At what age do you stop paying Medicare tax? Medicare Withholding after 65. As long as you have earned income, even after retirement, you continue to contribute to Social Security and Medicare with FICA taxes at the same rate as before you retired. If you have no earned income, you do not pay Social Security or Medicare taxes.

What age do you get to stop paying taxes?

Dec 10, 2021 · When Does Medicare Tax Stop? (Solution) Unlike Social Security taxes that stop at $106,800 in earnings each year, Medicare taxation covers all of your earned income. Medicare withholding stops only when you no longer have earned income. Medicare withholding stops only when you no longer have earned income. Medicare premiums are tax deductible.

When do you stop paying FICA for the year?

Jan 13, 2022 · Does Medicare withholding stop at age 65? As an employee, your employer withholds 1.45 percent from your earned income, regardless of the amount of money you make each year. Unlike Social Security taxes that stop at $106,800 in earnings each year, Medicare taxation covers all of your earned income. Medicare withholding stops only when you no longer …

When do you quit paying Social Security tax?

Unlike Social Security taxes that stop at $106,800 in earnings each year, Medicare taxation covers all of your earned income. Medicare withholding stops only when you no longer have earned income. Medicare at Age 65 Claim your Medicare benefits three months before age 65 by contacting Social Security.

Do you pay Medicare taxes while receiving Medicare benefits?

At what age do you stop paying Medicare tax? Medicare Withholding after 65 As long as you have earned income, even after retirement, you continue to contribute to Social Security and Medicare with FICA taxes at the same rate as before you retired. If you have no earned income, you do not pay Social Security or Medicare taxes.

Do you ever stop paying Medicare tax?

Yes. There is no exemption for paying the Federal Insurance Contribution Act (FICA) payroll taxes that fund the Social Security and Medicare systems. As long as you work in a job that is covered by Social Security, FICA taxes will be withheld from your paycheck. The same goes if you remain actively self-employed.

Do you still pay Medicare tax after 65?

After retirement, your source of income switches to investment income and retirement benefits, and you typically are not required to pay Medicare or FICA tax on most or all of your retirement income.Mar 29, 2021

What is the max Medicare tax for 2021?

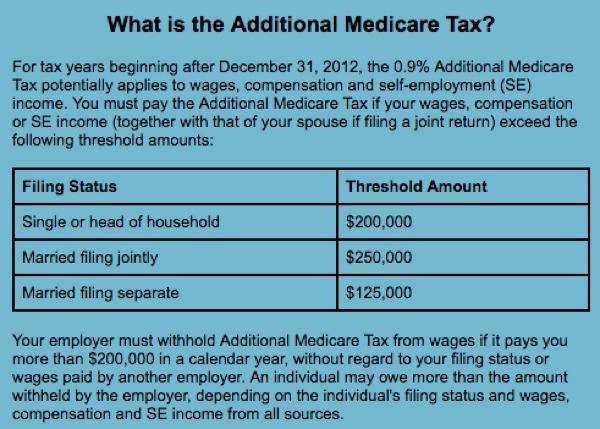

2021 updates. For 2021, an employee will pay: 6.2% Social Security tax on the first $142,800 of wages (maximum tax is $8,853.60 [6.2% of $142,800]), plus. 1.45% Medicare tax on the first $200,000 of wages ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return), plus.Oct 15, 2020

What is the maximum Medicare tax for 2020?

There is no limit on the amount of earnings subject to Medicare (hospital insurance) tax. The Medicare tax rate applies to all taxable wages and remains at 1.45 percent with the exception of an “additional Medicare tax” assessed against all taxable wages paid in excess of the applicable threshold (see Note).

Will tax brackets change in 2022?

In November, the IRS released revised tax brackets for 2022 that adjust the rates for inflation. However, those will not impact taxpayers who are still working to get their return submitted by the 18 April deadline.4 days ago

Who is exempt from paying Medicare tax?

The Code grants an exemption from Social Security and Medicare taxes to nonimmigrant scholars, teachers, researchers, and trainees (including medical interns), physicians, au pairs, summer camp workers, and other non-students temporarily present in the United States in J-1, Q-1 or Q-2 status.Sep 30, 2021

What is the 2022 Medicare tax rate?

1.45%For 2022, the FICA tax rate for employers is 7.65% — 6.2% for Social Security and 1.45% for Medicare (the same as in 2021). For 2022, an employee will pay: 6.2% Social Security tax on the first $147,000 of wages (6.2% of $147,000 makes the maximum tax $9,114), plus.Jan 12, 2022

How much of my Social Security is taxable in 2021?

50%For the 2021 tax year (which you will file in 2022), single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income was more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.5 days ago

What is the 2022 Social Security tax limit?

$147,000In 2022, the Social Security tax limit increased significantly, to $147,000. This could result in a higher tax bill for some taxpayers. The amount of the benefits received by individuals and couples rose to 5.9%.

How much of Medicare is covered by Part A and Part B?

In general, Part A and Part B cover 80% of Medicare-approved services. You would be responsible for the remaining 20%. Your medical insurance through your employer, or your spouse’s, should be reviewed to determine whether Part C or Medicare Advantage coverage and Part D—prescription drug coverage is right for you.

How old do you have to be to get Medicare Part A?

You are eligible for premium-free Medicare Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years.

What is payroll tax?

Payroll taxes under the Federal Insurance Contribution Act (FICA) or the Self-Employed Contributions Act (SECA) fund your Social Security benefits—including Medicare. If you are employed or self-employed in the United States you pay FICA or SECA taxes. These payroll deductions fund your Social Security and Medicare benefits ...

What is Social Security tax?

Social Security benefits provide partial replacement income if you’re a qualified retiree or disabled person, as well as for spouses, children, and survivors. The Social Security Administration (SSA) tracks your earnings throughout your career. It uses the 35 highest-earning years to calculate ...

Can you delay Medicare Part B enrollment?

You won’t pay a late enrollment penalty if you enroll within three months of when you first return to the U.S. If one of these reasons applies to you, then you can choose to delay enrollment in Medicare Part B without penalty.

Does Social Security appear on W-2?

These payroll deductions fund your Social Security and Medicare benefits and appear as FICA on your W-2 form. Some employers separate Social Security from Medicare, so you may see them listed on separate lines on the W-2.

Does working past retirement age increase Social Security?

Working past full retirement age may increase your Social Security benefits because contributions continue to be paid. If you have no earned income, you do not pay Social Security or Medicare taxes. There is no Social Security or Medicare tax charged on Social Security benefits. That’s because these are not taxable income.

Does Medicare withholding stop at age 65?

As an employee, your employer withholds 1.45 percent from your earned income, regardless of the amount of money you make each year. Unlike Social Security taxes that stop at $106,800 in earnings each year, Medicare taxation covers all of your earned income. Medicare withholding stops only when you no longer have earned income. Medicare at Age 65

Do you have to pay taxes on Medicare after 65?

Medicare Withholding after 65 You may think that once you start using Medicare and collecting Social Security benefits, taxation for these items will cease. That is not true. As long as you have earned income, even after retirement, you continue to contribute to Social Security and Medicare with FICA taxes at the same rate as before you retired.

Can I stop withholding Social Security taxes from my paycheck?

You aren鈥檛 allowed to tell either employer to stop withholding Social Security taxes from your paychecks. But, when you file your income tax return, you will receive a tax credit equal to the amount of the extra withholding so you鈥檒l get the excess back as a tax refund.

How much does Medicare tax stop?

Unlike Social Security taxes that stop at $106,800 in earnings each year, Medicare taxation covers all of your earned income. Medicare withholding stops only when you no longer have earned income.

How long before you can claim Medicare benefits?

Claim your Medicare benefits three months before age 65 by contacting Social Security. You have paid into the trust fund to assist with Part A or hospital care Medicare starting at age 65. You may continue to work; you do not have to retire to get the benefits of Medicare.

How much do you pay for Social Security in 2011?

If you are self-employed or an independent contractor, you pay both the employer and the employee portion of Social Security and Medicare taxes, for a total of 13.3 percent in 2011. You pay these on IRS Schedule SE. As an employee, your employer withholds 1.45 percent from your earned income, regardless of the amount of money you make each year.

What is the Medicare tax rate for 2011?

Medicare taxes are 1.45 percent. The employee gets a 2 percent break for the 2011 tax year. The employer pays 6.2 percent in 2011 and 1.45 percent for Medicare matching.

Do you have to pay taxes on Social Security after retirement?

You may think that once you start using Medicare and collecting Social Security benefits, taxation for these items will cease. That is not true. As long as you have earned income, even after retirement, you continue to contribute to Social Security and Medicare with FICA taxes at the same rate as before you retired.

Do you pay Medicare if you have no earned income?

If you have no earned income, you do not pay Social Security or Medicare taxes. There is no Social Security or Medicare tax charged on Social Security benefits, because these benefits are unearned income. Advertisement. references & resources. IRS.gov: Publication 15: (Circular E) Employer's Tax Guide for 2011.

Do you have to pay Social Security taxes on additional income?

When you reach $106,800 in income in a calendar year, you do not have to pay Social Security taxes on additional income.

What is the FICA tax rate for 2021?

FICA includes both Social Security and Medicare, the federal health insurance program for Americans 65 and over. 1 . As of 2021, your wages up to $142,800 ($137,700 for 2020) are taxed at 6.2% for Social Security, and your wages with no limit are taxed at 1.45% for Medicare. Your employer matches those amounts and sends the total to ...

What is the wage limit for Social Security in 2021?

After their income hits a certain level, their Social Security withholding stops for the year. Officially known as the wage base limit, the threshold changes every year. The 2021 wage limit for paying FICA taxes is $142,800, versus the $137,700 limit in 2020. 1 .

Do you have to pay Social Security if you were hired in 1984?

Workers covered by the CSRS are not required to pay Social Security taxes, nor will they receive Social Security benefits. However, those covered by the FERS are part of the Social Security system and contribute to it at the current tax rate. 6

Do you have to contribute to Social Security 2020?

Updated Dec 23, 2020. Of all the taxes that come out of your paycheck, none may be as inescapable as those that go to Social Security. Whether you're salaried or self-employed, you must generally contribute throughout your entire working life. There are, however, a few exceptions, which we'll cover here.

Do state employees pay Social Security?

State or local government employees, including those working for a public school system, college, or university, may or may not pay Social Security taxes. If they're covered by both a pension plan and Social Security, then they must make Social Security contributions.

Do non-resident aliens pay Social Security?

Although nonresident aliens employed in the U.S. normally pay Social Security tax on any income they earn here, there are some exceptions. Mostly, these apply to foreign government employees, students, and educators living and working in the country on a temporary basis and possessing the correct type of visa.

Do you have to pay both halves of your taxes?

If you work for yourself, you have to pay both halves because you are, in effect, both employee and employer. This is known as SECA, or the Self Employed Contributions Act, tax. 2 .

Can you opt out of paying Medicare tax?

If your group meets these requirements and opposes accepting Social Security benefits, you can apply for an exemption. To do that, you ‘ll use IRS Form 4029, Application for Exemption From Social Security and Medicare Taxes and Waiver of Benefits. 6 дней назад

What is Medicare tax used for?

The Medicare tax is a payroll tax that applies to all earned income and supports your health coverage when you become eligible for Medicare.

Why is Medicare tax taken out of my paycheck?

What is the Medicare tax? Your employer automatically withholds the Medicare tax from your paycheck in order to help cover the costs of the country’s Medicare program. The tax comprises one part of the Federal Insurance Contributions Act (FICA).

Who is exempt from paying Medicare tax?

The following classes of nonimmigrants and nonresident aliens are exempt from U.S. Social Security and Medicare taxes: A-visas. Employees of foreign governments, their families, and their servants are exempt on salaries paid to them in their official capacities as foreign government employees.

Do you get your Medicare tax back?

To claim a refund of Social Security and Medicare taxes, you will need to complete and submit IRS Form 843. When you apply for a refund from the IRS, include either: A letter from your employer stating how much you were reimbursed. A cover letter attesting that your employer has refused or failed to reimburse you.

At what point do you stop paying social security tax?

What Is the Social Security Tax Limit? You aren’t required to pay the Social Security tax on any income beyond the Social Security Wage Base. In 2021, this limit is $142,800, up from the 2020 limit of $137,700. As a result, in 2021 you’ll pay no more than $8,853.60 ($142,800 x 6.2%) in Social Security taxes.

Does everyone pay the same Medicare tax?

Today, the Medicare tax rate is 2.9%. Employers and employees split that cost with each paying 1.45%. Unlike with Social Security taxes, there is no limit on the income subject to Medicare taxes.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the FICA 751?

Topic No. 751 Social Security and Medicare Withholding Rates. Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

How is the Hospital Insurance Trust funded?

The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers , but is also funded by: The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio