What is a Medicare Part B premium?

Part B premiums. Most people will pay the standard premium amount. If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

Do you pay higher Medicare premiums for Medicare Part B and D?

While most people pay the standard monthly premium amounts for Medicare Part B and Part D, those with a higher income level will likely face higher premiums. Medicare looks at the modified adjusted gross income (MAGI) reported on your IRS tax return from 2 years ago to determine if you pay higher monthly premiums for Part B and Part D.

What is the cost of Medicare Part B in 2019?

Part B premiums. The standard Part B premium amount in 2019 is $135.50. Most people will pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What is the medicare surcharge?

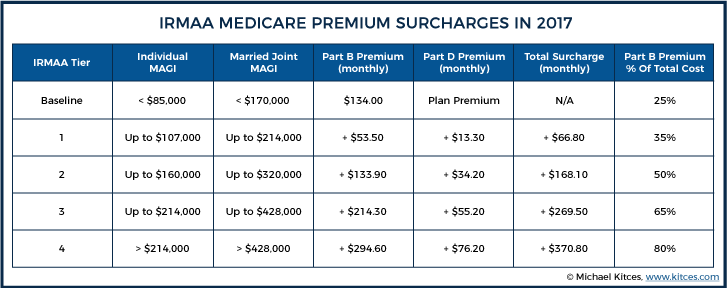

Medicare surcharge is a fee that people pay if their adjusted gross income (plus tax-exempt interest) is higher than $85,000 if you’re single or $170,000 if you’re married filing jointly. The vast majority will pay $104.90 every month for Medicare Part B premiums.

What will Irmaa be in 2021?

The maximum IRMAA in 2021 will be $356.40, bringing the total monthly cost for Part B to $504.90 for those in that bracket. The top IRMAA bracket applies to married couples with adjusted gross incomes of $750,000 or more and singles with $500,000 or more of income.

What is the Medicare surcharge for 2021?

Higher-income Medicare beneficiaries will pay more. In 2021, individuals with modified adjusted gross income of $88,000 or more and married couples with MAGIs of $176,000 or more will pay additional surcharges ranging from $59.40 per month to $356.40 per month on top of the standard Part B premium.

What is the Medicare MAGI for 2021?

In 2021, the adjustments will kick in for individuals with modified adjusted gross income above $88,000; for married couples who file a joint tax return, that amount is $176,000. For Part D prescription drug coverage, the additional amounts range from $12.30 to $77.10 with the same income thresholds applied.

How long does the Medicare surcharge last?

"You might have it one year and not the next," says Fried. Unlike late enrollment penalties that can last a lifetime, the surcharge can be temporary. As soon as your income falls below the thresholds, the surcharge will drop off. Say you owed the surcharge in 2017 as a result of temporarily high income in 2015.

What is the Medicare surtax for 2022?

The 2022 Medicare tax rate is 2.9%. Typically, you're responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%. Your Medicare tax is deducted automatically from your paychecks.

What is the Medicare Part B premium for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

How do I stop paying Irmaa?

To avoid getting issued an IRMAA, you can proactively tell the SSA of any changes your income has seen in the past two years using a “Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event” form or by scheduling an interview with your local Social Security office (1-800-772-1213).

What is the Part B premium for 2021?

$148.50Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What income level triggers higher Medicare premiums?

In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there. You'll receive an IRMAA letter in the mail from SSA if it is determined you need to pay a higher premium.

How long do I have to pay Irmaa?

The Social Security Administration (SSA) determines if you owe an IRMAA based on the income you reported on your IRS tax return two years prior, meaning two years before the year when you pay the IRMAA. For example, Social Security would use tax returns from 2021 to determine your IRMAA in 2023.

How do I get rid of Medicare surcharges?

How to avoid the Medicare Levy Surcharge. In order to avoid the surcharge, you must have the appropriate level of cover. For singles, that means a policy with an excess of $500 or less. For couples or families, it means an excess of $1,000 or less.

What will Irmaa be in 2023?

2023 IRMAA Brackets (Projected)PROJECTED 2023 IRMAA BRACKETS FOR MEDICARE PART BAbove $149,000 – $178,000Above $298,000 – $356,000Standard Premium x 2.6Above $178,000 – $500,000Above $356,000 – $750,000Standard Premium x 3.2Greater than $500,000Greater than $750,000Standard Premium x 3.45 more rows•May 22, 2022

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

Medicare Surcharge

Medicare surcharge is a fee that people pay if their adjusted gross income (plus tax-exempt interest) is higher than $85,000 if you’re single or $170,000 if you’re married filing jointly. The vast majority will pay $104.90 every month for Medicare Part B premiums.

Medicare Comes With a Cost

Medicare Part A which pays for healing center administrations, is free if it is possible that you or your life partner paid Medicare finance charges for no less than ten years, however in the event that individuals are not qualified with the expectation of complementary Part A can pay a month to month premium of a few hundred dollars.

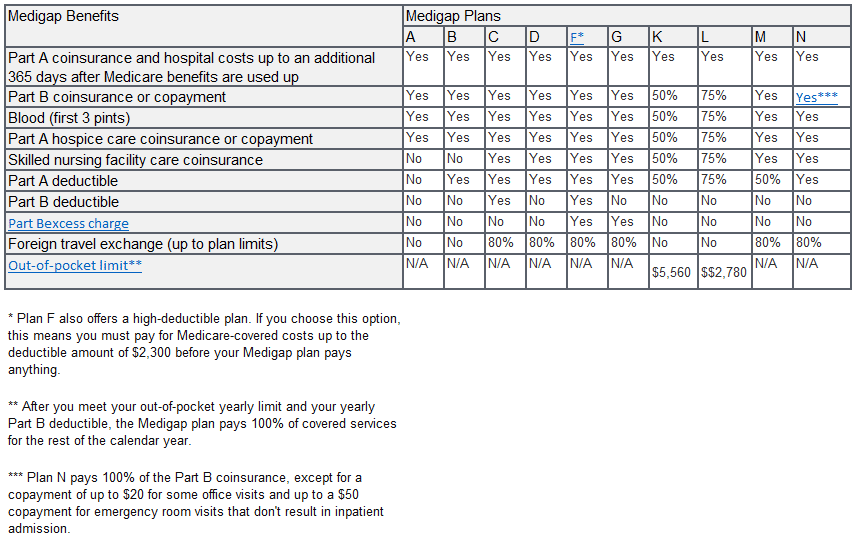

You Can Fill the Gap

Recipients of customary Medicare will probably need to agree to accept a Medigap supplemental protection design offered by private insurance agencies to help cover deductibles, co-installments, and different holes.

There Is an All-in-One Option

Recipient can agree to accept conventional Medicare - Parts A, B, and D, and a supplemental medigap arrangement. Another choice for recipient is to go an option course by agreeing to accept Medicare Advantage, which gives restorative and physician recommended medicate scope through private insurance agencies.

High Incomers Pay More

In the event that recipient picks customary Medicare and his or her wage is over a specific edge, he or she will pay more for Parts B and D.

At the Point When to Sign Up

Somebody effectively taking Social Security advantages will be naturally enlisted in Parts A and B. There is a choice to turn down Part B, since it has a month to month cost; if kept, the cost will be deducted from Social Security if there were benefits as of now guaranteed.

A Quartet of Enrollment Periods

On the off chance that a man missed agreeing to accept Part B amid the underlying enlistment time frame and he or she is not working or not secured by life partner's managers scope, that individual can agree to accept Part B amid the general enlistment time frame that keeps running from January 1 to March 31 and scope will start on July 1.

How long does it take to pay Medicare premiums if income is higher than 2 years ago?

If your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. IRMAA is re-evaluated every year as your income changes.

How much is Medicare Part B 2021?

The standard Medicare Part B premium is $148.50/month in 2021. A 40% surcharge on the Medicare Part B premium is about $700/year per person or about $1,400/year for a married couple both on Medicare. In the grand scheme, when a couple on Medicare has over $176k in income, they are probably already paying a large amount in taxes.

What percentage of Medicare premiums do Medicare beneficiaries pay?

The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%.

How much does Medicare cover?

The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%. Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with ...

How much does Medicare premium jump?

If your income crosses over to the next bracket by $1, all of a sudden your Medicare premiums can jump by over $1,000/year. If you are married and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.

When will IRMAA income brackets be adjusted for inflation?

The IRMAA income brackets (except the very last one) started adjusting for inflation in 2020. Here are the IRMAA income brackets for 2021 coverage and the projected brackets for 2022 coverage. Before the government publishes the official numbers, I’m able to make projections based on the inflation numbers to date.

What to do if your income is near a bracket cutoff?

So if your income is near a bracket cutoff, see if you can manage to keep it down and make it stay in a lower bracket. Using the income from two years ago makes it a little harder. Now in 2021, you don’t know where exactly the brackets will be for 2023.

What is the difference between Medicare Part B and Part D?

Medicare is made up of several parts. Most have monthly premiums, which is the amount you pay each month for coverage. Part B has a standard premium amount that most people pay each month. That amount changes from year to year , but it's generally consistent for most Medicare enrollees .

What is a Part D plan?

Unlike Medicare Part B, which the federal government provides, Part D prescription drug plans are provided by private health insurance companies that Medicare approves . Part D monthly premiums can vary a great deal from one health insurance company to another. to get the latest monthly premium costs for Part D plans.

Do you get a quarterly bill if you don't take Social Security?

If the amount isn't taken from your payment, you should receive a quarterly bill in the mail. And if you're not taking Social Security retirement benefits, you'll get a bill in the mail for the standard Part B premium amount, plus any IRMAA you owe.

Is MSA tax exempt?

An MSA is like a health savings account (HSA). Contributions made to an MSA are tax-exempt, and withdrawals are tax-free, if the money taken out is spent on qualified health care expenses. Moving money into an MSA could potentially lower your taxable income.

Is it important to get Medicare?

So as part of your retirement income planning, it's important to get the Medicare decisions right. Many older Americans are working longer and continuing to earn income well into their 60s and 70s. This income can help boost their retirement security, but it may also mean they face higher Medicare premiums.

Do people with higher incomes pay higher Medicare premiums?

Key takeaways. While most people pay the standard monthly premium amounts for Medicare Part B and Part D, those with a higher income level will likely face higher premiums.

What Is The Income Threshold before I am faced with the Medicare High-Income Surcharge?

Medicare beneficiaries whose income exceeds certain thresholds must pay more in monthly premiums for Part B doctor coverage and Part D drug coverage. These income adjusted premiums apply to single tax filers and those married filing separately with incomes of more than $85,000 and married couples filing jointly with incomes of more than $170,000.

How does having higher income affect me?

If you have higher income, you will pay an additional premium amount for Medicare Part B and Medicare prescription drug coverage. This additional amount is known as the adjustment amount. Here is how it works:

How does Social Security determine if I must pay higher premiums?

To know if you will pay higher premiums, Social Security uses the most recent federal tax return the internal revenue service provides for them. As a beneficiary, if you must pay higher premiums, a sliding scale is used to make the adjustments, based on your modified adjusted gross income (MAGI).

SEE ALSO: 11 Common Medicare Mistakes

Who has to pay extra? In government-ese, the surcharge is called an income-related monthly adjustment amount, or IRMAA. It's triggered when modified adjusted gross income--that is, adjusted gross income plus tax-exempt interest income--exceeds $170,000 on a married-filing-jointly tax return or $85,000 on an individual's return.

SEE ALSO: FAQs About Medicare

Are the income thresholds adjusted for inflation? The Part B trigger points were originally adjusted annually for inflation. But the ACA temporarily froze the thresholds for nine years. "With no indexing, more people get caught by it," says Cubanski. Under current law, inflation adjustments are scheduled to come back in 2020.

SEE ALSO: Why Some People Pay Less for Medicare Than Others

Does a one-time windfall count as a life-changing event? No. If you receive a windfall that will spike your income for the year--such as selling an investment for a large profit--immediately consider ways to lower your adjusted gross income, such as harvesting capital losses or, if you're still working, boosting retirement account contributions.

SEE ALSO: 10 Things You Must Know About Medicare

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

Does Medicare change if you make a higher income?

If you make a higher income, you’ll pay more for your premiums, even though your Medicare benefits won’t change.

Do you pay for Medicare Part A?

Medicare Part A premiums. Most people will pay nothing for Medicare Part A. Your Part A coverage is free as long as you’re eligible for Social Security or Railroad Retirement Board benefits. You can also get premium-free Part A coverage even if you’re not ready to receive Social Security retirement benefits yet.

When will the surcharge drop off?

As soon as your income falls below the thresholds, the surcharge will drop off. Say you owed the surcharge in 2017 as a result of temporarily high income in 2015. But your income fell back below the thresholds in 2016. Good news: The surcharge will go away in 2018.

How much did Medicare premiums increase in 2017?

In 2017, premiums rose no more than the 0.3% COLA for the 70% of beneficiaries protected by hold harmless, amounting to an average increase of about $5 a month and a total monthly premium of about $109.

What does "laflor" mean in Medicare?

laflor. Means testing is a hot topic when it comes to government benefits. But it's not just an academic debate, as high-income Medicare beneficiaries already pay higher premiums. And in reality, requiring wealthier people to pay more can get a bit messy when income spikes for, say, just one year. The following answers to common questions ...

Can you increase your adjusted gross income if you are still working?

No. If you receive a windfall that will spike your income for the year—such as selling an investment for a large profit—immediately consider ways to lower your adjusted gross income, such as harvesting capital losses or, if you’re still working, boosting retirement account contributions.