When do they start deducting Medicare?

The Medicare Part A deductible 2022 is $1,556 per benefit period. This amount represents an increase of $72 over the 2021 Part A deductible, which was $1,484. A benefit period begins on the day you’re admitted into a hospital or skilled nursing facility and ends when you have been out of the facility for 60 consecutive days.

Does Medicare charge a deductible?

Mar 07, 2022 · Starting January 1 or whenever your plan year begins, you pay your health care costs up to the deductible amount. After that, your health plan kicks in to help pay the cost of your care for the rest of the plan year. The cycle starts over at the beginning of each new plan year. Medicare Part A deductibles are different.

What is the yearly deductible for Medicare?

Your deductible is the amount of money you have to pay for your prescriptions and healthcare before Original Medicare, other insurance, or your prescription drug plan starts paying for your healthcare expenses. The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and...

When exactly does your Medicare coverage begin?

Dec 14, 2021 · In 2022, the Medicare Part A deductible is $1,556 per benefit period. That means when you are admitted to a hospital or other medical facility as an inpatient, you are responsible for paying the first $1,556 of covered care before Medicare Part A begins picking up any costs.

Are Medicare deductibles based on calendar year?

The concept of a benefit period is important because the Medicare Part A deductible is based on the benefit period, rather than a calendar year. With most other types of health insurance (ie, non-Medicare), the deductible is based on the calendar year.

How do Medicare deductibles work?

A deductible is the amount of money that you have to pay out-of-pocket before Medicare begins paying for your health costs. For example, if you received outpatient care or services covered by Part B, you would then pay the first $233 to meet your deductible before Medicare would begin covering the remaining cost.

What does Medicare consider a benefit period?

A benefit period begins the day you're admitted as an inpatient in a hospital or SNF. The benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row.

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

Does Medicare have a deductible for 2021?

Medicare Part B Premiums/Deductibles The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.Nov 6, 2020

What is the annual deductible for Medicare Part B?

$233Alongside the premium, Medicare Part B includes an annual deductible and 20% coinsurance for which you are responsible to pay out-of-pocket. In 2022, the Medicare Part B deductible is $233. Once you meet the annual deductible, Medicare will cover 80% of your Medicare Part B expenses.Feb 14, 2022

What is Part A deductible for 2021?

$1,484The Medicare Part A inpatient hospital deductible that beneficiaries pay if admitted to the hospital will be $1,556 in 2022, an increase of $72 from $1,484 in 2021.Nov 12, 2021

Does Medicare start the first day of the month you turn 65?

For most people, Medicare coverage starts the first day of the month you turn 65. Some people delay enrollment and remain on an employer plan. Others may take premium-free Part A and delay Part B. If someone is on Social Security Disability for 24 months, they qualify for Medicare.

How often do you pay Medicare Part A deductible?

Part A Deductible: The deductible is an amount paid before Medicare begins to pay its share. The Part A deductible for an inpatient hospital stay is $1,556 in 2022. The Part A deductible is not an annual deductible; it applies for each benefit period.

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Will Social Security get a $200 raise in 2021?

Which Social Security recipients will see over $200? If you received a benefit worth $2,289 per month in 2021, then you will see an increase worth over $200. People who get that much in benefits worked a high paying job for 35 years and likely delayed claiming benefits.Jan 9, 2022

How can I reduce my Medicare premiums?

How Can I Reduce my Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.Aug 30, 2021

What is the Medicare Deductible for 2022?

A deductible refers to the amount of money you must pay out of pocket for covered healthcare services before your health insurance plan starts to p...

Does Original Medicare Have Deductibles?

Original Medicare is composed of Medicare Part A and Medicare Part B. Both parts of Original Medicare have deductibles you will have to pay out of...

Do You Have to Pay a Deductible with Medicare?

You’ve probably heard the one about death and taxes. If you have Original Medicare, you can add deductibles to that list.

When does Medicare kick in?

Starting January 1 or whenever your plan year begins, you pay your health care costs up to the deductible amount. After that, your health plan kicks in to help pay the cost of your care for the rest of the plan year. The cycle starts over at the beginning of each new plan year. Medicare Part A deductibles are different.

How long does Medicare cover?

Medicare Part A covers an unlimited number of benefit periods, and it helps pay for up to 90 days of care for each one. After 90 days, it’s possible to tap into lifetime reserve days.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How long does Medicare Part A last?

A benefit period begins when you enter the hospital and ends when you are out for 60 days in a row. One benefit period may include more than one hospitalization.

How long is Roger in the hospital?

He was out of the hospital less than 60 days before he went back. Roger is in the hospital for a total of 8 days, all within a single benefit period.

Does Medicare have a deductible?

Medicare Part A, Benefit Periods and Deductibles. Published by: Medicare Made Clear. You may be familiar with insurance deductibles. Many homeowners and car insurance policies charge a deductible whenever you file a claim. A health insurance deductible is usually charged once for the plan year.

How much is Medicare deductible for 2021?

Here’s what you’ll pay in 2021: Initial deductible. Your deductible during each benefit period is $1,484. After you pay this amount, Medicare starts covering the costs. Days 1 through 60.

How long does Medicare pay for care?

Then, when you haven’t been in the hospital or a skilled nursing facility for at least 60 days ...

What are the benefits of Medicare Part A?

Some of the facilities that Medicare Part A benefits apply to include: hospital. acute care or inpatient rehabilitation facility. skilled nursing facility.

How long does Medicare Advantage last?

Takeaway. Medicare benefit periods usually involve Part A (hospital care). A period begins with an inpatient stay and ends after you’ve been out of the facility for at least 60 days.

How long can you use your lifetime reserve days?

After 90 days, you’ll start to use your lifetime reserve days. These are 60 additional days beyond day 90 that you can use over your lifetime. They can be applied to multiple benefit periods. For each lifetime reserve day used, you’ll pay $742 in coinsurance.

How long do you have to be in a hospital to get a new benefit?

You get sick and need to go to the hospital. You haven’t been in a hospital or skilled nursing facility for 60 days. This means you’re starting a new benefit period as soon as you’re admitted as in inpatient.

How long does it take to recover from a fall?

After a fall, you need inpatient hospital care for 5 days. Your doctor sends you to a skilled nursing facility for rehabilitation on day 6, so you can get stronger before you go home.

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

What happens when you reach your Part A or Part B deductible?

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

What is 20% coinsurance?

In this instance, you’d be responsible for 20% of the bill under Part B. Medicare would then cover the other 80%. The coinsurance amount you pay is 20% of the amount Medicare approved. This approved amount is the maximum amount your healthcare provider is allowed to charge you for an item or service. If you refer back to your broken arm example.

How much is a broken arm deductible?

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

What is Medicare Supplement?

Medicare Supplement, or Medigap, insurance plans are sold by private insurance companies to help pay some of the costs that Original Medicare does not. They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. Medicare Advantage. An alternative to Original Medicare, a Medicare ...

What is Medicare Advantage?

Medicare Advantage. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage. Most MA plans will have an annual out-of-pocket maximum limit. Extra Help Program. Finally, the Extra Help program is something low-income Medicare ...

What Is a Deductible?

A deductible is the amount of money that you must pay out of your own pocket for covered care before your plan coverage kicks in.

Medicare Part A Deductible

Medicare Part A covers inpatient care received at a hospital, skilled nursing facility or other inpatient facility.

What Is the Maximum Cost of Medicare Part B?

Medicare Part B does come with a premium cost. The monthly premium prices are set annually and depend on your annual income. Premium costs start at $148.50 per month. The maximum cost of Medicare Part B coverage is $504.90 per month in 2021, and that's for individuals reporting half a million dollars or more in income in 2019.

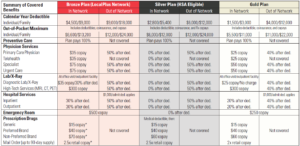

Medicare Part C (Medicare Advantage) Deductible

Medicare Part C plans, otherwise known as Medicare Advantage plans, are an alternative way to get Original Medicare benefits, often with additional coverage.

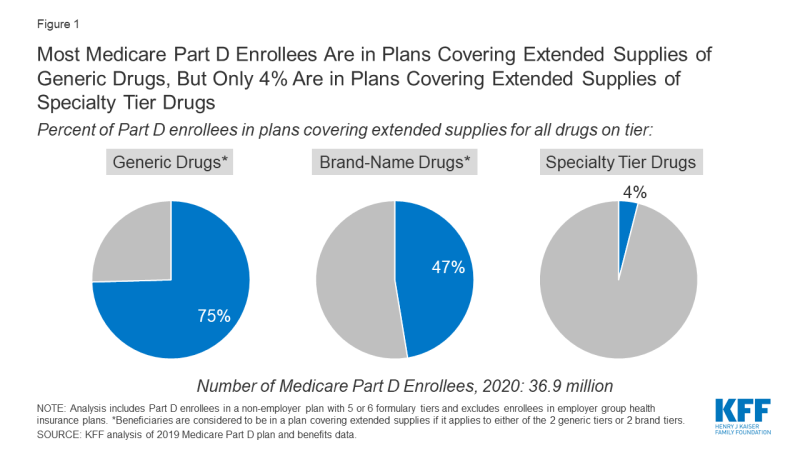

Medicare Part D Deductible

Medicare Part D plans cover prescription medications. Like Medicare Advantage, plans Medicare Part D plans are sold by private insurers and thus there is no standard deductible.

Medicare Supplement Deductibles by Plan

There are 10 standardized Medicare Supplement plans (also called Medigap) available in most states, and two of those plans offer a high-deductible option. Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,370 in 2021.

How much is Medicare Part B deductible?

Medicare Part B also employs a deductible. Unlike Part A, Part B has an annual deductible. In 2019, the annual Part B deductible is $185. That means you’re responsible for non-inpatient bills up to that amount.

How much is the 2019 deductible?

Your deductible for each period in 2019 is $1364. That means you’ll be charged up to that amount for any services provided during your inpatient stay at the hospital. The same deductible applies for each benefit period if you’re admitted as an inpatient at a skilled nursing facility for a period of time.

What does Medicare Part A cover?

Medicare Part A (Hospital Insurance) helps cover inpatient care in hospitals or skilled nursing facilities, in hospice, or home health care. For example, if you have an infected appendix and you are admitted to the hospital for a surgeon to perform an appendectomy, Part A will help cover the costs during your stay, ...

What is Medicare for seniors?

Medicare is the primary hospital and medical insurance coverage for tens of millions of Americans aged 65 or older or under 65 who qualify due to disabilities.

Your first chance to sign up (Initial Enrollment Period)

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Between January 1-March 31 each year (General Enrollment Period)

You can sign up between January 1-March 31 each year. This is called the General Enrollment Period. Your coverage starts July 1. You might pay a monthly late enrollment penalty, if you don’t qualify for a Special Enrollment Period.

Special Situations (Special Enrollment Period)

There are certain situations when you can sign up for Part B (and Premium-Part A) during a Special Enrollment Period without paying a late enrollment penalty. A Special Enrollment Period is only available for a limited time.

Joining a plan

A type of Medicare-approved health plan from a private company that you can choose to cover most of your Part A and Part B benefits instead of Original Medicare. It usually also includes drug coverage (Part D).

What does Medicare Part A cover?

What is Medicare Part A and what services does it cover? Medicare Part A provides health insurance coverage for inpatient hospital services, in addition to hospice care and limited coverage for skilled nursing care and certain home health services.

How much is the deductible for 2021?

Each benefit period requires that you meet a deductible. It’s $1,484 in 2021, but can change each year. Because hospital care is generally pretty expensive, you should brace yourself to pay that full amount each time you’re in the hospital.

How many people are on Medicare in 2019?

Understanding Medicare Part A Benefit Periods. More than 61 million people in the United States received Medicare benefits in 2019, making it a popular and essential health insurance option for seniors and younger people with certain disabilities and medical conditions.1.

When does Marge get the flu?

Marge has really bad luck and contracted the flu again on April 1. Because she’s been out of the hospital for more than 60 days, a new benefit period begins.

How much is a hospital stay in 2021?

For stays beyond that, you can expect to pay coinsurance. If you’re in the hospital between 61 and 90 days during one benefit period in 2021, each day will cost $371. If you’re in the hospital for more than 90 days during one benefit period, each day beyond that will cost $742. Starting on Day 91, you start tapping into your lifetime reserve days ...

Is there an out-of-pocket maximum for Medicare?

When your plan year ends, everything resets and a new benefit period begins. Medicare Part A is different. Its benefit periods aren’ t annual — they’re based on how long you’ve been discharged from the hospital.