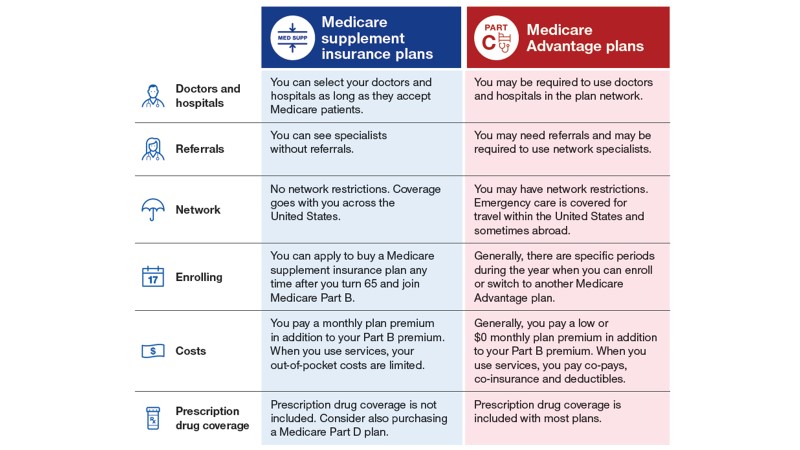

Medicare Advantage vs. Medigap comparison chart

| Medicare Advantage | Medigap | |

| Enrollment | Two open enrollment periods each year | People may only enroll when first eligib ... |

| Coverage | Bundled plans that include all the benef ... | Plans help cover out-of-pocket costs ass ... |

| Extra benefits | Many plans offer dental, vision, and hea ... | Plans may cover emergency care if a pers ... |

| In-network provider restrictions | Yes | No |

Full Answer

What is the difference between Medicare and advantage?

- Routine vision, including eye glasses, contacts, and eye exams

- Routine hearing, including hearing aids

- Routine dental care

- Prescription drugs and some over the counter medications

- Fitness classes and gym memberships

- Meal delivery to your home

- Transportation to doctor visits

- Other benefits

Is Medicare Advantage better than Medicare?

The MA program helps address social determinants of health and improve health equity: "...over 95 percent of Medicare Advantage beneficiaries have access to meal services, telehealth, transportation, dental, fitness, vision, and hearing benefits.

Why choose a Medicare Advantage plan?

When you have an Advantage plan, Medicare Parts A and Part B do not act as secondary coverage for your Advantage plan. You don't get healthcare services from both, because when you choose a Medicare Advantage plan you are deselecting CMS as the administrator of your healthcare needs.

Why are Medicare Advantage plans bad?

Is a Medigap plan better than an Advantage plan?

If you are in good health with few medical expenses, Medicare Advantage can be a suitable and money-saving choice. But if you have serious medical conditions with expensive treatment and care costs, Medigap is generally better.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What is the downside to Medigap plans?

Some disadvantages of Medigap plans include: Higher monthly premiums. Having to navigate the different types of plans. No prescription coverage (which you can purchase through Plan D)

When can I switch from Medigap to Medicare Advantage?

The best (and often only time) to switch from Medigap to Medicare Advantage is during the Open Enrollment Annual Election Period which runs from Oct 15th to Dec 7th. To switch during this time, you would enroll in a MA plan which can only start on Jan 1st of the following year.

Can you switch back to Medicare from Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

What is the best Medicare Advantage plan for 2022?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

What are the pros and cons of Medigap?

Medigap Pros and ConsMedigap ProsMedigap ConsAll plans offer an additional 365 days in hospitalNot all plans cover hospital deductibleSome plans offer extras like excess charges, foreign travel, and Silver Sneakers programDoes not include drug coverageNationwide coverageDoesn't cover acupuncture3 more rows•Jun 4, 2015

Why should I choose a Medigap plan?

Medigap policies are sold by private companies, and can help pay for some of the costs that Original Medicare doesn't, like copayments, coinsurance, and deductibles. Some Medigap policies also cover certain benefits Original Medicare doesn't cover, like emergency foreign travel expenses.

Can I switch from a Medicare Advantage plan to a Medigap plan?

Most Medicare Advantage Plans offer prescription drug coverage. , you may want to drop your Medigap policy. Your Medigap policy can't be used to pay your Medicare Advantage Plan copayments, deductibles, and premiums.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Why are Medigap policies so expensive?

Younger buyers may find Medicare Supplement insurance plans that are rated this way very affordable. Over time, however, these plans may become very expensive because your premium increases as you grow older. Premiums may also increase because of inflation and other factors.

Can you switch back and forth between Medicare Advantage and Medigap?

Can I switch from Medicare Advantage to Medigap? A person can switch from Medicare Advantage to Medicare with a Medigap policy. However, the Centers for Medicare and Medicaid Services designate certain periods to do so. That said, some people can also switch at certain other times without incurring a penalty.

How many studies have found that Medicare Advantage plans perform about equally to original Medicare?

A 2021 Health Affairs review of 48 different studies found that Medicare Advantage plans perform about equally to original Medicare when it comes to:

What is Medicare Advantage?

Medicare Advantage plans combine Medicare Part A (hospital insurance), Part B (medical insurance), and, usually, Part D (prescription drug coverage) in one plan, often for no more than the Part B premium. Many MA plans provide benefits like vision, hearing, and dental care that enrollees don’t get through traditional Medicare.

What is a Medigap plan?

Medigap is a supplement to Medicare that helps you cover healthcare copayments, coinsurance, and deductibles from Medicare Part A and Part B. Unlike MA plans, new Medigap policies don’t provide prescription drug coverage.

How long can you keep Medigap?

You can keep your Medigap plan as long as you keep up with Medigap and Part B premiums. There are 10 standard Medigap plans named by letters A through N, but not every state offers all of them.

How many people are enrolled in Medicare Advantage in 2020?

Enrollment has more than doubled in the last decade, rising from 11.1 million in 2010 to 24.1 million in 2020. As of 2020, 39 % of Medicare beneficiaries were enrolled in an MA plan.

When is open enrollment for Medigap?

Medicare open enrollment runs every year from October 15 through December 7.

How many types of Medicare Advantage Plans are there?

There are six kinds of MA plans. The most common types of Medicare Advantage plans are:

What is the difference between Medicare Advantage and Medigap?

The main difference between the two is how they work alongside original Medicare. Medigap plans work alongside original Medicare’s Part A and Part B to help with out-of-pocket expenses, such as deductibles, coinsurance, and copayments.

How long does it take to switch from Medicare Advantage to Medigap?

Switching between plan types. There are three opportunities for a person to switch from Medicare Advantage to Medigap. During the initial enrollment period (IEP): This 7-month period begins the month before a person reaches 65 years of age.

What is a Medigap plan?

Medigap plans are standardized, which means that they all provide the same basic benefits. However, some plans may offer additional benefits. Once a person decides on a plan, Medicare will provide contact information for the company administering the plan.

How does Medicare Advantage work?

Medicare Advantage plans work in different ways, so it is advisable for people to compare all the available plans in their area. They can do this using Medicare’s find-a-plan tool. After deciding on a specific plan, a person can enroll by doing one of the following: enrolling through the company’s website.

How long do you have to switch back to Medicare after enrolling?

Shortly after enrolling: When a person first becomes eligible for Medicare and enrolls in a Medicare Advantage plan, they have 3 months in which they can switch back to original Medicare and enroll with Medigap.

When does Medicare Advantage OEP end?

During the Medicare Advantage OEP: This OEP runs from January 1 to March 31 each year. Between these dates, a person can drop their Medicare Advantage plan, return to original Medicare, or enroll in a Medigap plan.

When is the best time to buy a Medigap plan?

The best time to buy a Medigap plan is during the 6-month open enrollment period (OEP). This window automatically begins the month a person reaches the age of 65 years.

When can you change your Medicare Advantage plan?

You see, Medicare Advantage plans have specific enrollment periods. If you enroll in a plan, Medicare locks you into that plan through December 31st. You can change mid-year only if a circumstance gives you a special election period, such as moving out of state. This makes it very important that you choose a plan wisely.

What is Medicare Advantage?

About Medicare Advantage. About 33% of beneficiaries choose to enroll into Medicare Advantage policies, which are private insurance plans. They usually have lower premiums than Medigap plans....sometimes even a $0 premium on some plans in some areas.

What is a Medicare supplement plan?

Medicare supplement plans are also called Medigap plans. Having a Medigap plan means you are still enrolled in Original Medicare as your primary insurance. You can see any provider that participates in Medicare, regardless of which supplement company you choose.

What are the two types of Medicare coverage?

So the two main types coverage that you can buy to help with this are Medicare Advantage vs Medigap (Medicare Supplement). It’s important that you know how each type of coverage, so that you can select the right plan for you.

What does $0 mean on Medicare?

When a plan has a $0 premium, it means that you will pay no additional premiums for the plan itself. You will still pay for your Part B premiums monthly though. You must be enrolled in both Medicare Parts A and B to be eligible for a Medicare Advantage plan.

What is the maximum amount you can get on Medicare in 2021?

In 2021, Medicare has declared that this maximum cannot be any higher than $7,550 . However, $7,550 is a lot of money for people on fixed incomes.

How much does a female paying for Plan G in 2021 cost?

In the DFW area, for example, a female, non-tobacco user turning 65 might pay around $100 - $130/month for Plan G in 2021.

Introduction

Like most seniors, you may be comparing Medicare Advantage (or Part C) plans versus Medigap (Medicare Supplement) plans.

How do we compare Medicare Advantage plans to Medigap plans?

While Medicare Advantage and Medigap plans have are both sold by private insurance companies, they are fundamentally different:

What are the differences between a Medicare Advantage and Medigap plans?

Is a Medigap better than a Medicare Advantage plan? The answer to this question depends on your specific circumstances.

How to choose between Medicare Advantage and Medigap?

Now that we have compared Medicare Advantage plans vs. Medigap insurance, some factors to consider are:

Final Words

How to choose between Medicare Advantage and Medigap? Choosing a suitable plan depends on your health, finances, risk tolerance, and personal preferences.

How much is Medicare Advantage 2021?

In most areas, there are “ zero-premium ” Medicare Advantage plans available (although you still have to pay for Medicare Part B; in 2021, the premium for Part B is $148.50/month for most enrollees ). According to the Kaiser Family Foundation, 96% of Medicare beneficiaries have access to at least one zero-premium Medicare Advantage plan for 2021.

How much does a 65 year old pay for medicaid?

But according to data from eHealth, the average 65-year-old paid $134/month for Medigap coverage in 2020.

What is a SNP in Medicare?

Would you qualify for a Medicare Advantage Special Needs Plan (SNP)? SNPs are geared to the needs of very specific populations, and can be a good choice for people with certain medical conditions, as well as those who are institutionalized or who are Medicare-Medicaid dual eligible.

How much will Medicare Part D cost in 2022?

The average premium for a stand-alone Part D plan in 2022 is expected to be about $33/month, but there is significant variation from one plan to another. The premiums for Medigap/Medicare Supplement plans vary considerably depending on which plan you select, where you live, and how old you are. But according to data from eHealth, the average 65-year-old paid $134/month for Medigap coverage in 2020.

What percent of primary care physicians are on Medicare?

Ninety-three percent of non-pediatric primary care physicians are participating providers with Original Medicare, and the coverage is nationwide (note that not all of those doctors are accepting new Medicare patients). With Medicare Advantage, each plan has its own network, and you may be limited to a much more local or regional area.

Does Medigap pay out of pocket?

But with Medigap, there are plans available that pay nearly first-dollar coverage for all Medicare-covered services, leaving you with little to no out-of-pocket exposure (for people who became eligible for Medicare prior to 2020, there are still plans available that cover all of the out-of-pocket costs for Medicare-covered services; for people who became eligible in 2020 or later, the most comprehensive Medigap plans do still require the beneficiary to pay the Part B deductible — $203 in 2021, projected to be $217 in 2022 — out of their own pockets). The most comprehensive Medigap plans tend to be among the more expensive options; less expensive options leave enrollees with varying amounts of out-of-pocket costs for services that are covered by Original Medicare.

Is a Medigap plan expensive?

Depending on your health, that could make a Medigap plan expensive or impossible to get. The limited window of opportunity for a guaranteed-issue Medigap plan is also an important consideration if you’re planning to enroll in a Medicare Advantage plan.

When will Medicare Advantage plans be available?

Medicare Advantage plans are available to most Medicare beneficiaries under the age of 65, except for those who qualified for Medicare based on an ESRD diagnosis (this will change in 2021, when all Medicare beneficiaries will be able to select Advantage plans in areas where they’re available, regardless of whether they have ESRD).

What is a Medigap plan?

The most basic Medigap plan (Plan A) covers your Original Medicare coinsurance and little else. The most comprehensive plan (Plan F, for those Medicare-eligible before 2020, and Plan G, for those newly eligible) covers virtually all out-of-pocket costs associated with your Medicare-covered treatment.

What is the final consideration for supplemental insurance?

A final consideration for supplemental insurance is deciding between trust in your standardized Medigap benefits and faith in your Medicare Advantage insurer.

How much does Medigap cost?

Medigap: The average cost of Medigap Plan G – the most expensive Medicare Supplement plan still available to new enrollees – starts at around $90 a month and can be much higher, depending on your state and other factors. With Plan G, you’re also liable for the Part B deductible, although the plan will cover the rest of the out-of-pocket costs you’d otherwise have under Medicare Parts A and B. When you don’t need frequent or regular medical care, the premiums for a comprehensive Medigap plan can seem like a tough pill to swallow.

What percentage of Medicare enrollees switch to a different plan each year?

Enrollees who re-evaluate and switch their Medicare Advantage plan could potentially save on their premiums and out-of-pocket limits. 16% of Medicare Advantage enrollees switch to a different Medicare Advantage plan each year. 3 An additional two percent of enrollees per year return to traditional Medicare.

What is Medicare Supplement?

The time-tested and widely available model for Medicare beneficiaries is Medicare Supplement, also known as Medigap. A newer and more flexible option called Medicare Advantage – formally known as Medicare Part C – is increasingly popular. You have to decide which one is right for you.

How many types of Medigap are there?

There are 10 types of Medigap plans, which are standardized so that plans within each level provide the same exact coverage. For example, all Plan L policies – regardless of which company offers them – must provide the same exact benefits.

Healthmarkets Helps With Medicare Advantage And Medigap Plans

HealthMarkets can quickly help you find the Medicare plan that best fits your needs. Need help deciding? Answer a few quick questions to see whether a Medicare Advantage or Medigap plan is a better choice for you.

How Does Original Medicare Work

Original Medicare is a government-funded medical insurance option for people age 65 and older. Many older Americans use Medicare as their primary insurance since it covers:

Choosing A Medicare Advantage Plan

Medicare Advantage Health Plans are similar to private health insurance. Most services, such as office visits, lab work, surgery, and many others, are covered after a small co-pay. Plans might offer an HMO or PPO network and all plans place a yearly limit on total out-of-pocket expenses. Each plan has different benefits and rules.

Why Should I Choose Medicare Advantage

Medicare Advantage covers some of the gaps of Original Medicare and usually offers a $0 premium through a private company. It can be an affordable option for patients who are not currently sick or in need of intense medical care. If a patients situation worsens, it might be difficult or expensive to switch plans.

What Does Medicare Cover

The two main parts of Medicare are Part A and Part B. Part A is hospital coverage for inpatient services, and Part B is your doctors coverage for outpatient services. Part A is premium-free for most beneficiaries, and Part B comes with a standard monthly premium.

Enrolling In Medicare Advantage

Your initial coverage election period begins three months before your 65th birthday and ends either the last day of the month before your Part B becomes effective or the last day of your IEP.

What Is The Difference Between Plan G And Plan G With A High Deductible

The difference between a regular Plan G plan and a High Deductible Plan G plan is the deductible amount and coverage timing. With a standard Supplement Plan G, youre covered immediately and are responsible only for the $233 Part B deductible, plus your monthly premium.