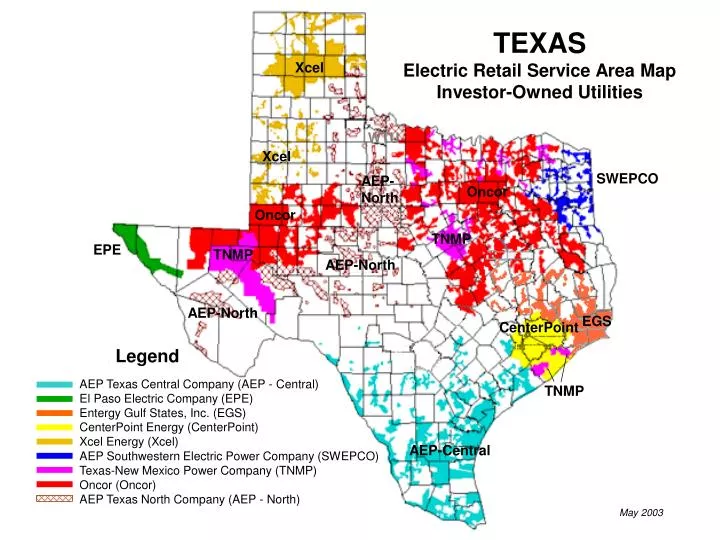

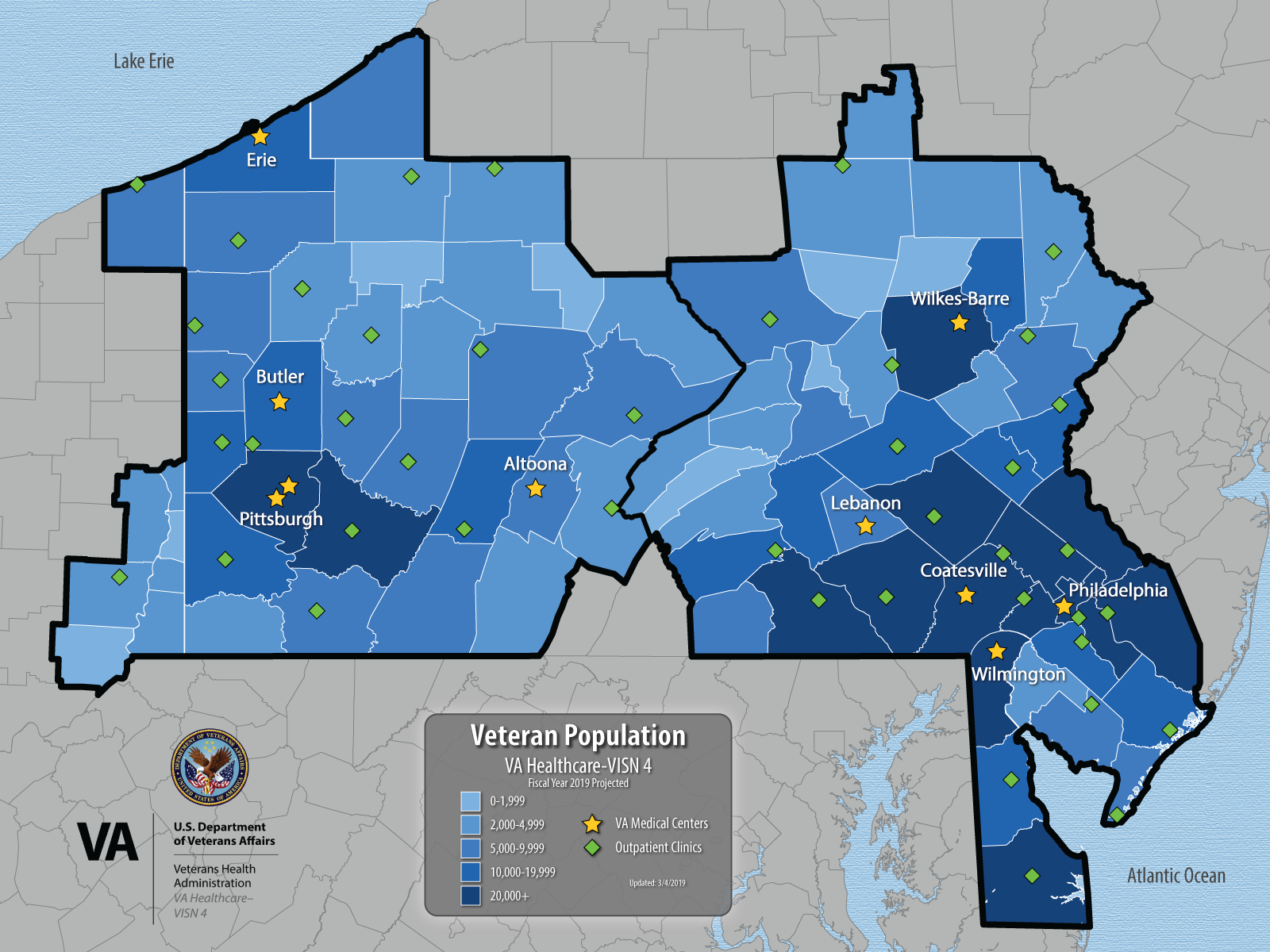

If you have a Medicare Advantage (Part C) or Prescription Drug (Part D) Plan, your coverage is likely restricted to a specific service area. If you are moving outside your current plan’s area, you must enroll in a new plan which includes the area where your new home is.

Full Answer

What happens to my Medicare Advantage plan if I move?

If you have a Medicare Advantage (Part C) or Prescription Drug (Part D) Plan, your coverage is likely restricted to a specific service area. If you are moving outside your current plan’s area, you must enroll in a new plan which includes the area where your new home is.

What is a Medicare Advantage plan?

Medicare Advantage Plans are another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by Medicare-approved private companies that must follow rules set by Medicare.

Do Medicare Advantage plans cover out-of-network providers?

Some Medicare Advantage plans may offer coverage for out-of-network providers. Depending on the plan’s terms, seniors may pay a higher co-payment or coinsurance for these services. Urgent and emergency situations are exceptions to these rules.

Do I still have Medicare if I join a Medicare Advantage plan?

If you join a Medicare Advantage Plan, you’ll still have Medicare but you’ll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare.

Which type of coverage may be excluded from a Medicare Advantage plan?

Non-medical services, including a private hospital room, hospital television and telephone, canceled or missed appointments, and copies of x-rays. Most non-emergency transportation, including ambulette services. Certain preventive services, including routine foot care.

Do Medicare Advantage plans follow Medicare billing guidelines?

Medicare Advantage Plans Must Follow CMS Guidelines In the United States, according to federal law, Part C providers must provide their beneficiaries with all services and supplies that Original Medicare Parts A and B cover.

Can you switch back and forth between Medicare and Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Can I have Medicare and Medicare Advantage at the same time?

People with Medicare can get their health coverage through either Original Medicare or a Medicare Advantage Plan (also known as a Medicare private health plan or Part C).

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Do Medicare Advantage plans follow the 2 midnight rule?

The two-midnight rule is included in the Medicare manuals and is not superseded by regulation, so Medicare Advantage plans must follow it.”

Can I switch from a Medicare Advantage plan to a Medigap plan?

Most Medicare Advantage Plans offer prescription drug coverage. , you may want to drop your Medigap policy. Your Medigap policy can't be used to pay your Medicare Advantage Plan copayments, deductibles, and premiums.

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.

Can you cancel a Medicare Advantage plan at any time?

No, you can't switch Medicare Advantage plans whenever you want. But you do have options if you're unhappy with your plan. You can jump to another plan or drop your Medicare Advantage plan and change to original Medicare during certain times each year.

Which two Medicare plans Cannot be enrolled together?

You generally cannot enroll in both a Medicare Advantage plan and a Medigap plan at the same time.

Do you still pay Medicare Part B with an Advantage plan?

You continue to pay premiums for your Medicare Part B (medical insurance) benefits when you enroll in a Medicare Advantage plan (Medicare Part C). Medicare decides the Part B premium rate. The standard 2022 Part B premium is estimated to be $158.50, but it can be higher depending on your income.

Can you have both a Medicare Advantage plan and a supplemental plan?

Can you have a Medicare Advantage plan and a Medicare Supplement plan? Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

What is an HMO plan?

Health Maintenance Organization (HMO) plan is a type of Medicare Advantage Plan that generally provides health care coverage from doctors, other health care providers, or hospitals in the plan’s network (except emergency care, out-of-area urgent care, or out-of-area dialysis). A network is a group of doctors, hospitals, and medical facilities that contract with a plan to provide services. Most HMOs also require you to get a referral from your primary care doctor for specialist care, so that your care is coordinated.

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).

What to do if you move to a new state with Medicare?

If you are moving, no matter what type of Medicare coverage you have, you must inform the Social Security Administration of your new address. If you cannot keep your current healthcare providers, perhaps they can recommend people in your new state.

How to enroll in Medicare Supplement Plan?

1. Enroll in a Medicare Supplement Plan through your current Medigap provider if it covers the same, or fewer benefits than your current SELECT plan. 2. Enroll in a Medigap plan offered by any provider in your new area of service. Also, if you have a Medicare Advantage plan in your current state but there are no available Part C plans in the state ...

How long does a SEP last?

If you notify your provider before you move, your SEP begins the month before you move and continues for two months after the move. If you wait until after you move to notify your provider, your SEP begins the month of notification and ends after two months have passed. If you have a Medicare Advantage plan before you move ...

What is a SEP in Medicare?

You can take advantage of a Special Enrollment Period (SEP) to make changes to a Part C or D plan. SEPs are available for Medicare recipients who experience certain life events. If you are moving outside your plan’s area of service and need a new plan, or if you are moving within the plan’s area of service and wish to include new plan options ...

How to change my Social Security mailing address?

When you move, you should also contact the Social Security Administration to change your on-file mailing address. You can do this online at the official S.S.A. site which is www.ssa.gov, or you can phone them at 1-800-772-1213 Monday through Friday from 7:00 a.m. to 7:00 p.m.

Does Medicare require you to use a hospital?

Medicare does not require you to use healthcare providers or hospitals in networks, as is the case with some Medicare Advantage plans. Once you have moved, you can choose any physician, hospital, or other healthcare provider as long as they accept Medicare assignment. Using healthcare providers who accept Medicare assignment ensures ...

Do you need to change your Medicare plan when you move?

Generally speaking, if your plan requires that you use a set network for healthcare service providers, you will need to make more changes when you move . Because having continuous healthcare coverage is so important, you should have all the facts about how your Medicare benefits are affected by your move before you start packing.

What is Medicare Advantage Plan?

When you enroll in a Medicare Advantage plan, it replaces your Original Medicare coverage and offers the same benefits that you get from Medicare Part A and Part B.

What is the Medicare Advantage spending limit?

Medicare Advantage (Medicare Part C) plans, however, do feature an annual out-of-pocket spending limit for covered Medicare expenses. While each Medicare Advantage plan carrier is free to set their own out-of-pocket spending limit, by law it must be no greater than $7,550 in 2021. Some plans may set lower maximum out-of-pocket (MOOP) limits.

What is the Medicare donut hole?

Medicare Part D prescription drug plans feature a temporary coverage gap, or “ donut hole .”. During the Part D donut hole, your drug plan limits how much it will pay for your prescription drug costs. Once you and your plan combine to spend $4,130 on covered drugs in 2021, you will enter the donut hole. Once you enter the donut hole in 2021, you ...

How much is Medicare Part A deductible in 2021?

You are responsible for paying your Part A deductible, however. In 2021, the Medicare Part A deductible is $1,484 per benefit period. During days 61-90, you must pay a $371 per day coinsurance cost (in 2021) after you meet your Part A deductible.

What happens if you spend $6,550 out of pocket in 2021?

After you spend $6,550 out-of-pocket on covered drugs in 2021, you leave the donut hole coverage gap and enter the catastrophic coverage stage. Once you reach this stage, you only pay a small coinsurance or copayment for your covered drugs for the rest of the year.

What is Medicare Part B and Part D?

Medicare Part B (medical insurance) and Part D have income limits that can affect how much you pay for your monthly Part B and/or Part D premium. Higher income earners pay an additional amount, called an IRMAA, or the Income-Related Monthly Adjusted Amount.

How long does Medicare cover hospital care?

Depending on how long your inpatient stay lasts, there is a limit to how long Medicare Part A will cover your hospital costs. For the first 60 days of ...

Is Medicare available in all 50 states?

Search. Page Reviewed / Updated – August 11, 2020. Original Medicare can be used in all 50 states, as well as in the District of Columbia, American Samoa, Guam, the Northern Mariana Islands, Puerto Rico and the Virgin Islands. The same isn’t true for Medicare Advantage plans. These plans have defined service areas and may not cover out-of-state ...

Can Medicare be used out of state?

While some Medicare Advantage plans can be used out of state, these plans usually don’t provide coverage outside of the U.S. Seniors who are traveling out of the country may choose to purchase travel medical insurance. In limited circumstances, Medicare Advantage plans provide coverage outside of the U.S. For example, if seniors are traveling ...

Do seniors have to pay for out of network providers?

Seniors who see out-of-network providers may need to pay the full cost of any services they receive. Some Medicare Advantage plans may offer coverage for out-of-network providers. Depending on the plan’s terms, seniors may pay a higher co-payment or coinsurance for these services. Urgent and emergency situations are exceptions to these rules.

Do Medicare Advantage plans have a network?

Medicare Advantage Plans Have a Provider Network. Generally, seniors need to see doctors who are in their Medicare Advantage plan’s network. Before traveling out of state, seniors should contact their plan to find out if there are any in-network providers at their destination.

Can seniors use their travel benefits outside of their home state?

These benefits may be called visitor or travel benefits, depending on the plan. Seniors who are enrolled in these plans may be able to use their coverage outside of their home state. Visitor or travel benefits may vary between plans. Coverage may only be available in certain areas, and the plan may not cover some types of care.

Does Medicare cover emergency situations?

Urgent and emergency situations are exceptions to these rules. Medicare Advantage plans must cover these situations anywhere in the United States. The plans can’t charge additional costs for these services.

What is Medicare Advantage Plan?

Following the rules of a Medicare Advantage plan can help avert denials for coverage, including seeking preapproval for procedures, exhausting in-network options before seeking alternatives and reviewing medical necessity with a provider before moving forward.

Does Medicare Advantage cover travel?

Medicare Advantage plans are required to offer the same coverage as Medicare Parts A and B, and often provide expanded coverage options.

Does Medicare Advantage cover end stage renal disease?

However, Medicare Advantage plans don’t offer guaranteed coverage under all circumstances.

Can I appeal a Medicare Advantage claim?

Appealing a Denial of Coverage. If a Medicare Advantage insurance claim has been denied, it’s possible to file an appeal. The procedures for appeal can differ from one provider to another, so it’s vital to fully review the plan documentation before starting this process.

What is Medicare Advantage?

Medicare Advantage plans vary, but most include coverage for prescription drugs, as well as vision and dental care. Medicare Advantage plans are guaranteed issue. This means you’re guaranteed acceptance into the plan, provided you live in the plan’s service area and are eligible for original Medicare.

Why won't my Medicare Advantage plan drop me?

Loss of coverage. Eligibility. Special Needs Plans. Finding new coverage. Takeaway. A Medicare Advantage plan can’t drop you because of a health condition or disease. Your plan may drop you, though, if you fail to pay your premiums within a specified grace period. You might also lose your plan if it’s no longer offered by the insurance company, ...

What happens if you miss Medicare open enrollment?

If you miss both your special enrollment window and open enrollment, your coverage will continue automatically through original Medicare. Because your Medicare Advantage plan will no longer be active, you won’t be able to enroll in a new Advantage plan during Medicare Advantage open enrollment.

What happens if you don't pay your Medicare premiums?

For example, if you don’t pay your premiums within the plan’s grace period for nonpayment, you can be dropped. Your plan can also drop you if it’ll no longer be offered in your area or through Medicare. Read on to learn more about why Medicare Advantage plans may end your coverage, how to find a new plan, and more.

When will Medicare Advantage be available for ESRD?

The new law allows individuals with ESRD to be eligible for Medicare Advantage plans, starting January 1, 2021. If you also qualify for an SNP, though, you might still prefer the coverage this type of plan provides.

When will Medicare leave?

It will let you know that your plan is leaving Medicare in January of the next calendar year and will give you information about your options for coverage.

How long does a special enrollment period last for a new insurance?

In most cases, moving will trigger a special enrollment period that generally lasts for 3 months from the date of your move.

What is Medicare General Agency?

Medicare General Agency (GA) is a term that describes an agency with an above street level CMS Medicare contract and two or more licensed, producing sub agents. On an annual basis CMS releases the street level or max commission that an individual agent can receive for either a Medicare Advantage (MA or MAPD) or Prescription Drug Plan (PDP) sale.

Does Aetna accept transfer release?

Aetna Transfer-Release Form – Aetna will only accept their own release. The current up-line would need to sign the release. You can send the signed release to our office either by fax 203-567-6235 or by email to Lisa at [email protected]. Steps after contracting and certifications are done.

Do GA carriers have to be certified before they process sub agents?

Important: Some carriers require the GA Principal to be contracted AND certified before they will process the sub agents contracts.

Does Medicare require GAs to complete licensing?

One issue is with the owner/principal of the GA. In order to receive compensation, Medicare requires GAs to complete licensing and certifications. This applies to their own production as well as production from sub agents.

Can GA agents receive street level compensation?

An agency with a GA contract can receive compensation above the street level. The additional compensation is paid as an override on every sale made from the GA or the sub agents. You can receive street level payments and the additional override in a few different ways. Read below for all the details.

Do new Medicare agents need a release?

If the new agents do not currently offer Medicare plans, they can easily fill out a contracting kit and get started. When you bring in agents that currently have an up-line, you will need a release in order to set them up under your agency.