The Social Security Administration handles the sign-up process for both Social Security and Medicare, and you can use a single application to file for both benefits if you're within three months of your 65th birthday. The SSA

Social Security Administration

The United States Social Security Administration is an independent agency of the U.S. federal government that administers Social Security, a social insurance program consisting of retirement, disability, and survivors' benefits. To qualify for most of these benefits, most workers pay Social …

Full Answer

When's the best time to file for Medicare?

What is Medicare? Medicare is a federal health insurance plan for people who are age 65 or older. People who are disabled or have permanent kidney failure can get Medicare at any age. Parts of Medicare. Social Security enrolls you in Original Medicare (Part A and Part B). • Medicare Part A (hospital insurance) helps pay for inpatient care in a

When is the earliest you can get Medicare?

If you do not fall into any of these categories, you will have to apply for Medicare when you turn 65. You have six months to get this done – 3 months before the month of your 65th birthday till 3 months after the month of your 65 birthday. Your Medicare will not be automatic. You will have to set it up. Do not apply late or you could be fined.

Will I be automatically enrolled in Medicare at 65?

Nov 22, 2021 · Social Security retirement benefits are available as early as age 62, but most people don’t become eligible to receive Medicare benefits until age 65. If you happen to want to retire right at age 65 and therefore want to start getting Social Security and Medicare benefits at the same time, then it’s easy to coordinate those benefits.

Is it mandatory to sign up for Medicare?

You must be at least 61 years and 9 months old and want your benefits to start no more than four months in the future. If you qualify for both retirement and spouse's benefits, please read: If you are eligible for a spouse's benefit and your own retirement benefit If you are almost 65, your application for benefits will include Medicare.

How many months in advance should I apply for Social Security benefits?

four monthsYou can apply up to four months before you want your retirement benefits to start. For example, if you turn 62 on December 2, you can start your benefits as early as December. If you want your benefits to start in December, you can apply in August.

When should I take Social Security and Medicare?

NOTE: Even though the full retirement age for Social Security is no longer 65, you should sign up for Medicare three months before your 65th birthday. You can apply at www.ssa.gov.

Can I apply for Social Security and Medicare at the same time?

The Social Security Administration handles the sign-up process for both Social Security and Medicare, and you can use a single application to file for both benefits if you're within three months of your 65th birthday. The SSA's online retirement application website is the easiest way to start.Jul 2, 2016

How long does it take to get first Social Security check after applying?

Once you have applied, it could take up to three months to receive your first benefit payment. Social Security benefits are paid monthly, starting in the month after the birthday at which you attain full retirement age (which is currently 66 and will gradually rise to 67 over the next several years).Apr 9, 2020

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

What month is Medicare deducted from Social Security?

Hi RCK. The Medicare premium that will be withheld from your Social Security check that's paid in August (for July) covers your Part B premium for August. So, if you already have Part B coverage you'll need to pay your Medicare premiums out of pocket through July.Mar 5, 2021

Do I automatically get Medicare when I turn 65?

Medicare will automatically start when you turn 65 if you've received Social Security Benefits or Railroad Retirement Benefits for at least 4 months prior to your 65th birthday. You'll automatically be enrolled in both Medicare Part A and Part B at 65 if you get benefit checks.

Are Medicare Part B premiums going up in 2021?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.Jan 12, 2022

Is it better to take Social Security at 62 or 67?

The short answer is yes. Retirees who begin collecting Social Security at 62 instead of at the full retirement age (67 for those born in 1960 or later) can expect their monthly benefits to be 30% lower. So, delaying claiming until 67 will result in a larger monthly check.Feb 21, 2022

Does Social Security start on your birthday or birth month?

If you were born on the 1st of the month, we figure your benefit (and your full retirement age) as if your birthday was in the previous month. If you were born on January 1st, we figure your benefit (and your full retirement age) as if your birthday was in December of the previous year.

How much money can you have in the bank on Social Security retirement?

The limit for countable resources is $2,000 for an individual and $3,000 for a couple.

Is it better to apply for Social Security benefits online or in person?

While some may prefer to apply in person at their local Social Security office, an increasing number of retirees are finding it easier and more convenient to claim their benefits by retiring online at www.socialsecurity.gov.Nov 7, 2016

How long do you have to withdraw Social Security?

Sometimes, life changes occur after you submit your application. You have up to 12 months to withdraw your application, if you change your mind. You will be required to repay any benefits you’ve already received. Learn more about Withdrawing Your Social Security Retirement Application.

Can you be held liable for false information?

You’ll have a chance to review your answers and make changes, if needed. Once you’ve filled everything out, we’ll ask you to confirm that your answers are true to the best of your knowledge. You can be held liable for intentionally providing false or misleading information.

How long do you have to apply for medicare?

Age to Apply for Medicare. If you do not fall into any of these categories, you will have to apply for Medicare when you turn 65. You have six months to get this done – 3 months before the month of your 65th birthday till 3 months after the month of your 65 birthday. Your Medicare will not be automatic.

How to contact Medicare for a new patient?

Call 1-800-772-1213 (TTY 1-800-325-0778). If they are busy, they will set an appointment to enroll you or do it right then. Your representative will send you forms to fill out and mail back. In order to use this option, you need to be enrolling at least 30-60 days before the start date of Medicare.

What is a Part B?

Part B – Physician Fees. Part C – Medicare Advantage Plans. Part D – Covers Drugs Costs. Part F – Supplemental Medicare Insurance. When you are eligible for Medicare you will receive Part A. You can purchase Part B but will probably have to pay a premium. You can purchase Part D and pay a premium for prescription drugs.

How long do you have to wait to get Medicare?

Waiting period. You can also qualify for full Medicare coverage if you have a chronic disability. You’ll need to qualify for Social Security disability benefits and have been receiving them for two years. You’ll be automatically enrolled in Medicare after you’ve received 24 months of benefits.

What is the difference between Medicare and Social Security?

Both programs help people who have reached retirement age or have a chronic disability. Social Security provides financial support in the form of monthly payments, while Medicare provides health insurance. The qualifications for both programs are similar.

How much does Medicare cost in 2020?

In 2020, the standard premium amount is $144.60. This amount will be higher if you have a large income.

What is Medicare and Medicaid?

Medicare is a health insurance plan provided by the federal government. The program is managed by the Centers for Medicare & Medicaid Services (CMS), a department of the United States Department of Health and Human Services.

How many credits do you need to qualify for Medicare?

Work credits. To meet the work requirement, you or your spouse need to have earned 40 work credits. Work credits are awarded once you’ve earned $1,410. You can earn a maximum of four work credits a year. This means 10 years of work will normally qualify you for full Medicare benefits.

Does Social Security pay for Medicare?

Social Security does not pay for Medicare, but if you receive Social Security payments, your Part B premiums can be deducted from your check. This means that instead of $1,500, for example, you’ll receive $1,386.40 and your Part B premium will be paid.

What is Medicare Part C?

Medicare Part C. Part C is also known as Medicare Advantage. Part C plans are sold by private insurance companies who contract with Medicare to provide coverage. Generally, Advantage plans offer all the coverage of original Medicare, along with extras such as dental and vision services.

Medicare Eligibility, Applications and Appeals

Find information about Medicare, how to apply, report fraud and complaints.

Medicare Prescription Drug Coverage (Part D)

Part D of Medicare is an insurance coverage plan for prescription medication. Learn about the costs for Medicare drug coverage.

Replace Your Medicare Card

You can replace your Medicare card in one of the following ways if it was lost, stolen, or destroyed:

Medicare Coverage Outside the United States

Medicare coverage outside the United States is limited. Learn about coverage if you live or are traveling outside the United States.

Voluntary Termination of Medicare Part B

You can voluntarily terminate your Medicare Part B (medical insurance). It is a serious decision. You must submit Form CMS-1763 ( PDF, Download Adobe Reader) to the Social Security Administration (SSA). Visit or call the SSA ( 1-800-772-1213) to get this form.

Do you have a question?

Ask a real person any government-related question for free. They'll get you the answer or let you know where to find it.

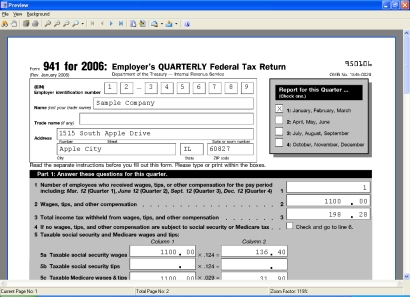

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the FICA tax?

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.