What is the 30 day free look period?

What is a 30 day free look? You have 30 days from the day you receive the policy to examine and return it to the insurance company. You can return it for any reason. Simply return it to the insurance company, or to the agent, producer or office thorugh which it was bought. The insurance company will refund the full amount paid for the policy within 30 days of return.

What is free look period in health insurance?

Step-by-Step Procedure to Cancel a Policy Within the Free-look Period:

- Check whether you meet the eligibility criteria – 3-year health insurance policy and policy cancellation within 15 days.

- Apply for policy cancellation under the Free-look Period via email and state your reasons. ...

- Submit the required documents.

- Insurer will verify the application.

What is free look period life insurance?

- Returns are often low when selling life insurance. ...

- Brokers may charge hefty fees or commissions that result in even less money in your pocket.

- The payment you receive may be taxable. ...

- Most buyers look for plans that give them the best odds of recouping their investment, so selling a policy can be difficult.

Are Medicare supplemental plans free?

“Free” according to the Merriam Webster dictionary means “not costing or charging anything.” Some people may refer to $0 premium Medicare Advantage plans as “free.” However, these plans are not actually free in the way that they could still cost you.

What is the cutoff date for Medicare changes?

If you have or are eligible for Medicare, you should only use the Fall Open Enrollment Period (October 15 through December 7) to make changes to your Medicare coverage.

What is the birthday rule in Medicare?

Q: What is the "Birthday Rule" and how does it apply to the new Medigap Plans? A: If you already have Medigap insurance, you have 30 days of "open enrollment" following your birthday each year when you can buy a new Medigap policy without a medical screening or a new waiting period.

Does Medicare coverage always start on the 1st of a month?

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month. If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65.

When a Medicare Supplement policy is replace the policy owner will have a free look period of blank days?

What is the Medicare Supplement insurance plan “free look” period? During the “free look period” you can generally have both your old and new Medicare Supplement insurance plans for a 30-day decision period. You will pay the premiums for both plans for one month so the “free” look is not free in terms of costs.

What does the birthday rule mean?

• Birthday Rule: This is a method used to determine when a plan is primary or secondary for a dependent child when covered by both parents' benefit plan. The parent whose birthday (month and day only) falls first in a calendar year is the parent with the primary coverage for the dependent.

Can I change my Medicare plan during my birthday month?

Changing Your Medicare Supplement. You can change your Medicare supplement plan ANY time of year.

What day of month does Medicare coverage begin?

When does Medicare start?If you sign up for Medicare Part A and/or Medicare Part B in this month:Your coverage starts:The month you turn 651 month after you sign up1, 2 or 3 months after you turn 65The first day of the month after you sign upDuring the Jan 1-March 31 General enrollment periodJuly 11 more row

What date does Medicare consider the date of service?

The date of service for the Certification is the date the physician completes and signs the plan of care. The date of the Recertification is the date the physician completes the review. For more information, see the Medicare Claims Processing Manual, Chapter 12, Section 180.1.

What day of the month does a Medicare Advantage plan take effect?

Coverage under a Medicare Advantage plan will begin the first day of the month after you enroll. Example: Judy's last day of work is July 1 and her group health plan ends July 31.

How long is the Medicare supplement free look period?

30 daysMedigap free-look period You have 30 days to decide if you want to keep the new Medigap policy. This is called your "free look period." The 30-day free look period starts when you get your new Medigap policy. You'll need to pay both premiums for one month.

How long will free look in period or cooling off period lasts?

A free look period often lasts 10 or more days depending on the insurer. During the free look period, the contract holder can decide whether or not to keep the insurance policy; if they are not satisfied and wish to cancel, the policy purchaser can receive a full refund.

How long is the typical free look period?

Free Look Period vs Grace Period for Life InsuranceFree Look PeriodGrace PeriodIs 10 days or moreIs usually one month, no less than 30 daysApplies to the initial purchase paymentApplies to the subsequent premium payments1 more row•Oct 27, 2021

Your first chance to sign up (Initial Enrollment Period)

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Between January 1-March 31 each year (General Enrollment Period)

You can sign up between January 1-March 31 each year. This is called the General Enrollment Period. Your coverage starts July 1. You might pay a monthly late enrollment penalty, if you don’t qualify for a Special Enrollment Period.

Special Situations (Special Enrollment Period)

There are certain situations when you can sign up for Part B (and Premium-Part A) during a Special Enrollment Period without paying a late enrollment penalty. A Special Enrollment Period is only available for a limited time.

Joining a plan

A type of Medicare-approved health plan from a private company that you can choose to cover most of your Part A and Part B benefits instead of Original Medicare. It usually also includes drug coverage (Part D).

How Does the Medicare Supplement Free Look Period Work?

You can use the free look period Medicare Supplement opportunity by not cancelling your existing coverage before your new plan begins. However, despite its name, the Medicare Supplement free look period isn’t actually free. You’ll need to pay the premium for your existing plan, as well as the one that you’re switching to.

Does the Medicare Supplement Free Look Period Work for Other Types of Coverage?

You can only use the free look period if you’re changing from one Medigap plan or carrier to another. The Medicare Supplement free look period is sometimes confused with the Medicare Advantage Trial right, which is a type of a guaranteed issue right.

Should I Use the Free Look Period Medicare Supplement Opportunity?

The free look period can provide you peace of mind if you’re nervous about changing your Medigap plan, but you do have to pay for it. While you can use the free look period to extend the amount of time you have to make a decision, ideally, you should be comfortable with the plan and carrier you’d be changing to before you apply.

Ma Clients Who Enrolled Upon Turning 65 & Less Than 12 Months Ago

If you have a client who enrolled in a Medicare Advantage plan upon joining Medicare Part A at age 65, they may switch to Original Medicare as long as they do so within a 12-month period.

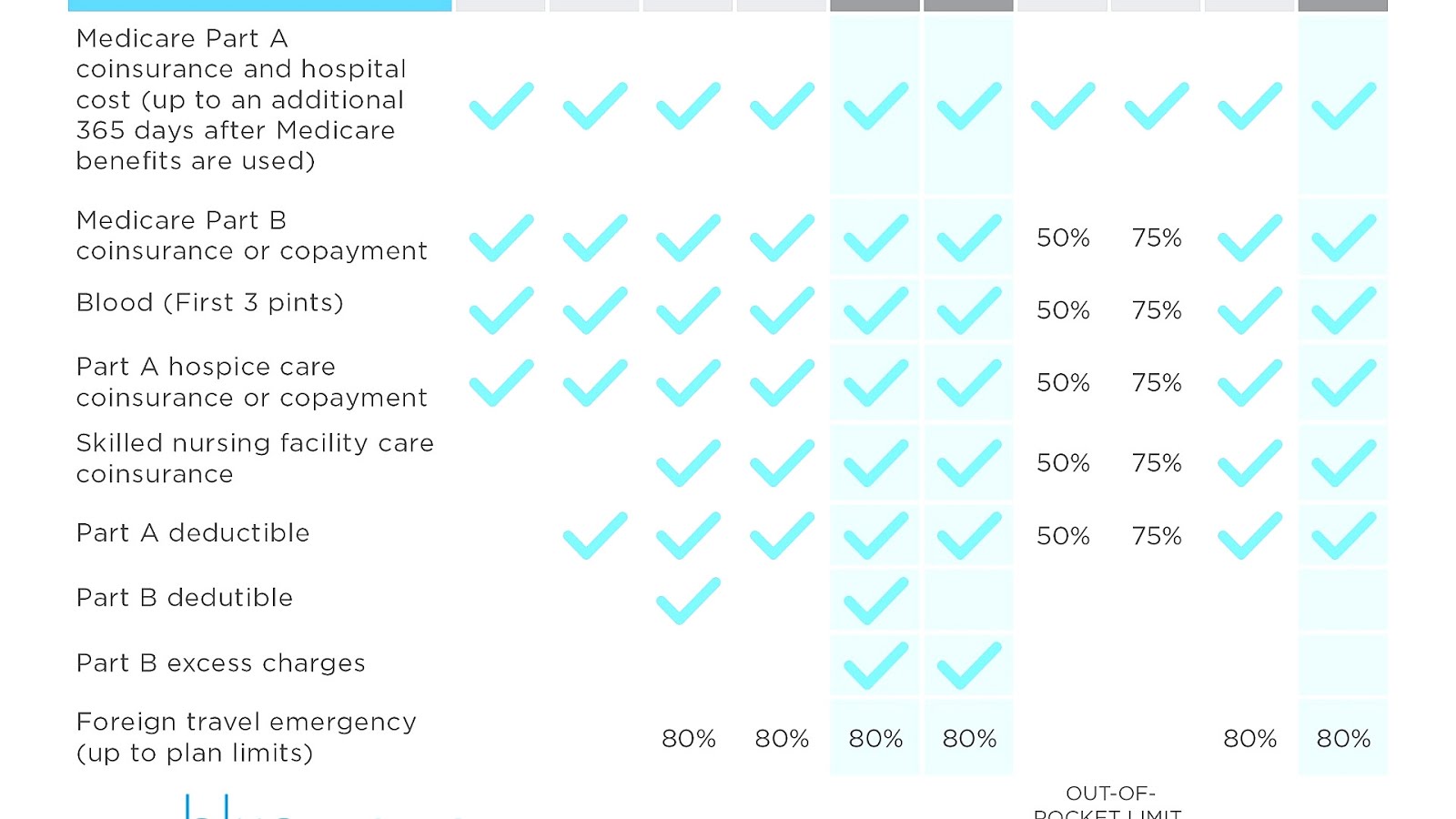

An Alphabet Of Medigap Policies

Across the nation, there is a confusing array of 10 Medigap policies offering different levels of coverage. To compare them, you can read this article on MedicareGuide.com or look at the chart below.

What Are The Reasons Why You Would Like To Switch To A Different Medigap Plan

Sometime after enrollment, youll probably realize that what you got is not the kind of plan you need. There are reasons why you might be unhappy with your current Medigap plan. Some of them are:

Why Change Policy During My Open Enrollment

Your Medigap open enrollment period starts the moment you are 65 and has Medicare part B. It runs for just 6 months and cant be repeated or be replaced in case you missed it.

Can I Switch Policies

In most cases, you won’t have a right under federal law to switch Medigap policies, unless one of these applies:

What If You Missed The Medigap Open Enrollment Period

What if you want to change plans after your Medigap Open Enrollment Period? You might have been enrolled in health insurance through your work at that time, for example. Under certain circumstances, you have a guaranteed issue right that enables you to buy a Medigap policy at the best available rate, no matter what your current health status is.

Federal Regulations For Medicare Supplements

There are actually ten Medicare supplemental insurance plans on the market, all of which are regulated by the Centers for Medicare and Medicaid Services . In line with the CMS rules, All Medigap plans have to offer the same coverage, regardless of the company providing the policy or the state theyre in.

How long is the Medicare Supplement Open Enrollment Period?

Your Medicare Supplement Open Enrollment Period (OEP) lasts six months and it begins when you’re both 65 or older and enrolled in Medicare Part B. During this OEP, your plan is immune from medical underwriting and you can buy any Medicare Supplement policy from any insurance company that’s licensed in your state.

What is Medicare Supplement?

A Medicare Supplement (Medigap) insurance plan can help pay for Original Medicare’s out-of-pocket costs. Different Medicare Supplement insurance plans pay for different amounts of those costs, such as copayments, coinsurance, and deductibles. You may be able to take advantage of the Medicare Supplement free look period, ...

How long is the Medicare free look period?

What is the Medicare Supplement insurance plan “free look” period? During the “free look period” you can generally have both your old and new Medicare Supplement insurance plans for a 30-day decision period. You will pay the premiums for both plans for one month so the “free” look is not free in terms of costs.

What is the deductible for Medicare Part A?

Medicare Part A deductible. 80% of foreign travel health expenses. If you want to try out Plan N but also think you might want to keep Plan A temporarily, you can take advantage of the “free look period.”.

When is the best time to apply for Medicare Supplement?

Although it’s possible to apply for any Medicare Supplement insurance plan at any time, the best time to shop may be when you don’t have to worry about medical underwriting, which is during your Medicare Supplement Open Enrollment Period (OEP) and when you have guaranteed issue.

How much does Plan N pay for Part B?

Plan N pays 100% of the Part B coinsurance, with some exceptions. You may have to pay a copayment of up to $20 for some doctor office visits a copayment of up to $50 for emergency room visits that don’t result in inpatient admission.

How long do you have to wait to get a new health insurance?

However, if your new policy has a benefit that isn’t in your current policy, you may have to wait up 6 months before that benefit will be covered. *Pre-existing conditions are generally health conditions that existed before the start of a policy.

Why was life insurance bad?

As a result, the whole life insurance industry got a bad reputation because of high-pressure tactics, badgering of customers and many disreputable, insolvent or even nonexistent insurance companies that never paid claims.

How long does Sam have to review a Texas insurance policy?

Sam's free look period begins when they receive those documents, and in Texas, they have 10 days to review the policy and decide whether they want to keep it. Two days later, Sam brings their policy to their lawyer to review, and their lawyer advises them to cancel the policy and go with another insurer instead.

What is a free look period?

The free look period is a required period of time in which a new life insurance policy owner can terminate the policy without penalties, such as surrender charges.

How long does a free look last?

The free look period is a required period of time, typically 10 days or more, in which a new life insurance policy owner can terminate the policy without penalties, such as surrender charges.

Can you cancel a free look policy?

If a policyholder is not satisfied with the terms and conditions of the policy , they can cancel and return the policy during the period and get a full refund. The free look period is for the benefit of a policyholder. In the U.S., all 50 states have laws requiring insurers to grant free-look periods to new policyholders.

Who is Julia Kagan?

Julia Kagan has written about personal finance for more than 25 years and for Investopedia since 2014. The former editor of Consumer Reports, she is an expert in credit and debt, retirement planning, home ownership, employment issues, and insurance. She is a graduate of Bryn Mawr College (A.B., history) and has an MFA in creative nonfiction ...