Can I sign up for Medicare Part B If I quit work?

You can wait until you stop working (or lose your health insurance, if that happens first) to sign up for Part B, and you won’t pay a late enrollment penalty. I (or my spouse) get a stipend from my employer to buy my own health insurance.

When should I sign up for Medicare Part B?

If you don’t have to pay a premium for Part A, you can choose to sign up when you turn 65 (or anytime later). You can wait until you stop working (or lose your health insurance, if that happens first) to sign up for Part B, and you won’t pay a late enrollment penalty.

Can I delay enrolling in Medicare Part B?

See also: Medicare starter kit. What you most need to know. A. Probably not. In most cases, for as long as you have group health insurance provided by an employer for whom you are still working, you can delay enrolling in Part B, which covers doctors visits and other outpatient services and requires a monthly premium.

What happens to my Medicare Part B when I retire?

When you eventually retire, or leave work, you'll be entitled to a special enrollment period of eight months to sign up for Part B without incurring a late penalty. AARP Membership: Join or Renew for Just $16 a Year This also applies to most people who are covered beyond age 65 by insurance from the employer of their working spouse.

How soon should I apply for Medicare Part B before I retire?

Generally, you're first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65. (You may be eligible for Medicare earlier, if you get disability benefits from Social Security or the Railroad Retirement Board.)

How long does it take to get Medicare Part B after?

This provides your Part A and Part B benefits. If you are automatically enrolled in Medicare, your card will arrive in the mail two to three months before your 65th birthday. Otherwise, you'll usually receive your card about three weeks to one month after applying for Medicare.

Can Medicare Part B be added at any time?

Special Enrollment Period If you are eligible for the Part B SEP, you can enroll in Medicare without penalty at any time while you have job-based insurance and for eight months after you lose your job-based insurance or you (or your spouse) stop working, whichever comes first.

Can I choose the start date for Medicare Part B?

You can't always pick the date you want to start Part B coverage because the start date depends on what type of enrollment period you sign up in and when during the enrollment period you apply.

How do I add Part B to my Social Security?

Fill out Form CMS-40B (Application for Enrollment in Medicare Part B). Send the completed form to your local Social Security office by fax or mail. Call 1-800-772-1213. TTY users can call 1-800-325-0778.

How do I add Part B to my Medicare online?

You can use one of the following options to submit your enrollment request under the Special Enrollment Period: Go to “Apply Online for Medicare Part B During a Special Enrollment Period” and complete CMS-40B and CMS-L564. Then upload your evidence of Group Health Plan or Large Group Health Plan.

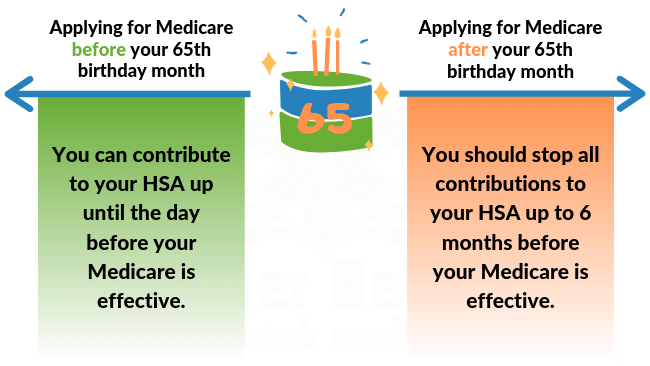

Can I delay Medicare Part B if I am still working?

Once you enroll in any part of Medicare, you won't be able to contribute to your HSA. If you would like to continue making contributions to your HSA, you can delay both Part A and Part B until you (or your spouse) stop working or lose that employer coverage.

What is the initial enrollment period for Part B?

The Initial Enrollment Period (IEP) is the first time you are eligible for Medicare Parts A and B. It occurs when you turn age 65 or have been receiving Social Security Disability benefits for 24 months.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Can Medicare Part B be backdated?

Social Security also offers you Part B coverage retroactively if you want it—while making it clear that, if you accept, you must pay backdated Part B premiums for the time period in question, which can amount to hundreds or even thousands of dollars.

Does Medicare B backdate coverage?

If you enroll in Social Security retirement benefits or Medicare benefits for the first time, and you're beyond your Initial Enrollment Period (IEP) in Medicare, your Part A benefits will be backdated up to 6 months from the month you initiate the enrollment, and you might incur tax penalties associated with excess HSA ...

Does Medicare coverage start the first day of the month you turn 65?

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month. If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65.

What is the Medicare Part B special enrollment period (SEP)?

The Medicare Part B SEP allows you to delay taking Part B if you have coverage through your own or a spouse’s current job. You usually have 8 month...

Do I qualify for the Medicare Part B special enrollment period?

You qualify for the Part B SEP if: you are eligible for Medicare because of your age or because you collect disability benefits. (People who have E...

How do I use the Part B SEP?

To use this SEP you should call the Social Security Administration at 1-800-772-1213 and request two forms: the Part B enrollment request form (CMS...

What if an employer gives me money to buy my own health plan?

A note about individual coverage: you’ll qualify for an SEP if you delayed Part B because you had employer-sponsored coverage through a group healt...

When do you have to enroll in Medicare Part B?

When You Must Enroll in Medicare Part B. You may be required to get Medicare Part B even when you’re still working. There are two situations in which you must get Part B when you turn 65. If your employer has fewer than 20 employees. If you’re covered by a spouse’s employer, and the employer requires covered dependents to enroll in Medicare ...

How long does it take to enroll in Medicare if you lose your employer?

When you lose your employer coverage, you will get an 8-month Special Enrollment Period during which to enroll in Medicare Part B, and Part A if you haven’t done so already. You’ll also be able to enroll in a Medicare Advantage (Part C) plan or Part D prescription drug plan in the first two months of this period.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How much does Medicare Part B cost?

Part B is different. Unlike Part A, Medicare Part B has a monthly premium, which can cost $148.50 to $504.90 depending on income. It has a late enrollment penalty for anybody who enrolls without qualifying for a Special Enrollment Period.

When do dependents have to enroll in Medicare?

If you’re covered by a spouse’s employer, and the employer requires covered dependents to enroll in Medicare when they turn 65. If you’re not married but living in a domestic partnership and are covered by your partner’s employer health insurance.

Can you avoid Medicare if you file for Social Security?

PHIL: When you file for Social Security, by law you must receive Part A of Medicare. You can't avoid it. If you want to get Social Security benefits, you have to be enrolled in Part A.

How long do you have to enroll in Part B?

There are two main times when you can enroll in part B when you are over 65 and covered by your employer’s insurance: 1 While your work coverage is still active 2 During the eight month period after your employer-based coverage ends or the employment ends, whichever occurs first.

What is the phone number for Medicare?

If you have an urgent matter or need enrollment assistance, call us at 800-930-7956. By submitting your question here, you agree that a licensed sales representative may respond to you about Medicare Advantage, Prescription Drug, and Medicare Supplement Insurance plans.

Can seniors over 65 delay Medicare?

Senior65 generally recommends those over 65 delay enrolling in Medicare Part B if they are offered coverage through work (including spouse’s work). We all want to stay clear of paying Medicare late-enrollment penalties while avoiding gaps in coverage. This is where Senior65 comes in to make sense of it all.

Does Medicare Part B start at the same time?

That way you can time it that when your work coverage ends, your Medicare Part B (and any supplemental or drug coverage you may purchase) all start at the same time. You should not have a gap when your work coverage has ended but your Medicare has yet to begin.

When do you have to take Part B?

You have to take Part B once your or your spouse’s employment ends. Medicare becomes your primary insurer once you stop working, even if you’re still covered by the employer-based plan or COBRA. If you don’t enroll in Part B, your insurer will “claw back” the amount it paid for your care when it finds out.

How long can you delay Part B?

You can delay your Part B effective date up to three months if you enroll while you still have employer-sponsored coverage or within one month after that coverage ends. Otherwise, your Part B coverage will begin the month after you enroll.

What is a Part B SEP?

The Part B SEP allows beneficiaries to delay enrollment if they have health coverage through their own or a spouse’s current employer. SEP eligibility depends on three factors. Beneficiaries must submit two forms to get approval for the SEP. Coverage an employer helps you buy on your own won’t qualify you for this SEP.

What to do if your Social Security enrollment is denied?

If your enrollment request is denied, you’ll have the chance to appeal.

What is a SEP for Medicare?

What is the Medicare Part B Special Enrollment Period (SEP)? The Medicare Part B SEP allows you to delay taking Part B if you have coverage through your own or a spouse’s current job. You usually have 8 months from when employment ends to enroll in Part B. Coverage that isn’t through a current job – such as COBRA benefits, ...

When do you have to enroll in Medicare?

If you work for a smaller employer, you must enroll in Part A and Part B when you turn 65, and then Medicare pays claims first and your employer plan becomes your secondary insurance. Medicare has strict enrollment rules that affect people differently according to their circumstances.

When does the eight month special enrollment period start?

The eight-month special enrollment period starts at the end of the month in which you stop working or lose your employer insurance, whichever is first. Generally, people eligible for Social Security benefits do not pay for Part A.

How much does a premium increase for a 12 month period?

If you don't sign up within your initial enrollment period or a special enrollment period (whichever is appropriate to you), your monthly premium will permanently increase 10 percent for each 12-month period you were eligible but did not enroll.

When do you have to sign up for Part B?

You usually don’t face a Part B late enrollment penalty if you sign up during the grace period after you retire, which is eight months after the month after the group health plan ends or after your employment ends , whichever happens first.

How long do you have to pay a late enrollment penalty for Part D?

For Part D, you may owe a late enrollment penalty if, for any continuous period of 63 days or more after your initial enrollment period is over, you go without Part D, Part C, or other creditable prescription drug coverage.

How many people are in the labor force at 65?

Nearly 20% of Americans age 65 and over are in the labor force, according to the Bureau of Labor Statistics. You become eligible for Medicare coverage at age 65, and will typically get Part A hospital coverage free, but the extent to which you need Part B coverage will depend on your employer plan. Part B covers doctors’ visits ...

Can Medicare pay for Part B?

In that scenario, Medicare only pays for what it would normally cover that wasn’t covered by the primary plan.

Is a group health plan primary to Medicare?

If you’re covered by a group health plan through your current job, and your employer has 20 or more employees, then the group plan is generally primary to Medicare—that is, the group plan pays your claims first. If you opt to take Part B in addition to your group plan, then your doctor can bill Medicare for secondary payment.

Does Medicare cover hearing?

These plans typically cover drugs as well and and may cover services that original Medicare doesn’t , such as vision or hearing services. A broker such as eHealthMedicare can help you compare your employer plan with your options under Medicare.

Do I need to sign up for Medicare when I turn 65?

It depends on how you get your health insurance now and the number of employees that are in the company where you (or your spouse) work.

How does Medicare work with my job-based health insurance?

Most people qualify to get Part A without paying a monthly premium. If you qualify, you can sign up for Part A coverage starting 3 months before you turn 65 and any time after you turn 65 — Part A coverage starts up to 6 months back from when you sign up or apply to get benefits from Social Security (or the Railroad Retirement Board).

Do I need to get Medicare drug coverage (Part D)?

You can get Medicare drug coverage once you sign up for either Part A or Part B. You can join a Medicare drug plan or Medicare Advantage Plan with drug coverage anytime while you have job-based health insurance, and up to 2 months after you lose that insurance.