Medicare is always the primary payer when you have both Medicare and Medicaid coverage. Medicaid will then act as a secondary payer. Medicaid coverage depends on your state, but most state plans will cover the majority of your out-of-pocket costs.

Full Answer

What does it mean when Medicare is a secondary payer?

Sep 13, 2021 · When you’re dual eligible for both Medicare and Medicaid, Medicare is your primary payer. Medicaid will not pay until Medicare pays first. Medicaid will not pay until Medicare pays first. If you’re dual-eligible and need assistance covering the costs of Part B and Part D, you could qualify for a Medicare Savings Program to assist you with these costs.

Who pays first with Medicare?

Medicare works with your other insurance and who pays your bills first . Each type of coverage is called a “payer .” When there’s more than one payer, “coordination of benefits” rules decide who pays first . The “primary payer” pays what it owes on your

Is Medicare always your primary insurance?

If you are over 65 and don’t have Medicare due to ESRD (End-Stage Renal Disease), then Medicare will be your primary payer. However, if you have ESRD and have both a COBRA plan and Medicare, then Medicare will be your secondary payer and your COBRA plan will pay first.

How to determine when Medicare is primary?

Oct 27, 2021 · If you have more than one health insurance plan, coordination of benefits determines which is the primary payer and which is secondary: The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover.

Is Medicare always the primary payer?

), Medicare pays first. If you have Medicare due to ESRD, COBRA pays first and Medicare pays second during a coordination period that lasts up to 30 months after you're first eligible for Medicare. After the coordination period ends, Medicare pays first.

In what situations is Medicare always the primary payer?

Medicare is always primary if it's your only form of coverage. When you introduce another form of coverage into the picture, there's predetermined coordination of benefits. The coordination of benefits will determine what form of coverage is primary and what form of coverage is secondary.

How do you know if Medicare is primary or secondary?

Medicare pays first and your group health plan (retiree) coverage pays second . If the employer has 100 or more employees, then the large group health plan pays first, and Medicare pays second .

How do you determine which insurance is primary?

Primary insurance is a health insurance plan that covers a person as an employee, subscriber, or member. Primary insurance is billed first when you receive health care. For example, health insurance you receive through your employer is typically your primary insurance.Oct 8, 2019

Does Medicare become primary at 65?

Medicare is primary when your employer has less than 20 employees. Medicare will pay first and then your group insurance will pay second. If this is your situation, it's important to enroll in both parts of Original Medicare when you are first eligible for coverage at age 65.Mar 1, 2020

Can you have Medicare and Humana at the same time?

Depending on where you live, you may be able to find a Medicare plan from Humana that suits your needs. Unlike Original Medicare (Part A and Part B), which is a federal fee-for-service health insurance program, Humana is a private insurance company that contracts with Medicare to offer benefits to plan members.

Does Medicare automatically forward claims to secondary insurance?

Medicare will send the secondary claims automatically if the secondary insurance information is on the claim. As of now, we have to submit to primary and once the payments are received than we submit the secondary.Aug 19, 2013

Are Medicare Advantage plans primary or secondary?

Even if you have a group health plan, Medicare is the primary insurer as long as you've been eligible for Medicare for 30 months or more.

Does Medicare cover copay as secondary?

Medicare will normally act as a primary payer and cover most of your costs once you're enrolled in benefits. Your other health insurance plan will then act as a secondary payer and cover any remaining costs, such as coinsurance or copayments.

When two insurance which one is primary?

If you have two plans, your primary insurance is your main insurance. Except for company retirees on Medicare, the health insurance you receive through your employer is typically considered your primary health insurance plan.

Can you have 2 primary insurances?

Yes, you can have two health insurance plans. Having two health insurance plans is perfectly legal, and many people have multiple health insurance policies under certain circumstances.Jan 21, 2022

What insurance is primary or secondary?

Primary health insurance is the plan that kicks in first, paying the claim as if it were the only source of health coverage. Then the secondary insurance plan picks up some or all of the cost left over after the primary plan has paid the claim.Aug 17, 2018

If you don't want to find yourself paying out-of-pocket, you need to know when Medicare is considered primary or secondary payer

If you have more than one insurance plan at a time, one of these plans will function as the primary payer, and one as the secondary. This can become very complicated, and in some situations one plan that was primary before will now be secondary.

What Is Benefits Coordination?

In general, the process of figuring out which plan is the primary plan and which functions as the secondary payer is known as coordination of benefits. Insurers have to coordinate benefits to find out who pays for what.

The Benefits Coordination & Recovery Center (BCRC): Your Go-To Resource

The Benefits Coordination & Recovery Center, or BCRC, is a dedicated contractor that works for Medicare to determine who pays first. Basically, it is a specialized unit that is entirely devoted to benefits coordination. If you have questions about coordination, you should call the BCRC, not Medicare.

If You Have a Group Health Plan (GHP)

If you have an employer group health plan, then it will usually pay first. This is assuming that the health insurance is provided by your or your family member's current employment. Even if so, then Medicare will pay second if your employer has more than 20 employees.

If You Have TRICARE

If you have Tricare and aren’t on active duty, Medicare will pay first unless your care is done in a military hospital, in which case TRICARE will pay. If you are an active duty member, then TRICARE will pay first.

If You Have Medicaid

If you’re receiving services that are covered by Medicare, then Medicaid will never pay first. Medicaid coordination tends to be easier to understand, because Medicaid will always pay last if the other payers cover the services in question.

If You Have a COBRA Plan

If you have a COBRA plan, Medicare will pay first under some circumstances. If you are over 65 and don’t have Medicare due to ESRD (End-Stage Renal Disease), then Medicare will be your primary payer. However, if you have ESRD and have both a COBRA plan and Medicare, then Medicare will be your secondary payer and your COBRA plan will pay first.

What Is Coordination of Benefits?

When you have more than one form of health insurance, each insurance plan is known as a payer. When a beneficiary has more than one payer, they work together through rules known as coordination of benefits. The rules state which plan pays first.

What Are a Primary Payer and Secondary Payer?

If you have more than one health insurance plan, coordination of benefits determines which is the primary payer and which is secondary:

When Is Medicare the Primary Payer?

Determining if Medicare is the primary payer depends on several things. Below are many, but not all, of the circumstances that may require coordination of benefits with Medicare.

How Does Medicare Know You Have Other Coverage?

Medicare doesn’t automatically know if you have other coverage. However, insurers must report to Medicare when they’re responsible for paying first on your medical claims.

What is the difference between Medicare and Medicaid?

Eligible for Medicare. Medicare. Medicaid ( payer of last resort) 1 Liability insurance only pays on liability-related medical claims. 2 VA benefits and Medicare do not work together. Medicare does not pay for any care provided at a VA facility, and VA benefits typically do not work outside VA facilities.

Is Medicare a secondary insurance?

When you have Medicare and another type of insurance, Medicare is either your primary or secondary insurer. Use the table below to learn how Medicare coordinates with other insurances. Go Back. Type of Insurance. Conditions.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).

What is primary payer?

A primary payer is the insurer that pays a healthcare bill first. A secondary payer covers remaining costs, such as coinsurances or copayments. When you become eligible for Medicare, you can still use other insurance plans to lower your costs and get access to more services. Medicare will normally act as a primary payer and cover most ...

How does Medicare work with employer sponsored plans?

Medicare is generally the secondary payer if your employer has 20 or more employees . When you work for a company with fewer than 20 employees, Medicare will be the primary payer.

How does Medicare and Tricare work together?

Medicare and TRICARE work together in a unique way to cover a broad range of services. The primary and secondary payer for services can change depending on the services you receive and where you receive them. For example: TRICARE will pay for services you receive from a Veteran’s Administration (VA) hospital.

How much does Medicare Part B cover?

If your primary payer was Medicare, Medicare Part B would pay 80 percent of the cost and cover $80. Normally, you’d be responsible for the remaining $20. If you have a secondary payer, they’d pay the $20 instead. In some cases, the secondary payer might not pay all the remaining cost.

What is the standard Medicare premium for 2021?

In 2021, the standard premium is $148.50. However, even with this added cost, many people find their overall costs are lower, since their out-of-pocket costs are covered by the secondary payer. Secondary payers are also useful if you have a long hospital or nursing facility stay.

Does Medicare pay for worker's compensation?

That’s because worker’s compensation is an agreement that your employer will pay medical costs if you’re hurt at work. In return, you agree not to sue them for damages. Since your employer has agreed to pay, Medicare will not pay until the benefit amount of your worker’s compensation is completely spent.

Does Medicare cover other insurance?

Medicare can work with other insurance plans to cover your healthcare needs. When you use Medicare and another insurance plan together, each insurance covers part of the cost of your service. The insurance that pays first is called the primary payer. The insurance that picks up the remaining cost is the secondary payer.

What is Medicare Secondary Payer?

Medicare Secondary Payer (MSP) is the term generally used when the Medicare program does not have primary payment responsibility - that is, when another entity has the responsibility for paying before Medicare. When Medicare began in 1966, it was the primary payer for all claims except for those covered by Workers' Compensation, ...

When did Medicare start?

When Medicare began in 1966 , it was the primary payer for all claims except for those covered by Workers' Compensation, Federal Black Lung benefits, and Veteran’s Administration (VA) benefits.

Why is Medicare conditional?

Medicare makes this conditional payment so that the beneficiary won’t have to use his own money to pay the bill. The payment is “conditional” because it must be repaid to Medicare when a settlement, judgment, award or other payment is made. Federal law takes precedence over state laws and private contracts.

How long does ESRD last on Medicare?

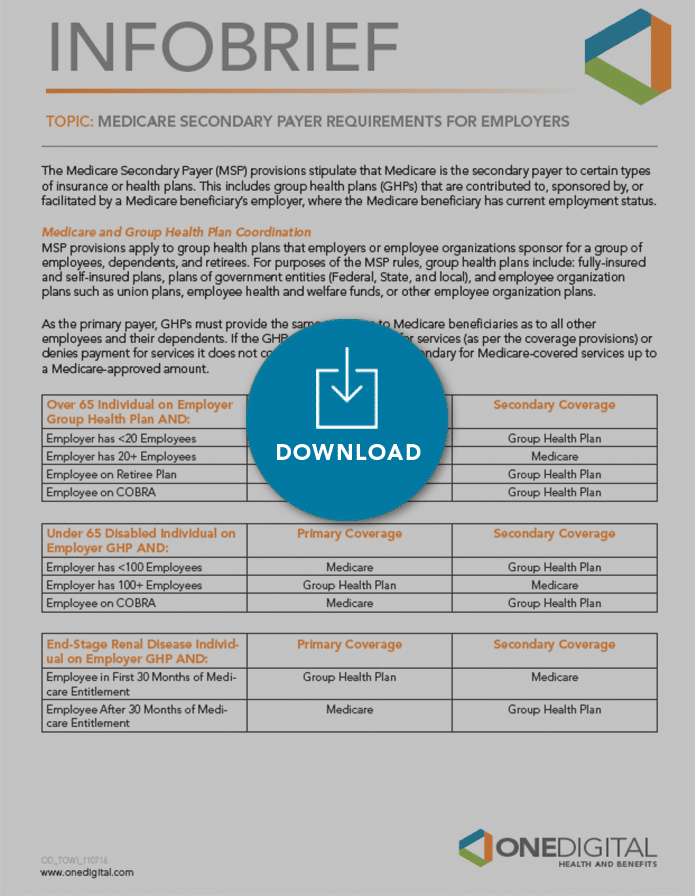

Individual has ESRD, is covered by a GHP and is in the first 30 months of eligibility or entitlement to Medicare. GHP pays Primary, Medicare pays secondary during 30-month coordination period for ESRD.

What are the responsibilities of an employer under MSP?

As an employer, you must: Ensure that your plans identify those individuals to whom the MSP requirement applies; Ensure that your plans provide for proper primary payments whereby law Medicare is the secondary payer; and.

What is the purpose of MSP?

The MSP provisions have protected Medicare Trust Funds by ensuring that Medicare does not pay for items and services that certain health insurance or coverage is primarily responsible for paying. The MSP provisions apply to situations when Medicare is not the beneficiary’s primary health insurance coverage.

What age does GHP pay?

Individual is age 65 or older, is covered by a GHP through current employment or spouse’s current employment AND the employer has 20 or more employees (or at least one employer is a multi-employer group that employs 20 or more individuals): GHP pays Primary, Medicare pays secondary. Individual is age 65 or older, ...