Are Medicare deductibles based on calendar year?

The concept of a benefit period is important because the Medicare Part A deductible is based on the benefit period, rather than a calendar year. With most other types of health insurance (ie, non-Medicare), the deductible is based on the calendar year.

How does the deductible work for Medicare?

A deductible is the amount of money that you have to pay out-of-pocket before Medicare begins paying for your health costs. For example, if you received outpatient care or services covered by Part B, you would then pay the first $233 to meet your deductible before Medicare would begin covering the remaining cost.

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

How do I know if I met my deductible on Medicare?

You pay a yearly deductible for services before Medicare pays. You can check your deductible information right on page 1 of your notice!

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

What is the deductible for Medicare Part D in 2022?

$480What is the Medicare Part D Deductible for 2022? The maximum deductible for Part D is $480 in 2022.Mar 23, 2022

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Will Social Security get a $200 raise in 2021?

Which Social Security recipients will see over $200? If you received a benefit worth $2,289 per month in 2021, then you will see an increase worth over $200. People who get that much in benefits worked a high paying job for 35 years and likely delayed claiming benefits.Jan 9, 2022

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

What is the annual deductible for Medicare Part B?

$233Alongside the premium, Medicare Part B includes an annual deductible and 20% coinsurance for which you are responsible to pay out-of-pocket. In 2022, the Medicare Part B deductible is $233. Once you meet the annual deductible, Medicare will cover 80% of your Medicare Part B expenses.Feb 14, 2022

How often do you pay Medicare Part A deductible?

Key Points to Remember About Medicare Part A Costs: With Original Medicare, you pay a Medicare Part A deductible for each benefit period. A benefit period begins when you enter the hospital and ends when you are out for 60 days in a row. One benefit period may include more than one hospitalization.

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is the Medicare Deductible for 2022?

A deductible refers to the amount of money you must pay out of pocket for covered healthcare services before your health insurance plan starts to p...

Does Original Medicare Have Deductibles?

Original Medicare is composed of Medicare Part A and Medicare Part B. Both parts of Original Medicare have deductibles you will have to pay out of...

Do You Have to Pay a Deductible with Medicare?

You’ve probably heard the one about death and taxes. If you have Original Medicare, you can add deductibles to that list.

Your first chance to sign up (Initial Enrollment Period)

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Between January 1-March 31 each year (General Enrollment Period)

You can sign up between January 1-March 31 each year. This is called the General Enrollment Period. Your coverage starts July 1. You might pay a monthly late enrollment penalty, if you don’t qualify for a Special Enrollment Period.

Special Situations (Special Enrollment Period)

There are certain situations when you can sign up for Part B (and Premium-Part A) during a Special Enrollment Period without paying a late enrollment penalty. A Special Enrollment Period is only available for a limited time.

Joining a plan

A type of Medicare-approved health plan from a private company that you can choose to cover most of your Part A and Part B benefits instead of Original Medicare. It usually also includes drug coverage (Part D).

What Is a Deductible?

A deductible is the amount of money that you must pay out of your own pocket for covered care before your plan coverage kicks in.

Medicare Part A Deductible

Medicare Part A covers inpatient care received at a hospital, skilled nursing facility or other inpatient facility.

What Is the Maximum Cost of Medicare Part B?

Medicare Part B does come with a premium cost. The monthly premium prices are set annually and depend on your annual income. Premium costs start at $148.50 per month. The maximum cost of Medicare Part B coverage is $504.90 per month in 2021, and that's for individuals reporting half a million dollars or more in income in 2019.

Medicare Part C (Medicare Advantage) Deductible

Medicare Part C plans, otherwise known as Medicare Advantage plans, are an alternative way to get Original Medicare benefits, often with additional coverage.

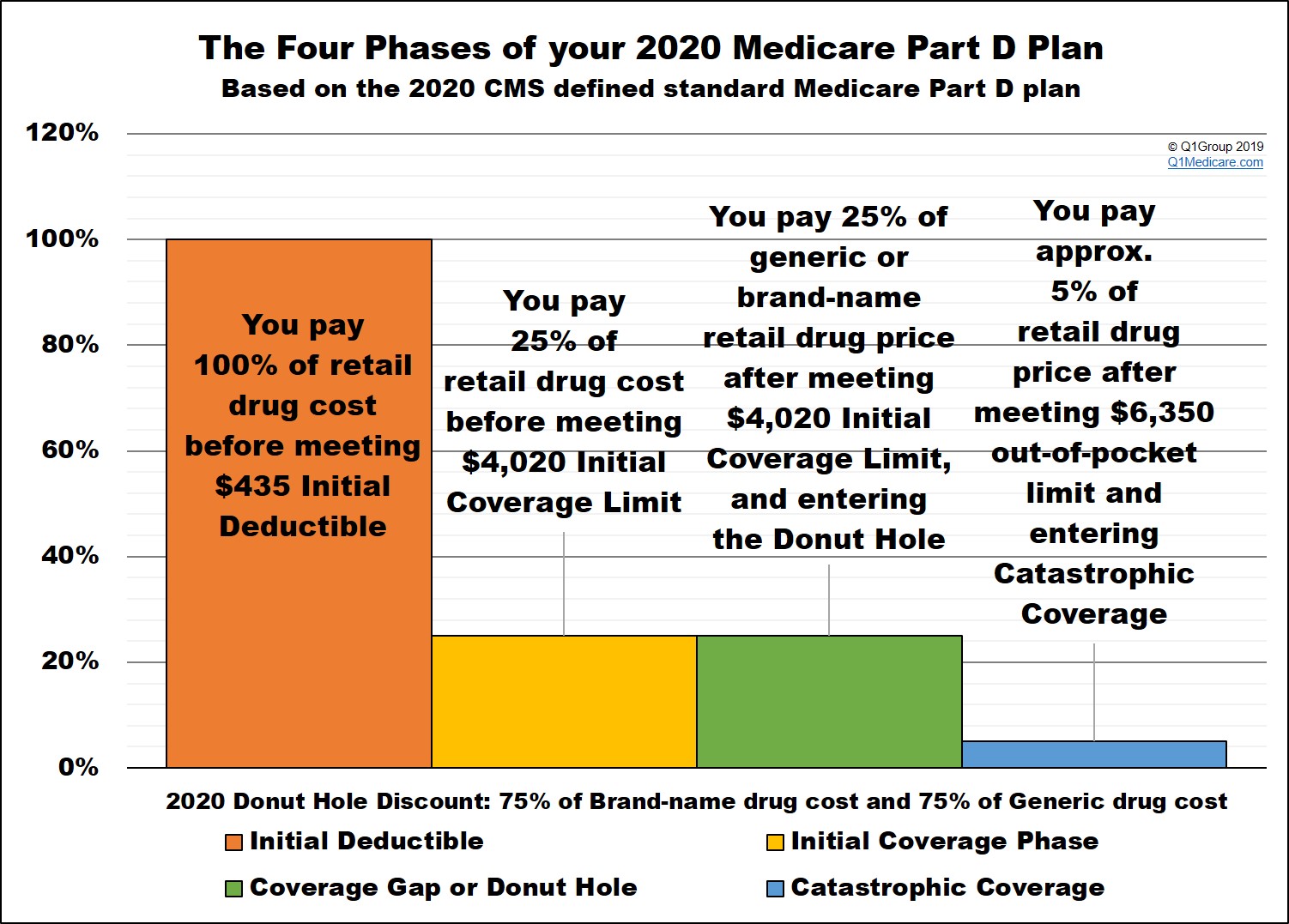

Medicare Part D Deductible

Medicare Part D plans cover prescription medications. Like Medicare Advantage, plans Medicare Part D plans are sold by private insurers and thus there is no standard deductible.

Medicare Supplement Deductibles by Plan

There are 10 standardized Medicare Supplement plans (also called Medigap) available in most states, and two of those plans offer a high-deductible option. Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,370 in 2021.

How much will Medicare cost in 2021?

In 2021, it costs $259 or $471 each month, depending on how long you paid Medicare taxes. 2 . That doesn’t mean you aren’t charged a deductible. For each benefit period, you pay the first $1,484 in 2021. A benefit period begins when you enter the hospital and ends when you haven’t received any inpatient hospital services for 60 consecutive days.

What is Medicare Part A 2021?

Medicare Part A Costs in 2021. Part A covers inpatient hospitalization, skilled nursing facilities, home health care, and hospice care. 1 For most people, this is the closest thing to free they’ll get from Medicare, as Medicare Part A (generally) doesn't charge a premium. 2 . Tip: If you don't qualify for Part A, you can buy Part A coverage.

What does Medicare cover?

What you pay for Medicare depends on the type of enrollment you have: Parts A, B, C, and/or D. Part A covers inpatient hospitalization, skilled nursing facilities, home health care, and hospice care. It doesn't generally charge a premium. Part B is considered your medical insurance. It covers medical treatments and comes with a monthly premium ...

What is the cost of Part B insurance?

Part B is considered your medical insurance. It covers medical treatments and comes with a monthly premium of $148.50 in 2021. Parts C and D are optional and may cover additional costs, including prescriptions.

How long does a hospital benefit last?

A benefit period begins when you enter the hospital and ends when you haven’t received any inpatient hospital services for 60 consecutive days . If you re-enter the hospital the day after your benefit period ends, you’re responsible for the first $1,484 of charges again. 3 .

What is the premium for Part B?

Part B is considered your medical insurance. It covers medical treatments and comes with a monthly premium of $148.50 in 2021. A small percentage of people will pay more than that amount if reporting income greater than $88,000 as single filers or more than $176,000 as joint filers. 3

Is Medicare free for 2020?

Updated December 29, 2020. You paid into Medicare all of your working career. You would think Medicare would be free once you enroll—but that’s only partially true. If you’re confused about what you’ll pay for Medicare, we have you covered.

When does Medicare kick in?

Starting January 1 or whenever your plan year begins, you pay your health care costs up to the deductible amount. After that, your health plan kicks in to help pay the cost of your care for the rest of the plan year. The cycle starts over at the beginning of each new plan year. Medicare Part A deductibles are different.

How long does Medicare cover?

Medicare Part A covers an unlimited number of benefit periods, and it helps pay for up to 90 days of care for each one. After 90 days, it’s possible to tap into lifetime reserve days.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How long does Medicare Part A last?

A benefit period begins when you enter the hospital and ends when you are out for 60 days in a row. One benefit period may include more than one hospitalization.

How long is Roger in the hospital?

He was out of the hospital less than 60 days before he went back. Roger is in the hospital for a total of 8 days, all within a single benefit period.

Does Medicare have a deductible?

Medicare Part A, Benefit Periods and Deductibles. Published by: Medicare Made Clear. You may be familiar with insurance deductibles. Many homeowners and car insurance policies charge a deductible whenever you file a claim. A health insurance deductible is usually charged once for the plan year.

How much is Medicare Part B deductible?

Medicare Part B also employs a deductible. Unlike Part A, Part B has an annual deductible. In 2019, the annual Part B deductible is $185. That means you’re responsible for non-inpatient bills up to that amount.

How much is the 2019 deductible?

Your deductible for each period in 2019 is $1364. That means you’ll be charged up to that amount for any services provided during your inpatient stay at the hospital. The same deductible applies for each benefit period if you’re admitted as an inpatient at a skilled nursing facility for a period of time.

What does Medicare Part A cover?

Medicare Part A (Hospital Insurance) helps cover inpatient care in hospitals or skilled nursing facilities, in hospice, or home health care. For example, if you have an infected appendix and you are admitted to the hospital for a surgeon to perform an appendectomy, Part A will help cover the costs during your stay, ...

What is Medicare for seniors?

Medicare is the primary hospital and medical insurance coverage for tens of millions of Americans aged 65 or older or under 65 who qualify due to disabilities.

When does Medicare deductible reset?

Your Medicare deductible resets on January 1 of each year. The Medicare deductible is based on each calendar year, meaning that it lasts from January 1-December 31, and then it resets for the new year.

How much is Medicare Part A deductible?

This year, the Medicare Part A deductible is $1,408, and the Medicare Part B deductible is $198. So, if you’re on Medicare, you would need to meet these deductibles before Medicare starts covering your medical bills.

How many Medicare Supplement Plans are there?

There is a way to avoid paying Medicare deductibles, which is to have a Medicare Supplement – also called a Medigap plan. There are 11 total Medicare Supplement plans, and each one varies in terms of price and benefits. The 3 most popular plans are Plan F, Plan G, and Plan N, because they provide the most coverage.

Does Medicare Supplement pay for deductible?

However, many of the Medicare Supplement plans help pay for your Medicare deductibles. If you’re on a Medicare Advantage plan, your deductible will vary depending on where you live and which plan you’re enrolled in. Your agent will be able to confirm your plan’s benefits.

How much is Medicare deductible for 2021?

Here’s what you’ll pay in 2021: Initial deductible. Your deductible during each benefit period is $1,484. After you pay this amount, Medicare starts covering the costs. Days 1 through 60.

How long does Medicare pay for care?

Then, when you haven’t been in the hospital or a skilled nursing facility for at least 60 days ...

What are the benefits of Medicare Part A?

Some of the facilities that Medicare Part A benefits apply to include: hospital. acute care or inpatient rehabilitation facility. skilled nursing facility.

How long does Medicare Advantage last?

Takeaway. Medicare benefit periods usually involve Part A (hospital care). A period begins with an inpatient stay and ends after you’ve been out of the facility for at least 60 days.

How much is coinsurance for skilled nursing in 2021?

Here is the breakdown of those costs in 2021: Initial deductible. The same Part A deductible of $1,484 applies during each benefit period is $1,484. Days 1 through 20.

How long do you have to be in a hospital to get a new benefit?

You get sick and need to go to the hospital. You haven’t been in a hospital or skilled nursing facility for 60 days. This means you’re starting a new benefit period as soon as you’re admitted as in inpatient.

How long does it take to recover from a fall?

After a fall, you need inpatient hospital care for 5 days. Your doctor sends you to a skilled nursing facility for rehabilitation on day 6, so you can get stronger before you go home.

When does Medicare start?

For most people, Medicare coverage starts the first day of the month you turn 65. Some people delay enrollment and remain on an employer plan. Others may take premium-free Part A and delay Part B. If someone is on Social Security Disability for 24 months, they qualify for Medicare. Those with End-Stage Renal Disease will be immediately eligiblee ...

When do you sign up for unemployment benefits?

It includes your birth month, and it ends three months after your birth month. If you want your benefits to start at the beginning of the month, you turn 65, be sure to sign up at least a month before your birthday. ...

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

Is Cobra a creditable Medicare?

Further, COBRA is NOT creditable coverage for Medicare. When you delay Part B without creditable coverage, a late enrollment penalty could be coming your way. Even those with TRICARE need to enroll in Medicare to keep their benefits. However, if you have TRICARE, it’s unlikely you’ll benefit from extra Medicare coverage.

Can you get Medicare if you have ALS?

Those with End-Stage Renal Disease will be immediately eligiblee for Medicare with a diagnosis. When Medicare starts is different for each beneficiary. People with disabilities, ALS, or End-Stage Renal Disease may be eligible for Medicare before they’re 65. If you qualify for Medicare because of a disability, there is no minimum age ...