Full Answer

What is the fall Medicare open enrollment period?

This period runs from October 15 to December 7 every year. During the Fall Medicare Open Enrollment Period for Medicare Advantage and Medicare prescription drug coverage, you can: Enroll in, make changes to or disenroll from a Medicare Advantage plan (Medicare Part C)

When can I enroll in Medicare?

The earliest time you can enroll in Original Medicare, a Medicare Advantage plan or a Medicare Part D prescription drug plan is during your Medicare Initial Enrollment Period (IEP). Your Initial Enrollment period lasts for seven months: It begins three months before you turn 65 It includes your birth month

Who enrolls in Medicare Advantage plans in 2019?

Medicare Advantage enrollment is highly concentrated among a small number of firms. UnitedHealthcare and Humana together account for 44 percent of all Medicare Advantage enrollees nationwide, and the BCBS affiliates (including Anthem BCBS plans) account for another 15 percent of enrollment in 2019.

What is the Medicare annual election period (AEP)?

AEP is also called the Medicare Annual Election Period and the Open Enrollment Period for Medicare Advantage and Medicare prescription drug coverage. This period runs from October 15 to December 7 every year.

What is the deadline for choosing a Medicare plan?

From October 15 – December 7 each year, you can join, switch, or drop a plan. Your coverage will begin on January 1 (as long as the plan gets your request by December 7). Medicare Advantage Open Enrollment Period.

Are Medicare plans calendar year?

Does Medicare Run on a Calendar Year? Yes, Medicare's deductible resets every calendar year on January 1st. There's a possibility your Part A and/or Part B deductible will increase each year. The government determines if Medicare deductibles will either rise or stay the same annually.

When should you start planning for Medicare?

65Generally, you're first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65. (You may be eligible for Medicare earlier, if you get disability benefits from Social Security or the Railroad Retirement Board.)

What are the 2022 changes to Medicare?

Part A premiums, deductible, and coinsurance are also higher for 2022. The income brackets for high-income premium adjustments for Medicare Part B and D start at $91,000 for a single person, and the high-income surcharges for Part D and Part B increased for 2022.

What is the plan year?

Plan year means a consecutive 12-month period during which a health plan provides coverage for health benefits. A plan year may be a calendar year or otherwise.

How do I know if my insurance is on a calendar year?

To find out when your plan year begins, you can check your plan documents or ask your employer. (Note: For individual health insurance policies this 12-month period is called a “policy year”).

What do I need to do before I turn 65?

Turning 65 Soon? Here's a Quick Retirement ChecklistPrepare for Medicare. ... Consider Additional Health Insurance. ... Review Your Social Security Benefits Plan. ... Plan Ahead for Long-Term Care Costs. ... Review Your Retirement Accounts and Investments. ... Update Your Estate Planning Documents.

Can you have Medicare and employer insurance at the same time?

Can I have Medicare and employer coverage at the same time? Yes, you can have both Medicare and employer-provided health insurance. In most cases, you will become eligible for Medicare coverage when you turn 65, even if you are still working and enrolled in your employer's health plan.

How much does Medicare cost at age 62?

Reaching age 62 can affect your spouse's Medicare premiums He can still receive Medicare Part A, but he will have to pay a monthly premium for it. In 2020, the Medicare Part A premium can be as high as $458 per month.

Will Medicare premiums increase in 2023?

After record rate hike this year, Medicare Part B could see a low premium increase for 2023. While Medicare Part B monthly premiums jumped almost 15% in 2022, unexpected savings on a new, expensive drug may mean a much smaller rise in rates for 2023.

What will the Medicare Part B premium be in 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What will Medicare cost me in 2022?

In 2022, the premium is either $274 or $499 each month, depending on how long you or your spouse worked and paid Medicare taxes. You also have to sign up for Part B to buy Part A. If you don't buy Part A when you're first eligible for Medicare (usually when you turn 65), you might pay a penalty.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What are the extra benefits that Medicare doesn't cover?

Plans may offer some extra benefits that Original Medicare doesn’t cover—like vision, hearing, and dental services.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

How much does Medicare pay for Part B?

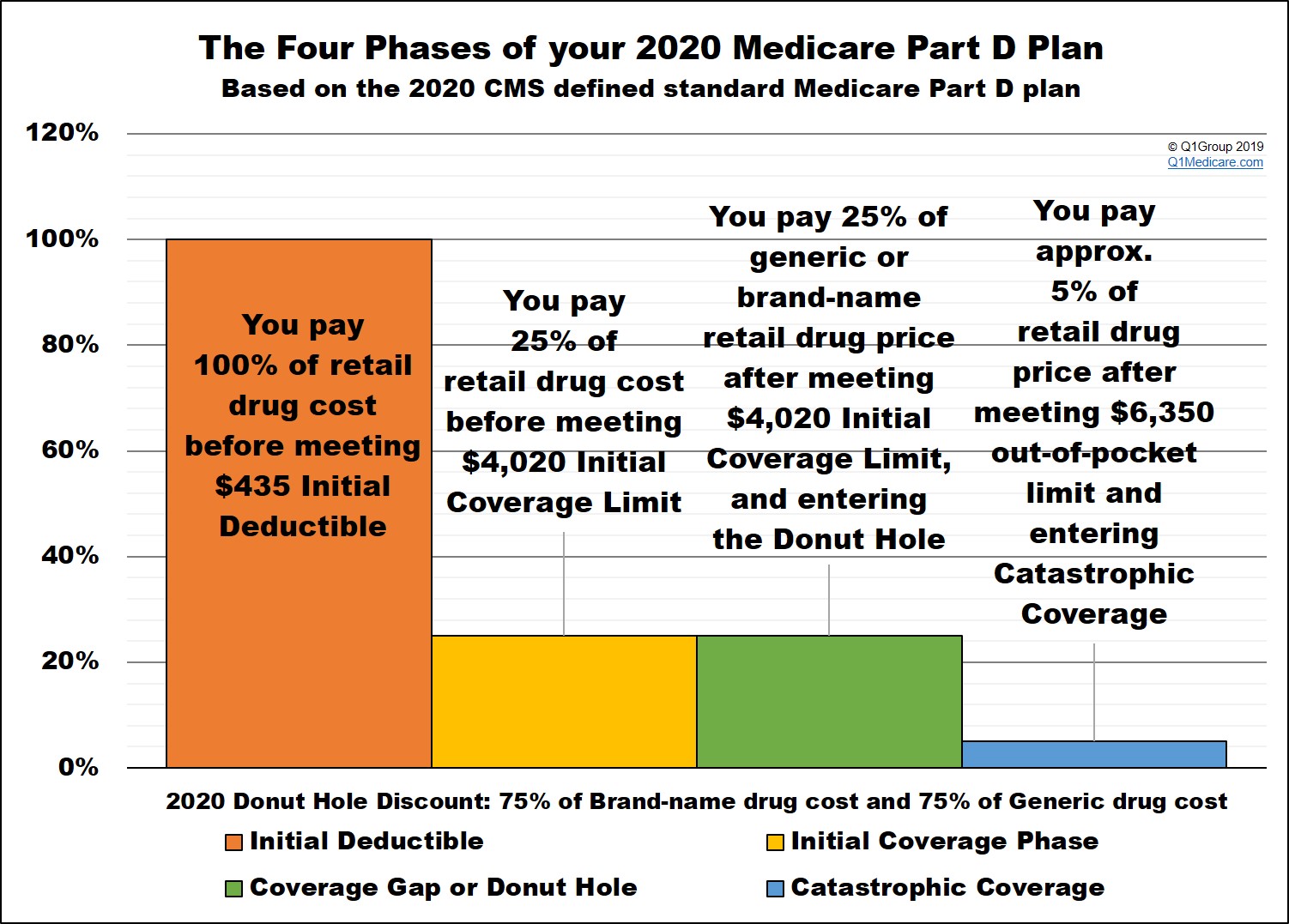

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

What is Medicare Supplement Insurance?

You can get a Medicare Supplement Insurance (Medigap) policy to help pay your remaining out-of-pocket costs (like your 20% coinsurance). Or, you can use coverage from a former employer or union, or Medicaid.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

Does Medicare have other coverage?

You may also have other coverage, like employer or union, military, or veterans' benefits. Learn about how Medicare works with other insurance.

When does Medicare open enrollment start?

The annual Medicare Advantage Open Enrollment Period begins January 1 and continues through March 31. During this period, you can change to a different Medicare Advantage plan or switch to Original Medicare and add a Part D plan if desired.

How to avoid Medicare enrollment pitfalls?

Avoid Medicare enrollment pitfalls by understanding Medicare’s various enrollment periods and whether you might qualify for them .

What about enrolling in Medicaid?

Although Medicare and Medicaid sound like closely named twins, these completely separate programs are cousins at most.

What happens if my Medicare coverage ends?

If your current Medicare or employer-provided coverage suddenly ends, you may not have to wait for Medicare Open Enrollment to obtain new coverage. Instead, that change may cause you to qualify for a Special Enrollment Period (SEP). Many people use an SEP because they move out of their plan’s area, lose health insurance at work or as a result ...

What happens if you miss the enrollment period for Medicare?

Unlike the health insurance you may have had as an employee, Medicare has multiple enrollment periods—each designed for people in a specific situation. If you miss the right period, you could end up going without coverage and racking up Late Enrollment Penalties (LEPs).

What is MAOEP in Medicare?

If you begin the year with a Medicare Advantage plan and then realize your needs have changed, the Medica re Advantage Open Enrollment Period (MAOEP) could save you from buyer’s remorse. Just don’t confuse this enrollment period with the fall Medicare Enrollment Period.

Can you get Medicare Supplement after open enrollment?

If you wait until Open Enrollment to enroll in Medicare Supplement (Medigap)—and it is after your Medicare Supplement Enrollment Period is over—insurers could potentially deny you coverage or charge higher premiums. That’s because a Medigap plan works a bit differently than other Medicare plans.

What changes can you make?

Starting next year, a new open enrollment period for Medicare Advantage plans will run from Jan. 1 through March 31. If you’re enrolled in one of these plans, you can make the following changes during this time.

Why switch up?

Many of the benefits the Medicare Advantage plans offer go beyond what original Medicare provides and can change from year to year. For instance, this year your plan may cover a prescription medicine that you regularly take, but next year it may not be on the list of covered medications, even if it’s the same plan.

When does Part A coverage start?

If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65. (If your birthday is on the first of the month, coverage starts the month before you turn 65.)

When does insurance start?

Generally, coverage starts the month after you sign up.

How long do you have to sign up for a health insurance plan?

You also have 8 months to sign up after you or your spouse (or your family member if you’re disabled) stop working or you lose group health plan coverage (whichever happens first).

What is a health plan?

In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

When will Medicare fall enrollment go into effect?

Plan changes you make during the 2020 Medicare Fall Annual Enrollment Period go into effect January 2021.

When do you get your Medicare card?

Your Medicare coverage will begin either on the first day of the month during which you turn 65 or on the first day of your 25th month receiving disability benefits.

Who Is Eligible for Medicare?

You are a U.S. citizen or permanent legal resident who has lived in the U.S. for five continuous years

What is the AEP period?

AEP is also called the Medicare Annual Election Period and the Open Enrollment Period for Medicare Advantage and Medicare prescription drug coverage.

How long does Medicare initial enrollment last?

Your Initial Enrollment period lasts for seven months : It begins three months before you turn 65.

How long does Medicare last?

It includes your birth month. It extends for another three months after your birth month. If you are under 65 and qualify for Medicare due to dis ability, the 7-month period is based around your 25th month of disability benefits.

What happens if you don't sign up for Medicare?

If you don't sign up during your Initial Enrollment Period and if you aren't eligible for a Special Enrollment Period , the next time you can enroll in Medicare is during the Medicare General Enrollment Period.

When will Medicare card arrive?

Your Medicare card will arrive in the mail 3 months before you 65th birthday. You may decline Part B coverage at that time if you so choose. If you choose to join a Medicare Advantage or standalone Medicare Prescription Drug plan, you may do so during your 7-month Medicare Initial Enrollment Period.

When will Medicare be available for Social Security?

Your Medicare card will arrive three months before your 25 month of disability. You may also choose to enroll in a Medicare Advantage plan or a Prescription Drug Plan.

How long is the Medigap Plan A guaranteed issue period?

And each year, carriers must designate a one-month guaranteed-issue period (outside of Open Enrollment), during which any applicant will be accepted into Medigap Plan A. Medicare Savings Programs (MSPs) – Main has state-specific guidelines for Medicare Savings programs related to income limits.

How long is the Medigap Open Enrollment Period?

Medigap OEP. Medigap Open Enrollment Period. 6 months, starting the month you’re 65 or older and enrolled in Medicare Part B. Can vary, but usually begins the first day of the month after you apply.

What is the Low Income Assistance Program?

Low Income Assistance Program — The Extra Help/Low Income Subsidy can help pay your Medicare Part D premiums, deductibles and copays. Old Age Pension Health and Medical Care Program (OAP) — If you make too much to qualify for Health First Colorado and receive Old Age Pension, you may be eligible for OAP.

How long does it take to get ALS on Medicare?

Amytrophic Lateral Sclerosis (ALS or Lou Gehrig's disease) If you have ALS, there's no 24 month waiting period. You'll be automatically enrolled in Original Medicare the same month your Social Security disability benefits begin. You may also choose to enroll in a Medicare Advantage or Prescription Drug plan.

What is SEP in Medicare?

SEP. Special Enrollment Period for the Working Aged and Working Disabled. For Original Medicare Part A and Part B: 8 months, following the month you retire or lose creditable coverage; For Medicare Part C and Part D: 63 days after the loss of employer healthcare coverage. Coverage start date varies.