Costs for Part B (Medical Insurance)

| Part B costs: | What you pay 2021: |

| Premium | $170.10 each month (or higher depending ... |

| Deductible | You’ll pay $233, before Original Medicar ... |

| Costs for services (coinsurance) | You’ll usually pay 20% of the cost for e ... |

Full Answer

What is the monthly premium for Medicare Part B?

The standard monthly premium for Medicare Part B is $148.50 per month in 2021. Some Medicare beneficiaries may pay more or less per month for their Part B coverage. The Part B premium is based on your reported income from two years ago (2019).

How much does Medicare Part B costs?

and Part B which covers doctor’s visits and other medical services, and costs $170.10 per month for most enrollees in 2021. Everyone is eligible for Medicare at age 65, even if your full Social ...

Does Medicaid pay for Part B premium?

Does Medicaid pay for Medicare premiums? Medicaid pays Part A (if any) and Part B premiums. Medicaid pays Medicare deductibles, coinsurance, and copayments for services furnished by Medicare providers for Medicare-covered items and services (even if the Medicaid State Plan payment does not fully pay these charges, the QMB is not liable for them).

Do you pay for Medicare Part B?

Whether you enroll in a Medicare Advantage (Medicare Part C), or you plan to keep Original Medicare Part A and Part B, and purchase a Medicare Supplement plan, you are still required to pay the Medicare Part B premium monthly. If you sign up for both Social Security and Medicare Part B – the part of Original Medicare that covers medically necessary and preventative services, The Social Security Administration will automatically deduct the premium from your monthly benefit.

What is the Medicare Part B premium for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

Do you pay Medicare Part B in advance?

These bills are paid in advance of coverage. For example, if you applied for Medicare to start in August, you'll receive a bill in July for your August, September, and October Part B premiums.

Does Medicare Part B have to start on the first of the month?

Part B (Medical Insurance) Generally, you're first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65. (You may be eligible for Medicare earlier, if you get disability benefits from Social Security or the Railroad Retirement Board.)

Is Medicare Part B billed monthly?

You pay a premium each month for Part B. Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board.

Is Medicare Part B paid in arrears?

Social Security benefits are paid in arrears, while Medicare premiums are paid in advance, so it's important to recognize the timing of these events. 1. The individual is collecting Social Security benefits for the months of November and December of the year prior to the COLA increase to Medicare.

How do I make a Medicare Part B payment?

4 ways to pay your Medicare premium bill:Pay online through your secure Medicare account (fastest way to pay). ... Sign up for Medicare Easy Pay. ... Pay directly from your savings or checking account through your bank's online bill payment service. ... Mail your payment to Medicare.

Does Medicare start on your birthday or the month of your birthday?

Your Medicare coverage generally starts on the first day of your birthday month. If your birthday falls on the first day of the month, your Medicare coverage starts the first day of the previous month. If you qualify for Medicare because of a disability or illness, in most cases your IEP is also seven months.

Can you add Medicare Part B at any time?

You can sign up for Medicare Part B at any time that you have coverage through current or active employment. Or you can sign up for Medicare during the eight-month Special Enrollment Period that starts when your employer or union group coverage ends or you stop working (whichever happens first).

Does Medicare coverage begin the month you turn 65?

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month. If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65.

Is Medicare Part B automatically deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Does Social Security pay a month ahead or behind?

We pay Social Security benefits monthly. The benefits are paid in the month following the month for which they are due. For example, you would receive your July benefit in August.

How do I check my Medicare payments?

Visiting MyMedicare.gov. Calling 1-800-MEDICARE (1-800-633-4227) and using the automated phone system. TTY users can call 1-877-486-2048 and ask a customer service representative for this information. If your health care provider files the claim electronically, it takes about 3 days to show up in Medicare's system.

What Is the Cost of Medicare Part B for 2022?

Have you ever asked a friend or family member: “How much does Medicare Part B cost?” If so, they probably responded with their monthly premium amou...

What is the Maximum Cost of Medicare Part B?

Typically, the cost of your Medicare Part B coverage comes down to several costs, starting with your monthly premium and annual Medicare Part B ded...

Is Medicare Part B Free for Seniors?

If you have Original Medicare (Parts A and B), you’ll likely pay for your Part B plan. Medicare beneficiaries that worked 10 or more years often re...

How is Medicare Part B premium calculated?

The Medicare Part B premium changes each year and is calculated based on data collected by the Centers for Medicare and Medicaid Services (CMS). Th...

How do I pay my Part B premium?

Your Medicare Part B premium is a monthly payment. It may be deducted automatically for you if you receive the following benefits:

What does Medicare Part B cover exactly?

Medicare Part B generally covers the medical treatments you receive. But Part B won’t cover everything — your treatments or services must either be:

How to enroll in Medicare Part B?

Are you or a loved one turning 65 and looking to enroll in Medicare? You’ll want to know when to enroll, and how. As a starting point, find your In...

How does Medicare calculate my Part B premium and Income Related Monthly Adjustment Amount (IRMAA)?

When you enroll, your IRMAA, if you pay one, will be based on your tax returns from two years prior. That year’s income will be used to determine h...

Do Part B costs remain the same after I enroll? Or do they increase each year?

Your Part B costs will change each year based on data collected by the Centers for Medicare and Medicaid Services (CMS). This generally means incre...

If I enroll in Medicare Advantage, will I still pay a Part B premium?

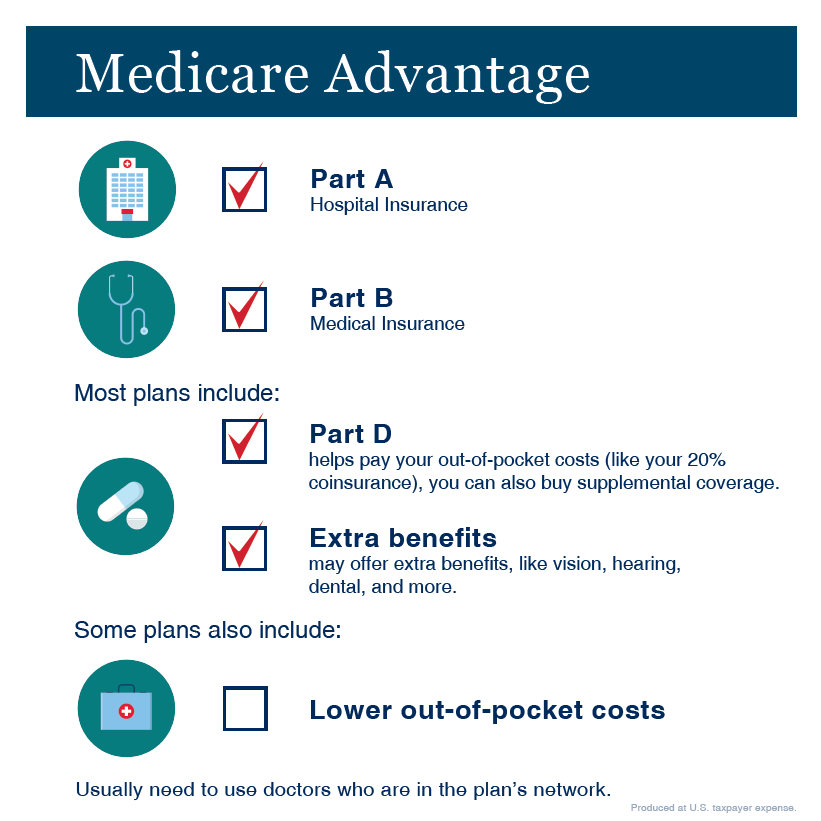

This depends on your plan. Some insurance companies will include the Part B premium in what you pay each month for your Medicare Advantage policy....

How does Medicare Part B work?

How it Works Premiums & Deductibles Coverage & Enrollment FAQs. Medicare Part B provides the medical portion of your Medicare coverage . Part B has costs, including a premium, deductible and coinsurance. Together, they make up the overall cost of Medicare Part B. But the costs aren’t the same for everyone.

What is Medicare premium?

A premium is a fee you pay to your insurance company for a health plan coverage. This is usually a monthly cost. A deductible is the amount you pay out of pocket before your insurance company covers its ...

What is premium insurance?

A premium is a fee you pay to your insurance company for a health plan coverage. This is usually a monthly cost. and annual deductible. A deductible is the amount you pay out of pocket before your insurance company covers its portion of your medical bills. For example: If your deductible is $1,000, your insurance company will not cover any costs ...

Does Medicare Supplement Insurance cover Part B?

Medicare Supplement Insurance (Medigap) has several policies that will help cover your Part B costs, including premiums, deductibles and out-of-pocket costs.

Is Medicare Part B based on income?

Unlike the Part B premium, this amount isn’t based on income. Everyone enrolled in Original Medicare pays the same Part B deductible. That means no matter how high your income is, you’ll pay the standard Medicare Part B deductible amount.

Is Medicare Part B the same as Medicare Advantage?

But Part B coverage isn’t exclusive to Original Medicare; you’ll receive at least the same benefits with Medicare Advantage (Part C).

Does Medicare cover wheelchairs?

Medically necessary: Your doctor must deem your treatment is required to improve or maintain your health. Preventive services: Medicare-approved screenings and other preventive services are covered and generally at no-cost. Part B can also cover wheelchairs and other medically necessary equipment.

How much is Medicare Part B 2021?

Medicare Part B Premium for 2021. In 2021, the standard Part B premium is $148.50 per month. Most people pay the standard premium amount. It’s either deducted from your Social Security check or you may pay Medicare directly, depending on your situation.

What is the Medicare Part B deductible for 2021?

Medicare Part B Deductible. The Part B deductible for 2021 is $203. This is the amount you are responsible for paying before Part B starts helping to pay your health care costs, but it doesn’t apply to most Medicare-covered preventive care services.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What is Medicare Part B coinsurance?

Medicare Part B Coinsurance. Coinsurance is a cost-sharing term that means insurance pays a percentage and you pay a percentage. With Medicare Part B, you pay 20 percent of the cost for the services you use. So if your doctor charges $100 for a visit, then you are responsible for paying $20 and Part B pays $80.

Does Medicare Advantage cover doctor visits?

With a Medicare Advantage plan, your costs will be different and may include copays for doctor visits or other services . However, your out-of-pocket costs are limited to the annual plan maximum. Once you’ve paid that amount, the plan pays 100 percent for Medicare-covered services through the end of the year.

Get help paying costs

Learn about programs that may help you save money on medical and drug costs.

Part A costs

Learn about Medicare Part A (hospital insurance) monthly premium and Part A late enrollment penalty.

Part B costs

How much Medicare Part B (medical insurance) costs, including Income Related Monthly Adjustment Amount (IRMAA) and late enrollment penalty.

Costs for Medicare health plans

Learn about what factors contribute to how much you pay out-of-pocket when you have a Medicare Advantage Plan (Part C).

Compare procedure costs

Compare national average prices for procedures done in both ambulatory surgical centers and hospital outpatient departments.

Ways to pay Part A & Part B premiums

Learn more about how you can pay for your Medicare Part A and/or Medicare Part B premiums. Find out what to do if your payment is late.

Costs at a glance

Medicare Part A, Part B, Part C, and Part D costs for monthly premiums, deductibles, penalties, copayments, and coinsurance.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What is Medicare Part A?

When you enroll in Original Medicare, you'll notice that your health benefits are divided into two parts — Medicare Part A (Hospital Insurance) and Part B (Medical Insurance). Many beneficiaries receive Part A benefits premium-free, but everyone typically pays a monthly premium for Part B.

How much will Medicare pay in 2021?

In addition to your monthly premium, you pay $203 per year in 2021 for your Part B deductible. Once your deductible is met, you generally pay a coinsurance of 20% of the Medicare-approved amount for medically necessary care and services.

What is the income related monthly adjustment amount?

If your yearly income is above $88,000 (or above $176,000 if you file taxes jointly with your spouse), you will most likely pay more than the standard Part B premium , based on the income you report to the IRS on your federal tax return. This additional amount is called the Income-Related Monthly Adjustment Amount (IRMAA).