Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

What is a Medicare supplement insurance plan?

Sep 13, 2019 · All Medicare Supplement plans typically cover: Your Medicare Part A hospital coinsurance, plus an additional full year of benefits after your Medicare benefits are exhausted; Some or all of your Medicare Part B coinsurance; Some or all of your Part A hospice coinsurance; Some or all of your first three pints of blood; Medicare Supplement Plan A is the most basic of …

When should I apply for Medicare supplement insurance?

Sep 16, 2018 · The best time to enroll in a Medicare Supplement plan is generally during your Medicare Supplement Open Enrollment Period—for most people, this period starts the month that you turn 65 and have Medicare Part B, and goes for six months. This is when you can get any Medicare Supplement plan that’s available in your area, regardless of any health issues you …

Is there an enrollment period for Medicare supplement plans?

Jan 20, 2022 · A Medicare Supplement Insurance plan (also called Medigap) can help cover some of the out-of-pocket costs that Original Medicare doesn't, such as copays and deductibles. Each type of plan offers a different combination of basic health insurance benefits. Use the following guide to compare Medicare Supplement Insurance plans and find the policy that fits your …

What is deadline for Medicare supplement?

What are the top 3 most popular Medicare supplement plans in 2021?

How much a month is Medicare supplement?

How do you qualify to get 144 back from Medicare?

What is the deductible for Plan G in 2022?

Are Medicare supplement plans being phased out?

What is the Medicare Part B premium for 2022?

Why are Medicare Supplement plans so expensive?

Does Medicare coverage start the month you turn 65?

Is there really a $16728 Social Security bonus?

Will Social Security get a $200 raise in 2021?

What is the income limit for extra help in 2021?

How Do Medicare Supplement (Medigap) Plans Work With Medicare?

Medigap plans supplement your Original Medicare benefits, which is why these policies are also called Medicare Supplement plans. You’ll need to be...

What Types of Coverage Are Not Medicare Supplement Plans?

As a Medicare beneficiary, you may also be enrolled in other types of coverage, either through the Medicare program or other sources, such as an em...

What Benefits Do Medicare Supplement Plans Cover?

Currently, there are 10 standardized Medigap plans, each represented by a letter (A, B, C, D, F, G, K, L, M, N; there’s also a high-deductible vers...

What Benefits Are Not Covered by Medicare Supplement Plans?

Medigap policies generally do not cover the following health services and supplies: 1. Long-term care (care in a nursing home) 2. Routine vision or...

Additional Facts About Medicare Supplement Plans

1. You must have Medicare Part A and Part B to get a Medicare Supplement plan. 2. Every Medigap policy must be clearly identified as “Medicare Supp...

When Am I Eligible For Medicare Supplement Coverage?

Because Medicare Supplement policies complement your Original Medicare coverage, you must be enrolled in Part A and Part B to be eligible for this...

How Can Enrollment Periods Affect My Eligibility For Medicare Supplement Plans?

The best time to enroll in a Medicare Supplement plan is generally during your Medicare Supplement Open Enrollment Period—for most people, this per...

Am I Eligible For A Medicare Supplement Plan If I’M Under Age 65?

Federal law does not require insurance companies to sell Medicare Supplement policies to people under 65, but many states do have this requirement....

Am I Eligible For A Medicare Supplement Plan If I Have A Medicare Advantage Plan?

Medicare Supplement policies don’t work with Medicare Advantage plans. If you decide to switch from Original Medicare to a Medicare Advantage plan,...

Am I Eligible For A Medicare Supplement Plan If I Have Coverage Through Medicaid?

While some beneficiaries may be eligible for both Medicare and Medicaid benefits (also known as “dual eligibles”), Medicaid typically doesn’t work...

How long does Medicare Supplement open enrollment last?

Your Medicare Supplement Open Enrollment Period (OEP) typically begins the month you are both age 65 or over and enrolled in Part B, and lasts for six months. If you think you will ever want coverage, it’s important to buy it during the OEP.

How many Medicare Supplement Plans are there?

There are four “parts” of Medicare, and there are up to 10 lettered, standardized Medicare Supplement plans in most states.

What is Medicare Part A coinsurance?

Your Medicare Part A hospital coinsurance, plus an additional full year of benefits after your Medicare benefits are exhausted. Some or all of your Medicare Part B coinsurance. Some or all of your Part A hospice coinsurance. Some or all of your first three pints of blood. Medicare Supplement Plan A is the most basic of the standardized, ...

What is community rated Medicare?

Medicare Supplement insurance companies can use one of three ways to rate, or price, their policies: Community-rated, which means everyone pays the same premium regardless of age. Issue-age rated, which means your premium is based on your age at the time you buy the policy.

Is there an annual enrollment period for Medicare Supplement?

Unlike with Medicare Advantage and Medicare Part D prescription drug plans, there is no annual enrollment period for Medicare Supplement plans. You can apply for a plan anytime you want, as long as you’re enrolled in Medicare Part A and Part B.

Does Medicare Supplement cover out of pocket expenses?

Out-of-pocket costs with Part A and Part B can pile up, especially if you have a chronic health condition or a medical emergency. Medica re Supplement plans help cover those out-of-pocket Medicare costs so it’s easier to budget for your health care.

Is community rated Medicare the least expensive?

Although the premium for a community-rated plan may be higher at first, it may be least expensive over time. Attained-age Medicare Supplement plans usually start with a low premium, but the increases at different age milestones can be steep.

How long does Medicare Supplement open enrollment last?

How can enrollment periods affect my eligibility for Medicare Supplement plans? The best time to enroll in a Medicare Supplement plan is generally during your Medicare Supplement Open Enrollment Period —for most people, this period starts the month that you turn 65 and have Medicare Part B, and goes for six months.

How long do you have to wait to get Medicare Supplement?

Keep in mind that even though a Medicare Supplement insurance company cannot reject your enrollment for health reasons, the company is allowed to make you wait up to six months before covering your pre-existing conditions.

How long is a trial period for Medicare Advantage?

Trial rights allow you to join a Medicare Advantage plan for a one-year trial period if you are enrolling in Medicare Part C for the first time. If you’re not happy with the plan, you can return to Original Medicare anytime within the first 12 months.

Can you change your Medicare Supplement plan if it goes bankrupt?

For example, if your Medicare Supplement insurance company goes bankrupt or misleads you, you may be able to change Medicare Supplement plans with guaranteed issue.

Can you get Medicare Supplement if you have health issues?

This is when you can get any Medicare Supplement plan that’s available in your area, regardless of any health issues you may have. The insurance company can’t charge you more if you have health problems or deny you coverage because of pre-existing conditions.

Does Medigap cover prescriptions?

Since Medigap plans don’t include prescription drug benefits, if you’re enrolled in Original Medicare and want help with prescription drug costs, you can get this coverage by enrolling in a stand-alone Medicare Prescription Drug Plan.

Does Medicare Supplement include prescription drug coverage?

In addition, keep in mind that Medicare Supplement plans don’t include prescription drug benefits (Medicare Part D). In the past, some Medicare Supplement plans may have included this coverage, but plans sold today don’t include prescription drug benefits. If you have an older Medicare Supplement policy with prescription drug coverage, ...

What is Medicare Supplement Insurance Plan?

What Is a Medicare Supplement Insurance Plan? A Medicare Supplement Insurance plan (also called Medigap) can help cover some of the out-of-pocket costs that Original Medicare doesn't, such as copays and deductibles. Each type of plan offers a different combination of basic health insurance benefits. Use the following guide to compare Medicare ...

When is the best time to buy Medicare Supplement?

The best time to buy a Medicare Supplement Insurance plan is during your Medigap open enrollment period. During your open enrollment period, insurance companies cannot consider any pre-existing conditions when deciding whether or not to offer you a policy. They also cannot charge you more for a Medigap plan based on pre-existing conditions.

How many types of Medigap are there?

Each of the ten types of Medigap plans are different, designed to give beneficiaries multiple options. The rates for different plans will vary. The important thing to remember is that the basic benefits are standardized by Medicare. No matter where you buy Medigap Plan G, the basic benefits have to be the same.

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

How long does Medicare open enrollment last?

Your Medigap open enrollment period only lasts for six months. It begins as soon as you are at least 65 years old and enrolled to receive Medicare Part B benefits.

Which is the most popular Medicare Supplement?

Medigap Plan F Is the Most Popular. Medicare Supplement Insurance Plan F is the most popular Medigap plan, largely because it offers the most comprehensive range of basic benefits. Plan F is the only Medigap plan that covers all nine of the basic Medigap benefits, including the Medicare Part B deductible and Part B excess charges.

How much does Plan N pay for Part B?

4 Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to $50 copayment for emergency room visits that don’t result in an inpatient admission .

How long does Medicare Supplement last?

This is the six-month period that starts the first month when you’re enrolled in Part B and age 65 or older; during this period, you typically have a guaranteed right to enroll in any Medicare Supplement plan of your choice without medical underwriting.

What is Medicare Supplement Plan F?

Medicare Supplement (Medigap) plans may help with certain out-of-pocket health-care costs that Original Medicare doesn’t pay for, such as deductibles, copayments, and coinsurance. Of the 10 standardized plans that may be available in most states, Medicare Supplement Plan F offers the most comprehensive coverage.

How much is Medicare deductible for 2017?

In 2017, the deductible is $2,200 (note that this amount may change from year to year).

When will Medicare stop covering Part B?

If you qualify for Medicare before January 1, 2020: You may be able to buy Medicare Supplement Plan F (or Plan C). You can typically keep your existing Plan F or Plan C. You can talk to your insurance company about how ...

Is Medicare Supplement Plan F the most comprehensive?

Because Medicare Supplement Plan F offers the most comprehensive coverage of the standardized lettered plans offered in most states, premium costs tend to be higher than other plans. Costs may vary by plan, company, and location, so check with the specific insurance company if you’re interested in this plan.

Does Medicare cover Part A coinsurance?

Medigap Plan F may cover: Part A coinsurance and hospital costs for an extra 365 days beyond what Medicare covers. * May be covered if your foreign travel emergency care starts during the first 60 days after leaving the United States and Medicare doesn’t otherwise cover the care.

Can you keep your existing plan F?

You can typically keep your existing Plan F or Plan C.

Who regulates Medicare Supplement Insurance?

Medicare Supplement Insurance plans are tightly regulated by the Centers for Medicare and Medicaid Services (CMS), a government agency. CMS determines what each letter plan will cover, and it requires each insurance company to offer the plan as is, without modifications.

What is Medicare subsidized by?

In the simplest terms, Medicare is a health insurance plan subsidized by the federal government. It was originally created to help Social Security beneficiaries receive healthcare services, but it’s now been expanded to cover everyone who is:

What is a Medigap plan?

Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share. Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020. Sign up for Medigap during Open Enrollment to lock in the best premium for your plan. Our Approach.

What is covered by Plan A?

Plan A also covers 100% of coinsurances or copayments for hospice care services, 100% of Medicare Part B coinsurances or copayments for medical outpatient services, and 100% of the cost of the first three pints of blood you are administered during a procedure.

How much does Medicare pay for a doctor's visit?

Here’s an example with numbers: if the doctor’s visit had a Medicare-approved cost of $100, Medicare would pay $80, your Medigap would pay $15, and you would only have to pay $5.

How much is Medicare Part B deductible?

For 2019, the deductible for Medicare Part B is $185. After the deductible, you’ll pay 20% of most medical expenses.

What happens if you don't enroll in Medicare?

If you don’t enroll in Part A (inpatient hospital services) when you initially qualify, you may find yourself saddled with a 10% late enrollment penalty on your Part A premium. Says the Medicare website, “You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.”

What is coinsurance in Medicare?

Coinsurance is usually a percentage (for example, 20%). The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. (unless the Medigap policy also pays the deductible).

How much is Medicare deductible for 2020?

With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,340 in 2020 ($2,370 in 2021) before your policy pays anything. (Plans C and F aren't available to people who were newly eligible for Medicare on or after January 1, 2020.)

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. but some offer additional benefits, so you can choose which one meets your needs.

Who decides which Medigap policies to sell?

Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. Insurance companies that sell Medigap policies:

Does Medicare cover Part B?

As of January 1, 2020, Medigap plans sold to new people with Medicare aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on January 1, 2020.

Is Medigap standardized?

Medigap policies are standardized. Every Medigap policy must follow federal and state laws designed to protect you, and it must be clearly identified as "Medicare Supplement Insurance.". Insurance companies can sell you only a "standardized" policy identified in most states by letters. All policies offer the same basic.

What is Medicare Supplement?

Medicare Supplement insurance plans, also known as Medigap, help supplement Original Medicare. They may help pay some of the healthcare costs that Original Medicare does pay like copayments, coinsurance and deductibles.

How old do you have to be to get a Medigap plan?

A Medigap plan may be purchased from a private insurance company. To be eligible, you must be enrolled in Medicare Parts A and B, you must live in the state where the policy is offered and be age 65 or over. In some states, you can be under age 65 with a disability or end-stage renal disease (ESRD).

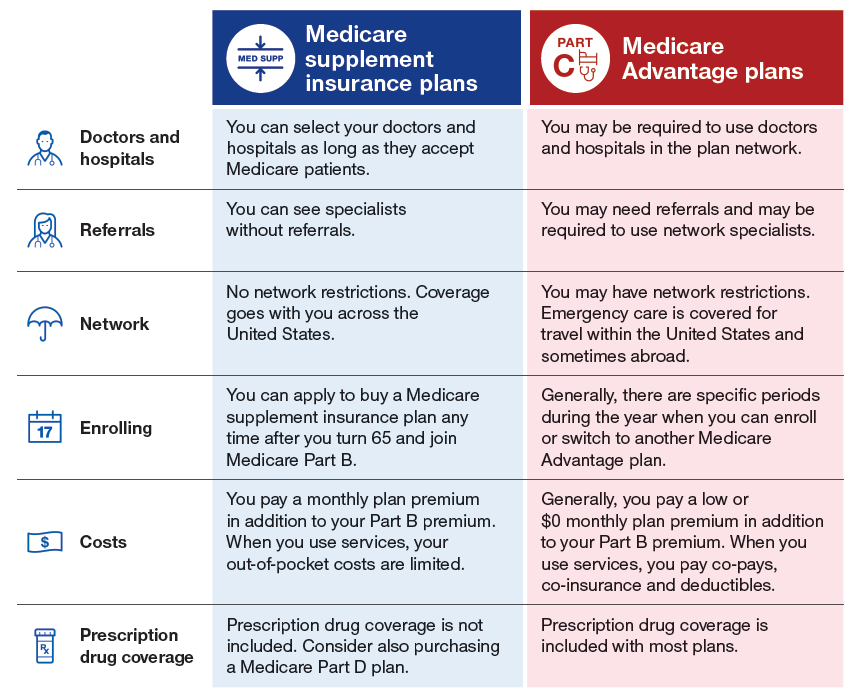

Is Medicare Supplement the same as Medicare Advantage?

Medicare Supplement insurance plans are not the same as Medicare Advantage plans.

Does Medigap cover prescriptions?

Medigap policies do not include prescription drug coverage. If you want prescription drug coverage, you can join a Medicare Prescription Drug Plan (Part D).