or more employees, then Medicare is the secondary payer, and your group health plan pays your claims first.

Do you have to be enrolled in Medicare if you are 65?

Many of the insurance companies assume that a 65-year-old member of the group health plan is enrolled in Medicare Parts A and B, and they pay claims as if the member were enrolled. Either you must enroll in Parts A and B to stay on the group health plan, or the premium is significantly higher if you are not enrolled.

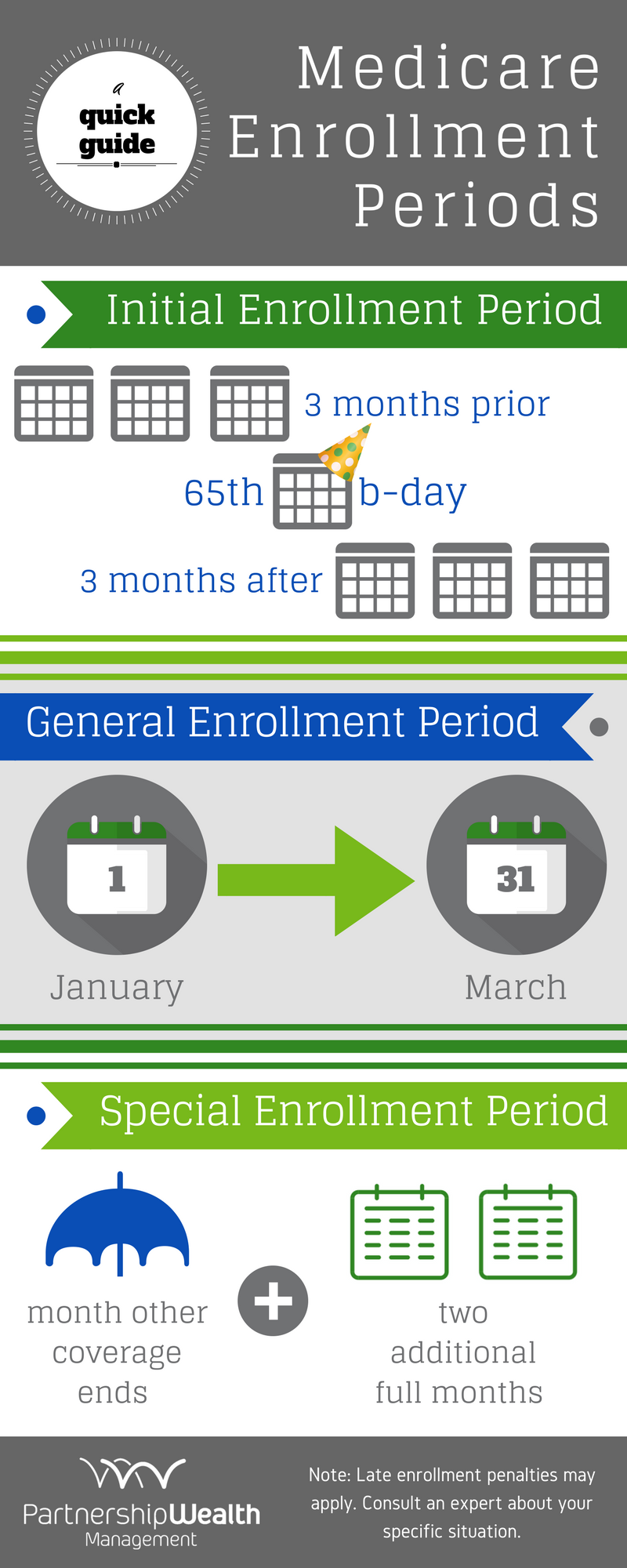

Your first chance to sign up (Initial Enrollment Period)

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Between January 1-March 31 each year (General Enrollment Period)

You can sign up between January 1-March 31 each year. This is called the General Enrollment Period. Your coverage starts July 1. You might pay a monthly late enrollment penalty, if you don’t qualify for a Special Enrollment Period.

Special Situations (Special Enrollment Period)

There are certain situations when you can sign up for Part B (and Premium-Part A) during a Special Enrollment Period without paying a late enrollment penalty. A Special Enrollment Period is only available for a limited time.

Joining a plan

A type of Medicare-approved health plan from a private company that you can choose to cover most of your Part A and Part B benefits instead of Original Medicare. It usually also includes drug coverage (Part D).

Answer a few questions to find out

These questions don’t apply if you have End-Stage Renal Disease (ESRD).

Do you have health insurance now?

Are you or your spouse still working for the employer that provides your health insurance coverage?

What happens if you don't get Part B?

NOTE: If you don’t get Part B when you are first eligible, you may have to pay a lifetime late enrollment penalty. However, you may not pay a penalty if you delay Part B because you have coverage based on your (or your spouse’s) current employment.

What is the individual health insurance marketplace?

NOTE: The Individual Health Insurance Marketplace is a place where people can go to compare and enroll in health insurance. In some states the Marketplace is run by the state and in other states it is run by the federal government. The Health Insurance Marketplace was set up through the Affordable Care Act, also known as Obamacare.

When do you get Part A and Part B?

You will automatically get Part A and Part B starting the first day of the month you turn 65. (If your birthday is on the first day of the month, Part A and Part B will start the first day of the prior month.)

Do you have to pay a penalty if you don't get Part A?

NOTE: If you don’t get Part A and Part B when you are first eligible, you may have to pay a lifetime late enrollment penalty. However, you may not pay a penalty if you delay Part A and Part B because you have coverage based on your (or your spouse’s) current employment.

What does Part B cover?

Part B helps cover medically necessary services like doctors’ services, outpatient care, and other medical services that Part A doesn’t cover. Part B also covers many preventive services. Part B coverage is your choice. However, you need to have Part B if you want to buy Part A.

What is Part A insurance?

Part A helps cover your inpatient care in hospitals. Part A also includes coverage in critical access hospitals and skilled nursing facilities (not custodial or long-term care). It also covers hospice care and home health care. You must meet certain conditions to get these benefits.

Is SSI the same as disability?

monthly benefit paid by Social Security to people with limited income and resources who are disabled, blind, or age 65 or older. SSI benefits aren’t the same as Social Security retirement or disability benefits.

Can you get a kidney transplant if you have a kidney transplant?

Yes, you can get Part A and Part B no matter how old you are if your kidneys no longer work, you need regular dialysis or have had a kidney transplant, and one of these applies to you:

Can I get medicare if I have SSI?

Getting SSI doesn’t make you eligible for Medicare. SSI provides a monthly cash benefit and health coverage under Medicaid. Your spouse may qualify for Medicare when he/she turns 65 or has received disability benefits for 24 months.

Does Medicare cover prescription drugs?

Medicare prescription drug coverage is available to everyone with Medicare. Private companies provide this coverage. You choose the Medicare drug plan and pay a monthly premium. Each plan can vary in cost and specific drugs covered. If you decide not to join a Medicare drug plan when you’re first eligible, and you don’t have other creditable prescription drug coverage, or you don’t get Extra Help, you’ll likely pay a late enrollment penalty. You may have to pay this penalty for as long as you have Medicare drug coverage.

How much does a premium increase for a 12 month period?

If you don't sign up within your initial enrollment period or a special enrollment period (whichever is appropriate to you), your monthly premium will permanently increase 10 percent for each 12-month period you were eligible but did not enroll.

When does the eight month special enrollment period start?

The eight-month special enrollment period starts at the end of the month in which you stop working or lose your employer insurance, whichever is first. Generally, people eligible for Social Security benefits do not pay for Part A.

When does the IEP start?

The seven-month initial enrollment period begins three months before the month of your 65th birthday and ends three months after that month. (So for example, if you turn 65 in April, your IEP begins Jan. 1 and ends July 31.)

When do you have to enroll in Medicare?

If you work for a smaller employer, you must enroll in Part A and Part B when you turn 65, and then Medicare pays claims first and your employer plan becomes your secondary insurance. Medicare has strict enrollment rules that affect people differently according to their circumstances.