Full Answer

What happens if Medicare denies me coverage?

If Medicare, your Medicare Advantage Plan (or other type of Medicare health plan), or your prescription drug plan denies you coverage for something you believe is necessary for your health, you can appeal the decision.

What happens if my Medicare Part C appeal is denied?

If your Medicare part C appeal is denied, you can move forward to level 2 and level 3 appeals, which are handled by the Office of Medicare Hearings and Appeals. The appeal process for a Medicare Part D denial must be initiated within 60 days of initial notification.

What to do if you receive a Medicare denial letter?

After you receive a denial letter, you have the right to appeal Medicare’s decision. The appeals process varies depending on which part of your Medicare coverage was denied. Let’s take a closer look at the reasons you might receive a denial letter and the steps you can take from there. Why did I receive a Medicare denial letter?

What is a Medicare Part B denial notice?

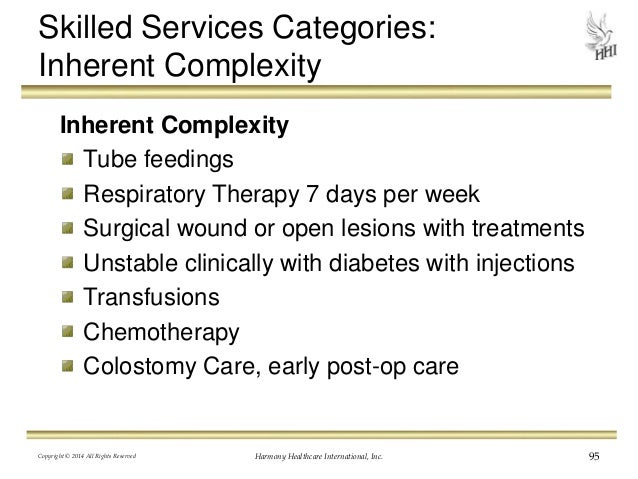

This notice is given when Medicare has denied services under Part B. Examples of possible denied services and items include some types of therapy, medical supplies, and laboratory tests that are not deemed medically necessary. This notice is for Medicare Advantage and Medicaid beneficiaries, which is why it’s called an Integrated Denial Notice.

What do I do if my Medicare application is denied?

If an application is formally rejected, applicants must re-initiate the enrollment process, complete a new CMS-855 form, and re-submit all supplementary documentation. Providers / suppliers who have their enrollment applications rejected do not have the right to appeal.

What happens if Medicare denies a claim?

An appeal is the action you can take if you disagree with a coverage or payment decision by Medicare or your Medicare plan. For example, you can appeal if Medicare or your plan denies: A request for a health care service, supply, item, or drug you think Medicare should cover.

Can I be turned down for Medicare?

For the most part, Medicare Supplement policies are guaranteed renewal. This means as long as you pay the monthly premium, you cannot be denied coverage once you enroll in a plan, regardless of any health conditions that may arise.

What can disqualify you from receiving Medicare?

You have Lou Gehrig's disease, also known as amyotrophic lateral sclerosis (ALS), which qualifies you immediately; or. You have permanent kidney failure requiring regular dialysis or a kidney transplant — and you or your spouse has paid Social Security taxes for a specified period, depending on your age.

Who pay if Medicare denies?

The denial says they will not pay. If you think they should pay, you can challenge their decision not to pay. This is called “appealing a denial.” If you appeal a denial, Medicare may decide to pay some or all of the charge after all.

Why do Medicare claims get denied?

If the claim is denied because the medical service/procedure was “not medically necessary,” there were “too many or too frequent” services or treatments, or due to a local coverage determination, the beneficiary/caregiver may want to file an appeal of the denial decision. Appeal the denial of payment.

How long does it take to be approved for Medicare?

between 30-60 daysMedicare applications generally take between 30-60 days to obtain approval.

Does Medicare have pre-existing conditions?

Medicare defines a pre-existing condition as any health problem that you had prior to the coverage start date for a new insurance plan. If you have Original Medicare or a Medicare Advantage plan, you are generally covered for all Medicare benefits even if you have a pre-existing condition.

When can someone enroll in a Medicare Supplement without the chance for denial premium increase or exclusions due to pre-existing conditions?

For up to six months after your Medicare Supplement plan begins, your new plan can choose not to cover its portion of payments for preexisting conditions that were treated or diagnosed within six months of the start of the policy.

Why would my Medicare be Cancelled?

Depending on the type of Medicare plan you are enrolled in, you could potentially lose your benefits for a number of reasons, such as: You no longer have a qualifying disability. You fail to pay your plan premiums. You move outside your plan's coverage area.

What determines Medicare eligibility?

You are eligible for Medicare if you are a citizen of the United States or have been a legal resident for at least 5 years and: You are age 65 or older and you or your spouse has worked for at least 10 years (or 40 quarters) in Medicare-covered employment.

What income is used to determine Medicare premiums?

modified adjusted gross incomeMedicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS.

You may not be guaranteed Medigap coverage

Lora Shinn has been writing about personal finance for more than 12 years. Her articles have also been published by CNN Money, U.S. News & World Report, and Bankrate, among others.

What Is Medicare Supplement Insurance?

Medicare Supplement Insurance or Medigap is sold by private insurance companies. You must be enrolled in both Parts A and B to be eligible for a policy. It’s not an option if you have a Medicare Advantage plan, and coverage is for one person only (spouses need to purchase Medigap separately).

Can You Be Denied Medigap Coverage?

The answer is yes, you can be denied Medigap coverage. But you can also be guaranteed Medigap coverage if you apply during your Medigap open enrollment period.

Denial of Medigap Policy Renewal

In most cases your renewal is considered guaranteed and cannot be dropped, however there are certain circumstances when the insurance company can decide not to renew your Medigap policy:

How Do You Get Medigap Coverage?

The best time to get Medigap coverage is during your once-per-lifetime Medigap open enrollment period. This period lasts for six months, beginning the first month you are enrolled in Medicare Part B and are at least 65. 10

Medigap Guaranteed Issue Rights

You may qualify for guaranteed issue in specific situations outside the Medigap open enrollment period by federal law. For example, if:

Medigap and Medicare Advantage

If you have a Medicare Advantage (MA) plan, it’s illegal for an insurance company to sell you a Medigap policy. But if you switch to MA after you’ve purchased a Medigap policy, you’ll probably want to drop your policy since you can’t use it to supplement your MA plan.

What happens if Medicare denies coverage?

If you feel that Medicare made an error in denying coverage, you have the right to appeal the decision. Examples of when you might wish to appeal include a denied claim for a service, prescription drug, test, or procedure that you believe was medically necessary.

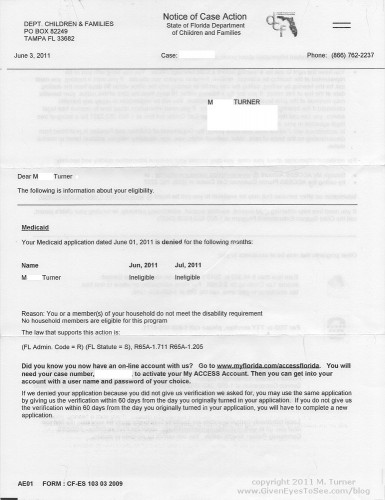

Why did I receive a denial letter from Medicare?

Example of these reasons include: You received services that your plan doesn’t consider medically necessary. You have a Medicare Advantage (Part C) plan, and you went outside the provider network to receive care.

What is an integrated denial notice?

Notice of Denial of Medical Coverage (Integrated Denial Notice) This notice is for Medicare Advantage and Medicaid beneficiaries, which is why it’s called an Integrated Denial Notice. It may deny coverage in whole or in part or notify you that Medicare is discontinuing or reducing a previously authorized treatment course. Tip.

How to avoid denial of coverage?

In the future, you can avoid denial of coverage by requesting a preauthorization from your insurance company or Medicare.

How long does it take to get an appeal from Medicare Advantage?

your Medicare Advantage plan must notify you of its appeals process; you can also apply for an expedited review if you need an answer faster than 30–60 days. forward to level 2 appeals; level 3 appeals and higher are handled via the Office of Medicare Hearings and Appeals.

What are some examples of Medicare denied services?

This notice is given when Medicare has denied services under Part B. Examples of possible denied services and items include some types of therapy, medical supplies, and laboratory tests that are not deemed medically necessary.

What is a denial letter?

A denial letter will usually include information on how to appeal a decision. Appealing the decision as quickly as possible and with as many supporting details as possible can help overturn the decision.

What does it mean if Medicare denied my claim?

Though Medicare is designed to give seniors and certain disabled individuals the most unobstructed access to healthcare possible, there are some rare circumstances that may unfortunately lead to a Medicare claim denial.

Why did Medicare deny my claim?

Medicare may deny your claim based on a few different factors. The exact reasoning behind your denied Medicare claim will be explained to you in the context of your denial letter. Learn more about the four main types of denial letters right here.

What can I do if Medicare denies a claim?

If you feel that Medicare has made in error in denying your coverage, you are welcome to appeal the decision. Some scenarios in which an appeal may be justified include denied claims for services, prescription drugs, lab tests, or procedures that you do believe were medically necessary.

What are the key things to remember when considering a Medicare denied claim appeal?

If you decide to appeal, be sure to ask your doctor, health care provider, or medical supplier for any relevant information that may help your case. In addition, take the time to review your coverage plan and your denial letter thoroughly.

Why is my Medicare claim denied?

The common reasons why a claim gets denied include: The claim is not considered that of a medical necessity. The claim has some payer/contractor issues. The expenses in the claim were incurred before or after the beneficiary was insured by Medicare. It’s a duplicate claim.

What does it mean when a Medicare claim is rejected?

According to the Medicare Administrative Contractor WPS-GHA, a rejected claim means, “Any claim with the incomplete or missing required information or any claim that contains complete and necessary information; however, the information provided is invalid.

What is the Medicare deductible for 2021?

Medicare Part B. Part B covers the cost of outpatient care. This includes doctor visits, preventative services, mental health coverage, and ambulance services. For the year 2021, the standard monthly premium is $148.50 and the deductible sits at $203. The premium increases for people who have an annual income of $88,000 or more.

How to reverse a Medicare rejection?

How To Reverse a Denial or Rejection from Medicare. In order to fix rejections, you just have to resubmit your email with the correct information. When you get a rejected claim, the missing or wrong information will be identified so you can adjust easily. Denials, on the other hand, are a bit tricky.

How long do you have to appeal a CER?

To appeal, you need to write a letter and there are five appeal levels you can pursue. You have 120 days from the date of the receipt of your remittance advance to write an appeal to the first stage.

How many types of Medicare are there?

As mentioned above, there are 4 types of Medicare coverage, and each one has its own “specialties”. Basic Medicare coverage includes Part A and B and is often called Original Medicare.

What is Medicare insurance?

Medicare is a federal health insurance program for certain individuals in the country. Medicare’s main goal is to subsidize healthcare services for select individuals that need the most help. These include the following:

How often do you get Medicare Summary Notice?

Those who have Original Medicare (Medicare Part A and Part B) will receive what’s called a “Medicare Summary Notice” every three months in the mail, if you get Part A and Part B-covered items and services. This notice will show the items and services that providers and suppliers have billed ...

What is Medicare appeal?

a particular health care service, certain supplies, a particular item, or a prescription drug that you believe should be covered that you think you should be able to get; or. payment for a health care service, certain supplies, a particular item, or a prescription drug you already received. It’s also possible to make an appeal if Medicare ...

What is the level of Medicare?

Level 1: Reconsideration from your plan. Level 2: Review by an independent review entity. Level 3: Decision by the Office of Medicare Hearings and Appeals. Level 4: Review by the Medicare Appeals Council. Level 5: Judicial review by a federal district court.

How many levels of appeals are there for Medicare?

For each part of the Medicare program (Part A, Part B, Part C, and Part D), the appeals process has five different levels. If you want to further appeal a decision made at any level of the process, you can usually go to the next level.

What is an organization determination in Medicare?

Those who have a Medicare Advantage Plan or other Medicare health plan can request that the plan provide or pay for items or services that they believe should be covered, provided , or continued. Commonly, this is referred to as an “organization determination.”

Can you appeal a Part D drug plan?

If the plan denies your request to pay for a drug, you can make an appeal. Once again, the appeals process consists of five levels:

Can you appeal a Medicare decision?

Appealing a Decision if You Have Been Denied Medicare Coverage. If Medicare, your Medicare Advantage Plan (or other type of Medicare health plan), or your prescription drug plan denies you coverage for something you believe is necessary for your health, you can appeal the decision.

How long does it take for a non-covered patient to appeal a Medicare decision?

The QIO should make a decision no later than two days after your care was set to end.

How long before home health care ends should you get a notice?

You should get this notice no later than two days before your care is set to end. If you receive home health care, you should receive the notice on your second to last care visit. If you have reached the limit in your care or do not qualify for care, you do not receive this notice and you cannot appeal.

How long does it take to appeal a QIO denial?

You have until noon of the day following the QIO’s denial to file this appeal. The QIC should make a decision within 72 hours.

How long does a hospital stay notice have to be signed?

This notice explains your patient rights, and you will be asked to sign it. If your inpatient hospital stay lasts three days or longer, you should receive another copy of the same notice before you leave the hospital. This notice should arrive up to two days, and no later than four hours, before you are discharged.

What happens if you appeal a QIO discharge?

If your appeal to the QIO is unsuccessful, you will not be held responsible for the cost of the 24-hour period while you waited for the QIO to make a decision.

What happens if you don't have Medicare?

If you don’t, you’ll incur penalties that may last your whole life. Like many people, you or a loved one might not be ready to take the plunge into Medicare coverage, despite being eligible. In some instances, it might make sense to defer coverage. In others, it may wind up costing you long-lasting or even permanent penalties.

What happens if you don't wait for Medicare open enrollment?

If this happens, don’t wait for the next Medicare open enrollment period, otherwise you may have a lapse in coverage and owe penalty fees.

How much is Medicare Part B in 2021?

Medicare Part B covers outpatient medical costs and comes with a monthly premium for all Medicare beneficiaries. The standard premium is $148.50 per month in 2021, but this rate could be higher based on your income. You can also defer Part B coverage. However, if you defer Medicare Part B coverage, you may receive significant financial penalties ...

How long do you have to enroll in Medicare if you have lost your current plan?

No matter your reasons for deferring, you must enroll in Medicare within 8 months of losing your current coverage.

How long do you have to work to get Medicare Part A?

Medicare Part A covers hospital expenses. If you or your spouse worked for at least 10 years (40 quarters), you will most likely be eligible for premium-free Part A when you turn 65 years old. You can defer Medicare Part A.

What happens if you miss your Part A?

If you miss both initial enrollment and special enrollment, your late enrollment penalties may be steep and may last a long time. If you’re not eligible for premium-free Part A and buy it late, your monthly premium will rise by 10 percent for double the number of years you didn’t sign up.

Is Medicare mandatory?

Medicare isn’t mandatory. You can defer Medicare coverage if you feel it’s in your best interest to do so. Keep in mind, though, that most people who are eligible for Medicare do benefit from enrolling in both Part A and Part B ( original Medicare) during their initial enrollment period.