What is the Medicare Shared Savings Program (shared savings program)?

The Medicare Shared Savings Program (Shared Savings Program) offers providers and suppliers (e.g., physicians, hospitals, and others involved in patient care) an opportunity to create an Accountable Care Organization (ACO).

What is a Medicare Shared Savings Program ACO?

April marks the 10-year anniversary of the start of the agreement period for the first Accountable Care Organizations (ACOs) in the Medicare Shared Savings Program (Shared Savings Program) – an ambitious program to reward health care providers for improving health care for people with Medicare.

What is the shared savings program track 1 model?

The vast majority of Shared Savings Program ACOs have chosen to enter and maximize the allowed time under Track 1, the one-sided, shared savings-only model, under which eligible ACOs receive a share of any savings under their benchmark but are not required to pay back a share of spending over the benchmark.

How do Medicare savings programs pay for care?

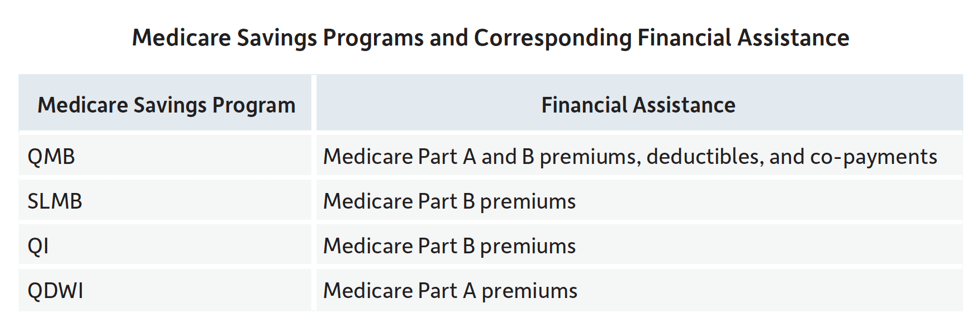

In some cases, Medicare Savings Programs may also pay Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care. Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services. deductibles, coinsurance, and copayments if you meet certain conditions.

What is the shared saving program?

The Shared Savings Program is a voluntary program that encourages groups of doctors, hospitals, and other health care providers to come together as an ACO to give coordinated, high quality care to their Medicare beneficiaries. To learn more about ACOs, visit the Accountable Care Organizations webpage.

What is the difference between MSSP and ACO?

The MSSP is a permanent ACO program in traditional Medicare that provides financial incentives for meeting or exceeding savings targets and quality goals. The MSSP program has multiple tracks that allow ACOs to choose between sharing in both savings and losses, or just savings.

How many MSSP ACOs are there?

CMS Wednesday released its annual summary of the Medicare Shared Savings Program (MSSP), showing that the number of accountable care organizations (ACOs) in the program grew to 483 in 2022, up from 477 in 2021.

What are the 2021 ACO quality measures?

In 2021, ACOs will have two options for reporting quality measures to CMS for quality assessments in the MSSP: 1) Report Web Interface measures—for ACOs choosing to report Web Interface measures in 2021, a sample of patients will be provided by CMS (as has been the case in previous years with this reporting method).

How does ACO shared savings work?

When an ACO achieves a certain level of savings, an ACO can “share” in the savings with its payer, whether it be Medicare, Medicaid, and/or a commercial insurer. Shared savings payouts are generally contingent upon quality performance to ensure that ACOs are not withholding needed services in order to retain savings.

What are the three types of Medicare accountable care organizations?

Medicare offers three main participation options, including the Medicare Shared Savings Program (MSSP), the Pioneer ACO Model, and the Next Generation ACO Model.

What is the difference between MSP and MSSP?

Difference between an MSP and MSSP While MSPs and MSSPs both provide third-party services to businesses; their focus is very different. An MSP delivers network, application, database and other general IT support and services while an MSSP is exclusively focused on providing cybersecurity services.

What is the difference between MDR and MSSP?

While MSSPs can be heavily automated services, MDR is human-operated, with live threat hunters monitoring customer networks in real time for both indicators of attack (IOAs) and IOCs.

How many ACOs are in the United States in 2021?

The number of accountable care organizations participating in the Medicare Shared Savings Program (MSSP) modestly increased to 483 this year compared with 477 for 2021, sparking new worries from advocates over the future of the program.

What is ACO quality score?

6. 85.50. The audit-adjusted quality score will be the quality score that is used to determine the final sharing rate of any savings that the ACO may share or the percentage of any losses for which the ACO is accountable.

How are ACO benchmarks calculated?

The benchmark is based upon adjusting each benchmark year to BY3 and blending each benchmark year into a composite per capita target. The benchmark can also be adjusted based on the BY3 expenditure levels in the ACO's region—this is called the regional FFS adjustment.

What is ACO 38?

ACO-38 measures the rate of risk- standardized acute, unplanned hospital admissions among Medicare fee-for-service beneficiaries 65 years and older with multiple chronic conditions who are assigned to the ACO.

For Accountable Care Organizations

Find information about the Shared Savings Program application process, program participation, financial benchmarking, quality reporting, and more. Learn more >

For Providers

Find information about eligibility requirements, locating Accountable Care Organizations (ACOs) in your area, and coordinating care as an ACO provider. Learn more >

Program Data

Find publicly available datasets related to ACO participation and performance. Learn more >

Program Guidance & Specifications

Find guidance and specification documents relevant to the application process and program participation. Learn more >

Program Statutes & Regulations

Find final rules, program statutes, and other regulatory documents for the Shared Savings Program. Learn more >

How much Medicare Part B do you have to pay for incentive payments?

To be eligible for incentive payments under MIPS, physicians must receive 25% of their Medicare Part B payments or see 20% of their patients through the advanced APM.

What is MSSP in healthcare?

Medicare Shared Savings Program (MSSP) Provide high-quality, coordinated care to improve outcomes and reduce costs. That’s the primary goal of the Medicare Shared Savings Program (MSSP). The MSSP is an alternative payment model in which eligible providers, hospitals, and suppliers are rewarded for achieving better health for individuals, ...

Is an ACO higher than MSSP?

In other words, the ACO’s actual costs will be higher than the anticipated ones. Without complete and accurate HCC capture, ACOs may not be able to stay below the MSSP benchmark even when cost reduction efforts have been maximized. Another consideration is that joining or forming an ACO may require significant costs.

Can Medicare beneficiaries choose any provider?

Medicare beneficiaries can continue to choose any provider who accepts Medicare—even if that provider is not part of the ACO. However, beneficiaries benefit from seeing providers in the ACO network because these providers all have a vested interest in providing coordinated, high-quality care.

Is MSSP still in the spotlight?

As the industry continues to shift toward value-based payment models, the MSSP will likely continue to remain in the spotlight. By rewarding providers to improve outcomes and lower costs, the MSSP will gain even more traction. DUMMYTEXT.

Does MSSP require an ACO?

Another consideration is that joining or forming an ACO may require significant costs. MSSP ACOs that include separately recognized legal entities must establish a new legal entity for the combined participants. Each ACO must also create a governing body that represents providers, suppliers, and beneficiaries.

What is shared savings?

The Shared Savings Program is an important innovation for moving the Centers for Medicare & Medicaid Services' (CMS') payment system away from volume and toward value and outcomes. It is an alternative payment model that: 1 Promotes accountability for a patient population. 2 Coordinates items and services for Medicare FFS beneficiaries. 3 Encourages investment in high quality and efficient services.

When does the ACO share savings program start?

The following table summarizes participation options under the BASIC track and ENHANCED track for agreement periods of at least five years, beginning on July 1, 2019, and in subsequent years.

What is Medicare ACO?

The Medicare Shared Savings Program (Shared Savings Program) offers providers and suppliers (e.g., physicians, hospitals, and others involved in patient care) an opportunity to create an Accountable Care Organization (ACO). An ACO agrees to be held accountable for the quality, cost, and experience of care of an assigned Medicare fee-for-service ...

What is the final rule for Medicare?

Final Rule Creates Pathways to Success for the Medicare Shared Savings Program. On December 21, 2018, the Centers for Medicare & Medicaid Services (CMS) issued a final rule that sets a new direction for the Medicare Shared Savings Program (Shared Savings Program). Referred to as “Pathways to Success,” this new direction for ...

When will CMS resume?

CMS will resume the usual annual application cycle for agreement periods starting on January 1, 2020, and in subsequent years. This fact sheet summarizes the major changes that are included in the Pathways to Success final rule. Additionally, earlier this year, CMS finalized certain changes to the Shared Savings Program as part ...

What is a beneficiary incentive program?

Beneficiary Incentive Programs: To encourage patient engagement, ACOs under certain two-sided models will have the opportunity to apply to operate a beneficiary incentive program. Consistent with the BBA of 2018, an ACO approved to operate a beneficiary incentive program will provide an incentive payment of up to $20 to an assigned beneficiary for each qualifying primary care service that the beneficiary receives from certain ACO professionals, or from a Federally Qualified Health Center or Rural Health Clinic. Further, we clarify that under the program’s existing regulations, we consider vouchers (certificates that can be used only for particular goods or services, including certain gift cards that are in the nature of a voucher), to be “in-kind items or services” that may be provided to beneficiaries so long as the voucher meets all other program requirements. For example, the items and services accessible through use of the voucher must have a reasonable connection to the beneficiary’s medical care and be preventive care items or services or advance a clinical goal for the beneficiary, including adherence to a treatment or drug regime, adherence to a follow-up care plan, or management of a chronic disease or condition.

When will the ACOs start automatic advancement?

For ACOs entering the BASIC track’s glide path for an agreement period beginning on July 1, 2019, the first automatic advancement occur at the start of performance year 2021.

Do ACOs have to pay CMS back?

ACOs receive a share of any savings they generate if they meet quality performance and program participation requirements, and ACOs participating in a two-sided model must also pay CMS back if spending exceeds the benchmark.

4 kinds of Medicare Savings Programs

Select a program name below for details about each Medicare Savings Program. If you have income from working, you still may qualify for these 4 programs even if your income is higher than the income limits listed for each program.

How do I apply for Medicare Savings Programs?

If you answer yes to these 3 questions, call your State Medicaid Program to see if you qualify for a Medicare Savings Program in your state:.

Medicare Shared Savings Program

Coming Together to Effect Change

- In the MSSP, teamwork is paramount. To participate, providers must be part of an Accountable Care Organization (ACO), a patient-centered network that shares financial and medical responsibilities with the goal of improving patient care while limiting unnecessary spending. The MSSP requires ACOs to promote evidence-based medicine, engage beneficiaries, report internall…

Financial Risk and The MSSP

- To understand truly understand the role of ACOs in the MSSP, one must understand the concept of financial risk. It’s the idea that ACOs in the MSSP can—and should—take on some degree of responsibility for lowering costs (i.e., ensuring that actual expenditures don’t exceed updated historical benchmark data). When they don’t accomplish this goal, they may be penalized. Howe…

Quality and The MSSP

- To be eligible for any shared savings that are generated, ACOs must also meet the established quality performance standards for 31 quality measures(29 individual measures and one composite that includes two individual component measures). These MSSP quality measures span the following four quality domains: 1. Patient/caregiver experience 2. Care coordination/pa…

The MSSP from The Beneficiary’S Perspective

- Medicare beneficiaries can continue to choose any provider who accepts Medicare—even if that provider is not part of the ACO. However, beneficiaries benefit from seeing providers in the ACO network because these providers all have a vested interest in providing coordinated, high-quality care.

Important Considerations in The MSSP

- There are several other important concepts to consider when joining an ACO as part of the MSSP. The article, What is an Accountable Care Organization (ACO), provides great insights into some overlying concerns with ACOs today. “Since the inception of ACOs in 2012, many are reaching the limit of their no-risk contracts and are considering whether they want to continue with the Medic…