How are Medicare wages calculated on W2?

Subtract the following:

- Before-Tax Medical deductions YTD

- Before-Tax Dental deductions YTD

- Before-Tax Vision deductions YTD

- Before-Tax FSA Health deductions YTD

- Before-Tax FSA Dependent Care deductions YTD

- Before-Tax HSA deductions YTD

- Before-Tax Parking deductions YTD

- Before-Tax T Pass deductions YTD

Why are Medicare wages higher on W2?

Why is Medicare wages higher on w2? Certain amounts that are taken out of your pay are not subject to federal income tax, so they are not included in box 1, but they are subject to Social Security and Medicare taxes, so they are included in boxes 3 and 5. A common example is contributions to a 401(k) plan.

How to calculate Medicare wages?

You can expect to be taxed at the 1.45% rate if you fall under the following categories:

- For Single Taxpayers: The first $200,000 of your wages

- For Married Taxpayers Filing Jointly: The first $250,000 of your wages

- For Married Taxpayers Filing Separately: The first $125,00 of your wages

What's included in Medicare wages?

Medicare Wages and Taxes Pretax benefits include those offered under a cafeteria – or Section 125 – plan, such as medical, dental, vision, life, accident and disability insurance; and flexible spending accounts such as dependent care, and health savings and adoption assistance reimbursement accounts.

What is Medicare wages and tips on W-2?

Box 5 "Medicare wages and tips": This is total wages and tips subject to the Medicare component of social security taxes. Box 6 "Medicare tax withheld": This is Medicare tax withheld from your pay for the Medicare component of social security taxes.

What counts as Medicare wages and tips?

Medicare wages and tips: The total wages, tips and other compensation that are subject to Medicare taxes. There is no limit on the amount of wages that are subject to Medicare taxes. Medicare tax withheld: The amount of Medicare tax withheld from your Medicare taxable wages, tips and other compensation.

What wages are considered Medicare wages?

It is calculated the same way as Social Security taxable wages, except there is no wage limit. Medicare taxable wage refers to the employee wages on which Medicare tax is paid. It is calculated as the employee's gross earnings less the non-taxable items, without any maximum on gross wages.

What is Box 5 Medicare wages and tips on my W-2?

Box 5: Medicare Wages and Tips. This represents income subject to Medicare tax. There is no maximum wage base for Medicare taxes. Medicare wages are reduced by pre-tax deductions such as health/dental/vision insurances, parking and flex spending but not reduced by your contributions to a retirement plan (403b or 457.)

What is the difference between wages and tips and Medicare wages and tips?

Box 1 (Wages, Tips and Other Compensation) represents the amount of compensation taxable for federal income tax purposes while box 3 (Social Security Wages) represents the portion taxable for social security purposes and box 5 (Medicare Wages) represents the portion taxable for Medicare tax purposes.

Where does Medicare wages and tips go on 1040?

Tips reported in box 7 are also included in box 5 (Medicare wages and tips). The taxpayer's employer is required to withhold federal income taxes, social security and Medicare taxes, and perhaps state income tax.

Why is Medicare wages more than wages?

How is that possible? Certain amounts that are taken out of your pay are not subject to federal income tax, so they are not included in box 1, but they are subject to Social Security and Medicare taxes, so they are included in boxes 3 and 5. A common example is contributions to a 401(k) plan.

What is the difference between Medicare wages and social security wages?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Is Medicare calculated on gross income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

How do you calculate box 5 on W-2?

Box 5 represents the amount of Medicare wages that are subject to Medicare tax. In general, Box 5 is calculated the same as Box 3. The main difference stems from there being no limit on Medicare taxable wages.

What is Box 14 on the W-2 for?

Box 14: Your employer may report additional tax information here. If any amounts are reported in Box 14, they should include a brief description of what they're for. For example, union dues, employer-paid tuition assistance or after-tax contributions to a retirement plan may be reported here.

Are wages and tips gross or net?

All wages, salaries and tips you received for performing services as an employee of an employer must be included in your gross income.

What to call if your W-2 does not match Social Security?

If you find that after making these adjustments to your Gross Pay YTD per your final pay stub, the result does not match Box 3 Social Security Wages and Box 5 Medicare Wages on your W-2, call Central Payroll, 617-495-8500, option 4 for assistance.

What to call if your W-2 does not match Box 1?

If you find that after making these adjustments to your Gross Pay YTD per your final pay stub, the result does not match Box 1 Federal Wages and Box 16 State Wages on your W-2, call Central Payroll, 617-495-8500, option 4, for assistance.

When do you report tips to your employer?

Tipped employees are required to report their cash tips to their employers by the 10th of the following month after the month the tips are received. If the 10th falls on a Saturday, Sunday, or legal holiday, your employee must report tips by the next day that's not a Saturday, Sunday, or legal holiday. Cash tips include tips paid by cash, check, ...

What happens if an employee doesn't report tips to the employer?

However, if an employee fails to report tips to his or her employer, many employers don't realize that they're also liable for the employer share of social security and Medicare taxes on the unreported tips, though not until the notice and demand is made to the employer by the Service.

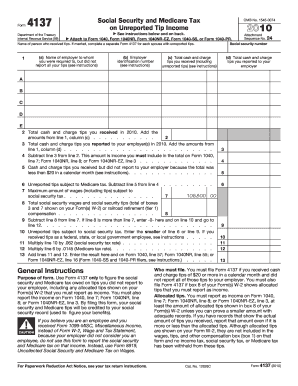

What is Form 4137?

Form 4137 is used by employees to report and pay their share of social security and Medicare taxes on tips they didn't report to you. This should include any allocated tips shown on Form W-2, unless the employee has adequate records (a daily tip record or other credible evidence) to show that the employee didn't receive the allocated tips.

Do you have to report tips to Social Security?

No report is required for months when tips are less than $ 20. You, as an employer, must collect and pay the employee share of social security and Medicare taxes on tips your employee reports. You can collect these taxes from the employee’s wages or from other funds he or she makes available.

Do you have to file Form 8027 for tips?

The employer isn't required to withhold and pay the employee share of social security and Medicare taxes on unreported tips. You must file Form 8027 if you operate a large food or beverage establishment. A large food or beverage establishment is a food or beverage operation located in the 50 states or in the District of Columbia ...

How is Medicare calculated on W2?

How are Medicare wages calculated on w2? It is calculated as the employee's gross earnings less the non-taxable items, without any maximum on gross wages. Employers are required to withhold 1.45% of employee's Medicare wages as Medicare tax and submit a matching amount to cover the costs of the Medicare program. Click to see full answer.

What is Medicare payroll tax?

Medicare wages are employee earnings that are subject to a U.S. payroll tax known as the "Medicare tax.". Similar to the other U.S. payroll tax, Social Security, the Medicare tax is used to fund the government's Medicare program, which provides subsidized healthcare and hospital insurance benefits to retirees and the.