What happens when you reach your Medicare Part D deductible?

· This is for a calendar year and resets every January 1. The 2020 maximum deductible set by CMS is $435, however, insurers can set their deductible below the limit. According to research by the Kaiser Family Foundation, 86% of stand-alone Part D prescription drug plans have an annual deductible.

What is the Part D deductible period?

Summary: The Medicare Part D deductible is the amount you pay for your prescription drugs before your plan begins to help. In 2021, the Medicare Part D deductible can’t be greater than $445 a year. In 2021, the Medicare Part D deductible can’t be greater than $445 a year.

How much is the deductible for Medicare Part D in 2021?

Yearly deductible for drug plans. This is the amount you must pay each year for your prescriptions before your Medicare drug plan pays its share. Deductibles vary between Medicare drug plans. No Medicare drug plan may have a deductible more than $480 in 2022. Some Medicare drug plans don't have a deductible.

What is the maximum deductible for Medicare Part D in 2019?

· Medicare sets the standard deductible every year. In 2021, that’s $445. Plans can have no deductible or any amount up to the standard amount. A plan determines which medications are subject to its...

How do deductibles work with Medicare Part D plans?

The deductible is the amount a beneficiary must pay for covered drugs before the plan starts to pay. The full cost of the drug determines how much a beneficiary must pay when the plan has a deductible. In other words, one pays the full cost for drugs subject to a deductible until the designated amount is met.

How does deductible work with Part D?

Summary: The Medicare Part D deductible is the amount you pay for your prescription drugs before your plan begins to help. In 2021, the Medicare Part D deductible can't be greater than $445 a year. You probably know that being covered by insurance doesn't mean you can always get services and benefits for free.

What is the deductible stage for Part D?

There are four different phases—or periods—of Part D coverage: Deductible period: Until you meet your Part D deductible, you will pay the full negotiated price for your covered prescription drugs. Once you have met the deductible, the plan will begin to cover the cost of your drugs.

Do Part D plans have an out-of-pocket maximum?

Medicare Part D plans do not have an out-of-pocket maximum in the same way that Medicare Advantage plans do. However, Medicare Part D plans have what's called a “catastrophic coverage” phase, which works similar to an out-of-pocket maximum.

What is the 2022 Medicare Part D deductible?

$480 inWhat is the Medicare Part D Deductible for 2022? The maximum deductible for Part D is $480 in 2022.

What are the 4 phases of Part D coverage?

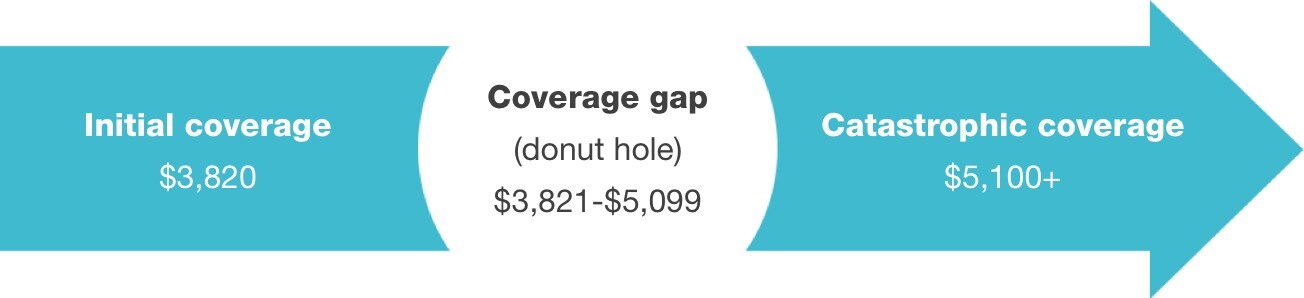

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.

What is Stage 2 of Medicare Part D?

Stage 2 – Initial Coverage In Stage 2, you pay your copay and we pay the rest. You stay in Stage 2 until the amount of your year-to-date total drug costs reaches $4,430. Total drug costs include your copay and what we pay.

Do prescriptions go towards deductible?

If you have a combined prescription deductible, your medical and prescription costs will count toward one total deductible. Usually, once this single deductible is met, your prescriptions will be covered at your plan's designated amount.

What is the coverage gap in Part D?

The Medicare Part D donut hole or coverage gap is the phase of Part D coverage after your initial coverage period. You enter the donut hole when your total drug costs—including what you and your plan have paid for your drugs—reaches a certain limit. In 2022, that limit is $4,430.

What drugs are not covered by Medicare Part D?

Medicare does not cover:Drugs used to treat anorexia, weight loss, or weight gain. ... Fertility drugs.Drugs used for cosmetic purposes or hair growth. ... Drugs that are only for the relief of cold or cough symptoms.Drugs used to treat erectile dysfunction.More items...

Is Medicare getting rid of the donut hole?

The Medicare donut hole is closed in 2020, but you still pay a share of your medication costs. Your coinsurance in the donut hole is lower today than in years past, but you still might pay more for prescription drugs than you do during the initial coverage stage.

What is the Medicare deductible for 2021?

$203 inThe standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

What is the deductible for Medicare Part D for 2021?

$445 is the maximum deductible that Medicare Part D plans can charge in 2021. Initial coverage. The initial coverage limit for Medicare Part D plans in 2021 is $4,130.

How do deductibles work for prescriptions?

If you have a combined prescription deductible, your medical and prescription costs will count toward one total deductible. Usually, once this single deductible is met, your prescriptions will be covered at your plan's designated amount. This doesn't mean your prescriptions will be free, though.

Do all Part D drug plans have a deductible?

Deductibles vary between Medicare drug plans. No Medicare drug plan may have a deductible more than $480 in 2022. Some Medicare drug plans don't have a deductible.

Are Medicare Part D premiums tax deductible?

Since 2012, the IRS has allowed self-employed individuals to deduct all Medicare premiums (including premiums for Medicare Part B – and Part A, for people who have to pay a premium for it – Medigap, Medicare Advantage plans, and Part D) from their federal taxes, and this includes Medicare premiums for their spouse.

Do I Need A Medicare Part D Plan?

If you have Original Medicare (Part A and Part B) and want prescription drug coverage for prescription drugs you take at home, you will likely have...

What Is The Medicare Deductible For A Medicare Part D Plan?

A Medicare deductible is the amount you must pay each year for your prescription drugs before your Medicare Part D Prescription Drug Plan begins to...

How Else Do Stand-Alone Medicare Part D Plans differ?

Unlike Medicare Part D deductibles, Medicare doesn’t set a dollar limit for Medicare Part D premiums. Your plan sets the amount for your monthly pr...

How much is Medicare Part D deductible in 2021?

In 2021, the Medicare Part D deductible can’t be greater than $445 a year. You probably know that being covered by insurance doesn’t mean you can always get services and benefits for free. You may have various out of pocket costs with Medicare insurance, including copayments, coinsurance, and deductibles.

What is Medicare Part D tier?

Medicare Part D plan prescription drug tiers are usually set such that the lower the tier number, the less expensive the drug , as in the following example::

What is tier 3 deductible?

Tier 3: preferred brand, generally cost more than tier 2. Tier 4: non-preferred brand, generally cost more than tier 3. Tier 5: specialty tier, generally cost more than tier 4. Tier 6: select care drugs. If you only take generic prescription drugs, for example, you may not be subjected to the deductible in certain plans.

Can you be 100% covered by your deductible?

Once you meet your deductible, you may not be covered 100%. You may still be responsible for copayments and coinsurance every time you fill a prescription.

What does deductible mean for a medical plan?

The deductible applies to drugs the plan covers. If the plan does not cover a given medication, the beneficiary pays the full cost, and those payments will not apply to the deductible.

What is a drug plan deductible?

Drug plan deductible facts. The deductible is the amount a beneficiary must pay for covered drugs before the plan starts to pay. The full cost of the drug determines how much a beneficiary must pay when the plan has a deductible. In other words, one pays the full cost for drugs subject to a deductible until the designated amount is met.

How much does Dorothy's tier 4 medication cost?

Dorothy’s one medication, a Tier 4 muscle relaxant with a full cost of $2.26, is subject to the deductible. She will pay that amount, $2.26, every month and won’t meet the plan’s deductible this year. Don’s regimen of seven drugs includes two of Tier 3 in the mix. The full cost for those two is $70.96.

What is EOB in Medicare?

In each month you get prescriptions, the plan sponsor will send a monthly prescription summary, which is an explanation of benefits (EOB).

Does Medicare deductible drop?

In many cases, costs can drop. The deductible works the same way whether you have drug coverage through a stand-alone drug plan (PDP) or a Medicare Advantage plan with prescription drug coverage (MA-PD). Information in the Medicare Plan Finder (noted as retail costs) or the plan’s benefit summary and evidence of coverage identifies ...

What is a tier 3 deductible?

A plan determines which medications are subject to its deductible. In many plans, that’s Tiers 3, 4 and 5 drugs. The deductible applies to drugs the plan covers. If the plan does not cover a given medication, the beneficiary pays the full cost, and those payments will not apply to the deductible.

What determines how much a beneficiary must pay when the plan has a deductible?

The full cost of the drug determines how much a beneficiary must pay when the plan has a deductible. In other words, one pays the full cost for drugs subject to a deductible until the designated amount is met.

What is the deductible phase of Medicare?

The Deductible Phase. Medicare Part D costs may change during the year. The reason being, Part D coverage has four different phases. The first up – Part D deductible phase. You’re responsible for prescription costs until you meet the Part D deductible. After you reach your deductible amount, Part D will then cover the cost of your medications.

How much does a Part D plan cost?

Although deductible expenses will vary between plans, no plan may exceed $445; and some cost $0.

What out of pocket expenses can bring you to the catastrophic coverage phase?

Some out-of-pocket expenses that can bring you to the catastrophic coverage phase are: Your plan’s deductible. Amount paid during your initial coverage phase. The cost of brand-name drugs spent during your coverage gap phase. Expenses paid by any person on your behalf.

Can you buy a smaller amount of pills with Part D?

For instance, a Part D plan may limit you to buying a smaller amount of pills in each purchase. Insurers often require doctors to ask before ordering certain high-cost medicines. The insurance company could require you to try a less expensive drug before covering a more costly drug.

What is the Part D fee?

The fee is called the Part D income-related monthly adjustment amount. The government assists people who need help paying for Part D. Depending on where you live, more assistance may be available from state or federal agencies. You must meet income and asset requirements to qualify.

What is TROOP in Medicare?

Troop Medicare Part D. True Out of Pocket Costs (TrOOP) is something Medicare will track annually. Since Medicare tracks spending, you get protection from paying the same thing two times. So, if you reach the deductible before you move out of state, then expect that you don’t need to meet the deductible in your new area.

What is Part D insurance?

Once your deductible is met, Part D helps cover the costs of your prescriptions. Beneficiaries are responsible for the costs of any co-payments or co-insurance; meanwhile, your plan will pay its’ share of the cost. The length of your initial coverage phase depends on drug costs and the benefits your plan offers.

What is the maximum deductible for Medicare Part D 2021?

When you enroll in a Part D plan, you are responsible for paying your deductible, premium, copayment, and coinsurance amounts. The maximum Medicare Part D deductible for 2021 is $445.

How much is the deductible for Part D in 2021?

The highest deductible amount that any Part D plan can charge in 2021 is $445.

How is Medicare Part D late enrollment penalty calculated?

The Medicare Part D late enrollment penalty is calculated by multiplying the “national base beneficiary premium” by 1 percent and then multiplying that amount by the number of full months you went without coverage.

How long can you go without prescription drug coverage?

If you go without prescription drug coverage for a period of 63 consecutive days or more after you initially enroll in Medicare, you will be charged a permanent Medicare Part D late enrollment penalty. This penalty fee is added to your prescription drug plan premium each month you are not enrolled.

Does Medicare Advantage include prescriptions?

Most Medicare Advantage plans include prescription drug coverage in addition to other coverage options such as dental, vision, hearing, and more. This additional coverage can lead to an increase in overall costs, and you may end up paying more for a Medicare Advantage plan than just adding Part D to your original plan.

How much does a Part D plan pay for generic drugs?

Example: If your prescription generic drug costs $100, you will pay $25 (plus the dispensing fee). Your Part D plan will pay the remaining $75.

What is the Medicare Part D limit for 2021?

Initial coverage. The initial coverage limit for Medicare Part D plans in 2021 is $4,130.

How much does Medicare cover if you have met your deductible?

If you already met your deductible, you’d only have to pay for 20% of the $80. This works out to $16. Medicare would then cover the final $64 for the care.

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

What is Medicare Advantage?

Medicare Advantage. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage. Most MA plans will have an annual out-of-pocket maximum limit. Extra Help Program. Finally, the Extra Help program is something low-income Medicare ...

What is Medicare Supplement?

Medicare Supplement, or Medigap, insurance plans are sold by private insurance companies to help pay some of the costs that Original Medicare does not. They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. Medicare Advantage. An alternative to Original Medicare, a Medicare ...

How much coinsurance do you pay for Medicare?

Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year. In this instance, you’d be responsible for 20% of the bill under Part B. Medicare would then cover the other 80%. The coinsurance amount you pay is 20% ...

How much is a broken arm deductible?

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

How much is a Part D deductible in 2021?

While deductibles can vary from plan to plan, no plan’s deductible can be higher than $445 in 2021, ...

Why does Medicare Part D cost change?

If you notice that prices have changed, it may be because you are in a different phase of Part D coverage. There are four different phases—or periods—of Part D coverage: Deductible period: Until you meet your Part D deductible, you will pay the full negotiated price ...

What out of pocket costs help you reach catastrophic coverage?

The out-of-pocket costs that help you reach catastrophic coverage include: Your deductible. What you paid during the initial coverage period. Almost the full cost of brand-name drugs (including the manufacturer’s discount) purchased during the coverage gap.

How much does catastrophic coverage cost?

Catastrophic coverage: In all Part D plans, you enter catastrophic coverage after you reach $6,550 in out-of-pocket costs for covered drugs. This amount is made up of what you pay for covered drugs and some costs that others pay.

What is the coverage gap for drugs?

Coverage gap: After your total drug costs reach a certain amount ($4,130 for most plans), you enter the coverage gap, also known as the donut hole. The donut hole closed for all drugs in 2020, meaning that when you enter the coverage gap you will be responsible for 25% of the cost of your drugs.

Do you have a coverage gap if you have extra help?

Note: If you have Extra Help, you do not have a coverage gap. You will pay different drug costs during the year. Your drug costs may also be different if you are enrolled in an SPAP. It is also important to know that under certain circumstances, your plan can change the cost of your drugs during the plan year.

What happens if you have a deductible on your old plan?

If your old plan had a deductible that you haven’t yet met, and the new plan also has a deductible, you must pay the difference.

Do you have to meet your deductible before you can get prescriptions?

If the plan you join has an annual deductible, you must meet it before your prescriptions can be covered, regardless of the time of year. The deductible is not prorated according to how many months have passed since the beginning of the year.

Does Plan B have a deductible?

Example: Plan A had a deductible of $295 and your total drug costs so far this year come to $185. Because Plan B does not charge a deductible, coverage under it starts immediately even though you didn’t meet the deductible under Plan A.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.