Will Medicare be around when I retire?

Since Medicare pays first after you retire, your retiree coverage is likely to be similar to coverage under Medicare Supplement Insurance (Medigap). Retiree coverage isn't the same thing as a Medigap policy but, like a Medigap policy, it usually offers benefits that fill in some of Medicare's gaps in coverage—like Coinsurance and deductibles. Sometimes retiree coverage includes extra benefits, like coverage for extra days in the hospital.

What is considered the Medicare end date?

- The stay is less than 8 days within a spell of illness

- The SNF is notified on an untimely basis of, or is unaware of, a Medicare Secondary Payer denial

- The SNF is notified on an untimely basis of a beneficiary’s enrollment in Medicare Part A

- The SNF is notified on an untimely basis of the revocation of a payment ban

When does one become eligible for Medicare?

- You cannot perform the duties of your occupation.

- Social Security determines that you cannot adapt to another occupation due to your disability or condition.

- Your disability will last at least a year (or already has lasted a year) or will result in death.

Are retirement dates required on Medicare claim?

Providers must report collected retirement dates on their Medicare claims using occurrence code 18 for the beneficiary’s retirement date and occurrence code 19 for the spouse’s retirement date.

When can retirees get Medicare?

65When you turn 65, you're eligible to enroll in Medicare Part B. If you do not enroll in Part B when you're first eligible, you may be subject to the federal late enrollment penalty.

Will there be Medicare at 62?

What Are the Age Requirements for Medicare? Medicare is health insurance coverage for people age 65 and older. Most people will not qualify for Medicare at age 62. At age 62, you may meet the requirements for early retirement but have not met the requirements for Medicare coverage.

Do you automatically get Medicare when you retire?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

Can I get Medicare at 63 years of age?

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or transplant).

How much does Medicare cost at age 62?

Reaching age 62 can affect your spouse's Medicare premiums He can still receive Medicare Part A, but he will have to pay a monthly premium for it. In 2020, the Medicare Part A premium can be as high as $458 per month.

Will the Medicare age be raised to 67?

3 The retirement age will remain 66 until 2017, when it will increase in 2-month increments to 67 in 2022. Several proposals have suggested raising both the normal retirement age and the Medicare eligibility age.

Do you automatically get a Medicare card when you turn 65?

You should receive your Medicare card in the mail three months before your 65th birthday. If you are NOT receiving benefits from Social Security or the RRB at least four months before you turn 65, you will need to sign up with Social Security to get Parts A and B.

How soon before I retire should I apply for Medicare Part B?

You should start your Part B coverage as soon as you stop working or lose your current employer coverage (even if you sign up for COBRA or retiree health coverage from your employer). You have 8 months to enroll in Medicare once you stop working OR your employer coverage ends (whichever happens first).

Are you automatically enrolled in Medicare Part A when you turn 65?

If you are approaching age 65 and you already receive Social Security or Railroad Retirement benefits through early retirement, you will be automatically enrolled in Medicare Parts A (hospital insurance) and B (medical insurance) when you turn 65.

How do you qualify for Medicare at age 62?

You can only enroll in Medicare at age 62 if you meet one of these criteria:You have been on Social Security Disability Insurance (SSDI) for at least two years.You are on SSDI because you suffer from amyotrophic lateral sclerosis, also known as ALS or Lou Gehrig's disease. ... You suffer from end-stage renal disease.

Is it better to take Social Security at 62 or 67?

The short answer is yes. Retirees who begin collecting Social Security at 62 instead of at the full retirement age (67 for those born in 1960 or later) can expect their monthly benefits to be 30% lower. So, delaying claiming until 67 will result in a larger monthly check.

How do I retire at 62 with health insurance?

If you retire at 62, you'll need to make sure you can afford health insurance until age 65 when your Medicare benefits begin. 5 (If you have a disability, you can qualify early.) With the Affordable Care Act, you are guaranteed to get coverage even if you have a pre-existing condition.

When do you get Medicare?

Medicare is a public health insurance program that you qualify for when you turn 65 years old. This might be retirement age for some people, but others choose to continue working for many reasons, both financial and personal. In general, you pay for Medicare in taxes during your working years and the federal government picks up a share of the costs.

How long do you have to sign up for Medicare if you have an employer?

Once your (or your spouse’s) employment or insurance coverage ends, you have 8 months to sign up for Medicare if you’ve chosen to delay enrollment.

What is Medicare Supplement?

Medicare Supplement, or Medigap, plans are optional private insurance products that help pay for Medicare costs you would usually pay out of pocket . These plans are optional and there are no penalties for not signing up; however, you will get the best price on these plans if you sign up during the initial enrollment period that runs for 6 months after you turn 65 years old.

Does Medicare cover late enrollment?

Medicare programs can help cover your healthcare needs during your retirement years. None of these programs are mandatory, but opting out can have significant consequences. And even though they’re option, late enrollment can cost you.

Do you have to sign up for Medicare if you are 65?

Medicare is a federal program that helps you pay for healthcare once you reach age 65 or if you have certain health conditions. You don ’t have to sign up when you turn 65 years old if you continue working or have other coverage. Signing up late or not at all might save you money on monthly premiums but could cost more in penalties later.

Do you pay Medicare premiums when you turn 65?

Because you pay for Medicare Part A through taxes during your working years, most people don’t pay a monthly premium. You’re usually automatically enrolled in Part A when you turn 65 years old. If you’re not, it costs nothing to sign up.

Is Medicare mandatory?

While Medicare isn’t necessarily mandatory, it may take some effort to opt out of. You may be able to defer Medicare coverage, but it’s important to if you have a reason that makes you eligible for deferment or if you’ll face a penalty once you do enroll.

What is Medicare 2020?

Summary. When a person retires, part of their retirement plan may include looking at Medicare options and deciding which is best for their needs. Medicare is a federally run and funded health insurance plan that helps provide health care benefits for those aged 65 and older . Everyone aged 65 and older is eligible, ...

How long is the open enrollment period for Medicare?

The Medigap Open Enrollment Period runs for six months, beginning the month a person turns 65 and has enrolled in Medicare Part B. Delayed enrollment may mean an individual is no longer eligible for a Medigap policy.

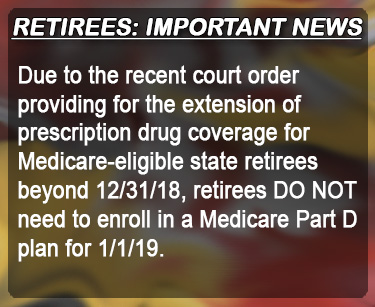

What is Medicare Advantage and Part D?

Medicare Advantage and Part D. Medicare Advantage and Medicare Part D are optional programs. They are available to everyone during their IEP. When a person does not purchase Part D during the IEP, they may have to pay a late enrollment penalty.

How much will Medicare cost in 2021?

premium-free if a person has worked for 40 quarters over their lifetime and paid taxes to Medicare. $471 monthly premium for those not eligible for premium-free. Part A deductible. $1,484.00 for each benefit period.

What is the difference between Medicare Part A and Part B?

Original Medicare are comprised of parts A and B. Part A covers inpatient care and Part B helps pay for outpatient services.

How do I enroll in Medicare?

Enrollment for Medicare is carried out through the Social Security Administration (SSA) and can be done online or in person. Individuals who receive Social Security or Railroad Retirement Board benefits will automatically be enrolled in Medicare.

What are the benefits of Medicare Advantage?

All Medicare Advantage plans must offer the same benefits found in Medicare Parts A and B, but private insurance companies can choose to add extra benefits. These may include coverage for: 1 vision 2 hearing 3 dental treatment

How much is Medicare Part B in 2021?

Unlike premium-free Part A, Medicare Part B requires you to pay a monthly premium for your Part B benefits ($148.50 per month in 2021, though it could potentially be higher based on your income).

What is special enrollment period?

Special Enrollment Periods are times outside of your Medicare Initial Enrollment Period and the Medicare General Enrollment Period during which you can enroll in Medicare or make changes to your Medicare coverage .

How long does it take to enroll in a health plan after separation?

You can apply to the Marketplace with a Special Enrollment Period any time from 60 days before and 60 days after your separation date.

Can I get Medicare Marketplace before I start?

Yes. You can get a Marketplace plan to cover you before your Medicare begins. You can then cancel the Marketplace plan once your Medicare coverage starts. Learn more if you have Marketplace coverage but will soon be eligible for Medicare.

Can I get premium tax credits if I have retiree health insurance?

If you have retiree health benefits. If you have retiree coverage and want to buy a Marketplace plan instead, you can. But: You can’t get premium tax credits and other savings based on your income. This is true only if you’re actually enrolled in retiree coverage.

Can I retire at 65 without health insurance?

If you retire before age 65 without health coverage. If you retire before you’re 65 and lose your job-based health plan when you do, you can use the Health Insurance Marketplace® to buy a plan. Losing health coverage qualifies you for a Special Enrollment Period.

When can I retire from Medicare?

In some cases, a person may have retired before they reached 65 years of age. They may be eligible for Medicare if they have a disability, end stage renal disease, or permanent kidney failure needing dialysis or transplant.

What age can I enroll in Medicare?

A person who has a disability and is under 65 years of age may receive automatic enrollment in original Medicare (Parts A and B) if they fulfill the following conditions:

How long is a SEP for Medicare?

For example, a person or their spouse with insurance cover from a union or group health plan may be eligible for a SEP. The SEP for original Medicare is for 8 months, including the month after the end of a person’s group health plan or a person’s employment.

How long does it take to get a Medicare Welcome Pack?

How to enroll in Medicare. A person who receives automatic enrollment into Medicare will get a “Welcome to Medicare” pack approximately 3 months before coverage begins. In general, a person who gets Railroad Retirement Board or Social Security benefits is automatically enrolled in Medicare.

How many enrollment periods are there for Medicare?

A person may receive automatic enrollment in original Medicare (Part A and Part B), or they may have to enroll during specific periods. The four enrollment periods offer a person the opportunity to take different actions, including signing up for original Medicare (Parts A and B), switching plans, or joining new ones.

What is Medicare insurance?

Medicare is the United States federal government program that provides healthcare coverage to citizens and permanent legal residents of the U.S. A combination of income streams, including Social Security, Medicare taxes, and Medicare premiums, fund the program.

How long do you have to be a resident to receive Social Security?

In addition, a person must be a U.S. citizen or permanent legal resident for at least 5 years and have paid at least 10 years of contributing payments to Social Security benefits.

How long do you have to wait to get Medicare if your spouse is 62?

However, if your spouse is only 62, they will not yet qualify for Medicare and will have to wait an additional three years to be eligible.

What is Medicare Part A?

Medicare Part A is responsible for covering hospital expenses. These can include inpatient hospital stays, overnight stays after a medical procedure when you are formally admitted, inpatient testing and care, hospice care for those at end of life, and skilled nursing facility stays.

Why do people retire early?

Retirement is on the minds of most everybody from the day they start working, and some people have the desire to retire early so that they can spend more time with family, participate in their hobbies more often, travel more, or just relax and enjoy their time off after a long career.