Full Answer

What is the maximum premium for Medicare Part B?

The standard monthly premium for Part B, which covers outpatient care and durable equipment ... or offers a different copay and an out-of-pocket maximum (a Medicare Advantage Plan). The Aduhelm situation highlights the ripple effect that expensive drugs ...

What determines your Medicare Part B premium?

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employer’s pension plan.

How to calculate your Medicare Part B premium?

The standard monthly premium for Part B is $148.50 for 2021. The total Medicare cost is what you get out of Medicare. Simply add up the Original Medicare (Part A and B) costs and the other benefits you get.

Does Medicaid pay for Part B premium?

Does Medicaid pay for Medicare premiums? Medicaid pays Part A (if any) and Part B premiums. Medicaid pays Medicare deductibles, coinsurance, and copayments for services furnished by Medicare providers for Medicare-covered items and services (even if the Medicaid State Plan payment does not fully pay these charges, the QMB is not liable for them).

Is Medicare Part B monthly or quarterly?

Part B premiums You pay a premium each month for Part B. Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board.

Are Medicare Part B premiums paid quarterly?

If your income exceeds a certain amount, you'll receive a monthly bill for your Part D income-related monthly adjustment amount (IRMAA) surcharge. If you have only Part B, the bill for your Part B premium will be sent quarterly and will include the cost of 3 months' worth of premiums.

Will Medicare send me a bill for Part B?

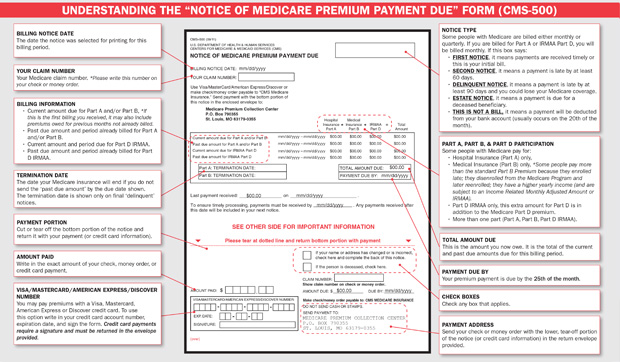

If you have Medicare Part B but you are not receiving Social Security or Railroad Retirement Board benefits yet, you will get a bill called a “Notice of Medicare Premium Payment Due” (CMS-500). You will need to make arrangements to pay this bill every month.

How are Medicare Part B premiums paid?

Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. premium deducted automatically from their Social Security benefit payment (or Railroad Retirement Board benefit payment).

What is the Part B premium for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

How often is Medicare Part B billed?

every 3 monthsMedicare will issue Part A bills monthly and Part B bills every 3 months. There are several ways to pay the premiums, including: through the Medicare account. online through a bank's bill payment service.

Is Medicare Part B automatically deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Why is my Medicare bill for 5 months?

You have been charged for 5 months of Medicare Part B premiums because you are not receiving a Social Security check to have your Medicare premiums deducted.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

Are Medicare Part B premiums going up in 2021?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.

Can I see my Medicare premium bill online?

You can use your online MyMedicare account to view your Medicare premium bills, check your payment history and set up Medicare Easy Pay for auto payments.

Are Medicare premiums tax deductible in 2021?

Yes, your monthly Medicare Part B premiums are tax-deductible. Insurance premiums are among the many items that qualify for the medical expense deduction. Since it's not mandatory to enroll in Part B, you can be “rewarded” with a tax break for choosing to pay this medical expense.

How much is Medicare Part B 2021?

The standard Part B premium for 2021 is $148.50 to $504.90 per month depending on your income. However, some people may pay less than this amount because of the “hold harmless” rule. The rule states that the Part B premium may not increase more than the Social Security Cost of Living Adjustment (COLA) increase in any given year. In short, this provision prevents your Social Security checks from declining year-over-year and caps Medicare Part B premium increases to be no more than the amount of your COLA.2

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What happens if you don't receive Medicare?

In this case, Medicare will send you a bill for Part B coverage called the Medicare Premium Bill. Read this article for five ways to pay your Part B premium payments.

Does Medicare Part B premium change?

You probably know that your Medicare Part B premium can change each year. Do you know why? Or how the amount is calculated? Or why it may increase?

Do you get Social Security if you are new to Medicare?

You are new to Medicare. You don’t get Social Security benefits. You pay higher premiums due to having a higher income. Additionally, people with higher incomes may pay more than the standard Part B premium amount due to an “income-related monthly adjustment.”.

Does Medicare Part B increase?

In short, this provision prevents your Social Security checks from declining year-over-year and caps Medicare Part B premium increases to be no more than the amount of your COLA.2. For people who are not “held harmless” the Part B premiums can increase as much as necessary until the standard rate is reached for the given year.

How Do I Pay My Medicare Part B Premium?

If you receive benefits from Social Security, Railroad Retirement Board, or the Office of Personnel Management, then your premium for Part B is automatically deducted before benefits are deposited .

How much is Medicare Part B 2021?

What is the Medicare Part B Premium for 2021. The standard Part B premium amount is $148.50 for 2021. For those who fall in a higher income bracket, you could pay as much as $504.90 a month for Part B. Below, we’ll go over the standard Part B premium, the premium surcharge, how to pay your premium, and how to get help paying ...

Does Everyone Pay the Same for Medicare Part B?

No, each beneficiary will have a Part B premium that’s based on their income. As long as you make less than $88,000 as an individual and less than $176,000 as a couple, you’ll pay the standard premium.

Do You Pay the Part B Premium with Medicare Advantage?

You must still pay your Part B premium, even when you enroll in a Medicare Advantage plan. When you see “zero-premium Medicare Advantage” plans, you’re still responsible for the monthly premium.

Who Qualifies for Free Medicare Part B?

Nobody qualifies for free Medicare Part B. The only part of Medicare that is free is Part A as long as you paid into it enough quarters.

What If Your Medicare Premium is Late?

Medicare will send you a second bill to remind you to pay the premium. If you avoid paying the premium by the due date of the second bill, a delinquent bill will be sent out. If you avoid paying the delinquent bill, you’ll lose Medicare coverage.

Where to send Medicare payment?

You can do this by simply sending the payment to Medicare Premium Collection Center. PO Box 790355. St.Louis, MO 63179-0355