When does Medicare Part D open enrollment start?

2013 and Earlier Reports. While Medicare Part D prescription drug plan premiums are generally expected to remain stable in 2014, this PPI Fact Sheet by Leigh Purvis finds that premiums for many popular plans will actually be considerably higher than they were in 2013. Plan designs also continue to evolve, with all of the most popular stand-alone ...

When is Medicare Part C open enrollment 2022?

Oct 01, 2013 · During Medicare’s annual Fall Open Enrollment Period that begins October 15 and ends December 7 (not to be confused with the October 1 start of open enrollment in the health insurance marketplaces established by the Affordable Care Act), people with Medicare can change their Medicare health and drug coverage options such as their Part D plan.

When do Medicare Part C and Part D plans take effect?

2014 Medicare Plan Changes for Open Enrollment on Oct.15. Medicare recipients who want to enroll or change their Medicare health care and Part-D coverage for 2014 will be able to this week from Oct. 15 to Dec. 7. Beginning the 15th seniors can now change any type of Medicare coverage you choose but changes don’t take effect Jan. 1, 2014.

Are you eligible to enroll in Medicare Part D plans?

Previous Medicare enrolled seniors cant start signing up until October 15 2013. Open enrollment runs through December 7 2013. Understand how Medicare Part D works Medicare Part D sometimes called "PDPs" is a subsidized prescription drug program backed by the US Federal government that provides anyone on Medicare access to medications at reduced rates. All …

When can Medicare Part D be added?

When you first become eligible for Medicare, you can join a plan. Open Enrollment Period. From October 15 – December 7 each year, you can join, switch, or drop a plan. Your coverage will begin on January 1 (as long as the plan gets your request by December 7).

Can I add Medicare Part D at anytime?

Keep in mind, you can enroll only during certain times: Initial enrollment period, the seven-month period that begins on the first day of the month three months before the month you turn 65 and lasts for three months after the birthday month.

When did Part D become mandatory?

Medicare Part D Prescription Drug benefit Under the MMA, private health plans approved by Medicare became known as Medicare Advantage Plans. These plans are sometimes called "Part C" or "MA Plans.” The MMA also expanded Medicare to include an optional prescription drug benefit, “Part D,” which went into effect in 2006.Dec 1, 2021

What is the initial enrollment period for Part D?

7 monthsFor people who are new to Medicare, the Initial Enrollment Period (IEP) for Part D is 7 months long. It begins 3 months prior to the month you become eligible for Medicare Part A or B, includes the month you become eligible and ends 3 months later.

Is GoodRx better than Medicare Part D?

GoodRx can also help you save on over-the-counter medications and vaccines. GoodRx prices are lower than your Medicare copay. In some cases — but not all — GoodRx may offer a cheaper price than what you'd pay under Medicare. You won't reach your annual deductible.Sep 27, 2021

What is the best Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Do I need Medicare Part D if I don't take any drugs?

Even if you don't take drugs now, you should consider joining a Medicare drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little to no monthly premiums. 2. Enroll in Medicare drug coverage if you lose other creditable coverage.

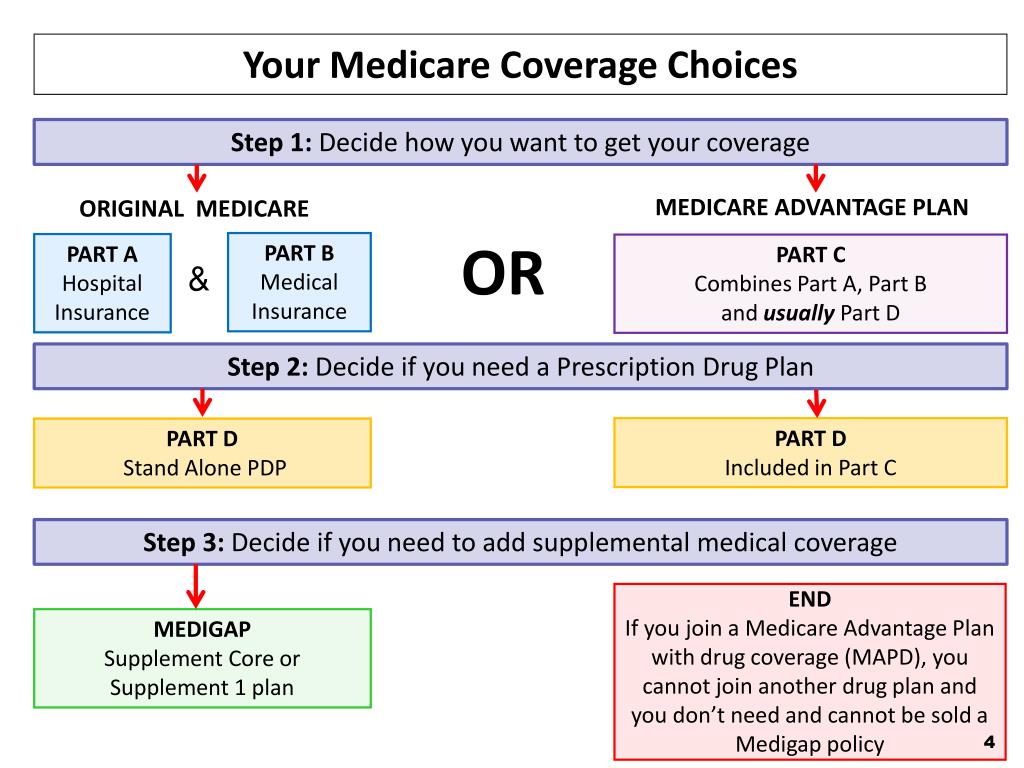

Do I need Part D if I have Medicare Advantage?

Plans can now cover more of these benefits. You can join a separate Medicare drug plan (Part D) to get drug coverage. Drug coverage (Part D) is included in most plans. In most types of Medicare Advantage Plans, you don't need to join a separate Medicare drug plan.

How can I avoid Medicare Part D Penalty?

The penalty can be avoided by signing up for Part D during the initial enrollment period. If you're not ready to get Medicare yet, be sure not to go more than 63 days without Part D or creditable prescription drug coverage after your initial enrollment period is up.

When can I change Part D plans?

You can change from one Part D plan to another during the Medicare open enrollment period, which runs from October 15 to December 7 each year. During this period, you can change plans as many times as you want. Your final choice will take effect on January 1.Sep 26, 2021

Can you change Part D plans without penalty?

You can change plans as many times as you need during Fall Open Enrollment, and your last choice takes effect January 1. To avoid enrollment problems, it is usually a good idea to make as few changes as possible.

What is Part D late enrollment penalty?

The late enrollment penalty amount typically is 1% of the “national base beneficiary premium” (also called the base beneficiary premium) for each full, uncovered month that the person didn't have Medicare drug coverage or other creditable coverage. The national base beneficiary premium for 2022 will be $33.37.

Star ratings and MTM

Medicare health and prescription drug plans are rated on their performance on a scale of one star (“Poor”) to five stars (“Excellent”). The overall star ratings are available at Medicare.gov/find-a- plan. These star ratings can be used to compare plans to find the best plan for the patient.

Mailing prescriptions in 2014

In the guidance for 2014, CMS encouraged Part D plans to require mailservice and community pharmacies to obtain patient consent to deliver a new or refill prescription, before each delivery, including refills or new prescriptions received directly from the physician.

Closing the donut hole

The Part D donut hole will continue to close gradually under the Medicare Coverage Gap Discount Program in the Affordable Care Act. In 2014, Medicare patients in the donut hole (who don’t qualify for the low-income Extra Help program) will pay 47.5% of the cost for brand-name drugs and 72% of the cost for generic drugs.

How long do you have to sign up for Medicare Part D?

When you first become eligible for original Medicare Parts A and B, you have seven months to sign up for a Part D drug plan. During that time you can not be declined for a drug plan based on your health history you are what is called guaranteed issue. After your initial enrollment is expired every year there is an annual enrollment period between October 15 and December 7, this is when you can change drug plans and your change would go into effect the following January. If you elect not to sign up for a drug plan when you first become eligible, but decide later to sign up for coverage you will pay a Medicare Part D penalty of 1% for every month you did not have the Part D plan but were eligible. If you decide to join a Medicare drug plan, the plan will tell you if you owe a penalty, and what your penalty will cost per month.

What is Medicare Part D?

Medicare Part D sometimes called "PDPs" is a subsidized prescription drug program backed by the US Federal government that provides anyone on Medicare access to medications at reduced rates. All Medicare Part D plans have some basic benefits that are required by Medicare, since it is regulated by the government.

What is the Medicare coverage gap in 2014?

In plan year 2014, Medicare beneficiaries who reach the Coverage Gap (Donut Hole) will receive a 28% discount on generic drugs purchased and continue to receive a 52.5% (50% paid by the drug manufacturer and 2.5% paid by the Medicare Part D plan) discount on brand name drugs.

When will Medicare Part D enrollment start in 2022?

If you would like for us to send you an email as additional 2022 Medicare Part D plan information comes online and when enrollment begins (October 15th), please complete the form below. We will NOT share your information with any third-parties.

What is a SEP in Medicare?

To promote high Medicare Part D and MA plan quality, The Centers for Medicare and Medicaid Services (CMS) will alert plan members if their Medicare Part D drug plan or Medicare Advantage health plan has failed for three straight years to achieve at least a 3-star quality rating and offer a Special Enrollment Period (SEP), if desired, that will allow the member to move to a higher quality plan. The SEP began in 2013 and continues for 2014.

When does Medicare Part D start?

The coverage you choose during the Medicare Part D Enrollment will be effective the first day of the following year. For example, if you enrolled in a Part D drug plan by December 7, 2020, your coverage would start January 1, 2021.

How to opt out of Medicare Part D?

The Medicare Part D Enrollment Period also allows you to opt out of Part D drug benefits. You can: 1 Drop your PDP or MAPD coverage completely. 2 Switch from a PDP or MAPD to a Medicare Advantage plan without drug coverage.

What happens if you don't get Medicare Part D?

If you didn’t get Part D during your IEP, you get another chance to do so during the Medicare Part D Open Enrollment. However, you might pay the Part D late enrollment penalty (an extra amount added to your Part D premium) if:². You went more than 63 days past your IEP without having other credible drug coverage.

When is it important to review Medicare Part D?

It’s important to review your Part D options annually during Medicare Open Enrollment. The cost, pharmacy network, and drug formulary for Medicare Part D plans can vary from plan to plan year to year.

How long does an IEP last?

Your IEP lasts for seven months and:¹. Begins three months before, and ends three months after, your 25th month of getting Social Security or Railroad Retirement Board (RRB) disability benefits. If you didn’t get Part D during your IEP, you get another chance to do so during the Medicare Part D Open Enrollment.

When is the fall open enrollment period for Medicare?

Medicare also offers a Fall Open Enrollment Period (OEP) every year that runs from October 15 to December 7. This period allows for Medicare Part D enrollment as well. You can also switch from one prescription drug plan to another during this time.

How long does Medicare Part D cover?

It includes your birthday month and the three months following for a total of seven months. During that time, you can enroll in a Part D Prescription Drug plan or a Medicare Part C plan that includes prescription drug coverage.

What is the difference between Medicare Part A and Part B?

Original Medicare helps you pay many of your medical expenses. Part A pays a portion of your bills if you are a hospital inpatient. Part B covers other medical care, like doctor visits and some medical equipment.

When do you get an IEP?

Your Initial Enrollment Period (IEP) occurs when you first become eligible for Medicare. For most people, eligibility happens when you turn 65 . The IEP begins three months before the month you turn 65. It includes your birthday month and the three months following for a total of seven months. During that time, you can enroll in a Part D ...

What is Medicare Advantage?

A Medicare Advantage plan is an alternative way to get your Original Medicare (Part A and Part B) benefits. These plans might also offer coverage for additional services like routine vision or dental care, and prescription medications. Medicare Part D enrollment provides you with choices of plans in most service areas.

How long can you go without Medicare Part D?

However, if you go without Medicare Part D or other creditable prescription drug coverage for a continuous period of 63 days or longer after your IEP is over, you could be subject to a Part D late enrollment penalty. Coverage could come from a stand-alone prescription drug plan, a Medicare Advantage plan with prescription drug coverage (Part C), ...

What is required for Medicare?

All plans are required by Medicare to offer a standard level of coverage. Some plans may offer additional benefits beyond this standard. The cost of plans may include monthly premiums, deductibles, copayments, and coinsurance. The amounts can vary from plan to plan.