Full Answer

When does the initial enrollment period for Medicare start and end?

Initial Enrollment Period (IEP) The IEP is a 7-month period that begins 3 months before the month a person turns 65 and ends 3 months after the person turns 65. For someone under age 65 who becomes entitled to Medicare based on disability, entitlement begins with the 25th month of disability benefit entitlement.

What is the dependent health insurance section?

This section is for employees with dependents (e.g., spouse, children) who are also enrolled in the employer-sponsored medical plan and the employee pays some or all of the cost of dependent coverage.

Who can enroll in Original Medicare automatically?

Individuals with ALS, also referred to as Lou Gehrig’s disease, can be enrolled in Original Medicare automatically once an individual starts receiving SSDI benefit payments. Individuals who have end-stage renal disease (ESRD).

When do you become eligible for Medicare?

Most people become eligible for Medicare when they turn 65 years of age, as long as they are an American citizen or have lived in the U.S. as a legal permanent resident for five consecutive years or more. Most people qualify for premium free Part A (Hospital Insurance) when they turn 65 due to the number of quarters they worked and paid taxes.

Can a dependent be added to Medicare?

Medicare is individual insurance, not family insurance, and coverage usually does not include spouses and children. Unlike other types of insurance, Medicare is not offered to your family or dependents once you enroll. To get Medicare, each person must qualify on their own.

Are most Medicare beneficiaries automatically enrolled?

Original Medicare enrollment Most Medicare beneficiaries are automatically enrolled in Original Medicare, Part A and Part B. You're generally enrolled automatically the month you turn 65 if you're receiving Social Security Administration (SSA) or Railroad Retirement Board (RRB) benefits.

When should someone enroll in Medicare?

age 65Generally, we advise people to file for Medicare benefits 3 months before age 65. Remember, Medicare benefits can begin no earlier than age 65.

What is a Medicare Dependent plan?

The Medicare-Dependent, Small Rural Hospital (MDH) program was established by Congress in 1990 with the intent of supporting small rural hospitals for which Medicare patients make up a significant percentage of inpatient days or discharges.

Who is automatically enrolled in Medicare?

You automatically get Medicare when you turn 65 Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care.

What is the Medicare initial enrollment period?

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Do I automatically get Medicare when I turn 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

Can you have Medicare and employer insurance at the same time?

Medicare paying secondary means that your employer insurance pays first, and Medicare pays on some or all of the remaining costs. Medicare works with current employer coverage in different ways depending on the size of the employer.

What do I need to do before I turn 65?

Turning 65 Soon? Here's a Quick Retirement ChecklistPrepare for Medicare. ... Consider Additional Health Insurance. ... Review Your Social Security Benefits Plan. ... Plan Ahead for Long-Term Care Costs. ... Review Your Retirement Accounts and Investments. ... Update Your Estate Planning Documents.

How do I add a dependent to my Medicare card?

On your homepage, select My card. You'll see your current Medicare card. Select Add someone to my card. You'll see information about how we can help people with family and domestic violence concerns.

How long can my child stay on my Medicare card?

Once a child turns 14, families are no longer able to access a child's Medicare records. To act as a nominee for Medicare issues, you need to fill out the following form: Authorisation to act on an incapacitated persons behalf for Medicare.

What are eligible dependents?

To claim your child as your dependent, your child must meet either the qualifying child test or the qualifying relative test: To meet the qualifying child test, your child must be younger than you and either younger than 19 years old or be a "student" younger than 24 years old as of the end of the calendar year.

How old do you have to be to get medicare?

Medicare Recipients Over the Age of 65. Most people become eligible for Medicare when they turn 65 years of age, as long as they are an American citizen or have lived in the U.S. as a legal permanent resident for five consecutive years or more.

How long does it take to get Medicare if you are 65?

Individuals receiving SSDI will be automatically enrolled in Original Medicare after 24 months of consecutive benefit payments. Railroad Retirement Board (RRB) recipient.

What are the requirements for Medicare?

Individuals under the age of 65 can qualify for Medicare under these specific conditions: 1 Social Security Disability Insurance (SSDI) recipient. Individuals receiving SSDI will be automatically enrolled in Original Medicare after 24 months of consecutive benefit payments. 2 Railroad Retirement Board (RRB) recipient. Individuals receiving RRB benefits will be automatically enrolled in Original Medicare after 24 months of consecutive benefit payments. 3 Individuals with amyotrophic lateral sclerosis (ALS). Individuals with ALS, also referred to as Lou Gehrig’s disease, can be enrolled in Original Medicare automatically once an individual starts receiving SSDI benefit payments. 4 Individuals who have end-stage renal disease (ESRD). Individuals sign up for Original Medicare through their local Social Security office.

Can dependents get Medicare if they lose their health insurance?

If your dependents have lost coverage from your employee health insurance due to your transition to Medicare , they may be eligible for this temporary form of insurance. Private insurance. There are a variety of private health insurance companies with plans that can cover anyone in your household who is not eligible for Medicare benefits. CHIP. ...

Can I get Medicare if I have Lou Gehrig's disease?

Individuals with ALS, also referred to as Lou Gehrig’s disease, can be enrolled in Original Medicare automatically once an individual starts receiving SSDI benefit payments. Individuals who have end-stage renal disease (ESRD).

How much will my dependent pay if I drop out of Cobra?

They will have the same benefits as they had before you dropped out of the plan. If your employer has 20 or more employees and is subject to Federal COBRA laws, your dependents will pay 102 percent of the total cost of their coverage If your employer is subject to California laws and has between 2 to 19 employees your dependents will be able ...

What age can I get my spouse's health insurance?

So, if your spouse is much younger, and your group health plan uses age bands to set the monthly premium, your spouse’s coverage may be significantly less expensive than the premium for you as an employee at age 64 or 65.

What is Part A insurance?

Part A helps cover your inpatient care in hospitals. Part A also includes coverage in critical access hospitals and skilled nursing facilities (not custodial or long-term care). It also covers hospice care and home health care. You must meet certain conditions to get these benefits.

Does Medicare cover prescription drugs?

Medicare prescription drug coverage is available to everyone with Medicare. Private companies provide this coverage. You choose the Medicare drug plan and pay a monthly premium. Each plan can vary in cost and specific drugs covered. If you decide not to join a Medicare drug plan when you’re first eligible, and you don’t have other creditable prescription drug coverage, or you don’t get Extra Help, you’ll likely pay a late enrollment penalty. You may have to pay this penalty for as long as you have Medicare drug coverage.

Can I get medicare if I have SSI?

Getting SSI doesn’t make you eligible for Medicare. SSI provides a monthly cash benefit and health coverage under Medicaid. Your spouse may qualify for Medicare when he/she turns 65 or has received disability benefits for 24 months.

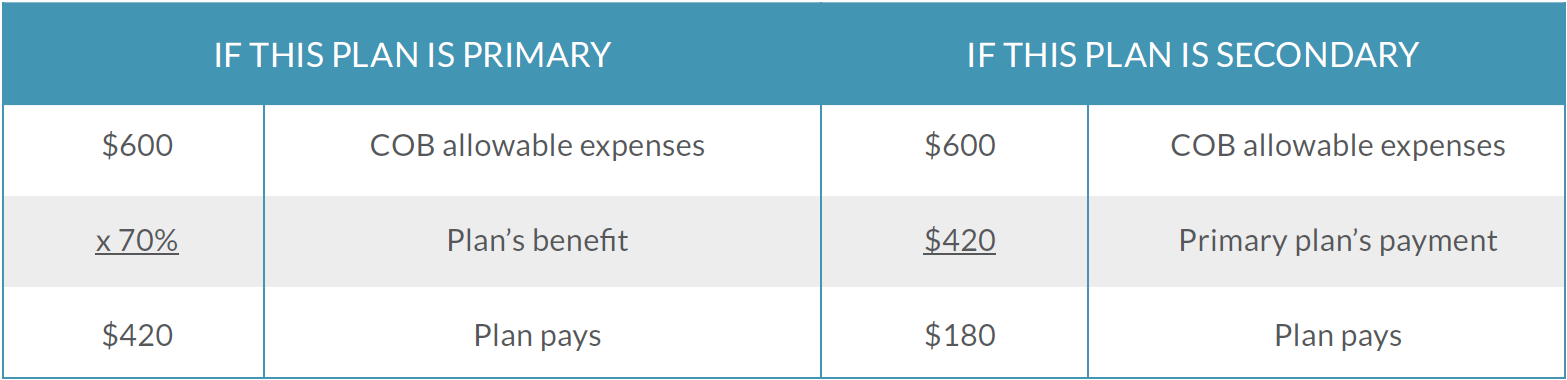

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).

What happens when there is more than one payer?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) to pay. In some rare cases, there may also be a third payer.