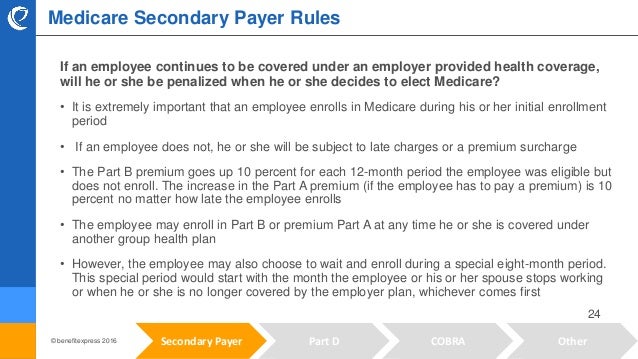

Medicare may be the secondary payer when:

- a person has a GHP through their own or a spouse’s employment, and the employer has more than 20 employees

- a person is disabled and covered by a GHP through an employer with more than 100 employees

- an individual has ESRD, is protected by COBRA, and is within the first 30 months of Medicare eligibility

How does Medicare work when it is a secondary insurance?

Jun 30, 2020 · Medicare Secondary Payer (MSP) is the term generally used when the Medicare program does not have primary payment responsibility - that is, when another entity has the responsibility for paying before Medicare.

When Medicare is secondary how does it pay?

Medicare Secondary Payer (MSP) is a term used when Medicare is not responsible for paying first on a healthcare claim. The decision as to who is responsible for paying first on a claim and who pays second is known in the insurance industry as “coordination of benefits.”

How to deal with Medicare as a secondary insurance?

The Medicare Secondary Payer (MSP) provisions protect the Medicare Trust Fund from making payments when another entity has the responsibility of paying first. Any entity providing items and services to Medicare patients must determine if Medicare is the primary payer.

How to bill Medicaid as secondary insurance?

Mar 11, 2020 · Medicare is the secondary payer if the recipient is: Over the age of 65 and covered by an employment-related group health plan as a current employee or the spouse of a current employee in an organization with more than 20 employees.

Can Medicare be a secondary payer?

You can still get Medicare if you're insured by a private company, but there are some occasions when Medicare becomes the secondary payer for your benefits. Being a “secondary payer” means that Medicare is second-in-line to paying your healthcare claims.Jan 6, 2022

Is Medicare always the primary payer?

If you don't have any other insurance, Medicare will always be your primary insurance. In most cases, when you have multiple forms of insurance, Medicare will still be your primary insurance.

How do you know if Medicare is primary or secondary?

Medicare pays first and your group health plan (retiree) coverage pays second . If the employer has 100 or more employees, then the large group health plan pays first, and Medicare pays second .

Under which circumstance is Medicare the secondary payer?

If the group health plan doesn't pay all of a bill, the doctor or health care provider should send the bill to Medicare for secondary payment. You may have to pay any costs Medicare or the group health plan doesn't cover. I'm under 65, disabled, retired and I have group health coverage from my former employer.

Does Medicare become primary at 65?

Medicare is primary when your employer has less than 20 employees. Medicare will pay first and then your group insurance will pay second. If this is your situation, it's important to enroll in both parts of Original Medicare when you are first eligible for coverage at age 65.Mar 1, 2020

Does Medicare automatically forward claims to secondary insurance?

Medicare will send the secondary claims automatically if the secondary insurance information is on the claim. As of now, we have to submit to primary and once the payments are received than we submit the secondary.Aug 19, 2013

Will secondary pay if primary denies?

If your primary insurance denies coverage, secondary insurance may or may not pay some part of the cost, depending on the insurance. If you do not have primary insurance, your secondary insurance may make little or no payment for your health care costs.

Can you have Medicare and Humana at the same time?

Depending on where you live, you may be able to find a Medicare plan from Humana that suits your needs. Unlike Original Medicare (Part A and Part B), which is a federal fee-for-service health insurance program, Humana is a private insurance company that contracts with Medicare to offer benefits to plan members.

Can you have Medicare and Medicare Advantage at the same time?

If you join a Medicare Advantage Plan, you'll still have Medicare but you'll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare. You must use the card from your Medicare Advantage Plan to get your Medicare- covered services.

How do I submit a secondary claim to Medicare?

Medicare Secondary Payer (MSP) claims can be submitted electronically to Novitas Solutions via your billing service/clearinghouse, directly through a Secure File Transfer Protocol (SFTP) connection, or via Novitasphere portal's batch claim submission.Sep 9, 2021

What case does Medicare act as secondary?

Medicare may be the secondary payer when: a person has a GHP through their own or a spouse's employment, and the employer has more than 20 employees. a person is disabled and covered by a GHP through an employer with more than 100 employees.Oct 29, 2020

What is ABN in healthcare?

What is a Medicare waiver/Advance Beneficiary Notice (ABN)? An ABN is a written notice from Medicare (standard government form CMS-R-131), given to you before receiving certain items or services, notifying you: Medicare may deny payment for that specific procedure or treatment.

What is Medicare Secondary Payer?

Medicare Secondary Payer (MSP) is the term generally used when the Medicare program does not have primary payment responsibility - that is, when another entity has the responsibility for paying before Medicare. When Medicare began in 1966, it was the primary payer for all claims except for those covered by Workers' Compensation, ...

When did Medicare start?

When Medicare began in 1966 , it was the primary payer for all claims except for those covered by Workers' Compensation, Federal Black Lung benefits, and Veteran’s Administration (VA) benefits.

How long does ESRD last on Medicare?

Individual has ESRD, is covered by a GHP and is in the first 30 months of eligibility or entitlement to Medicare. GHP pays Primary, Medicare pays secondary during 30-month coordination period for ESRD.

What age does GHP pay?

Individual is age 65 or older, is covered by a GHP through current employment or spouse’s current employment AND the employer has 20 or more employees (or at least one employer is a multi-employer group that employs 20 or more individuals): GHP pays Primary, Medicare pays secondary. Individual is age 65 or older, ...

What are the responsibilities of an employer under MSP?

As an employer, you must: Ensure that your plans identify those individuals to whom the MSP requirement applies; Ensure that your plans provide for proper primary payments whereby law Medicare is the secondary payer; and.

Why is Medicare conditional?

Medicare makes this conditional payment so that the beneficiary won’t have to use his own money to pay the bill. The payment is “conditional” because it must be repaid to Medicare when a settlement, judgment, award or other payment is made. Federal law takes precedence over state laws and private contracts.

What is the purpose of MSP?

The MSP provisions have protected Medicare Trust Funds by ensuring that Medicare does not pay for items and services that certain health insurance or coverage is primarily responsible for paying. The MSP provisions apply to situations when Medicare is not the beneficiary’s primary health insurance coverage.

What is secondary payer?

A secondary payer assumes coverage of whatever amount remains after the primary payer has satisfied its portion of the benefit, up to any limit established by the policies of the secondary payer coverage terms.

Who is responsible for making sure their primary payer reimburses Medicare?

Medicare recipients may be responsible for making sure their primary payer reimburses Medicare for that payment. Medicare recipients are also responsible for responding to any claims communications from Medicare in order to ensure their coordination of benefits proceeds seamlessly.

How does Medicare work with insurance carriers?

Generally, a Medicare recipient’s health care providers and health insurance carriers work together to coordinate benefits and coverage rules with Medicare. However, it’s important to understand when Medicare acts as the secondary payer if there are choices made on your part that can change how this coordination happens.

How old do you have to be to be covered by a group health plan?

Over the age of 65 and covered by an employment-related group health plan as a current employee or the spouse of a current employee in an organization that shares a plan with other employers with more than 20 employees between them.

Is Medicare a secondary payer?

Medicare is the secondary payer if the recipient is: Over the age of 65 and covered by an employment-related group health plan as a current employee or the spouse of a current employee in an organization with more than 20 employees.

Does Medicare pay conditional payments?

In any situation where a primary payer does not pay the portion of the claim associated with that coverage, Medicare may make a conditional payment to cover the portion of a claim owed by the primary payer. Medicare recipients may be responsible for making sure their primary payer reimburses Medicare for that payment.

How often do you need to collect MSP information?

Following the initial collection, the MSP information should be verified once every 90 days. If the MSP information collected by the hospital, from the beneficiary or his/her representative and used for billing, is no older than 90 calendar days from the date the service was rendered, then that information may be used to bill Medicare for recurring outpatient services furnished by hospitals. This policy, however, will not be a valid defense to Medicare’s right to recover when a mistaken payment situation is later found to exist.

When a provider receives a reduced no fault payment because of failure to file a proper claim, what is

When a provider receives a reduced no-fault payment because of failure to file a proper claim, (see Chapter 1, §20 for definition), the Medicare secondary payment may not exceed the amount that would have been payable if the no-fault insurer had paid on the basis of a proper claim.

Is GHP primary to Medicare?

Do you have employer group health plan (GHP) coverage through yourself, a spouse, or family member if dually entitled based on Disability and ESRD? If yes, the employer GHP may be primary to Medicare. Continue below.

Can a beneficiary recall his/her retirement date?

During the intake process, when a beneficiary cannot recall his/her precise retirement date as it relates to coverage under a group health plan as a policyholder or cannot recall the same information as it relates to his/her spouse, as applicable, hospitals must follow the policy below.

Does Medicare require independent labs?

The Centers for Medicare & Medicaid Services (CMS) will not require independent reference laboratories to collect MSP information in order to bill Medicare for reference laboratory services as described in subsection (b) above. Therefore, pursuant to section 943 of The Medicare Prescription Drug, Improvement & Modernization Act of 2003, CMS will not require hospitals to collect MSP information in order to bill Medicare for reference laboratory services as described in subsection (b) above. This policy, however, will not be a valid defense to Medicare’s right to recover when a mistaken payment situation is later found to exist.

Can you send a claim to Medicare with multiple primary payers?

Claims with multiple primary payers cannot be sent electronically to Medicare.