Table 1. Medicare Advantage Enrollment and Penetration Rate, by State, 2016-2017

| State | 2016 Total Enrollment | 2017 Total Enrollment | Change in Total Enrollment, 2016-2017 | Percent Change in Enrollment, 2016-2017 |

| Total U.S. | 17,625,200 | 18,973,154 | 1,347,954 | 8% |

| Alabama | 257,218 | 358,325 | 101,107 | 39% |

| Alaska | 93 | 655 | 562 | 604% |

Full Answer

When to choose Original Medicare vs. Medicare Advantage?

You may want to choose between Original Medicare and Medicare Advantage for financial reasons, but you may also want to consider access to certain healthcare services. The important thing is to understand the differences between each type of Medicare before you commit yourself to a plan for the coming year.

How to join a Medicare Advantage plan?

When can I enroll in a Part C plan?

- Initial Enrollment Period (IEP)

- Annual Enrollment Period (AEP)

- Special Enrollment Period (SEP)

What is Medicare Advantage plan?

Everything you need to know about Medicare Advantage. Medicare Advantage is a managed health care plan that acts as an alternative to original Medicare. Medicare is offered to people aged 65 or older who have met the working credit requirements by paying into the Medicare system through payroll deductions.

Is Medicare a Medicare Advantage?

There are several parts to original Medicare, as well as a combined option called Medicare Advantage, or Medicare Part C. When a person approaches the age at which they can sign up for Medicare, they may need to look into which plan will suit them and their needs best.

What is the Medicare Advantage initial enrollment period?

Initial Enrollment Period (IEP): Seven-month period, including the three months before, the month of, and the three months after the month you first become eligible for Medicare (either your 65th birth month or the 25th month you have collected disability benefits).

Do you have to reapply for Medicare Advantage every year?

In general, once you're enrolled in Medicare, you don't need to take action to renew your coverage every year. This is true whether you are in Original Medicare, a Medicare Advantage plan, or a Medicare prescription drug plan.

What is the timeframe for the Medicare annual enrollment period AEP )?

AEP runs from October 15th to December 7th every year, and it allows Medicare beneficiaries to make changes to their plan, switch plans, or disenroll from a plan.

Can you add Medicare Advantage plans at any time?

If you're covered by both Medicare and Medicaid, you can switch plans at any time during the year. This applies to Medicare Advantage as well as Medicare Part D.

Do Medicare Advantage plans automatically renew each year?

Medicare Advantage. Your Medicare Advantage, or Medicare Part C, plan will automatically renew unless Medicare cancels its contract with the plan or your insurance company decides not to offer the plan you're currently enrolled in.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Is there a trial period for Medicare Advantage plans?

Medicare allows you to try Medicare Advantage without losing your access to Medigap. This is known as the Medicare Advantage trial period, or the Medicare “right to try.” During this time, you can buy a Medicare Advantage plan and keep it for up to 1 year.

What is the difference between AEP and OEP?

AEP stands for Medicare Annual Enrollment Period and OEP stands for Medicare Open Enrollment Period. Depending on the context, OEP can refer to many other Medicare enrollment windows.

Which of the following is a qualifying life event for a Medicare Advantage Special Enrollment Period?

You qualify for a Special Enrollment Period if you've had certain life events, including losing health coverage, moving, getting married, having a baby, or adopting a child, or if your household income is below a certain amount.

When can I switch to Medicare Advantage?

You can switch your Medicare Advantage plan at any time during your initial enrollment period. If you qualify for Medicare based on your age, then your initial enrollment begins 3 months before the month of your 65th birthday, includes your birth month, and continues for 3 months afterward.

Can you switch from Medicare supplement to advantage?

If you currently have Medicare, you can switch to Medicare Advantage (Part C) from Original Medicare (Parts A & B), or vice versa, during the Medicare Annual Enrollment Period. If you want to make a switch though, it may also require some additional decisions.

Can you switch back to traditional Medicare from Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Where are Medicare Advantage plans offered?

The number of firms offering Medicare Advantage plans will be highest in the New York City area (Bronx, Kings, Queens, and New York Counties), Los Angeles County, and Orange County, California, where 15 or more firms will be offering Medicare Advantage plans.

How many Medicare beneficiaries were in 2016?

Just under 3 percent of all Medicare Advantage enrollees in 2016, 414,710 beneficiaries, will need to choose a new plan in 2017 because their plan exited.

How many HMOs are there in 2017?

Since 2010, the number of HMOs has increased each year, with 36 more HMOs in 2017, while the availability of other plan types has either remained similar or decline. Since 2012, the number of plans available to Medicare beneficiaries has been relatively stable. The average beneficiary will be able to choose from among 19 plans, on average, in 2017, ...

Which companies have the largest footprint in the Medicare Advantage market?

Two firms with the largest footprints in the Medicare Advantage market are United Healthcare and Humana. In 2017, 74 percent of Medicare beneficiaries will have a United Health plan available to them for individual enrollment, and 83 percent will have a Humana plan.

Does Medicare Advantage have the same quality rating?

This means that every Medicare Advantage plan covered under the same contract receives the same quality rating, and most contracts cover multiple plans of the same type (e.g. HMO).

Does Medicare Advantage offer prescription drug coverage?

In 2017, the vast majority (88%) of Medicare Advantage plans will offer prescription drug coverage. Historically, plans without a drug benefit were developed for beneficiaries who may have access to other sources of prescription drug coverage, such as retiree health coverage from former employers or the Veterans Health Administration, as well as those who for any other reason do not want to purchase such coverage.

Do Medicare Advantage plans pay for prescription drugs?

Medicare beneficiaries enrolled in Medicare Advantage plans pay the Part B premium like other beneficiaries (less any rebate provided by the Medicare Advantage plan), and may also pay an additional monthly premium charged by the Medicare Advantage plan for benefits and prescription drug coverage. This analysis of premiums includes only Medicare Advantage plans that offer prescription drug coverage (MA-PDs). The minority of Medicare Advantage plans (12%) that do not cover prescription drugs are not included in the analysis, in order to better compare premiums across plan types and years. The analysis also weights plans by their 2016 enrollment to reflect the impact of premium changes on current enrollees. (Unweighted premiums, which reflect beneficiaries’ plan options, are in Appendix Table A3)

How many people are enrolled in Medicare Advantage 2017?

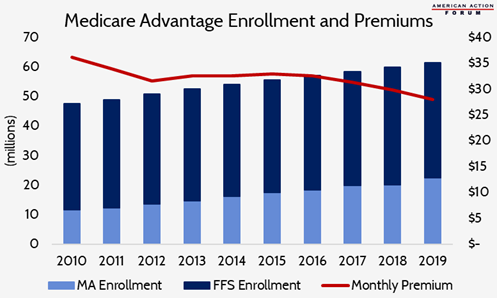

Medicare Advantage 2017 Spotlight: Enrollment Market Update 2. In 2017, one in three (33%) Medicare beneficiaries – 19.0 million people – is enrolled in a Medicare Advantage . plan (Figure 1).

How many states have Medicare Advantage?

In contrast, fewer than 20 percent of . Medicare beneficiaries are enrolled in Medicare Advantage plans in 13 states, plus the District of Columbia.

Which states have the largest Medicare Advantage?

Some states have a much larger than average share of Medicare Advantage enrollees in group plans, including . Alaska (100%), West Virginia (53%), Michigan (49%), Illinois (43%), Kentucky (40%), and New Jersey (36%). Between 2016 and 2017, enrollment in Medicare Advantage group plans grew at least as much as enrollment in .

Medicare Advantage Enrollment, by Firm and Affiliates

- Enrollment by Firm and Affiliates

Medicare Advantage enrollment tends to be highly concentrated among a small number of firms (Figure 6). In 2017, UnitedHealthcare, Humana, and the BCBS affiliates (including Anthem BCBS plans) together account for well over half (57%) of Medicare Advantage enrollment. Eight firms …

Premiums

- Medicare Advantage enrollees are responsible for paying the Part B premium, in addition to any premium charged by the plan. This brief analyzes premiums for Medicare Advantage plans that offer prescription drug benefits (MA-PDs) because the vast majority (89%) of Medicare Advantage enrollees is in MA-PDs and Medicare Advantage enrollees who seek prescription drug benefits a…

Cost Sharing

- Medicare Advantage plans are required to provide all Medicare covered services, and have some flexibility in setting cost-sharing for specific Medicare-covered services. In addition, since 2011 Medicare Advantage plans have been required to limit enrollees’ out-of-pocket expenditures for services covered under Parts A and B – in contrast with traditional Medicare. In 2011, CMS bega…

Star Quality Ratings

- For many years, CMS has posted quality ratings of Medicare Advantage plans to provide beneficiaries with additional information about plans offered in their area. All plans are rated on a 1 to 5-star scale, with 1 star representing poor performance, 3 stars representing average performance, and 5 stars representing excellent performance. CMS assigns quality ratings at th…

Discussion

- Medicare Advantage enrollment has steadily increased both nationally and across states since 2005, with one-third of Medicare beneficiaries enrolled in Medicare Advantage plans in 2017. Enrollment continues to be highly concentrated among a handful of firms, both nationally and in local markets; UnitedHealthcare and Humana together account for 41 percent of enrollment in 2…

Plan Offerings in 2017

Plan Premiums

- Medicare beneficiaries enrolled in Medicare Advantage plans pay the Part B premium like other beneficiaries (less any rebate provided by the Medicare Advantage plan), and may also pay an additional monthly premium charged by the Medicare Advantage plan for benefits and prescription drug coverage. This analysis of premiums includes only Medicare Advantage plans …

Limits on Out-Of-Pocket Spending

- The traditional Medicare program does not include a limit on out-of-pocket spending for services covered under Parts A and B. In contrast, Medicare Advantage plans are required to limit enrollees’ out-of-pocket expenses for services covered under Parts A and B to no more than $6,700, with higher limits allowed for services received from out-of-network providers. Even befo…

Prescription Drug Coverage

- In 2017, the vast majority (88%) of Medicare Advantage plans will offer prescription drug coverage. Historically, plans without a drug benefit were developed for beneficiaries who may have access to other sources of prescription drug coverage, such as retiree health coverage from former employers or the Veterans Health Administration, as well as those who for any other reas…

Quality Ratings

- For many years, the CMS has posted quality ratings of Medicare Advantage plans to provide Medicare beneficiaries with additional information about plans offered in their area. All Medicare Advantage plans are rated on a 1 to 5-star scale, with 1 star representing poor performance, 3 stars representing average performance, and 5 stars representing excellent performance. CMS a…

Change in Number and Availability of Plans Offered by Firm

- While many organizations offer Medicare Advantage plans, most plans are owned or affiliated with a small number of companies and organizations. In 2016, 7 firms and affiliates accounted for almost three-quarters of all enrollment: UnitedHealthcare, Humana, Blue Cross and Blue Shield (BCBS) affiliated companies (including Anthem BCBS plans), Kaiser Permanente, Aetna, Cigna, a…

How Mergers Could Affect Medicare Advantage Plan Offerings

- Aetna’s proposed merger with Humana has raised concerns about its potential to reduce competition in the Medicare market. Humana is a dominant firm in the Medicare Advantage market and a merger with Aetna would likely increase the dominance of the combined firms, even with some divestment. Even without a merger, Aetna’s footprint in the Medicare Advantage mark…

Discussion

- Plan choices for beneficiaries will be relatively stable between 2016 and 2017, with very little change in the number or type of plans available to beneficiaries or the firms offering those plans. Firms continue to offer diverse products and most beneficiaries have a choice of HMOs and PPOs, while fewer beneficiaries have access to PFFS plans. Most beneficiaries will continue to h…