Medicare Start Date Calculator Medicare pays for most dialysis. It can start to pay on the 1st day of the 1st month for home dialysis—or at the 4th month of treatment for in-center.

Full Answer

When does my Medicare coverage start?

Medicare coverage starts based on when you sign up and which sign-up period you’re in. Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65. My birthday is on the first of the month.

Do you have a hard time calculating Medicare monthly premiums?

Most Medicare beneficiaries have a hard time calculating Medicare monthly premiums. Use the calculator to see how much you need to pay for Medicare to keep your benefits. An overwhelming majority of Medicare beneficiaries don’t pay for Part A.

How much does Original Medicare cost per month?

If you decide to use Original Medicare with a Medicare Supplement and a drug plan, your monthly costs would be: 1 $148.50 for Medicare Part B 2 Get a quote for your Medicare Supplement (prices vary widely) 3 An average of $30 for your drug plan (this can vary)

How do I calculate my Medicare benefits?

Simply add up the Original Medicare (Part A and B) costs and the other benefits you get. For example, if you’re also getting Part D drug prescriptions, add that up to your Original Medicare costs and you will have the total amount you need to pay for Medicare benefits.

Does Medicare start on your birthday or beginning of the month?

Your first chance to sign up (Initial Enrollment Period) This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65. My birthday is on the first of the month.

Does Medicare have to start on the first of the month?

If you choose to enroll at age 65, benefits start on the first day of the month you turn 65. For example, if you turn 65 on June 30th, your coverage begins on June 1st. However, if your birthday is on the 1st, your Medicare will begin the first day of the month before you turn 65.

When should I expect my first Medicare bill?

If you enroll in Medicare before you begin collecting Social Security benefits, your first premium bill may surprise you. It will be due, paid in full, 1 month before your Medicare coverage begins. This bill will typically be for 3 months' worth of Part B premiums. So, it's known as a quarterly bill.

How does Medicare determine your monthly payment?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

How many months before your 65th birthday should you apply for Medicare?

3 monthsGenerally, we advise people to file for Medicare benefits 3 months before age 65. Remember, Medicare benefits can begin no earlier than age 65. If you are already receiving Social Security, you will automatically be enrolled in Medicare Parts A and B without an additional application.

Do I automatically get Medicare when I turn 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

How much does Social Security take out for Medicare each month?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

How often do I pay my Medicare Part B premium?

each monthPart B premiums You pay a premium each month for Part B. Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board.

Does Medicare come out of your Social Security check?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.

What will Medicare cost in 2021?

The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

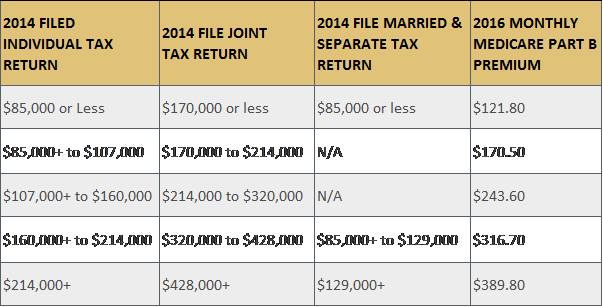

What income level triggers higher Medicare premiums?

In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there. You'll receive an IRMAA letter in the mail from SSA if it is determined you need to pay a higher premium.

Your first chance to sign up (Initial Enrollment Period)

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Between January 1-March 31 each year (General Enrollment Period)

You can sign up between January 1-March 31 each year. This is called the General Enrollment Period. Your coverage starts July 1. You might pay a monthly late enrollment penalty, if you don’t qualify for a Special Enrollment Period.

Special Situations (Special Enrollment Period)

There are certain situations when you can sign up for Part B (and Premium-Part A) during a Special Enrollment Period without paying a late enrollment penalty. A Special Enrollment Period is only available for a limited time.

Joining a plan

A type of Medicare-approved health plan from a private company that you can choose to cover most of your Part A and Part B benefits instead of Original Medicare. It usually also includes drug coverage (Part D).

How long does Medicare pay for Part A?

It’s because it comes free if the beneficiary has paid Medicare taxes for more than 40 quarters which equals 10 years. So if you’ve been working for ten or more years, you won’t pay for Part A premiums and it will be included in your plan for free.

What are the requirements for Medicare Part A?

Medicare Part A Premium Free Requirements 1 You’ve paid Medicare taxes for 10 or more years. 2 You are eligible for Social Security or Railroad Retirement Board benefits. 3 You or your spouse have Medicare-covered government employment.

How much is Medicare Part A deductible for 2021?

Medicare Part A deductible is $1,484 for 2021. Medicare Part A monthly premium is $471 if you’ve paid Medicare taxes for less than 30 quarters. The beneficiaries who paid Medicare taxes for between 30 and 39 quarters pay $259. As you now know, those who’ve paid Medicare taxes for more than 40 quarters don’t pay for Part A.

How much is Medicare coinsurance?

The coinsurance, on the other hand, is $0 for days between 1 and 60, $371 for days between 61 and 90, and $742 for days beyond 90.

What is total Medicare cost?

The total Medicare cost is what you get out of Medicare. Simply add up the Original Medicare (Part A and B) costs and the other benefits you get. For example, if you’re also getting Part D drug prescriptions, add that up to your Original Medicare costs and you will have the total amount you need to pay for Medicare benefits.

Does Medicare pay monthly premiums?

Medicare Part A Monthly Premiums. The Medicare beneficiaries that don’t qualify for premium-free Part A have to pay for the coverage. Since Part A covers hospital costs, the number of days spent in the hospital affect the coinsurance but the monthly premiums have a direct relationship with the duration of Medicare taxes paid.

How long do you have to be on Medicare to receive Part A?

People under age 65 may receive Part A with no liability for premiums under the following circumstances: Have received Social Security or Railroad Retirement Board disability benefits for two years.

How many years of work do you need to be eligible for Medicare?

Four is the maximum number of credits a person can earn per year, so it takes at least 10 years or 40 quarters of employment to be eligible for Medicare.

What is the Medicare premium for 2020?

For 2020, the standard monthly rate is $144.60. However, it will be more if you reported above a certain level of modified adjusted gross income on your federal tax return two years ago. Any additional amount charged to you is known as IRMAA, which stands for income-related monthly adjustment amount. Visit Medicare.gov, point to “Your Medicare Costs,” and then click “Part B costs” to see a matrix of premiums corresponding to income ranges across different tax filing statuses.

Is Medicare the same for everyone?

Medicare is a federal program that mandates standardization of services nationwide, so many people may assume the premiums would be the same for everyone. In reality, there are variations in the premiums people pay, if they pay any at all.

Can Medicare be charged at 65?

For Part A, most Medicare recipients are not charged any premium at all. Seniors at age 65 are eligible for premium-free Part A if they meet the following criteria: Currently collect retirement benefits from Social Security or the Railroad Retirement Board. Qualify for Social Security or Railroad benefits not yet claimed.

When can Medicare start paying for dialysis?

It can start to pay on the 1st day of the 1st month for home dialysis—or at the 4th month of treatment for in-center. Starting Medicare on the 1st day of the 1st month can save thousands of dollars in out-of-pocket costs.

When does Medicare close the window for home HD?

The date that closes the window is the 1st day of the 4th month of dialysis:

Avoid Late Penalties By Signing Up During this Time

Lorraine Roberte is an insurance writer for The Balance. As a personal finance writer, her expertise includes money management and insurance-related topics. She has written hundreds of reviews of insurance products.

How Medicare Initial Enrollment Works

There are four different parts of Medicare— Part A and Part B (known as Original Medicare), Part C (Medicare Advantage plans), and Part D (Medicare prescription drug coverage). Plus, you can get Medicare supplement insurance, also known as Medigap, to help pay for costs that Original Medicare doesn’t cover.

When Is Medicare Initial Enrollment?

The Medicare initial enrollment period lasts for seven months. It begins three months before the month of your 65th birthday, and includes your birth month and the three months that follow your birth month.

When Does Medicare Coverage Start?

If you qualify for premium-free Part A, your coverage begins the month you turn 65. If you have to pay a premium for Part A, your coverage starts when Part B coverage starts, following the table below. The month you sign up matters, as it impacts when your coverage begins. 1 2

Medicare Parts You Can Enroll In

Original Medicare (Parts A and B) is managed by the federal government, while Medicare Advantage plans and Part D prescription drug plans are managed by insurance companies.

What if You Miss Initial Enrollment?

If you miss your initial enrollment period, there are a few other opportunities you have to join Medicare:

Am I automatically enrolled in Medicare once I turn 65?

If you’ve been getting Social Security benefits or benefits from the Railroad Retirement Board for at least four months before your 65th birthday, you will be automatically enrolled in Medicare Parts A and B when you turn 65. 14

How often do Medicare payments come out?

People who do not get SS or RRB benefits will receive bills for their Medicare premiums. Medicare will issue Part A bills monthly and Part B bills every 3 months. There are several ways to pay the premiums, including: through the Medicare account. online through a bank’s bill payment service.

How often is Medicare Part A premium due?

Help with costs. Summary. A person enrolled in original Medicare Part A receives a premium bill every month, and Part B premium bills are due every 3 months. Premium payments are due toward the end of the month. Original Medicare consists of Part A, which is hospitalization insurance, and Part B, which is medical insurance.

What is Medicare Supplement?

Medicare supplement insurance. Medigap is a Medicare supplement insurance plan that pays 50–100% of the original Medicare (parts A and B) out-of-pocket costs. These plans are available to people enrolled in original Medicare, and there will be a monthly premium to pay. Learn more about how Medigap plans work here.

What is Medicare Advantage?

Medicare Advantage. Instead of enrolling in original Medicare (parts A and B), some people choose to enroll in Part C, or Medicare Advantage. This is an alternative to original Medicare. In that case, a person must pay their Part B premiums in addition to their Medicare Advantage plan costs. Learn more about choosing a Medicare Advantage plan here.

What is the average Part D premium for 2020?

In 2020, the average Part D monthly premium base was $32.74 for people with an income of $87,000 or under. As with Part B, the premiums increase in relation to having an income above a certain amount. People can use this online tool to compare various Part D plans.

What happens if you are late on Medicare?

For original Medicare (parts A and B), Medicare will send a person a First Bill. If they are late with payment, they will get a Second Bill, which includes the past-due premium amount and the premium that is due the following month.

What programs help people with low incomes pay Medicare?

Medicaid: This state-federal program helps people with low incomes and limited resources pay their healthcare costs.

How much does Medicare cover?

Since Medicare only covers about 80% of your medical bills, many people add on a Medicare Supplement to pick up the remaining costs. The monthly premium for a Medicare Supplement will depend on which plan you choose, your age, your gender, your zip code, and your tobacco usage.

What will Medicare pay for in 2021?

2021 Medicare Part A Costs. Medicare Part A helps cover bills from the hospital. So, if you are admitted and receive inpatient care, Medicare Part A is going to help with those costs. If you’ve worked at least 10 years or can draw off a spouse who has, Medicare Part A is free to have.

What is Medicare MSA?

A Medicare MSA, a type of Medicare Advantage plan, is another option for seniors. The most widely available plan is from Lasso Healthcare, and it is $0 premium. An MSA combines high-deductible health coverage with an annually funded medical savings account.

How much is Medicare Part A deductible for 2021?

The Medicare Part A deductible, as well as the coinsurance for care, fluctuates slightly every year, but here are the current costs for 2021: $1,484 deductible. Days 1-60: $0 coinsurance. Days 61-90: $371 coinsurance. Days 91+: $742 coinsurance per “lifetime reserve day,” which caps at 60 days. Beyond lifetime reserve days: You pay all costs.

How much does Medicare Part B cost in MA?

Often times, MA plans also include a drug benefit, so you also replace Part D. However, you still must pay the $148.50 monthly premium for Medicare Part B. MA premiums vary, depending on which type of plan you choose, which area you’re in, and other similar factors.

How much is coinsurance for days 21 through 100?

For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in a benefit period will be $185.50 in 2021.

Does Medicare Part A have coinsurance?

That means you don’t have any monthly costs to have Medicare Part A . This doesn’t mean that Medicare Part A doesn’t have other costs like a deductible and coinsurance – because it does – but you won’t have to pay those costs unless you actually need care. For most people, having Medicare Part A is free.

What is the number to call for Medicare prescriptions?

If we determine you must pay a higher amount for Medicare prescription drug coverage, and you don’t have this coverage, you must call the Centers for Medicare & Medicaid Services (CMS) at 1-800-MEDICARE ( 1-800-633-4227; TTY 1-877-486-2048) to make a correction.

How to determine 2021 Social Security monthly adjustment?

To determine your 2021 income-related monthly adjustment amounts, we use your most recent federal tax return the IRS provides to us. Generally, this information is from a tax return filed in 2020 for tax year 2019. Sometimes, the IRS only provides information from a return filed in 2019 for tax year 2018. If we use the 2018 tax year data, and you filed a return for tax year 2019 or did not need to file a tax return for tax year 2019, call us or visit any local Social Security office. We’ll update our records.

What is MAGI for Medicare?

Your MAGI is your total adjusted gross income and tax-exempt interest income. If you file your taxes as “married, filing jointly” and your MAGI is greater than $176,000, you’ll pay higher premiums for your Part B and Medicare prescription drug coverage.

What happens if your MAGI is greater than $88,000?

If you file your taxes using a different status, and your MAGI is greater than $88,000, you’ll pay higher premiums (see the chart below, Modified Adjusted Gross Income (MAGI), for an idea of what you can expect to pay).

What is the MAGI for Social Security?

Your MAGI is your total adjusted gross income and tax-exempt interest income.

What is the standard Part B premium for 2021?

The standard Part B premium for 2021 is $148.50. If you’re single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

Do you pay monthly premiums for Medicare?

If you’re a higher-income beneficiary with Medicare prescription drug coverage, you’ll pay monthly premiums plus an additional amount, which is based on what you report to the IRS. Because individual plan premiums vary, the law specifies that the amount is determined using a base premium.