Centers for Medicare and Medicaid Services

The Centers for Medicare & Medicaid Services, previously known as the Health Care Financing Administration, is a federal agency within the United States Department of Health and Human Services that administers the Medicare program and works in partnership with state government…

When is the Medicare credit report due?

Mar 31, 2022 · Reminder: Medicare Credit Balance Report As a reminder, the Medicare Credit Balance Report for the quarter ending March 31, 2022 , is due in our office, postmarked by April 30, 2022 . A Medicare credit balance is an amount determined to be refundable to the Medicare program for an improper or excess payment made to a provider due to patient billing or claim …

When should I submit a credit balance report (cms-838)?

Report all Medicare credit balances shown in your records regardless of when they occurred. You are responsible for reporting and repaying all improper or excess payments you have received from the time you began participating in the Medicare program. Once you identify and report a credit balance on the CMS-838 report, do

What happens if I don’t complete the Medicare credit balance report?

Mar 16, 2022 · Credit balance reports due April 30, 2022. This notice is a reminder that the Medicare credit balance report for the quarter ending 03/31/22 is due by 4/30/2022. The quarterly report is to include all new Medicare credit balances not reported on a previous quarterly report. In addition, your quarterly reports should not contain previously demanded Recovery Auditor …

What is a Medicare credit balance?

A complete and acceptable Medicare Credit Balance Report (CMS-838) is due within 30 calendar days from the end of each calendar quarter. Use Palmetto GBA’s (4) … When is the credit balance report due? A completed CMS-838 must be submitted within 30 calendar days after the close of each calendar quarter. (5) …

How often are facilities required to report credit balances to Medicare?

What is Medicare credit balance report?

How do I submit CMS 838?

What is a credit balance audit?

• Offers comprehensive integrated post adjudication financial audit. review of hospital credit balances by leveraging the payer and. provider's resources to identify the following: ✓ Duplicate/similar claim overpayments. ✓ Coordination of benefits (COB) errors.

What is the CMS 838?

What is Medicare credit balance?

Medicare credit balance is an amount determined to be refundable to Medicare. Generally, when a provider receives an improper or excess payment for a claim, it is reflected in their accounting records (patient accounts receivable) as a "credit.". The CMS-838 is specifically used to monitor identification and recovery of "credit balances" owed ...

What is a CMS 838?

The CMS-838 is specifically used to monitor identification and recovery of "credit balances" owed to Medicare. A credit balance is an improper or excess payment made to a provider as the result of patient billing or claims processing errors. There are two forms associated with the Credit Balance Report.

What is credit balance?

A credit balance is an improper or excess payment made to a provider as the result of patient billing or claims processing errors. There are two forms associated with the Credit Balance Report. Links to both forms can be found at the bottom of this page.

What does "overpaid" mean?

Paid for services planned but not performed or for non-covered services. Overpaid because of errors made in calculating beneficiary deductible and/or coinsurance amounts or. A hospital that bills and is paid for outpatient services included in a beneficiary’s inpatient claim. Please note:

What is the paperwork burden reduction act?

The Paperwork Burden Reduction Act of 1995 was enacted to inform you about why the Government collects information and how it uses the information. In accordance with sections 1815(a) and 1833(e) of the Social Security Act (the Act), the Secretary is authorized to request information from participating providers that is necessary to properly administer the Medicare program. In addition, section 1866(a)(1)(C) of the Act requires participating providers to furnish information about payments made to them, and to refund any monies incorrectly paid. In accordance with these provisions, all providers participating in the Medicare program are to complete a Medicare Credit Balance Report (CMS-838) to help ensure that monies owed to Medicare are repaid in a timely manner.

What is CMS 838?

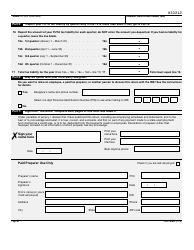

The CMS-838 consists of a certification page and a detail page. An officer (the Chief Financial Officer or Chief Executive Officer) or the Administrator of your facility must sign and date the certification page. Even if no Medicare credit balances are shown in your records for the reporting quarter, you must still have the form signed and submitted to your FI in attestation of this fact. Only a signed certification page needs to be submitted if your facility has no Medicare credit balances as of the last day of the reporting quarter. An electronic file (or hard copy) of the certification page is available from your FI.

Do I need to submit a CMS-838?

Providers with extremely low Medicare utilization do not have to submit a CMS-838. A low utilization provider is defined as a facility that files a low utilization Medicare cost report as specified in PRM-I, section 2414.4.B, or files less than 25 Medicare claims per year.

How long do you have to pay Medicare?

MSP regulations at 42 CFR 489.20(h) require you to pay Medicare within 60 days from the date you receive payment from another payer (prima ry to Medicare) for the same service. Submission of the CMS-838 and adherence to CMS’ instructions do not interfere with this rule. You must repay credit balances resulting from MSP payments within the 60-day period.