See more

Is Medicare Part A free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

What happens if you don't enroll in Medicare Part A at 65?

The Part A penalty is 10% added to your monthly premium. You generally pay this extra amount for twice the number of years that you were eligible for Part A but not enrolled. For example, suppose that: You were eligible for Medicare in 2020, but you didn't sign up until 2022.

Do you still have to pay for Medicare?

Most people don't have to pay a monthly premium for their Medicare Part A coverage. If you've worked for a total of 40 quarters or more during your lifetime, you've already paid for your Medicare Part A coverage through those income taxes.

Does Medicare cover me the month I turn 65?

If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65. (If your birthday is on the first of the month, coverage starts the month before you turn 65.)

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Can you decline Medicare coverage?

If you do not want to use Medicare, you can opt out, but you may lose other benefits. People who decline Medicare coverage initially may have to pay a penalty if they decide to enroll in Medicare later.

What part of Medicare is free?

Part APart A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A." Most people get premium-free Part A.

Do you pay for Medicare out of your Social Security check?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

Why do I have to pay for Part B Medicare?

Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B.

What do I need to do before I turn 65?

Turning 65 Soon? Here's a Quick Retirement ChecklistPrepare for Medicare. ... Consider Additional Health Insurance. ... Review Your Social Security Benefits Plan. ... Plan Ahead for Long-Term Care Costs. ... Review Your Retirement Accounts and Investments. ... Update Your Estate Planning Documents.

Do you automatically get Medicare with Social Security?

If you are already getting benefits from Social Security or the RRB, you will automatically get Part A and Part B starting on the first day of the month when you turn 65. If your birthday is on the first day of the month, Part A and Part B will start the first day of the prior month.

Do I have to enroll in Medicare?

Many people are working past age 65, so how does Medicare fit in? It is mandatory to sign up for Medicare Part A once you enroll in Social Security. The two are permanently linked. However, Medicare Parts B, C, and D are optional and you can delay enrollment if you have creditable coverage.

How many people are covered by Medicare?

Today, Medicare provides this coverage for over 64 million beneficiaries, most of whom are 65 years and older.

What percentage of Medicare deductible is paid?

After your deductible is paid, you pay a coinsurance of 20 percent of the Medicare-approved amount for most services either as an outpatient, inpatient, for outpatient therapy, and durable medical equipment.

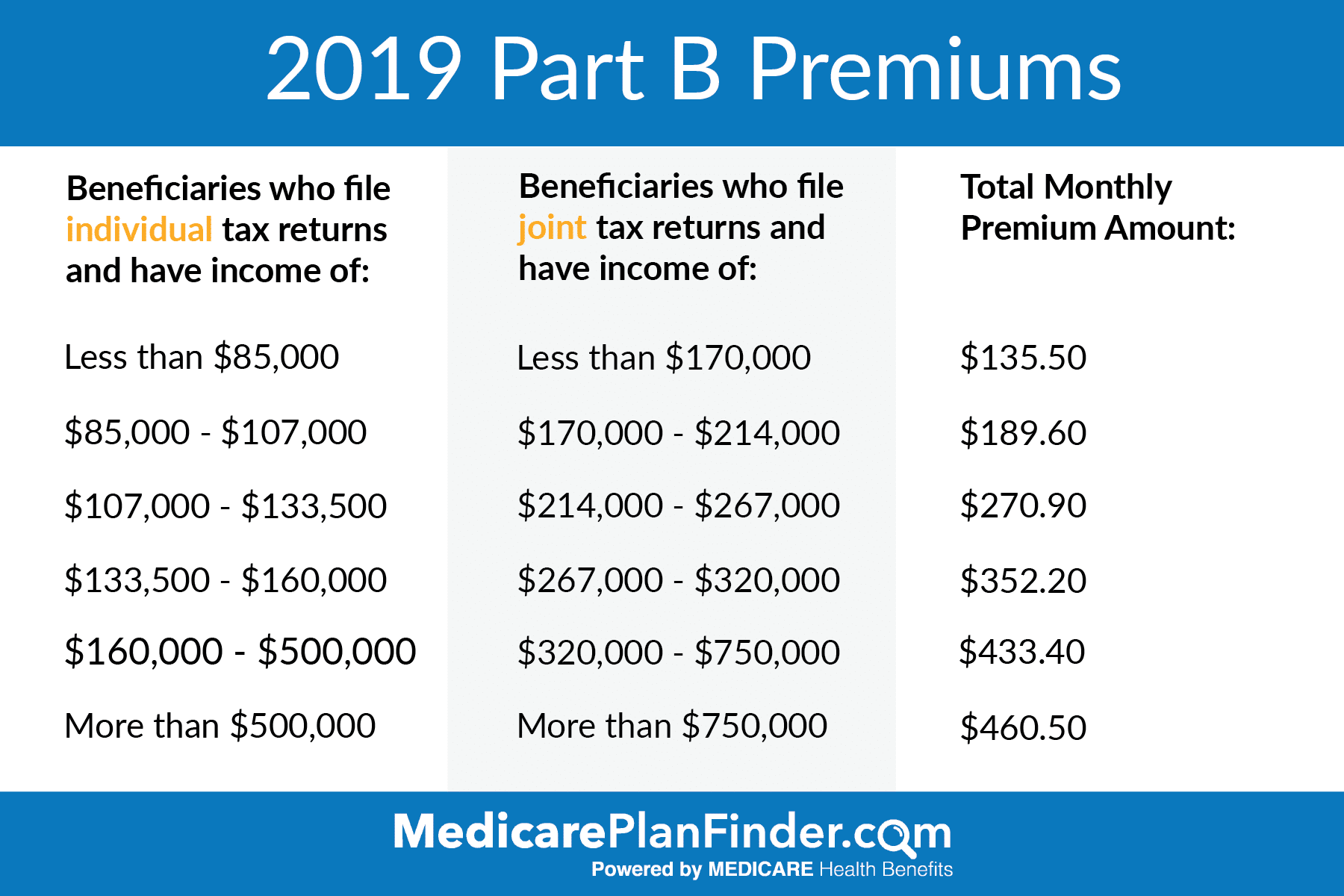

How much does Medicare Part B cost?

Medicare Part B has a monthly premium. The amount you pay depends on your yearly income. Most people pay the standard premium amount of $144.60 (as of 2020) because their individual income is less than $87,000.00, or their joint income is less than $174,000.00 per year.

How many parts of Medicare are there?

The four parts of Medicare have their own premiums, deductibles, copays, and/or coinsurance costs. Here is a look at each part separately to see what your costs may be at age 65.

Enroll In Medicare Part A Consider Your Hsa First

Some people enroll in Medicare Part A when they turn 65 whether theyre working or not, because Part A is usually premium-free. You earn premium-free Part A by paying into the Medicare program through payroll deductions. You qualify if you or your spouse contributed to Medicare for at least 10 years.

If The Employer Has Fewer Than 20 Employees

The laws that prohibit large insurers from requiring Medicare-eligible employees to drop the employer plan and sign up for Medicare do not apply to companies and organizations that employ fewer than 20 people. In this situation, the employer decides.

Who Should Sign Up At 65 Even If They Have Other Insurance

This leaves a fairly long list of other types of insurance that become secondary payers to Medicare. Therefore, if you’re turning 65 and any of these situations apply to you, you should sign up for Medicare during your initial enrollment period.

Am I Automatically Signed Up For Medicare When I Turn 65

The short answer is no, unless you are already receiving Social Security or Railroad Retirement Board benefits. If youre already receiving those benefits, youll receive your Medicare card in the mail before your 65th birthday.

If Your Employer Is Small

If you have health insurance through a company with fewer than 20 employees, you should sign up for Medicare at 65 regardless of whether you stay on the employer plan. If you do choose to remain on it, Medicare is your primary insurance.

How To Opt Out Of Medicare Part B

So, if you dont want to be enrolled, you may be able to opt out. Follow the instructions in your Welcome to Medicare packet, which Medicare sends you during the three months before youre eligible, in most cases.

Your Medicare Special Enrollment Period

If your employer has at least 20 employees and youre still working and covered under that plan when you turn 65, you can delay your enrollment in Medicare . In that case, youll get an eight-month special enrollment period to sign up for Medicare if and when you leave your job or your employer stops offering coverage.

How old do you have to be to sign up for Medicare?

While workers at businesses with fewer than 20 employees generally must sign up for Medicare at age 65 , people working for larger companies typically have a choice: They can stick with their group plan and delay signing up for Medicare without facing penalties down the road, or drop the company option and go with Medicare.

What to do if you are 65 and still working?

If you’ll hit age 65 soon and are still working, here’s what to do about Medicare 1 The share of people age 65 to 74 in the workforce is projected to reach 30.2% in 2026, up from 26.8% in 2016 and 17.5% in 1996. 2 If you work at a company with more than 20 employees, you generally have the choice of sticking with your group health insurance or dropping the company option to go with Medicare. 3 If you delay picking up Medicare, be aware of various deadlines you’ll face when you lose your coverage at work (i.e., you retire).

How long does Medicare last?

Original, or basic, Medicare consists of Part A (hospital coverage) and Part B (outpatient and medicare equipment coverage). You get a seven-month window to sign up that starts three months before your 65th birthday month and ends three months after it.

What happens if you delay picking up Medicare?

It’s becoming a common scenario: You’re creeping closer to your 65th birthday, which means you’ll be eligible for Medicare, yet you already have health insurance through work.

How many employees can you delay signing up for Medicare?

If you work at a large company. The general rule for workers at companies with at least 20 employees is that you can delay signing up for Medicare until you lose your group insurance (i.e., you retire). At that point, you’d be subject to various deadlines to sign up or else face late-enrollment penalties.

What is your 2018 income used for?

In other words, your 2018 income is used for your 2020 premiums. (There’s a form you can fill out to request a reduction in that income-related amount due to a life-changing event, such as retirement.) Roughly a third of Medicare enrollees choose to get their Parts A and B delivered through an Advantage Plan.

What happens if you don't sign up for Part A?

If you don’t sign up when eligible and you don’t meet an exception, you face late-enrollment penalties. Having qualifying insurance — i.e., a group plan through a large employer — is one of those exceptions. Many people sign up for Part A even if they stay on their employer’s plan.

What happens if you don't sign up for Medicare?

Specifically, if you fail to sign up for Medicare on time, you’ll risk a 10 percent surcharge on your Medicare Part B premiums for each year-long period you go without coverage upon being eligible.

How long does it take to get Medicare?

Learn how to make sure they have health insurance once you’re enrolled. Medicare eligibility starts at age 65. Your initial window to enroll is the seven-month period that begins three months before the month of your 65th birthday and ends three months after it. Seniors are generally advised to sign up on time to avoid penalties ...

When do you get Medicare if you leave your job?

In that case, you’ll get an eight-month special enrollment period to sign up for Medicare if and when you leave your job or your employer stops offering coverage. It will start the month after you separate from your employer, or the month after your group health coverage ends – whichever happens sooner.

Do you have to double up on Medicare?

No need to double up on coverage. Many seniors are no longer employed at age 65, and thus rush to sign up for Medicare as soon as they’re able. But if you’re still working at 65, and you have coverage under a group health plan through an employer with 20 employees or more, then you don’t have to enroll in Medicare right now.

Does Medicare pay for Part A?

That said, it often pays to enroll in Medicare Part A on time even if you have health coverage already. It won’t cost you anything, and this way, Medicare can serve as your secondary insurance and potentially pick up the tab for anything your primary insurance (in this case, your work health plan) doesn’t cover.

Who is the expert on Medicare 2021?

by Christian Worstell. February 22, 2021. Reviewed by John Krahnert. Medicare expert Christian Worstell outlines important benefits and enrollment information for people who qualify for Medicare because of a disability before age 65.

Does Medicare change at 65?

No, your Original Medicare (Part A and Part B) benefits will not change when you turn 65. All of the Part A and Part B coverage you have had for the last decade will stay as is. What may change, however, are your options for private Medicare insurance, such as Medicare Advantage (Part C) plans, standalone Medicare Part D prescription drug plans ...

Is it important to celebrate 65?

It’s just as important to celebrate 65 (you get Medicare!) as it is to celebrate 18 (you get to vote!). Age 65 is an important age to look at your health insurance options. If you have Medicaid (called Medical Assistance in Minnesota) and you’re about to turn 65 years old, here’s what you can expect to happen.

Do you have to have Medicaid to be 65?

If you already have Medicaid, you’ve been in touch with a county worker who helps you with your plan. As you approach your 65th birthday, your county worker will provide you with a list of options so you can choose the right plan for your needs.

Key takeaways

What costs should you expect if you’re moving from expanded Medicaid to Medicare?

Millions under expanded Medicaid will transition to Medicare

There are currently almost 20 million people covered under expanded Medicaid, accounting for almost a quarter of all Medicaid enrollees nationwide. Under ACA rules, there are no asset limitations for Medicaid eligibility for pregnant women, children, or adults eligible due to Medicaid expansion.

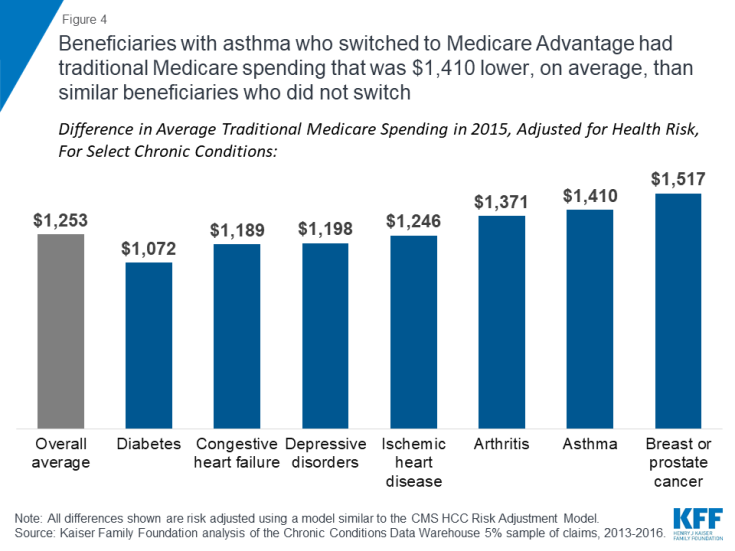

Moving from expanded Medicaid to Medicare Advantage

Depending on your circumstances, you might choose to enroll in a Medicare Advantage plan that provides prescription, dental, and vision coverage – and caps enrollees’ annual out-of-pocket costs for Parts A and B, which traditional Medicare does not do.

Transitioning from expanded Medicaid to Medigap

The more expensive way to cover the gaps in traditional Medicare is to buy a Medigap policy, which generally costs anywhere from a minimum of $25/month to more than $200/month to cover out-of-pocket costs for Parts A and B. That’s on top of premiums for Medicare Parts B and D (prescription drugs).

Medicare can pull you out of the coverage gap

Although the transition from expanded Medicaid to Medicare can be financially challenging, eligibility for Medicare will likely come as a welcome relief if you’ve been in the coverage gap in one of the 11 states that have refused to expand Medicaid.

What steps do I need to take to move from expanded Medicaid to Medicare?

If you’re enrolled in expanded Medicaid and you’ll soon be 65, you’ll want to familiarize yourself with the health coverage and assistance programs that might be available to you.

Legislation aims to make Medicare more affordable for lower-income Americans

The Improving Medicare Coverage Act, introduced in the U.S. House in September by Washington Representative Pramila Jayapal, would do away with cost-sharing and premiums for Medicare beneficiaries with income up to 200% of the poverty level (it would also lower the Medicare eligibility age to 60).