Your Medicare Supplement

Medigap

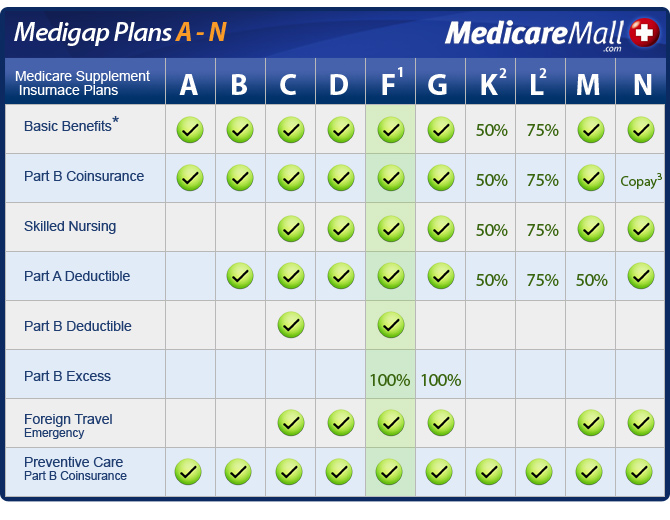

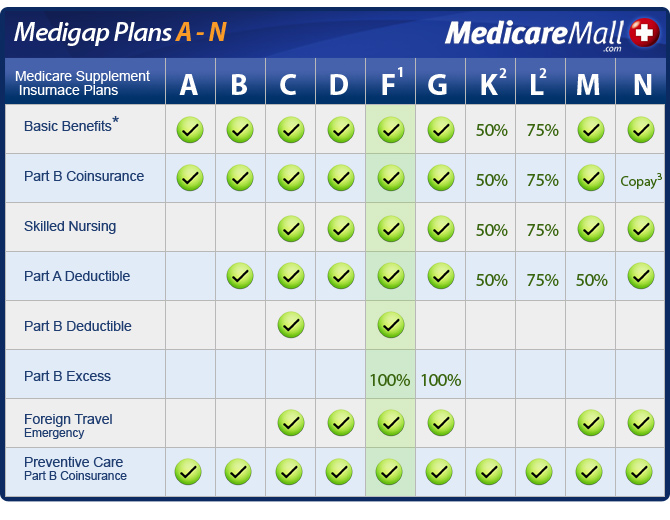

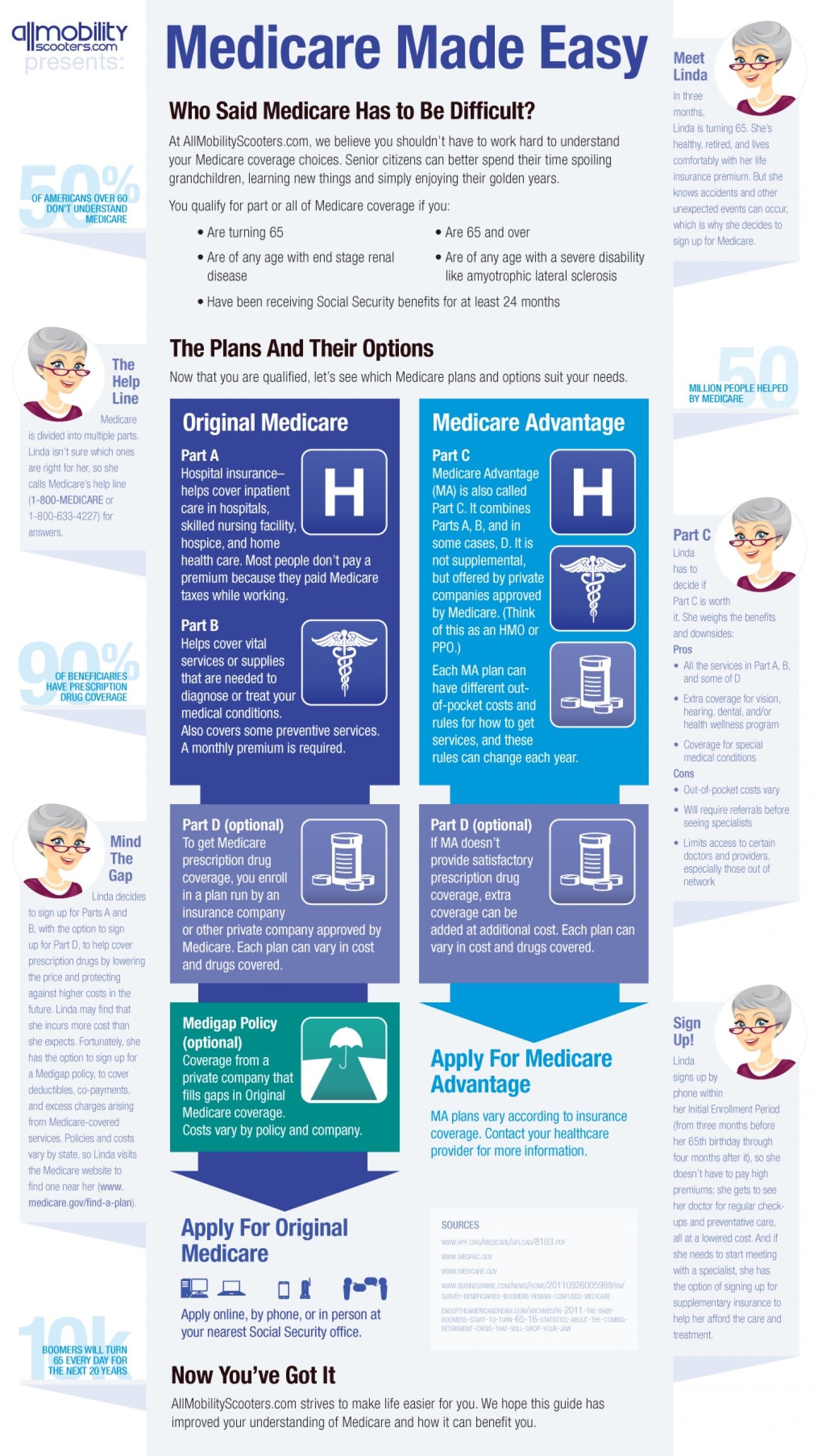

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

When is the Medicare supplement open enrollment period (OEP)?

Dec 22, 2020 · Medicare Supplement Insurance (Medigap) has a six-month open enrollment period (OEP). Your open enrollment period begins when you are both: 65 years old and. Enrolled in Medicare Part B. Unlike the Medicare OEP that happens once every year, you have only one Medigap OEP. If you get Medicare Part B before you turn 65, your Medigap OEP starts the first …

When can you sign up for Medicare supplement insurance?

Dec 16, 2021 · Your Medicare Supplement Open Enrollment period is a once-in-a-lifetime period that you get when you start Medicare. For most people, it’s when you turn 65. Sometimes it begins once you retire and start your Medicare Part B. During your one-time Medigap Open Enrollment Period, you can: Enroll in any Medigap plan with any carrier without health …

When is open enrollment?

Aug 03, 2019 · When Does Medicare Supplement Open Enrollment Occur? Your initial 6-month Medigap enrollment period begins when you turn 65 years of age and you are enrolled in Part B. During this period of time, you can purchase any Medigap policy sold in your state.

When does Medicare coverage start?

If you have Original Medicare and would like to enroll in a Medicare Supplement Insurance plan (also called Medigap), the best time to sign up is during your six-month Medigap Open Enrollment Period. Your Medigap Open Enrollment Period starts as soon as you are age 65 or older and are enrolled in Medicare Part B.

Can you change your Medicare supplement anytime during the year?

You can change your Medicare Supplement Plan anytime, just be aware that you might have to answer medical questions if your outside your Open Enrollment Period.

Can you add a Medicare supplement at any time?

One interesting feature of Medicare Supplement insurance plans is that you can apply for a plan anytime – you only need to be enrolled in Medicare Part A and Part B. However, a plan doesn't have to accept your application, unless you have guaranteed-issue rights.

What is deadline for Medicare supplement?

You can enroll in a Medicare Advantage plan when you're first eligible for Medicare, or during the annual Medicare open enrollment period in the fall (October 15 to December 7).Apr 1, 2022

When a Medicare supplement policy is purchased during the open enrollment period?

Under federal law, you have a six-month open enrollment period that begins the month you are 65 or older and enrolled in Medicare Part B. During your open enrollment period, Medigap companies must sell you a policy at the best available rate regardless of your health status, and they cannot deny you coverage.

Can you be denied a Medicare Supplement plan?

Within that time, companies must sell you a Medigap policy at the best available rate, no matter what health issues you have. You cannot be denied coverage.

What are the four prescription drug coverage stages?

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.Oct 1, 2021

Are you automatically enrolled in Medicare if you are on Social Security?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

Is Medicare Part B going up 2022?

And those with fewer than 30 quarters worth of Medicare taxes will likely see a jump from the current rate of $471 in 2021 to $499 in 2022. The standard Medicare Part B premium is also on the rise in 2022. The 2022 Medicare Part B premium is $170.10 per month, which is up from $148.50 in 2021.Jan 4, 2022

What is the maximum out-of-pocket for Medicare Advantage?

The US government sets the standard Medicare Advantage maximum out-of-pocket limit every year. In 2019, this amount is $6,700, which is a common MOOP limit. However, you should note that some insurance companies use lower MOOP limits, while some plans may have higher limits.Oct 1, 2021

How long is an open enrollment period for Medicare supplement policies quizlet?

How long is an open enrollment period for Medicare supplemental policies? 6 months; 6-month period that guarantees the applicants the right to buy Medigap once they first sign up for Medicare Part B.

Can you switch from Medicare Advantage to Medigap?

For example, when you get a Medicare Advantage plan as soon as you're eligible for Medicare, and you're still within the first 12 months of having it, you can switch to Medigap without underwriting. The opportunity to change is the "trial right."Jun 3, 2020

What states allow you to change Medicare supplement plans without underwriting?

In some states, there are rules that allow you to change Medicare supplement plans without underwriting. This includes California, Washington, Oregon, Missouri and a couple others. Call us for details on when you can change your plan in that state to take advantage of the “no underwriting” rules.

What is Medicare Supplemental Insurance?

Medicare supplemental insurance, or Medigap, is an insurance product that is provided by private insurance companies to help cover things that Original Medicare benefits does not , such as deductibles, copayments, or coinsurance.

Is Medicare for seniors?

Medicare is relied upon by millions of Americans, including seniors 65 years of age or older and individuals under the age of 65 with certain disabilities. Medicare coverage is a vital part of health and wellness for many individuals, as it includes coverage for healthcare expenses for a wide range of care. The Medicare program serves ...

When does Medicare open enrollment end?

The Medicare Advantage Open Enrollment Period starts January 1 and ends March 31 every year. During this period, you can switch Medicare Advantage plans or leave a Medicare Advantage plan and return to Original Medicare.

When is the best time to enroll in Medicare Supplement?

If you have Original Medicare and would like to enroll in a Medicare Supplement Insurance plan (also called Medigap), the best time to sign up is during your six-month Medigap Open Enrollment Period .

How long does Medicare initial enrollment last?

Your Initial Enrollment period lasts for seven months : It begins three months before you turn 65.

How long does Medicare last?

It includes your birth month. It extends for another three months after your birth month. If you are under 65 and qualify for Medicare due to dis ability, the 7-month period is based around your 25th month of disability benefits.

What happens if you don't sign up for Medicare?

If you don't sign up during your Initial Enrollment Period and if you aren't eligible for a Special Enrollment Period , the next time you can enroll in Medicare is during the Medicare General Enrollment Period.

How long does it take to switch back to Medicare?

If you sign up for a Medicare Advantage plan during your Initial Enrollment Period, you can change to another Medicare Advantage plan or switch back to Original Medicare within the first 3 months that you have Medicare.

Can you qualify for a special enrollment period?

Depending on your circumstances, you may also qualify for a Special Enrollment Period (SEP). Medicare Special Enrollment Periods can happen at any time during the year. You may qualify for a Special Enrollment Period for a number of reasons, which can include:

What is Medicare Supplement Open Enrollment Period?

What is Medicare Supplement Open Enrollment? Medicare Supplement Open Enrollment Period is a once in a lifetime window that allows you to enroll in any Medigap plan without answering health questions.

How long does Medicare open enrollment last?

Applying outside your open enrollment window can result in higher premiums, as well as restrict your coverage options. This window only lasts for six months for each new beneficiary, unless you delay enrollment into Part B due to having other creditable coverage.

What happens if you miss your Medigap open enrollment period?

When you miss your Medigap Open Enrollment Period and are denied coverage, there are alternative options. If you have a serious health condition that causes a Medigap carrier not to accept you, you should be able to enroll in a Medicare Advantage plan.

Why do people delay enrolling in Medicare Supplement?

For some; they choose to delay enrolling in Part B due to still working and having creditable coverage with their employer. When they do retire and enroll in Part B, they will initiate their Medicare Supplement Open Enrollment Period.

Does timing affect Medigap coverage?

Timing can affect how much you pay for coverage; how easy coverage is to obtain, and it can significantly determine the options available to you. The Megiap OEP is the only time you’ll ever get that allows you to enroll in any Medigap letter plan. You’ll be able to avoid having to answer any health questions.

Which states have open enrollment?

Some states have unique open enrollment rules, like Connecticut and California. In California, they have a birthday rule that allows you to enroll days surrounding your birthday without answering health questions. In Connecticut, they have a year-round open enrollment window for all beneficiaries.

Can you get insurance if you enroll in one time?

If they enroll as soon as their first eligible, during the one-time individual open enrollment window, these health problems will not prevent them from getting coverage.

Important Enrollment Periods

There are several enrollment periods associated with Medicare that you should familiarize yourself with. Below, we give a brief description of each to help you get the most from your Medicare coverage.

Medicare Initial Enrollment Period

If you're new to Medicare, you can sign up for Medicare Part A and Part B during your Initial Enrollment Period, which is the seven-month period that:

General Enrollment Period

If you don’t sign up for Medicare during your Initial Enrollment Period, you can sign up during the Medicare General Enrollment Period. This period runs annually from January 1 to March 31.

When will Medicare open enrollment start in 2022?

Medicare open enrollment for 2022 coverage starts on October 15, 2021, and continues through December 7. Learn how you can change your Medicare coverage outside of the fall open enrollment period.

What is Medicare's general enrollment period?

Medicare’s general enrollment period is for people who didn’t sign up for Medicare Part B when they were first eligible, and who don’t have access to a Medicare Part B special enrollment period. It’s also for people who have to pay a premium for Medicare Part A and didn’t enroll in Part A when they were first eligible.

How much will Medicare cost in 2021?

The standard Part B premium for 2021 is $148.50 per month. The increase in the Part B premiums was limited by the short-term government spending bill that was signed into law on October 1, 2020. The Part B premium for most enrollees was $144.60/month in 2020, and the spending bill capped the increase for 2021 at a quarter of what it would otherwise have been. Earlier in 2020, the Medicare Trustees Report had projected a Part B premiums of $153.30 per month for most enrollees in 2021. The actual price that people pay can also also be limited by the Social Security cost of living adjustment (COLA) that beneficiaries receive, but the 1.3% COLA for 2021 was adequate to allow the full standard Part B premium to be deducted from most beneficiaries’ Social Security checks.

How much is coinsurance for skilled nursing in 2021?

After the first 20 days, your skilled nursing facility coinsurance in 2021 is $185.50 per day for days 21-100 (after that, Medicare no longer covers skilled nursing facility charges, so you’ll pay the full cost). Supplemental coverage, including Medigap plans, is designed to pay the Part A coinsurance on your behalf.

What is the Medicare Advantage Plan 2021?

$7,550 is the upper limit; the average Medicare Advantage plan tends to have an out-of-pocket cap below the maximum that the government allows.

How much is Part A coinsurance for 2021?

2021 Part A coinsurance: $371 per inpatient day (days 61-90 in the benefit period for which the deductible applied; up from $352 per day in 2020) $742 per inpatient day for day 91 and beyond during the benefit period (up from $704 per day in 2020).

When does Medicare coverage take effect?

If you enroll during the general enrollment period, your coverage will take effect July 1. Learn more about Medicare’s general enrollment period. Back to top.