If your primary payer was Medicare, Medicare Part B would pay 80 percent of the cost and cover $80. Normally, you’d be responsible for the remaining $20. If you have a secondary payer, they’d pay the $20 instead.

Full Answer

What happens if you have a secondary payer on Medicare?

If you have a secondary payer, they’d pay the $20 instead. In some cases, the secondary payer might not pay all the remaining cost. When this happens, you’ll receive a bill for the amount left after the primary and secondary payer’s coverage. Is Medicare primary or secondary?

When did Medicare become the secondary payer?

In 1980, Congress passed legislation that made Medicare the secondary payer to certain primary plans in an effort to shift costs from Medicare to the appropriate private sources of payment.

What is Medicare Secondary Payer (MSP)?

Medicare Secondary Payer (MSP) is the term generally used when the Medicare program does not have primary payment responsibility - that is, when another entity has the responsibility for paying before Medicare.

What is Medicare Part B reimbursement?

The remaining 20 percent that can be billed to the patient is known as the Medicare coinsurance. One of the keys to understanding Medicare Part B reimbursement is “ assignment ,” which can be confusing for those not familiar with medical insurance terminology.

What does Medicare Part A reimburse for?

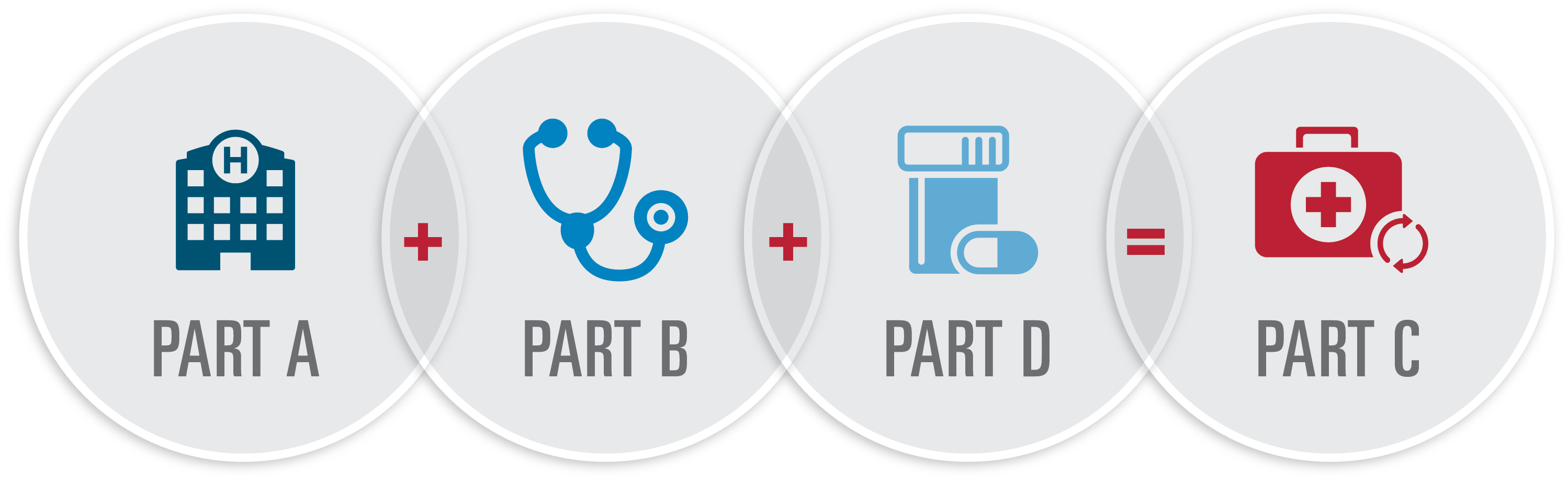

Medicare Part A covers hospital services, hospice care, and limited home healthcare and skilled nursing care. All your Part A–related expenses are covered by Medicare if you receive them through a participating provider who accepts Medicare assignment.

What happens when Medicare is secondary?

The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the remaining costs. If your group health plan or retiree coverage is the secondary payer, you may need to enroll in Medicare Part B before they'll pay.

How is Medicare secondary payment calculated?

As secondary payer, Medicare pays the lowest of the following amounts: (1) Excess of actual charge minus the primary payment: $175−120 = $55. (2) Amount Medicare would pay if the services were not covered by a primary payer: . 80 × $125 = $100.

How do you fill out CMS 1500 when Medicare is secondary?

1:239:21Medicare Secondary Payer (MSP) CMS-1500 Submission - YouTubeYouTubeStart of suggested clipEnd of suggested clipOther insurance that may be primary to medicare is shown on the cms 15 claim form when block 10 isMoreOther insurance that may be primary to medicare is shown on the cms 15 claim form when block 10 is completed a primary insurer is identified in the remarks portion of the bill items 10 a through 10c.

Does Medicare automatically send claims to secondary insurance?

Medicare will send the secondary claims automatically if the secondary insurance information is on the claim. As of now, we have to submit to primary and once the payments are received than we submit the secondary.

Does Medicare pay copays as secondary?

Usually, secondary insurance pays some or all of the costs left after the primary insurer has paid (e.g., deductibles, copayments, coinsurances). For example, if Original Medicare is your primary insurance, your secondary insurance may pay for some or all of the 20% coinsurance for Part B-covered services.

How are Medicare payments calculated?

Your MAGI is calculated by adding your AGI to any of your other income. This includes untaxed foreign income, non-taxable Social Security benefits, tax-exempt interest, and income from within the US territories not already included in your AGI. For most individuals, your MAGI will be the same as your AGI.

How are Medicare claims calculated?

Medicare primary payment is $120 - $100 (deductible) × 80% = $16.Primary allowed of $150 is the higher allowed amount.Primary allowed minus primary paid is $150 - $120 = $30.The lower of Step 1 or 3 is $16. ( This claim will pay $16)

Will Medicare secondary pay primary deductible?

“Medicare pays secondary to other insurance (including paying in the deductible) in situations where the other insurance is primary to Medicare.

What is a CMS-1500 claim?

The CMS-1500 form is the standard claim form used by a non-institutional provider or supplier to bill Medicare carriers and durable medical equipment regional carriers (DMERCs) when a provider qualifies for a waiver from the Administrative Simplification Compliance Act (ASCA) requirement for electronic submission of ...

What is a secondary claim?

You can file a secondary claim to get more disability benefits for a new disability that's linked to a service-connected disability you already have. For example, you might file a secondary claim if you: Develop arthritis that's caused by a service-connected knee injury you got while on active duty, or.

Does Medicare accept the CMS-1500 claim form?

Medicare will accept any Page 3 type (i.e., single sheet, snap-out, continuous feed, etc.) of the CMS-1500 claim form for processing. To purchase forms from the U.S. Government Printing Office, call (202) 512-1800. The following instructions are required for a Medicare claim.

What is Medicare Part B reimbursement?

One of the keys to understanding Medicare Part B reimbursement is “ assignment ,” which can be confusing for those not familiar with medical insurance terminology. Medicare’s definition of an assignment is “an agreement by your doctor, provider, or supplier to be paid directly by Medicare, to accept the payment amount Medicare approves for ...

What percentage of Medicare Part B is paid?

The approved amount is also sometimes referred to as the Medicare Fee Schedule. Medicare Part B pays 80 percent of its approved amount. The remaining 20 percent that can be billed to the patient is known as the Medicare coinsurance.

How much does an assignment cost if a provider does not accept it?

A provider who does not accept assignment can bill you for the $25 difference between the professional fee and the approved amount, plus the $15 coinsurance for a total of $40. From a financial standpoint, it is obvious that it’s to your advantage to find providers and suppliers that accept assignment.

What is Medicare coinsurance?

Medicare coinsurance is your responsibility. Finding providers who accept assignment will save you money and the potential issues of filing your own claim. Medicare claims are processed by contracted insurance providers known as MACs. You have the right to appeal any decision by Medicare.

How much is Medicare Part B deductible?

Medicare Part B has an annual deductible that is currently set at $198 per year. Medicare will not pay anything under Part B until that amount is paid by the patient.

What is an appeal in Medicare?

An appeal is an action you can take if you disagree with the way your claim was processed. If you believe a service or item was denied in error, or you disagree with the amount of payment, you have the right to appeal. You may also appeal if Medicare stops paying for an item or service that you are currently receiving and believe you still need.

Is Medicare less than billed?

It is usually less than the billed charge and varies by geography . Medicare takes into account, for example, that the same office visit probably costs more in New York City than a small town in Nebraska. The approved amount is also sometimes referred to as the Medicare Fee Schedule.

For those who qualify, there are multiple ways to have your Medicare Part B premium paid

In 2022, the standard Medicare Part B monthly premium is $170.10. Beneficiaries also have a $233 deductible, and once they meet the deductible, must typically pay 20% of the Medicare-approved amount for any medical services and supplies.

What is the Part B premium reduction benefit?

The giveback benefit, or Part B premium reduction, is when a Part C Medicare Advantage (MA) plan reduces the amount you pay toward your Part B monthly premium. Your reimbursement amount could range from less than $1 to the full premium amount, which is $170.10 in 2022.

How to find plans that offer the giveback benefit

Not all MA plans offer this benefit, so you must find a plan that does in order to take advantage of the opportunity. In 2022, these plans are offered in nearly all states, so you may find one close to you.

Other Part B reimbursement options

There are other ways you can lower or eliminate how much you pay for the Medicare Part B premium. This includes certain Medicaid programs or benefits from some retiree health plans.

Medicare Second Payer

Medicare Secondary Payer (MSP) is the term used by Medicare when Medicare is not responsible for paying first. (The private insurance industry generally talks about “ Coordination of Benefits ” when assigning responsibility for first and second payment.)

Precedence of Federal Law

Federal law takes precedence over State law and private contracts. Thus, for the categories of people described below, Medicare is the secondary payer regardless of state law or plan provisions. These Federal requirements are found in Section 1862 (b) of the Social Security Act {42 USC Section 1395y (b) (5)}.

Group Health Plans (GHP)

An employer cannot offer, subsidize, or be involved in the arrangement of a Medicare supplement policy where the law makes Medicare the secondary payer. Even if the employer does not contribute to the premium, but merely collects it and forwards it to the appropriate individual’s insurance company, the GHP policy is the primary payer to Medicare.

Responsibilities of Attorneys Under MSP

Immediately, upon taking a case, that involves a Medicare beneficiary, inform the COB Contractor about a potential liability lawsuit, and

Responsibilities of Insurers Under MSP

Report to the COB Contractor if you find that CMS has paid primary when you are primary to Medicare (i.e. 411.25).

How much does Medicare Part B cover?

If your primary payer was Medicare, Medicare Part B would pay 80 percent of the cost and cover $80. Normally, you’d be responsible for the remaining $20. If you have a secondary payer, they’d pay the $20 instead. In some cases, the secondary payer might not pay all the remaining cost.

How does Medicare work with employer sponsored plans?

Medicare is generally the secondary payer if your employer has 20 or more employees . When you work for a company with fewer than 20 employees, Medicare will be the primary payer.

How does Medicare and Tricare work together?

Medicare and TRICARE work together in a unique way to cover a broad range of services. The primary and secondary payer for services can change depending on the services you receive and where you receive them. For example: TRICARE will pay for services you receive from a Veteran’s Administration (VA) hospital.

What is primary payer?

A primary payer is the insurer that pays a healthcare bill first. A secondary payer covers remaining costs, such as coinsurances or copayments. When you become eligible for Medicare, you can still use other insurance plans to lower your costs and get access to more services. Medicare will normally act as a primary payer and cover most ...

What is the standard Medicare premium for 2021?

In 2021, the standard premium is $148.50. However, even with this added cost, many people find their overall costs are lower, since their out-of-pocket costs are covered by the secondary payer. Secondary payers are also useful if you have a long hospital or nursing facility stay.

Does Medicare pay for worker's compensation?

That’s because worker’s compensation is an agreement that your employer will pay medical costs if you’re hurt at work. In return, you agree not to sue them for damages. Since your employer has agreed to pay, Medicare will not pay until the benefit amount of your worker’s compensation is completely spent.

Does Medicare cover other insurance?

Medicare can work with other insurance plans to cover your healthcare needs. When you use Medicare and another insurance plan together, each insurance covers part of the cost of your service. The insurance that pays first is called the primary payer. The insurance that picks up the remaining cost is the secondary payer.

Who is responsible for making sure their primary payer reimburses Medicare?

Medicare recipients may be responsible for making sure their primary payer reimburses Medicare for that payment. Medicare recipients are also responsible for responding to any claims communications from Medicare in order to ensure their coordination of benefits proceeds seamlessly.

What is secondary payer?

A secondary payer assumes coverage of whatever amount remains after the primary payer has satisfied its portion of the benefit, up to any limit established by the policies of the secondary payer coverage terms.

How does Medicare work with insurance carriers?

Generally, a Medicare recipient’s health care providers and health insurance carriers work together to coordinate benefits and coverage rules with Medicare. However, it’s important to understand when Medicare acts as the secondary payer if there are choices made on your part that can change how this coordination happens.

Is Medicare a secondary payer?

Medicare is the secondary payer if the recipient is: Over the age of 65 and covered by an employment-related group health plan as a current employee or the spouse of a current employee in an organization with more than 20 employees.

Does Medicare pay conditional payments?

In any situation where a primary payer does not pay the portion of the claim associated with that coverage, Medicare may make a conditional payment to cover the portion of a claim owed by the primary payer. Medicare recipients may be responsible for making sure their primary payer reimburses Medicare for that payment.

When did Medicare become secondary?

Prior to August 10, 1993 , Medicare was secondary for active individuals under age 65, entitled to Medicare due to disability and covered by a LGHP through a relationship to an employer (i.e. employed or retired beneficiary, spouse or other family member).

When was Medicare dually entitled?

Anytime an individual is entitled to Medicare for 2 different reasons, they are considered dually entitled. Prior to August 10, 1993, Medicare became primary or first payer on the first day of the month an individual became dually entitled.

What is LGHP in Medicare?

A LGHP is defined as a plan sponsored or contributed to by an employer or employee organization (union).

How many employees are required to be on Medicare?

In order to meet the Working Aged provision, the employer must have at least 20 employees working for the company. At times, 2 or more smaller employers combine to provide coverage.

When did Medicare become the primary payer?

Until 1980, Medicare was the primary payer for all Medicare covered services except for services covered by workers’ compensation or black lung benefits or paid for by the Department of Veterans Affairs or other government entities. Since 1980, a series of changes in the Medicare law has shifted costs from the Medicare program to private sources ...

When a veteran is eligible for Medicare benefits and has no prior authorization from the VA for care, what is the answer

When a veteran is eligible for Medicare benefits and has no prior authorization from the VA for care—unless the veteran is eligible for payment for care as an unauthorized service, and the veteran chooses to submit a claim to the VA for unauthorized services rather than utilizing Medicare benefits.

Is Medicare a secondary insurance?

For Medicare to be secondary, the coverage must be the result of current employment status. The Medicare beneficiary may be retired and have retiree coverage. If the spouse is still employed and provides coverage, this coverage will be primary to Medicare. a.1 Vow of Poverty Provision.

What is Medicare beneficiary?

The Medicare beneficiary when the beneficiary has obtained a settlement, judgment, award or other payment. The liability insurer (including a self-insured entity), no-fault insurer, or workers’ compensation (WC) entity when that insurer or WC entity has ongoing responsibility for medicals (ORM). For ORM, there may be multiple recoveries ...

What is included in a demand letter for Medicare?

The demand letter also includes information on administrative appeal rights. For demands issued directly to beneficiaries, Medicare will take the beneficiary’s reasonable procurement costs (e.g., attorney fees and expenses) into consideration when determining its demand amount.

Can CMS issue more than one demand letter?

For ORM, there may be multiple recoveries to account for the period of ORM, which means that CMS may issue more than one demand letter. When Medicare is notified of a settlement, judgment, award, or other payment, including ORM, the recovery contractor will perform a search of Medicare paid claims history.

What is the penalty for reimbursing Medicare Part B?

Unless the employer payment plan is integrated with a group health plan, reimbursing Medicare Part B or Part D premiums will result in a non-compliant group health plan, subject to $100 per employee per day penalties. (See Question 12 for more.)

What are the penalties for Medicare secondary payer?

There are numerous penalties that exist for violation of Medicare Secondary Payer rules.Medicare Civil Money Penalties: Any entity that makes a prohibited offer or incentive to an employee, whether oral or in writing, is subject to a civil money penalty of up to $5,000 per offer. Failure on the part of a group health plan to fulfill reporting ...

What are the penalties for Medicare?

A12. There are numerous penalties that exist for violation of Medicare Secondary Payer rules.Medicare Civil Money Penalties: 1 Any entity that makes a prohibited offer or incentive to an employee, whether oral or in writing, is subject to a civil money penalty of up to $5,000 per offer. 2 Failure on the part of a group health plan to fulfill reporting requirements under Section 111 to allow for the coordination of benefits can result in a civil money penalty of $1,000 a day for each day of non-compliance for each individual for which the information should have been submitted.

How much is the penalty for Medicare not integrated?

If an employer reimburses an individual’s Medicare premium that is not integrated with a group health plan (see Question 10), they are subject to a $100 IRS penalty, per employee, per day for violating individual premium reimbursement rules under PPACA. For practical purposes, employers with more than 20 employees will not be able ...

What is Medicare questionnaire?

The Centers for Medicare and Medicaid (CMS) mails questionnaires to individuals before they become entitled to benefits under Medicare Part A or enroll in Medicare Part B to determine if they are eligible for primary coverage under another plan. Q6.

How old do you have to be to get Medicare?

Generally the Medicare Secondary Payer rules prohibit employers with more than 20 employees from in any way incentivizing an active employee age 65 or older to elect Medicare instead of the group health plan, which includes offering a financial incentive.

What age do you have to be to get the same health insurance?

A2. Employers are required to offer employees age 65 or over the same group health plan coverage offered to younger workers. Workers with Medicare-eligible spouses must be offered the same spousal benefits as employees with spouses that are not Medicare-eligible.

Important Terminology

Billed Amount vs. Approved Amount

- The billed amount, or professional fee, is simply the amount for a service or item that appears on a provider’s bill. If no insurance was involved, that is the amount a patient would be charged. Medicare takes into account, for example, that the same office visit probably costs more in New York City than a small town in Nebraska. The approved amount is also sometimes referred to a…

Assignment

- One of the keys to understanding Medicare Part B reimbursement is “assignment,” which can be confusing for those not familiar with medical insurance terminology. Medicare’s definition of an assignment is “an agreement by your doctor, provider, or supplier to be paid directly by Medicare, to accept the payment amount Medicare approves for the servic...

What If The Doctor Or Supplier Does Not Accept assignment?

- This does not mean you cannot seek treatment from them. It also doesn’t mean the service or item will be denied by Medicare. These are both common misconceptions. However, there are some distinct disadvantages to using non-participating providers: 1. You may have to pay the entire charge for the service or item at the time of service. 2. You will usually end up paying mor…

How Are Medicare Part B Claims paid?

- All Medicare Part B claims are processed by contracted insurance providers divided by region of the country. The current term for these providers is “Medicare administrative contractors” (MACS). Providers file your Part B claim to one of the MACS and it is from them that you will receive a notice of how the claim was processed. The statement you will receive is called a Medicare Sum…

Medicare Supplemental Insurance

- While not strictly a part of Medicare, “Medigap” plans are worth a brief mention. They are sold by private insurers in every state, and their main function is to pick up the 20 percent Medicare coinsurance. More extensive information on them is available on the Medicare website at this tab.

Filing An Appeal

- An appeal is an action you can take if you disagree with the way your claim was processed. If you believe a service or item was denied in error, or you disagree with the amount of payment, you have the right to appeal. You may also appeal if Medicare stops paying for an item or service that you are currently receiving and believe you still need. If you decide toappeal Medicare’s decision…