When do they start deducting Medicare?

Your deductible is the amount of money you have to pay for your prescriptions and healthcare before Original Medicare, other insurance, or your prescription drug plan starts paying for your healthcare expenses. The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and...

Does Medicare charge a deductible?

Jan 01, 2022 · Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65. My birthday is on the first of the month. Avoid the penalty

What is the yearly deductible for Medicare?

Mar 07, 2022 · Starting January 1 or whenever your plan year begins, you pay your health care costs up to the deductible amount. After that, your health plan kicks in to help pay the cost of your care for the rest of the plan year. The cycle starts over at the beginning of each new plan year. Medicare Part A deductibles are different.

When exactly does your Medicare coverage begin?

Nov 12, 2021 · The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021. The increases in the 2022 Medicare Part B premium and deductible are due to:

Are Medicare deductibles based on calendar year?

The concept of a benefit period is important because the Medicare Part A deductible is based on the benefit period, rather than a calendar year. With most other types of health insurance (ie, non-Medicare), the deductible is based on the calendar year.

What is the 2021 Medicare deductible?

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What is the deductible before Medicare starts paying?

A deductible is the amount of money that you have to pay out-of-pocket before Medicare begins paying for your health costs. For example, if you received outpatient care or services covered by Part B, you would then pay the first $233 to meet your deductible before Medicare would begin covering the remaining cost.

How often do you pay the Medicare Part B deductible?

annualTo pay, Medicare offers an online payment option called Easy Pay, which you can access with a MyMedicare account. Additionally, you may pay your quarterly premium by mail instead. Alongside the premium, Medicare Part B includes an annual deductible and 20% coinsurance for which you are responsible to pay out-of-pocket.Feb 14, 2022

What is the deductible for Medicare Part D in 2022?

$480 inWhat is the Medicare Part D Deductible for 2022? The maximum deductible for Part D is $480 in 2022.Mar 23, 2022

How much is deducted from Social Security for Medicare?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.Nov 24, 2021

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

How is the Medicare deductible paid?

Typically, you'll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year. In this instance, you'd be responsible for 20% of the bill under Part B. Medicare would then cover the other 80%.

Is Medicare free for seniors?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

What is the Part A deductible for 2021?

$1,484The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital for 2021 will be $1,484, which is an increase of $76 from $1,408 in 2020.Nov 13, 2020

What is deducted from your monthly Social Security check?

You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes. Only these percentages can be withheld. Flat dollar amounts are not accepted. Sign the form and return it to your local Social Security office by mail or in person.

What month is Medicare deducted from Social Security?

Hi RCK. The Medicare premium that will be withheld from your Social Security check that's paid in August (for July) covers your Part B premium for August. So, if you already have Part B coverage you'll need to pay your Medicare premiums out of pocket through July.Mar 5, 2021

Your first chance to sign up (Initial Enrollment Period)

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Between January 1-March 31 each year (General Enrollment Period)

You can sign up between January 1-March 31 each year. This is called the General Enrollment Period. Your coverage starts July 1. You might pay a monthly late enrollment penalty, if you don’t qualify for a Special Enrollment Period.

Special Situations (Special Enrollment Period)

There are certain situations when you can sign up for Part B (and Premium-Part A) during a Special Enrollment Period without paying a late enrollment penalty. A Special Enrollment Period is only available for a limited time.

Joining a plan

A type of Medicare-approved health plan from a private company that you can choose to cover most of your Part A and Part B benefits instead of Original Medicare. It usually also includes drug coverage (Part D).

When does Medicare kick in?

Starting January 1 or whenever your plan year begins, you pay your health care costs up to the deductible amount. After that, your health plan kicks in to help pay the cost of your care for the rest of the plan year. The cycle starts over at the beginning of each new plan year. Medicare Part A deductibles are different.

How often is Medicare deductible charged?

Many homeowners and car insurance policies charge a deductible whenever you file a claim. A health insurance deductible is usually charged once for the plan year.

How much is the Medicare deductible for 2021?

She is in the hospital over 60 days this time, so she must also pay a co-pay for 5 days. For 2021, the Part A deductible is $1,484 and the daily copay is $371. Item. Amount. First Stay. Medicare Part A deductible. $1,484.

How long is Roger's hospital stay?

Here's an example of how a single benefit period could span more than one hospitalization. Roger is admitted to the hospital in December and stays 5 days. He is readmitted in early February and stays for 3 days. He was out of the hospital less than 60 days before he went back.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How long does it take to get a deductible back after a hospital stay?

If you go back into the hospital after 60 days, then a new benefit period starts, and the deductible happens again. You would be responsible for paying two deductibles in this case – one for each benefit period – even if you’re in the hospital both times for the same health problem.

How long does Medicare Part A last?

A benefit period begins when you enter the hospital and ends when you are out for 60 days in a row. One benefit period may include more than one hospitalization.

When does Medicare deductible reset?

Your Medicare deductible resets on January 1 of each year. The Medicare deductible is based on each calendar year, meaning that it lasts from January 1-December 31, and then it resets for the new year.

How much is Medicare Part A deductible?

This year, the Medicare Part A deductible is $1,408, and the Medicare Part B deductible is $198. So, if you’re on Medicare, you would need to meet these deductibles before Medicare starts covering your medical bills.

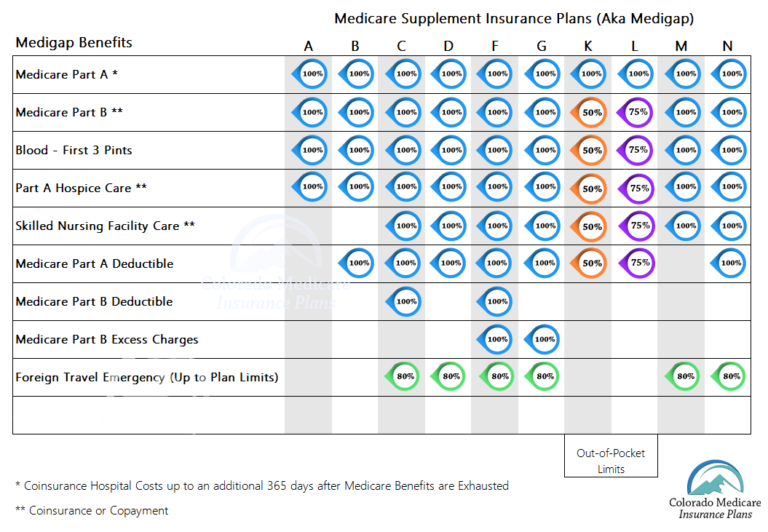

How many Medicare Supplement Plans are there?

There is a way to avoid paying Medicare deductibles, which is to have a Medicare Supplement – also called a Medigap plan. There are 11 total Medicare Supplement plans, and each one varies in terms of price and benefits. The 3 most popular plans are Plan F, Plan G, and Plan N, because they provide the most coverage.

Does Medicare Supplement pay for deductible?

However, many of the Medicare Supplement plans help pay for your Medicare deductibles. If you’re on a Medicare Advantage plan, your deductible will vary depending on where you live and which plan you’re enrolled in. Your agent will be able to confirm your plan’s benefits.

When does Medicare start?

For most people, Medicare coverage starts the first day of the month you turn 65. Some people delay enrollment and remain on an employer plan. Others may take premium-free Part A and delay Part B. If someone is on Social Security Disability for 24 months, they qualify for Medicare. Those with End-Stage Renal Disease will be immediately eligiblee ...

When do you sign up for unemployment benefits?

It includes your birth month, and it ends three months after your birth month. If you want your benefits to start at the beginning of the month, you turn 65, be sure to sign up at least a month before your birthday. ...

Can you get Medicare if you have ALS?

Those with End-Stage Renal Disease will be immediately eligiblee for Medicare with a diagnosis. When Medicare starts is different for each beneficiary. People with disabilities, ALS, or End-Stage Renal Disease may be eligible for Medicare before they’re 65. If you qualify for Medicare because of a disability, there is no minimum age ...

Is group coverage better than Medicare?

In this scenario, delaying enrollment would make sense, especially if the coverage is better than Medicare. Although, group coverage better than Medicare isn’t the typical scenario. Many people work for small employers;

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

Can you have Cobra if you don't have Medicare?

So, if you don’t have Medicare, and you only have the group plan, the employer plan won’t pay until your Medicare is active. Further, COBRA is NOT creditable coverage for Medicare. When you delay Part B without creditable coverage, a late enrollment penalty could be coming your way.

How long does Medicare Part A deductible last?

In this case, it only applies to Medicare Part A and resets (ends) after the beneficiary is out of the hospital for 60 consecutive days. There are instances in which you can have multiple benefit periods within a calendar year. This means you’ll end up paying a Part A deductible more than once in 12 months.

What is the deductible for Medicare 2021?

Yearly Medicare Deductibles. The calendar-year deductible is what you must pay before Medicare pays its portion, but you will still have coverage until you reach your deductible. In 2021, the deductible for Part A costs $1,484, while Part B’s deductible is $203.

How does Medicare benefit period work?

How Do Medicare Benefit Periods Work? It’s important to understand the difference between Medicare’ s benefit period from the calendar year. A benefit period begins the day you’re admitted to the hospital or skilled nursing facility. In this case, it only applies to Medicare Part A and resets ...

How long does Medicare cover inpatient care?

Part A covers inpatient hospital care, skilled long-term facility, and more, for up to 90 days. But if you ever need to extend your hospital stay, Medicare will cover 60 additional days, called lifetime reserve days. For instance, if your hospital stay lasts over 120 days, you will have used 30 lifetime reserve days.

How many Medigap plans are there?

One way to avoid paying for deductibles is by purchasing Medicare Supplement, also called a Medigap plan. There are 12 Medigap plans, letters A-N. Each plan varies by price and benefits. All Medigap plans, with the exception of Plan A, cover the Part A deductible.

How many lifetime reserve days can you use?

For instance, if your hospital stay lasts over 120 days, you will have used 30 lifetime reserve days. Please note that you’ll pay a coinsurance of $742 for each lifetime reserve day you use. You can only use your lifetime reserve days once.

Do Medicare Advantage plans have a benefit period?

The Medicare Advantage plans that use benefit periods are typically for skilled nursing facility stays. A large majority of Medicare Advantage plans do not use benefit periods for hospital stays. Most beneficiaries pay a copayment for the first few days. Afterward, you’re required to pay the full amount for each day.

How much will Medicare cost in 2021?

In 2021, it costs $259 or $471 each month, depending on how long you paid Medicare taxes. 2 . That doesn’t mean you aren’t charged a deductible. For each benefit period, you pay the first $1,484 in 2021. A benefit period begins when you enter the hospital and ends when you haven’t received any inpatient hospital services for 60 consecutive days.

How much does Medicare pay for a hospital stay in 2021?

Part A also charges coinsurance if your hospital stay lasts more than 60 days. In 2021, for days 61 to 90 of your hospital stay, you pay $371 per day; days 91 through the balance of your lifetime reserve days, you pay $742 per day. 3 Lifetime reserve days are 60 days that Medicare gives you to use if you stay in the hospital for more than 90 days.

What does Medicare cover?

What you pay for Medicare depends on the type of enrollment you have: Parts A, B, C, and/or D. Part A covers inpatient hospitalization, skilled nursing facilities, home health care, and hospice care. It doesn't generally charge a premium. Part B is considered your medical insurance. It covers medical treatments and comes with a monthly premium ...

What is Medicare Part A 2021?

Medicare Part A Costs in 2021. Part A covers inpatient hospitalization, skilled nursing facilities, home health care, and hospice care. 1 For most people, this is the closest thing to free they’ll get from Medicare, as Medicare Part A (generally) doesn't charge a premium. 2 . Tip: If you don't qualify for Part A, you can buy Part A coverage.

What is the Medicare Advantage premium for 2021?

The average plan premium is about $21.00 a month in 2021. 7 . But coinsurance, copayments, premiums, and deductibles may still vary depending on your plan of choice. 3 .

What is the premium for Part B?

Part B is considered your medical insurance. It covers medical treatments and comes with a monthly premium of $148.50 in 2021. A small percentage of people will pay more than that amount if reporting income greater than $88,000 as single filers or more than $176,000 as joint filers. 3

How long does a hospital benefit last?

A benefit period begins when you enter the hospital and ends when you haven’t received any inpatient hospital services for 60 consecutive days . If you re-enter the hospital the day after your benefit period ends, you’re responsible for the first $1,484 of charges again. 3 .

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

What percentage of Medicare deductible is paid?

After your Part B deductible is met, you typically pay 20 percent of the Medicare-approved amount for most doctor services. This 20 percent is known as your Medicare Part B coinsurance (mentioned in the section above).

What is a copay in Medicare?

A copay is your share of a medical bill after the insurance provider has contributed its financial portion. Medicare copays (also called copayments) most often come in the form of a flat-fee and typically kick in after a deductible is met. A deductible is the amount you must pay out of pocket before the benefits of the health insurance policy begin ...

How much is Medicare coinsurance for days 91?

For hospital and mental health facility stays, the first 60 days require no Medicare coinsurance. Days 91 and beyond come with a $742 per day coinsurance for a total of 60 “lifetime reserve" days.

How much is Medicare Part B deductible for 2021?

The Medicare Part B deductible in 2021 is $203 per year. You must meet this deductible before Medicare pays for any Part B services. Unlike the Part A deductible, Part B only requires you to pay one deductible per year, no matter how often you see the doctor. After your Part B deductible is met, you typically pay 20 percent ...

How much is Medicare Part A 2021?

The Medicare Part A deductible in 2021 is $1,484 per benefit period. You must meet this deductible before Medicare pays for any Part A services in each benefit period. Medicare Part A benefit periods are based on how long you've been discharged from the hospital.

What is Medicare approved amount?

The Medicare-approved amount is the maximum amount that a doctor or other health care provider can be paid by Medicare. Some screenings and other preventive services covered by Part B do not require any Medicare copays or coinsurance.