Where did the Medicare Part D prescription drug program come from?

President George W. Bush signed into law the Medicare Prescription Drug Improvement and Modernization Act of 2003, adding an optional prescription drug benefit known as Part D, which is provided only by private insurers. Until this time, about 25 percent of those receiving Medicare coverage did not have a prescription drug plan.

How does Medicare Part D work?

Oct 07, 2020 · When did Medicare Part D become mandatory? January 1, 2006. Why did AMA opposed Medicare? “The AMA decided to leave the Partnership for America’s Health Care Future so that we can devote more time to advocating for these policies that will address current coverage gaps and dysfunction in our health care system.”

When did Medicare Part D go into effect for kids?

Jan 14, 2018 · medicare part D The MMA (Medical Prescription Drug, Improvement and Modernization Act) became law back in the year 2003 (Matthews, 2006). Through the act, Medicare part D drugs were also created and implemented from …

What are the requirements to enroll in Medicare Part D?

Aug 23, 2011 · Medicare did not cover outpatient prescription drugs until January 1, 2006, when it implemented the Medicare Part D prescription drug benefit, authorized by Congress under the “Medicare Prescription Drug, Improvement, and Modernization Act of 2003.” [1] This Act is generally known as the “MMA.”

When did Medicare Part D become mandatory?

January 1, 2006In 2003 the Medicare Modernization Act created a drug benefit for seniors called Part D. The benefit went into effect on January 1, 2006.Aug 10, 2017

When did Part D become mandatory?

January 1, 2006Medicare did not cover outpatient prescription drugs until January 1, 2006, when it implemented the Medicare Part D prescription drug benefit, authorized by Congress under the “Medicare Prescription Drug, Improvement, and Modernization Act of 2003.”[1] This Act is generally known as the “MMA.”

Is Part D mandatory?

Is Medicare Part D Mandatory? It is not mandatory to enroll into a Medicare Part D Prescription Drug Plan.

When did the Medicare Part D Penalty start?

When the Part D program began in 2006, people already in Medicare could sign up until May 15 of that year without incurring a late penalty.

Can I opt out of Medicare Part D?

To disenroll from a Medicare drug plan during Open Enrollment, you can do one of these: Call us at 1-800 MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. Mail or fax a signed written notice to the plan telling them you want to disenroll.

What happens if I don't want Medicare Part D?

If you don't sign up for a Part D plan when you are first eligible to do so, and you decide later you want to sign up, you will be required to pay a late enrollment penalty equal to 1% of the national average premium amount for every month you didn't have coverage as good as the standard Part D benefit.

Do I need Medicare Part D if I don't take any drugs?

If you don't take any medications at all, you'll still want to enroll in Part D when you're first eligible (unless you have other creditable drug coverage), to avoid the late enrollment penalty described above.

What is the cost of Medicare Part D for 2021?

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

Do I need Medicare Part D if I use GoodRx?

You can't use GoodRx and Medicare together. But you can use GoodRx as an alternative to Medicare. You may want to use GoodRx instead of Medicare in certain situations, such as when Medicare doesn't cover your medication, the GoodRx price is cheaper than your Medicare copay, or you won't reach your annual deductible.Sep 27, 2021

Can Medicare Part D be added at any time?

Keep in mind, you can enroll only during certain times: Initial enrollment period, the seven-month period that begins on the first day of the month three months before the month you turn 65 and lasts for three months after the birthday month.

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

What is the maximum Part D Penalty?

The late enrollment penalty amount typically is 1% of the “national base beneficiary premium” (also called the base beneficiary premium) for each full, uncovered month that the person didn't have Medicare drug coverage or other creditable coverage.

What is Medicare Part D?

Medicare Part D Prescription Drug benefit. The Medicare Prescription Drug Improvement and Modernization Act of 2003 (MMA) made the biggest changes to the Medicare in the program in 38 years. Under the MMA, private health plans approved by Medicare became known as Medicare Advantage Plans.

When did Medicare expand?

Over the years, Congress has made changes to Medicare: More people have become eligible. For example, in 1972 , Medicare was expanded to cover the disabled, people with end-stage renal disease (ESRD) requiring dialysis or kidney transplant, and people 65 or older that select Medicare coverage.

How long has Medicare and Medicaid been around?

Medicare & Medicaid: keeping us healthy for 50 years. On July 30, 1965, President Lyndon B. Johnson signed into law legislation that established the Medicare and Medicaid programs. For 50 years, these programs have been protecting the health and well-being of millions of American families, saving lives, and improving the economic security ...

What is the Affordable Care Act?

The 2010 Affordable Care Act (ACA) brought the Health Insurance Marketplace, a single place where consumers can apply for and enroll in private health insurance plans. It also made new ways for us to design and test how to pay for and deliver health care.

When was the Children's Health Insurance Program created?

The Children’s Health Insurance Program (CHIP) was created in 1997 to give health insurance and preventive care to nearly 11 million, or 1 in 7, uninsured American children. Many of these children came from uninsured working families that earned too much to be eligible for Medicaid.

Does Medicaid cover cash assistance?

At first, Medicaid gave medical insurance to people getting cash assistance. Today, a much larger group is covered: States can tailor their Medicaid programs to best serve the people in their state, so there’s a wide variation in the services offered.

When did Medicare start?

But it wasn’t until after 1966 – after legislation was signed by President Lyndon B Johnson in 1965 – that Americans started receiving Medicare health coverage when Medicare’s hospital and medical insurance benefits first took effect. Harry Truman and his wife, Bess, were the first two Medicare beneficiaries.

How much was Medicare in 1965?

In 1965, the budget for Medicare was around $10 billion. In 1966, Medicare’s coverage took effect, as Americans age 65 and older were enrolled in Part A and millions of other seniors signed up for Part B. Nineteen million individuals signed up for Medicare during its first year. The ’70s.

How many QMBs were there in 2016?

In 2016, there were 7.5 million Medicare beneficiaries who were QMBs, and Medicaid funding was being used to cover their Medicare premiums and cost-sharing. To be considered a QMB, you have to be eligible for Medicare and have income that doesn’t exceed 100 percent of the federal poverty level. The ’90s.

How much will Medicare be spent in 2028?

Medicare spending projections fluctuate with time, but as of 2018, Medicare spending was expected to account for 18 percent of total federal spending by 2028, up from 15 percent in 2017. And the Medicare Part A trust fund was expected to be depleted by 2026.

What is the Patient Protection and Affordable Care Act?

The Patient Protection and Affordable Care Act of 2010 includes a long list of reform provisions intended to contain Medicare costs while increasing revenue, improving and streamlining its delivery systems, and even increasing services to the program.

How many people will have Medicare in 2021?

As of 2021, 63.1 million Americans had coverage through Medicare. Medicare spending is expected to account for 18% of total federal spending by 2028. Medicare per-capita spending grew at a slower pace between 2010 and 2017. Discussion about a national health insurance system for Americans goes all the way back to the days ...

What was Truman's plan for Medicare?

The plan Truman envisioned would provide health coverage to individuals, paying for such typical expenses as doctor visits, hospital visits, ...

Which president first proposed Medicare?

On July 30, 1965, President Lyndon Johnson traveled to the Truman Library in Independence, Missouri, to sign Medicare into law. His gesture drew attention to the 20 years it had taken Congress to enact government health insurance for senior citizens after Harry Truman had proposed it.

Did FDR create Medicare?

Roosevelt. The law created the Social Security program as well as insurance against unemployment. The law was part of Roosevelt’s New Deal domestic program. … The law was later amended by acts such as the Social Security Amendments of 1965, which established two major healthcare programs: Medicare and Medicaid.

Who was Medicare created for?

This act was signed into law by President Lyndon Johnson on July 30, 1965, in Independence, MO. It established Medicare, a health insurance program for the elderly, and Medicaid, a health insurance program for the poor.

Has the US ever had universal healthcare?

The United States does not have a universal healthcare program, unlike most other developed countries. In 2013, 64% of health spending was paid for by the government, and funded via programs such as Medicare, Medicaid, the Children’s Health Insurance Program, and the Veterans Health Administration.

Do I need to reenroll in Medicare every year?

In general, once you’re enrolled in Medicare, you don’t need to take action to renew your coverage every year. … As long as you continue to pay any necessary premiums, your Medicare coverage should automatically renew every year with a few exceptions as described below.

What did the Medicare Modernization Act do?

An act to amend title XVIII of the Social Security Act to provide for a voluntary prescription drug benefit under the medicare program and to strengthen and improve the medicare program, and for other purposes.

How has Medicare changed overtime?

Beginning in 1966, workers paid 0.35 percent of their earnings into the Medicare system, and it was raised to 0.5 percent the following year. … The current tax rate of 1.45 percent has been in effect since 1986, and self-employed workers pay 2.9 percent of their earned income into the trust fund.

When did Medicare Part D pass?

Why Medicare Part D Passed. The MMA (Medical Prescription Drug, Improvement and Modernization Act) became law back in the year 2003 (Matthews, 2006). Through the act, Medicare part D drugs were also created and implemented from the 1 st of January in the year 2006. This was done for the purpose of providing drugs coverage to elderly people ...

Why was Medicare Part D not in the best interest of the citizens?

This is mainly because the passage of Medicare part D was not in the best interest of the citizens as it came at a time when there was a looming economic deficit and the exact deficit figures were suppressed by those in power, the Republicans, and the public missed the information (Zwillich, 2006).

How much did Medicare cost in 2001?

The cost of $6.5 billion as at the year 2001 compared to the $700 million incurred back in the year 1992 brought the quick attention of the country’s policymakers (Zwillich, 2006). This was mainly because Medicare was found to be paying two to ten times the value charged by manufacturers for these prescription drugs (Matthews, 2006).

How many prescription drugs are covered by Medicare?

These actions have in turn increased the number of prescription drugs which fall under Medicare and are physician dispensed to around 454 drugs.

What did the trustees of the 2003 Medicare report predict?

The trustees of the 2003 Medicare report projected that spending would increase more than the government’s earnings. The Republicans who already had this information suppressed it before it could be released to the public and exerted unwarranted influence on fellow Republicans to have the law passed (Krugman, 2006).

When was the Kerr Mills program enacted?

The AMA, on the other hand, proposed that the Kerr-Mills program that had been enacted back in the year 1960 should be expanded through the use of state-based and means-tested programs of understandable benefits (Matthews, 2006).

When did Truman defeat Socialized Medicine?

This took place from the year 1945 to 1948 and was followed by a big defeat against ‘ socialized medicine ’ on Truman in 1949 at the hands of the AMA (Krugman, 2006).

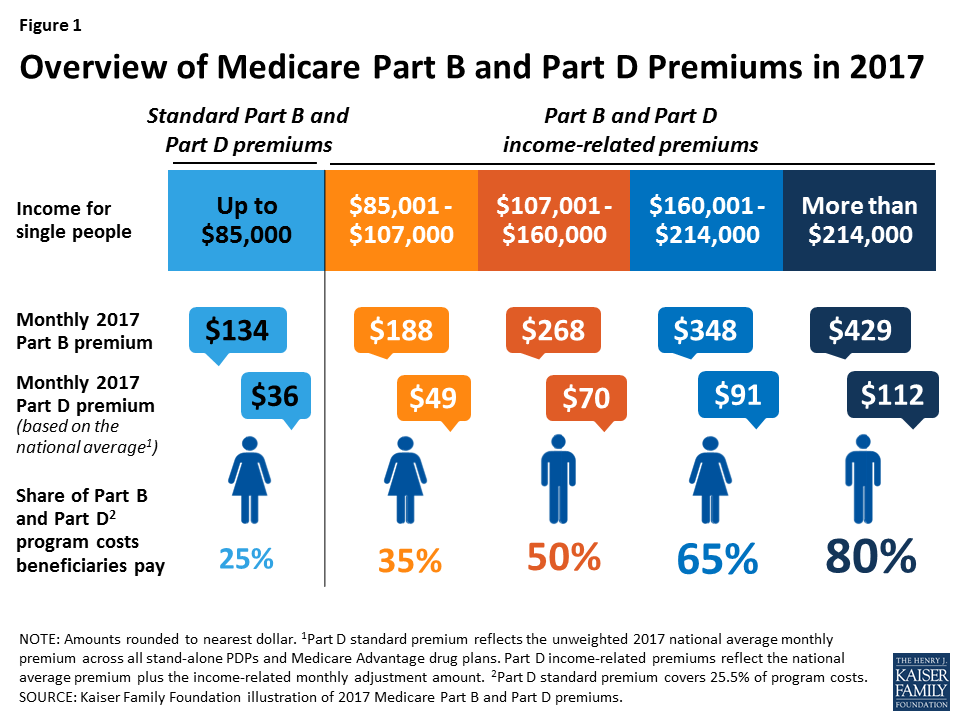

What is Medicare Part D based on?

Medicare Part D beneficiaries with higher incomes pay higher Medicare Part D premiums based on their income, similar to higher Part B premiums already paid by this group. The premium adjustment is called the Income-Related Monthly Adjustment Amount (IRMAA). The IRMAA is not based on the specific premium of the beneficiary's plan, but is rather a set amount per income-level that is based on the national base beneficiary premium (the national base beneficiary premium is recalculated annually; for 2016 it is $34.10). In effect, the IRMAA is a second premium paid to Social Security, in addition to the monthly Part D premium already being paid to the plan.

What is the gap in Medicare Part D?

The costs associated with Medicare Part D include a monthly premium, an annual deductible (sometimes waived by the plans), co-payments and co-insurance for specific drugs, a gap in coverage called the "Donut Hole," and catastrophic coverage once a threshold amount has been met.

What is Medicare Savings Program?

Medicare Savings Programs help low income individuals to pay for their Medicare Part A and/or Part B co-pays and deductibles. There are four Medicare Savings programs, all of which are administered by state Medicaid agencies and are funded jointly by states and the federal governments. Participants in these programs are sometimes called "partial dual eligibles." Individuals who qualify for a Medicare Savings program automatically qualify for the Part D Low Income Subsidy (LIS), which is also known as "Extra Help." The LIS helps qualified individuals pay their Part D expenses, including monthly premiums, co-pays and co-insurance. The LIS also covers people during the deductible period and the gap in coverage called the "Donut Hole."

What is LIS in Medicare?

Individuals who qualify for a Medicare Savings program automatically qualify for the Part D Low Income Subsidy (LIS), which is also known as "Extra Help.". The LIS helps qualified individuals pay their Part D expenses, including monthly premiums, co-pays and co-insurance.

What is FDA approved medicine?

A drug that is for a "medically accepted indication" is one that is prescribed to treat a disease or condition (indication) approved by the FDA.

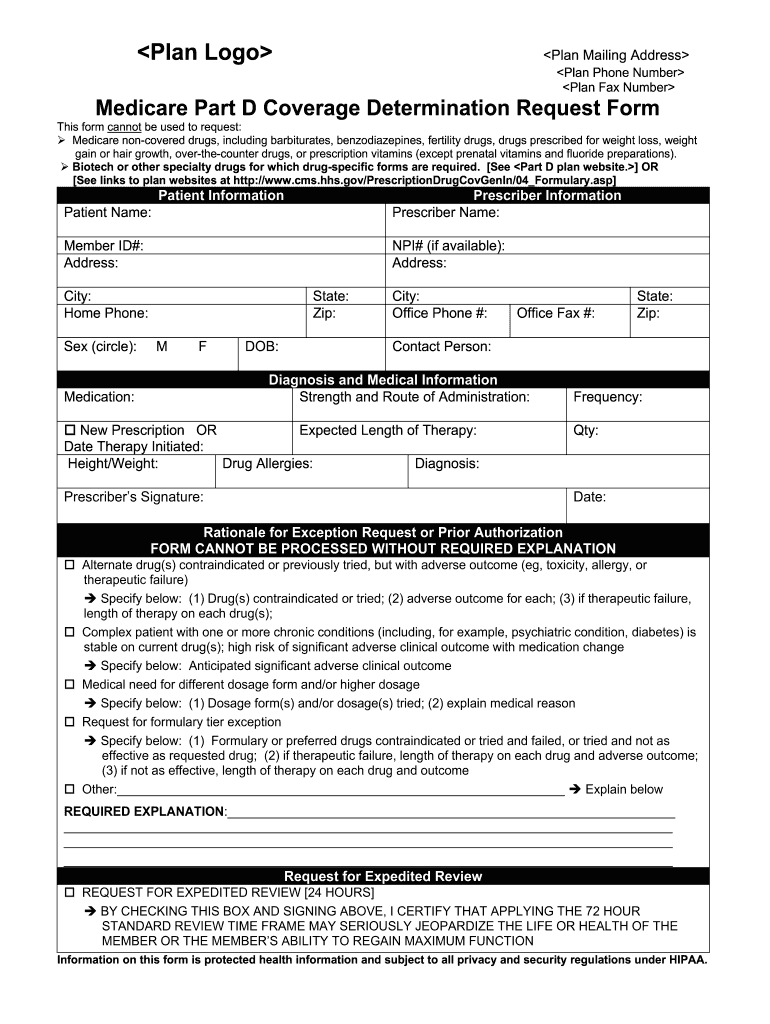

How long does a medical plan have to make an exception?

The member (or his/her representative, or the prescriber) has 60 days from the date of the plan’s Notice of Denial to request an Exception. The plan has 72 hours (three calendar days) to render a "standard" decision, or 24 hours if an expedited ("fast") decision is requested. The plan must render an expedited decision (in 24 hour or less, based on medical necessity) if the plan determines, or the prescriber statement indicates, that a standard decision would seriously jeopardize the patient’s life or health or ability to regain maximum function. The plan is not required to render an expedited decision if the member has already obtained the medication. The timing of the plan’s decision begins when it receives the prescriber’s documentation.

What is MA plan?

MA plans are only appropriate for people who have prescription drug coverage from some other source, such as the Veteran’s Administration (VA).

What is Medicare Part D?

Medicare prescription drug coverage (Part D) helps you pay for both brand-name and generic drugs. Medicare drug plans are offered by insurance companies and other private companies approved by Medicare.

Who is responsible for Medicare Part D?

The Centers for Medicare and Medicaid Services (CMS) or Medicare is responsible for the administration of the Medicare Part D prescription drug program. Private insurance carriers actually implement the various Medicare Part D plans across the country under the direction of CMS. Top.

What is the discount for Donut Hole 2021?

In plan year 2021, your Medicare Part D plan will pay 75% of your generic medication costs in the Donut Hole and your brand-name drug purchases receive a 75% discount while in the Donut Hole. The brand-name drug manufacturer pays 70% and your Medicare Part D plan pays 5% of this discount.

Does Medicare cover prescription drugs?

In general, Medicare Part D prescription drug plans provide insurance coverage for your prescription drugs - just like other types of insurance. Your Medicare prescription drug coverage can be provided by a "stand-alone" Medicare Part D plan (only prescription coverage) or a Medicare Advantage plan that includes prescription coverage ...

Does Medicare have a deductible?

Some Medicare Part D or Medicare Advantage plans have an initial deductible where you pay 100% of your pre scription costs before your Part D prescription drug coverage or benefits begin.

How long does Medicare cover a break?

When a person joins a Medicare drug plan, the plan will review Medicare’s systems to see if the person had a potential break in creditable coverage for 63 days or more in a row. If so, the Medicare drug plan will send the person a notice asking for information about prior prescription drug coverage. It’s very important that the person complete this form and return it by the date on the form, because this is the person’s chance to let the plan know about prior coverage that might not be in Medicare’s systems.

Is Mrs Martinez on Medicare?

Mrs. Martinez is currently eligible for Medicare, and her Initial Enrollment Period ended on May 31, 2016. She doesn’t have prescription drug coverage from any other source. She didn’t join by May 31, 2016, and instead joined during the Open Enrollment Period that ended December 7, 2018. Her drug coverage was effective January 1, 2019

Does Mrs Kim have Medicare?

Mrs. Kim didn’t join a Medicare drug plan before her Initial Enrollment Period ended in July 2017. In October 2017, she enrolled in a Medicare drug plan (effective January 1, 2018). She qualified for Extra Help, so she wasn’t charged a late enrollment penalty for the uncovered months in 2017. However, Mrs. Kim disenrolled from her Medicare drug plan effective June 30, 2018. She later joined another Medicare drug plan in October 2019 during the Open Enrollment Period, and her coverage with the new plan was effective January 1, 2020. She didn’t qualify for Extra Help when she enrolled in October 2019. Since leaving her first Medicare drug plan in June 2018 and joining the new Medicare drug plan in October 2019, she didn’t have other creditable coverage. However, she was still deemed eligible for Extra Help through December 2018. When Medicare determines her late enrollment penalty, Medicare doesn’t count:

Who is Dan McGrath?

Dan McGrath. Mr. McGrath is a Co-Founder of Healthcare Retirement Planner as well as Jester Financial Technologies. He is a best selling author, "What you don't know about retirement will hurt you" and is a nationally recognized speaker on how health costs impact retirement.

When did the IRMAA bracket change?

The other change to the IRMAA brackets happened in 2018 with the passing of the Bi-Partisan Budget Act.

What is the IRMAA bracket 2019?

On average the IRMAA Brackets have inflated from 2007 to 2021 as follows: 1st Surcharge Bracket: 4.94%. 2nd Surcharge Bracket: 6:42%. 3rd Surcharge Bracket: 7.36%.

When was IRMAA created?

IRMAA was created in 2003 through the Medicare Modernization Act of 2003 as it was a way, according to the Act, for Congress and the people “to begin to address the fiscal challenges facing the Medicare program”. The first year of implementation was in 2007 with a surcharge being placed upon only the Medicare Part B premium.

Is Medicare Part D accurate?

When it comes to Medicare and future projections, thankfully, the Medicare Board of Trustees releases an annual report detailing what to expect in terms of future costs and since 2007, when Medicare Part D and IRMAA were first implemented, when it comes to Part B premiums as well as IRMAA surcharges they have been extremely accurate.

When did Medicare start?

Medicare officially began once President Lyndon B. Johnson signed it into law on July 30, 1965. At slightly more than 60 years old, Medicare has grown and changed in the attempt to meet the needs of its growing population of older and disabled adults.

Why was Medicare established?

The government’s response to the financial ruination occurring throughout the country’s older adult population, Medicare was established to provide coverage for both in-hospital and outpatient medical services.

How many Americans are covered by Medicare?

Ensuring access to inpatient and outpatient medical care, a wide range of specialists and diagnostic services, Medicare currently insures more than 61 million Americans — or more than 18% of the population. Medicare’s coverage continues to expand to give beneficiaries access to the latest testing and treatment options for various conditions.

What is Medicare Supplement?

Today, Medicare is a broad term that can be used to describe Parts A and B, Part C or Medicare Advantage plans, or standalone Part D plans that offer prescription drug coverage. There are also Medicare Supplement policies designed to cover a recipient’s cost share for medical services (usually 20% of the allowed charge).

What percentage of the population had health insurance before Medicare?

Prior to Medicare, Americans who had any form of health insurance accounted for less than half of the population. Citizens and, eventually, every level of government became concerned about the problem unfolding in the country.

Was Medicare available to low income people?

Before Medicare, there was some funding available for low or very low-income Americans, but the problem reached further into the middle and even upper class. Not just a problem for low-income individuals, large medical bills quickly depleted someone's life savings and earned assets, such as homes or businesses.