When can you sign up for Part D Medicare?

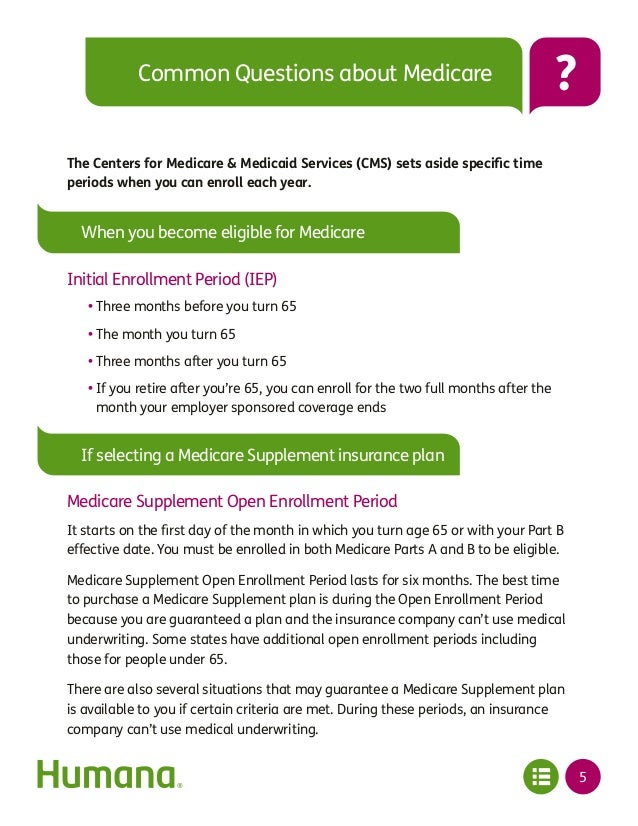

Your Medicare Initial Enrollment Period. For most people, this is the seven-month period that starts 3 months before the month you turn 65, includes the month you turn 65, and continues three months after that. The Annual Election Period (AEP), also called Fall Open Enrollment, October 15 – December 7 every year.

What are the requirements for Medicare Part D?

- Prior to the individual’s initial period of entitlement for Medicare Part D

- Prior to the effective date of the individual’s enrollment in the employer’s prescription drug plan

- Upon any change in the employer’s prescription drug coverage as creditable or non-creditable

- Annually, on or before October 15 of each year

- Upon an individual’s request.

How and when you should enroll in Medicare?

Sign up for Parts A and B of Medicare

- I’m already receiving Social Security retirement benefits. ...

- I’m signing up during my initial enrollment period , the three months before to the three months after the month you turn 65. ...

- I’m signing up during a special enrollment period , a time you can enroll in Medicare outside the initial enrollment period when certain conditions are met. ...

How do you sign up for Medicare Part D?

- Initial enrollment period: during the 7 months when first becoming eligible.

- Annual open enrollment season: every October 15th through December 7th.

- Medicare Advantage Disenrollment period: from January 1st through February 14th, if you have an MAPD plan you can drop it and get a stand-alone Part D policy, also returning you ...

Do I need to re enroll in Medicare Part D every year?

Do I have to reenroll in my Medicare Part D prescription drug plan every year? En español | No. If you like your current Part D drug plan, you can keep it without doing anything additional. You don't have to reenroll or inform the plan that you're staying.

Does my Medicare Part D plan automatically renew?

Like Medicare Advantage, your Medicare Part D (prescription drug) plan should automatically renew. Exceptions would be if Medicare does not renew the contract with your insurance company or the company no longer offers the plan.

How often can Medicare Part D be changed?

You can change from one Part D plan to another during the Medicare open enrollment period, which runs from October 15 to December 7 each year. During this period, you can change plans as many times as you want.

Does Medicare Part D expire?

If your Medicare Advantage or Part D plan is ending at the close of the year, it is important to understand how you are affected and actions you should take to ensure you have needed coverage. If your plan is ending, it should send you a letter in early October explaining that it will no longer be available next year.

How often do you have to reapply for Medicare?

annuallyYou will be automatically re-enrolled in your Medicare Advantage plan annually – unless the company that provides your plan stops offering it. Then you'll get a chance to buy a different one during the annual Open Enrollment Period from October 15 to December 7.

Do I need to cancel my old Part D plan?

You don't need to cancel your old Medicare drug plan. Your old Medicare drug plan coverage will end when your new drug plan begins.

What is the enrollment period for Part D?

7 monthsEnrollment Periods This period is from October 15 through December 7 each year. Coverage begins the following January 1. For people who are new to Medicare, the Initial Enrollment Period (IEP) for Part D is 7 months long.

Is GoodRx better than Medicare Part D?

GoodRx can also help you save on over-the-counter medications and vaccines. GoodRx prices are lower than your Medicare copay. In some cases — but not all — GoodRx may offer a cheaper price than what you'd pay under Medicare. You won't reach your annual deductible.

What is the main problem with Medicare Part D?

The real problem with Medicare Part D plans is that they weren't set up with the intent of benefiting seniors. They were set up to benefit: –Pharmacies, by having copays for generic medications that are often far more than the actual cost of most of the medications.

Why was my Medicare Part D Cancelled?

Why was my Medicare plan coverage cancelled? Your Medicare Part D prescription drug plan (PDP) or Medicare Advantage plan (MA, MAPD, or SNP) coverage can be cancelled because of changes to the Medicare plan or because of something that you have done (or not done).

What are the 4 phases of Part D coverage?

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.

What drugs are not covered by Medicare Part D?

Medicare does not cover:Drugs used to treat anorexia, weight loss, or weight gain. ... Fertility drugs.Drugs used for cosmetic purposes or hair growth. ... Drugs that are only for the relief of cold or cough symptoms.Drugs used to treat erectile dysfunction.More items...

How long does it take to enroll in Part D?

This includes three months prior to your 65th birthday, the month of your birthday and then three months after your 65th birthday. Failing to enroll within this time period, also known as the initial enrollment period, means that you may face a late enrollment penalty if you choose to add Part D coverage at a later date.

Why is Medicare important?

Enrolling in Medicare is an important step for many people in protecting their health and their finances as they age. The Medicare program assists millions of seniors and certain individuals with qualifying disabilities, and without Medicare, some Americans would struggle to afford the cost of healthcare and related expenses.

Medicare Part D: The Basics

Medicare eligibility begins at 65. Most older adults approaching 65 feel overwhelmed when it comes to signing up for Medicare coverage. Learning about enrollment periods, the parts of Medicare, and plan options can be stressful.

What is Medicare Part D?

Before we discuss when to enroll in Medicare Part D, it’s important to first understand what Medicare Part D is. Medicare Part D is the part of Medicare that helps Medicare beneficiaries pay for some or all of their prescription drug costs. Part D plans are offered by private insurance companies as stand-alone prescription drug plans.

Who can Enroll in Medicare Part D?

A Medicare Part D plan is available to anyone who is eligible for Medicare. However, you must be enrolled in Original Medicare (Part A and Part B) or a Medicare Advantage plan to enroll in a Part D prescription drug plan. It is important to note, enrolling in Original Medicare does not automatically enroll you in a prescription drug plan.

Medicare Part D Enrollment Periods

There are a few specific enrollment periods to be aware of when signing up for a Medicare Part D plan:

How to Enroll in Medicare Part D

Enrolling in Medicare Part D is simple. However, before you begin the enrollment process it’s important to shop and compare plans to ensure you receive the right coverage for your needs. Here are some questions to consider before enrolling in a Part D plan

Appealing a Late Enrollment Penalty

Medicare Part D enrollees have the right to appeal a decision they believe to be wrong about a late enrollment penalty. Common reasons individuals appeal a decision include

Medicare Part D Enrollment FAQs

Should I enroll in Medicare Part D if I don’t currently take any medications?

How long is the Medicare enrollment period?

General enrollment period (GEP) The GEP lasts for 3 months, from January 31 to March 31 each year. During this period, a person can enroll in original Medicare if they did not do so during their IEP. A person can also make changes to Medicare Advantage plans during the GEP.

When is the open enrollment period for Medicare?

Open enrollment period (OEP) The OEP, also known as the annual enrollment period (AEP), lasts from October 15 to December 7 each year , and a person can make changes to original Medicare, Advantage, and Medicare Part D prescription plans.

What is a SEP period?

Special enrollment periods. SEPs are periods during which Medicare allows a person to make changes to Medicare plans depending on certain circumstances. This online tool may help a person check if they meet the criteria for a SEP. Learn how to enroll for Medicare here.

How long can you go without a prescription?

If a person goes more than 63 days in a row without creditable drug coverage, they may be subject to a Medicare late enrollment penalty. The late enrollment penalty is not a one-time cost. Instead, a person pays the penalty as long as they continue with their Medicare-based prescription drug coverage.

How much does Medicare increase if you don't sign up for Medicare?

Failing to enroll in Medicare Part B when a person is first eligible can increase a person’s monthly payment by 10% for each 12-month period they did not sign up. A person is subject to this increase in premium for the entire time they have Medicare Part B.

When does Medicare open enrollment go into effect?

A person can make these changes during the Medicare open enrollment period (OEP), which is from October 15 to December 7. When a person selects a new plan, it will go into effect on January 1 of the following year. Learn more about choosing a Medicare Advantage plan here.

How long does a person have to pay the 10% premium?

For example, if a person delayed signing up for Medicare Part A for 2 years, they would pay the 10% premium for 4 years.

How many enrollment periods are there for Medicare Part D?

There are three different enrollment periods for Medicare Part D. Each one is unique to you, the beneficiary. It’s important to understand these enrollment periods to avoid late penalties that will stay with you forever.

What is a special enrollment period?

Life happens for everyone; Special Enrollment Periods are for when certain situations or events happen in life. SEPs give you chances to make changes to your Part D plan or Medicare Advantage plan.

When does IEP end?

Everyone’s Initial Enrollment Period is different, it’s specific to your 65th birthday month. Your IEP starts 3 months before your 65th birthday and ends 3 months after your birthday month.

When is the AEP period?

Each fall the Annual Election Period runs from October 15th through December 7th. AEP is commonly mistaken for the Open Enrollment Period.

Key Takeaways

Do you have to re-enroll in Medicare every year? Original Medicare coverage automatically renews every year so you don’t have to re-enroll.

Medicare Renewal Periods

Do I have to re-enroll in Medicare every year? In most cases, Medicare re-enrollment is automatic so you only have to enroll in Medicare once.

Will I Get an Annual Notice of Change?

When you’re enrolled in a Medicare Advantage plan or a Medicare Part D plan, you’ll get an Annual Notice of Change (ANOC) every September. This letter details any new changes to your Medicare plan. You’ll have time to review the changes and make sure this is still the right plan for your healthcare needs.

Do I Have to Do Anything During Medicare Open Enrollment?

If you’re happy with your current Medicare coverage, you don’t need to do anything during the Annual Enrollment Period, also referred to as the Medicare Open Enrollment Period. Your plan will automatically renew, and your coverage will continue.

Does Your Medicare Card Expire?

Your Medicare plan automatically renews each year, and so does your Medicare card. You’ll get an Original Medicare card in the mail when you first enroll. And you’ll receive a Medicare Advantage plan card or a Part D card when you first enroll. As long as you’re enrolled in Medicare and pay your monthly premiums, these Medicare cards do not expire.

What happens if Medicare pays late enrollment?

If Medicare’s contractor decides that your late enrollment penalty is correct, the Medicare contractor will send you a letter explaining the decision, and you must pay the penalty.

What is the late enrollment penalty for Medicare?

Part D late enrollment penalty. The late enrollment penalty is an amount that's permanently added to your Medicare drug coverage (Part D) premium. You may owe a late enrollment penalty if at any time after your Initial Enrollment Period is over, there's a period of 63 or more days in a row when you don't have Medicare drug coverage or other.

What happens if Medicare decides the penalty is wrong?

What happens if Medicare's contractor decides the penalty is wrong? If Medicare’s contractor decides that all or part of your late enrollment penalty is wrong, the Medicare contractor will send you and your drug plan a letter explaining its decision. Your Medicare drug plan will remove or reduce your late enrollment penalty. ...

How long do you have to pay late enrollment penalty?

You must do this within 60 days from the date on the letter telling you that you owe a late enrollment penalty. Also send any proof that supports your case, like a copy of your notice of creditable prescription drug coverage from an employer or union plan.

How long does it take for Medicare to reconsider?

In general, Medicare’s contractor makes reconsideration decisions within 90 days. The contractor will try to make a decision as quickly as possible. However, you may request an extension. Or, for good cause, Medicare’s contractor may take an additional 14 days to resolve your case.

Do you have to pay a penalty on Medicare?

After you join a Medicare drug plan, the plan will tell you if you owe a penalty and what your premium will be. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

Does Medicare pay late enrollment penalties?

, you don't pay the late enrollment penalty.

How long do you have to enroll in Medicare Part D?

From the AEP start date (October 15), you have about eight weeks to enroll in Medicare Part D coverage before the AEP deadline. The coverage you choose during the Medicare Part D Enrollment will be effective the first day of the following year. For example, if you enrolled in a Part D drug plan by December 7, 2020, ...

How long does Medicare Part D last?

Your IEP lasts for seven months and:¹. Begins three months before , and ends three months after, you turn 65, or.

What happens if you don't get Medicare Part D?

If you didn’t get Part D during your IEP, you get another chance to do so during the Medicare Part D Open Enrollment. However, you might pay the Part D late enrollment penalty (an extra amount added to your Part D premium) if:². You went more than 63 days past your IEP without having other credible drug coverage.

When is it important to review Medicare Part D?

It’s important to review your Part D options annually during Medicare Open Enrollment. The cost, pharmacy network, and drug formulary for Medicare Part D plans can vary from plan to plan year to year.

When does Medicare open enrollment end?

Begins three months before, and ends three months after, your 25th month of getting Social Security or Railroad Retirement Board (RRB) disability benefits. If you didn’t get Part D during your IEP, you get another chance to do so during the Medicare Part D Open Enrollment.

Do I have to have Medicare Part A or Part B to enroll in Medicare?

To be eligible for enrollment in a Part D Medicare plan during the fall Medicare Open Enrollment Period or other election period, you must live in an area where plans are available; if you want to join a standalone prescription drug plan (PDP), you must have Medicare Part A and/or Part B. However, if you want to get drug benefits ...

Can you switch from Medicare to MAPD?

Whether you’re switching from Original Medicare or from a standalone drug plan to an MAPD, making the switch not only allows you to get drug benefits but access to other health benefits such as dental, vision, hearing, and wellness coverage.