How and when to enroll in Medicare Part B?

Jan 01, 2022 · Extra time to sign up for Medicare is available for anyone who wasn’t able to contact the Social Security Administration because of problems with Social Security’s telephone system between January 1, 2022 - December 30, 2022. Find out if …

When do I have to enroll in Medicare Part B?

Jan 02, 2021 · You should set up Part B to start the very next day after you lose your employer coverage. For example, if you know you will be retiring on June 30 th, you should enroll in Medicare Parts A and/or B to begin on July 1 st. When you activate your Part B, you will activate your 6-month Medicare supplement open enrollment window.

What age do you have to sign up for Medicare?

Sign up Most people get Medicare Part A (Hospital Insurance) and Part B (Medical Insurance) when first eligible (usually when turning 65). Answer a few questions to check when and how to sign up based on your personal situation. Learn about Part A and Part B sign up periods and when coverage starts. Check when to sign up

When is open enrollment for Medicare B?

You have a seven-month initial period to enroll in Medicare Part B. The seven months include the three months prior to your 65th birthday, the month containing your 65th birthday and the three months that follow your birthday month. If you turn 65 on March 8, then you have from December 1 to June 30 to enroll in Medicare Part B.

Can you add Medicare Part B at any time?

You can sign up for Medicare Part B at any time that you have coverage through current or active employment. Or you can sign up for Medicare during the eight-month Special Enrollment Period that starts when your employer or union group coverage ends or you stop working (whichever happens first).

Do you have to sign up for Part B at 65?

You should enroll in Part A and Part B when you turn 65. Period, you will have to wait to sign up and you may have to pay a lifetime late enrollment penalty—and that penalty increases the longer you wait.

What happens if I don't sign up for Medicare Part B when I turn 65?

If you miss your 7-month Initial Enrollment Period, you may have to wait to sign up and pay a monthly late enrollment penalty for as long as you have Part B coverage. The penalty goes up the longer you wait. You may also have to pay a penalty if you have to pay a Part A premium, also called “Premium-Part A.”

Is Part B mandatory on Medicare?

Medicare Part B is optional, but in some ways, it can feel mandatory, because there are penalties associated with delayed enrollment. As discussed later, you don't have to enroll in Part B, particularly if you're still working when you reach age 65.

Are you automatically enrolled in Medicare if you are on Social Security?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

How long does it take to get Medicare Part B after?

Most Medicare provider number applications are taking up to 12 calendar days to process from the date we get your application. Some applications may take longer if they need to be assessed by the Department of Health. We assess your application to see if you're eligible to access Medicare benefits.Dec 10, 2021

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

How do you pay for Medicare Part B if you are not collecting Social Security?

If you have Medicare Part B but you are not receiving Social Security or Railroad Retirement Board benefits yet, you will get a bill called a “Notice of Medicare Premium Payment Due” (CMS-500). You will need to make arrangements to pay this bill every month.

Can I decline Medicare Part B?

Declining Part B Coverage You can decline Medicare Part B coverage if you can't get another program to pay for it and you don't want to pay for it yourself. The important thing to know about declining Part B coverage is that if you decline it and then decide that you want it later, you may have to pay a higher premium.

Does Medicare Part B pay for prescriptions?

Medicare Part B (Medical Insurance) includes limited drug coverage. It doesn't cover most drugs you get at the pharmacy. You'll need to join a Medicare drug plan or health plan with drug coverage to get Medicare coverage for prescription drugs for most chronic conditions, like high blood pressure.

Do you have to enroll in Medicare Part B every year?

For Original Medicare (Parts A and B), there are no renewal requirements once enrolled. Medigap plans ― also known as Medicare Supplement plans ― auto renew annually unless you make a change.Apr 5, 2022

Why do you have to pay for Medicare Part B?

You must keep paying your Part B premium to keep your supplement insurance. Helps lower your share of costs for Part A and Part B services in Original Medicare. Some Medigap policies include extra benefits to lower your costs, like coverage when you travel out of the country.

You Always Need Part B If Medicare Is Primary

Once you retire and have no access to other health coverage, Medicare becomes your primary insurance. While Part A pays for your room and board in...

You Need Part B to Be Eligible For Supplemental Coverage

Medigap plans do not replace Part B. They pay secondary to Part B.Part B works together with your Medigap plan to provide you full coverage. This m...

Do I Need Medicare Part B If I Have Other Insurance?

Many people ask if they should sign up for Medicare Part B when they have other insurance. At a large employer with 20 or more employees, your empl...

Enrolling Into Part B on A Delayed Basis

If you have delayed Part B while you were still working at a large employer, you’ll still need to enroll in Part B eventually. When you retire and...

Do I Need Medicare Part B If I’M A Veteran?

Some people have 2 different coverages that they can choose independent of one another. Federal employees who can opt to use their FEHB instead of...

Most Common Mistakes Regarding Part B

The most common mistake we see is from people who confuse Part B and Medigap. Just this week, a reader on our Facebook page commented that she was...

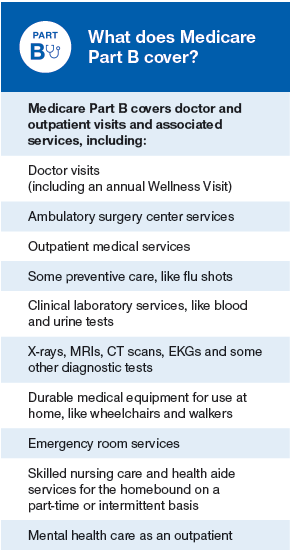

Understanding What Medicare Part B Offers

First, let’s take a look at what Medicare Part B actually covers. Medicare Part B covers medical treatments and services under two classifications:...

Medicare Part B Enrollment Options and Penalties

Medicare Part B is optional, but in some ways, it can feel mandatory, because there are penalties associated with delayed enrollment. As discussed...

The Cost of Medicare Part B

Unlike Medicare Part A, Medicare Part B requires a premium. For the most part, the premium for Medicare Part B is $134 per month. You also pay $204...

Medicare Part B Financial Assistance

Because Medicare Part B requires a monthly payment (known as a premium) for its services, some people may find it difficult to pay for the monthly...

Medicare Part B Special Circumstances and Updates

Some people don’t need Medicare Part B coverage right away, because they have medical insurance through their employers or meet other special condi...

Benefits of Medicare Part B

Medicare Part B covers a variety of routine healthcare visits and treatments. If you can afford the premiums, then you may want to take advantage o...

What is it?

This package notifies people of the chance to enroll in Part B during the General Enrollment Period. It includes a letter and booklet. The package explains how to sign up for Part B, the risks for delaying enrollment, and other decisions you may need to make about your Medicare coverage.

When should I get it?

At the start of the Part B General Enrollment Period, which occurs from January 1-March 31 each year

What should I do if I get these materials?

Read the materials carefully as soon as you them because they explain important decision that you should make now.

Download a sample

"Sign up for Part B" package for people living in the United States and come U.S. Territories (the Virgin Islands, Guam, the Northern Mariana Islands, and American Samoa)

Publication, product, or other number

Product No. 11873 for people living in the United States and some U.S. Territories

How long do you have to enroll in Part B if you retire?

When you retire and lose your employer coverage, you’ll be given a 8-month Special Enrollment Period to enroll in Part B without any late penalty.

What happens if you opt out of Part B?

Be aware that if you opt out of Part B and then later decide to join, you will pay a Part B late penalty. You’ll also need to wait until the next General Enrollment Period to enroll, which means there could be a delay before your coverage becomes active. In my opinion, most Veterans should sign up for Part B.

How much does Medicare pay for outpatients?

Your healthcare providers will bill Medicare, and Part B will then pay 80% of your outpatient expenses after your small deductible. Medicare then sends the remainder of that bill to your Medigap plan to pay the other 20%. The same goes for Medicare Advantage plans.

How much is Part B insurance?

Most people delay Part B in this scenario. Your employer plan likely already provides good outpatient coverage. Part B costs at least $148.50/month for new enrollees in 2020.

Does Medigap replace Part B?

Medigap plans do not replace Part B. They pay secondary to Part B. Part B works together with your Medigap plan to provide you full coverage. This means you must be enrolled in Part B before you are even eligible to apply for a Medicare supplement.

Do you have to be enrolled in Part B for Medicaid?

When you are 65 or older and enrolled in Medicaid. All of these scenarios require you to be enrolled in Part B. Without it, you would be responsible for the first 80% of all outpatient charges. Even worse, your secondary coverage may not pay at all if you are not actively enrolled in Part B as your primary coverage.

Do you need Part B before you can enroll in Medigap?

Conclusion. To recap the important points in this article, most people need Part B at some point. When you enroll will depend on what other coverage you currently have when you turn 65. Also, Part B is not a supplement. You need Part B before you can enroll in Medigap or a Medicare Advantage plan.

Check when to sign up

Answer a few questions to find out when you can sign up for Part A and Part B based on your situation.

When coverage starts

The date your Part A and Part B coverage will start depends on when you sign up.

How long do you have to be in Medicare to get Medicare Part B?

You have a seven-month initial period to enroll in Medicare Part B. The seven months include the three months prior to your 65th birthday, the month containing your 65th birthday and the three months that follow your birthday month. If you turn 65 on March 8, then you have from December 1 to June 30 to enroll in Medicare Part B.

Why don't people enroll in Medicare Part B?

And some people choose not to enroll in Medicare Part B, because they don’t want to pay for medical coverage they feel they don’t need. There are a variety of reasons why you might hesitate to pay for medical insurance. Likewise, you may be concerned about how the new healthcare laws affect Medicare Part B coverage.

How much does Medicare pay if you make less than $500,000?

Individuals who earn more than $163,000 but less than $500,000 per year will pay $462.70 in Medicare Part B premiums per month. If you earn $500,000 per year or more, your Medicare Part B premium will be $491.60 per month. These amounts reflect individual incomes only.

How much is Medicare Part B in 2021?

That premium changes each year, usually increasing. In 2021, the Part B premium is $148.50 a month. You’ll also have an annual deductible of $203 in 2021 (an increase from the $198 deductible in 2020).

What is covered by Medicare Part B?

In addition, Part B may cover other medical procedures and treatments that fall within the necessary or preventive range. Ambulance services, clinical research, mental health counseling and some prescription drugs for outpatient treatment may all be covered under Medicare Part B.

What is the number to call for Medicare?

1-800-810-1437 TTY 711. If you are about to turn 65 and need information regarding the various portions of Medicare, then you’ve come to the right place. We know how overwhelming all of the information regarding Medicare can be. And we want to help you choose a plan that meets your individual needs.

How much does a person make on Part B?

If you earn more than $109,000 and up to $136,000 per year as an individual, then you’ll pay $289.20 per month for Part B premiums. If you earn more than $136,000 and up to $163,000 for the year as a single person, you’ll pay $376.00 per month for Part B premiums.

How does Medicare work with my job-based health insurance when I stop working?

Once you stop working, Medicare will pay first and any retiree coverage or supplemental coverage that works with Medicare will pay second.

When & how do I sign up for Medicare?

You can sign up anytime while you (or your spouse) are still working and you have health insurance through that employer. You also have 8 months after you (or your spouse) stop working to sign up.

Do I need to get Medicare drug coverage (Part D)?

Prescription drug coverage that provides the same value to Medicare Part D. It could include drug coverage from a current or former employer or union, TRICARE, Indian Health Service, VA, or individual health insurance coverage.

When do you start enrolling in Medicare?

However, you may begin the enrollment process three months before turning 65, which is when your Medicare Initial Enrollment Period (IEP) typically begins. Learn more about the Medicare Initial Enrollment Period.

How long does it take to sign up for Medicare?

You may apply for Medicare online through the Social Security Administration (SSA) website. The application process typically takes no more than 10 minutes to complete. By phone.

How to apply for medicare over the phone?

By phone. Call 1-800-772-1213 between 7am and 7pm Monday through Friday to apply over the phone. If you are hard of hearing, you may dial 1-800-325-0778. In person. Visit your local Social Security office to apply for Medicare in person. If you're eligible for or enrolled in Medicare and you want to compare your Medicare plan options, ...

Do you have to provide military records for Medicare?

There are some specific rules concerning Medicare and veteran’s health insurance benefits, and you may have to provide records of your military service if you are receiving any such military or veteran’s benefits.

Is Medicare Part C the same as Original Medicare?

Medicare Advantage plans (Medicare Part C) provide the same benefits as Original Medicare, and many plans may offer additional benefits that Original Medicare doesn’t cover. If you are eligible for Original Medicare, you may also be eligible for a Medicare Advantage plan.

Do I need to sign up for Medicare when I turn 65?

It depends on how you get your health insurance now and the number of employees that are in the company where you (or your spouse) work.

How does Medicare work with my job-based health insurance?

Most people qualify to get Part A without paying a monthly premium. If you qualify, you can sign up for Part A coverage starting 3 months before you turn 65 and any time after you turn 65 — Part A coverage starts up to 6 months back from when you sign up or apply to get benefits from Social Security (or the Railroad Retirement Board).

Do I need to get Medicare drug coverage (Part D)?

You can get Medicare drug coverage once you sign up for either Part A or Part B. You can join a Medicare drug plan or Medicare Advantage Plan with drug coverage anytime while you have job-based health insurance, and up to 2 months after you lose that insurance.

What Is It?

When Should I Get It?

- At the start of the Part B General Enrollment Period, which occurs from January 1-March 31 each year

What Should I Do If I Get These Materials?

- Read the materials carefully as soon as you them because they explain important decision that you should make now.

Download A Sample

- "Sign up for Part B" package for people living in the United States and come U.S. Territories (the Virgin Islands, Guam, the Northern Mariana Islands, and American Samoa) 1. English [PDF, 1067 KB] 2. Spanish [PDF, 798 KB] "Sign up for Part B" package for people living in Puerto Rico 1. English [PDF, 1054 KB] 2. Spanish [PDF, 810 KB]

Publication, Product, Or Other Number

- Product No. 11873 for people living in the United States and some U.S. Territories Product No. 11874 for people living in Puerto Rico