Who qualifies for premium-free Medicare Part A?

If you are over 65 and qualify for Medicare, you are eligible for premium-free Part A if you or your spouse have at least 40 calendar quarters of work in a job where you paid payroll taxes to Social Security, or are eligible for Railroad Retirement benefits.

Who pays for part a Medicare coverage?

- Income taxes paid on Social Security benefits

- Interest earned on the trust fund investments

- Medicare Part A premiums from people who aren't eligible for premium-free Part A

What is the initial enrollment period for Medicare?

You can sign up for Medicare only at certain times. You can enroll during your seven-month initial enrollment period, which starts on the first day of the month three months before the month you turn 65 and lasts through the three months after ...

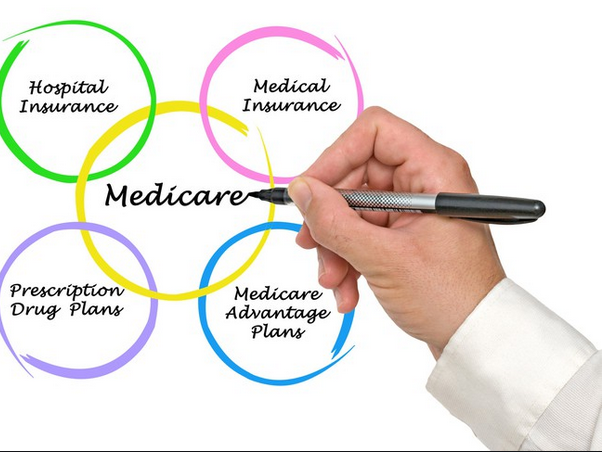

What do Medicare Parts A, B, C, D mean?

Medicare parts A and B together are known as original Medicare. Medicare Part C plans cover everything that original Medicare does and often include additional coverage options. Medicare Part D is prescription drug coverage.

Can Medicare Part B be added at any time?

Special Enrollment Period If you are eligible for the Part B SEP, you can enroll in Medicare without penalty at any time while you have job-based insurance and for eight months after you lose your job-based insurance or you (or your spouse) stop working, whichever comes first.

Do I automatically get Medicare Part B when I turn 65?

Medicare will enroll you in Part B automatically. Your Medicare card will be mailed to you about 3 months before your 65th birthday. If you're not getting disability benefits and Medicare when you turn 65, you'll need to call or visit your local Social Security office, or call Social Security at 1-800-772-1213.

Is Part B mandatory on Medicare?

Part B is optional. Part B helps pay for covered medical services and items when they are medically necessary. Part B also covers some preventive services like exams, lab tests, and screening shots to help prevent, find, or manage a medical problem. Cost: If you have Part B, you pay a Part B premium each month.

Can I get Medicare Part B at 62?

In the news, you may often hear about the possibility of lowering the age of Medicare eligiblity to 62, or even 60. Currently, Medicare eligibility starts at age 65 for most people. However, you can get Medicare before age 65 in certain situations.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

What do I do if I don't have Medicare Part B?

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B.

Why do I have to pay for Medicare Part B?

You must keep paying your Part B premium to keep your supplement insurance. Helps lower your share of costs for Part A and Part B services in Original Medicare. Some Medigap policies include extra benefits to lower your costs, like coverage when you travel out of the country.

Does Medicare Part B pay for prescriptions?

Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. covers a limited number of outpatient prescription drugs under certain conditions. A part of a hospital where you get outpatient services, like an emergency department, observation unit, surgery center, or pain clinic.

Why is my first Medicare bill so high?

If you're late signing up for Original Medicare (Medicare Parts A and B) and/or Medicare Part D, you may owe late enrollment penalties. This amount is added to your Medicare Premium Bill and may be why your first Medicare bill was higher than you expected.

Is it better to take Social Security at 62 or 67?

The short answer is yes. Retirees who begin collecting Social Security at 62 instead of at the full retirement age (67 for those born in 1960 or later) can expect their monthly benefits to be 30% lower. So, delaying claiming until 67 will result in a larger monthly check.

Are they changing Medicare to 60?

But this week, the Congressional Budget Office (CBO) released an analysis of lowering the Medicare eligibility to age 60, and there are some interesting takeaways and important caveats. CBO's top line numbers are relatively straightforward.

How does Medicare work when you turn 62?

You can only enroll in Medicare at age 62 if you meet one of these criteria: You have been on Social Security Disability Insurance (SSDI) for at least two years. You are on SSDI because you suffer from amyotrophic lateral sclerosis, also known as ALS or Lou Gehrig's disease.

How long do you have to sign up for a health insurance plan?

You also have 8 months to sign up after you or your spouse (or your family member if you’re disabled) stop working or you lose group health plan coverage (whichever happens first).

What is a health plan?

In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

When does insurance start?

Generally, coverage starts the month after you sign up.

When does Part A coverage start?

If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65. (If your birthday is on the first of the month, coverage starts the month before you turn 65.)

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is IRMAA in insurance?

IRMAA is an extra charge added to your premium. If your yearly income in 2019 (for what you pay in 2021) was. You pay each month (in 2021) File individual tax return. File joint tax return. File married & separate tax return. $88,000 or less. $176,000 or less. $88,000 or less.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What happens if you don't sign up for Part B?

If you don't sign up for Part B when you're first eligible, you may have to pay a late enrollment penalty.

What medical equipment is ordered by your doctor for use in the home?

Certain medical equipment, like a walker, wheelchair, or hospital bed, that's ordered by your doctor for use in the home.

How to qualify for Medicare premium free?

To be eligible for premium-free Part A, an individual must be entitled to receive Medicare based on their own earnings or those of a spouse, parent, or child. To receive premium-free Part A, the worker must have a specified number of quarters of coverage (QCs) and file an application for Social Security or Railroad Retirement Board (RRB) benefits. The exact number of QCs required is dependent on whether the person is filing for Part A on the basis of age, disability, or End Stage Renal Disease (ESRD). QCs are earned through payment of payroll taxes under the Federal Insurance Contributions Act (FICA) during the person's working years. Most individuals pay the full FICA tax so the QCs they earn can be used to meet the requirements for both monthly Social Security benefits and premium-free Part A.

How long do you have to be on Medicare if you are disabled?

Disabled individuals are automatically enrolled in Medicare Part A and Part B after they have received disability benefits from Social Security for 24 months. NOTE: In most cases, if someone does not enroll in Part B or premium Part A when first eligible, they will have to pay a late enrollment penalty.

How long does it take to get Medicare if you are 65?

For someone under age 65 who becomes entitled to Medicare based on disability, entitlement begins with the 25 th month of disability benefit entitlement.

What is the income related monthly adjustment amount for Medicare?

Individuals with income greater than $85,000 and married couples with income greater than $170,000 must pay a higher premium for Part B and an extra amount for Part D coverage in addition to their Part D plan premium. This additional amount is called income-related monthly adjustment amount. Less than 5 percent of people with Medicare are affected, so most people will not pay a higher premium.

How long does Medicare take to pay for disability?

A person who is entitled to monthly Social Security or Railroad Retirement Board (RRB) benefits on the basis of disability is automatically entitled to Part A after receiving disability benefits for 24 months.

When do you have to apply for Medicare if you are already on Social Security?

Individuals already receiving Social Security or RRB benefits at least 4 months before being eligible for Medicare and residing in the United States (except residents of Puerto Rico) are automatically enrolled in both premium-free Part A and Part B. People living in Puerto Rico who are eligible for automatic enrollment are only enrolled in premium-free Part A.

Why does Part A end?

There are special rules for when premium-free Part A ends for people with ESRD. Premium Part A and Part B coverage can be voluntarily terminated because premium payments are required. Premium Part A and Part B coverage ends due to: Voluntary disenrollment request (coverage ends prospectively); Failure to pay premiums;

Can I switch from Part B to a Medicare Advantage plan?

Yes, you can enroll in a Medicare Advantage plan during certain enrollment periods.

What is Medicare Supplement Insurance?

If you have Medicare Part A and Part B, you might also consider a Medicare Supplement Insurance (also called Medigap) plan. Medigap plans can help cover some of the out-of-pocket costs that Medicare does not cover, such as deductibles, coinsurance and copayments.

What is Medicare Advantage Plan?

A Medicare Advantage (Medicare Part C) plan is an alternative to Part A and Part B (though you still need to enroll in Part B before you can enroll in a Medicare Advantage plan). Your Medicare Advantage plan carrier (a private insurance company) provides all of your Part A and Part B benefits, instead of the federal government.

What happens if you don't have creditable coverage?

If you do not have “creditable coverage” after you first become eligible for Medicare Part B, you incur a penalty that you will pay when you eventually do enroll in Part B . The late enrollment penalty fee amount is a 10 percent increase in your Part B premium (which is $135.50 per month for most people in 2019) for each 12-month period you could ...

How much is the penalty for not enrolling in Part B?

For example, if you did not enroll in Part B when first eligible and delayed your enrollment for 14 months (and if no enrollment exception applied), your standard Part B premium amount – including your late enrollment penalty – would be $149.05 per month.

When is the open enrollment period for Medicare?

This enrollment period (also called the Open Enrollment Period for Medicare Advantage & Medicare prescription drug coverage) lasts from October 15 to December 7 every year.

Do retirees have to enroll in Medicare?

You may be automatically enrolled in Medicare Part A. Your retiree health plan (if you have one) may require you to enroll in Medicare. Whether or not this is the case, many health plans coordinate benefits with Medicare. Medicare is the usually the primary payer.

Do I Need Medicare Part B if I Have Other Insurance?

Many people ask if they should sign up for Medicare Part B when they have other insurance or private insurance. At a large employer with 20 or more employees, your employer plan is primary. Medicare is secondary, so you can delay Part B until you retired if you want to.

How much does Medicare pay for outpatients?

Your healthcare providers will bill Medicare, and Part B will then pay 80% of your outpatient expenses after your small deductible. Medicare then sends the remainder of that bill to your Medigap plan to pay the other 20%. The same goes for Medicare Advantage plans.

How much is Part B insurance?

Most people delay Part B in this scenario. Your employer plan likely already provides good outpatient coverage. Part B costs at least $148.50/month for new enrollees in 2020.

What happens if you opt out of Part B?

Be aware that if you opt out of Part B and then later decide to join, you will pay a Part B late penalty. You’ll also need to wait until the next General Enrollment Period to enroll, which means there could be a delay before your coverage becomes active. In my opinion, most Veterans should sign up for Part B.

What to do if Social Security says no?

If he or she tells you no, be sure you get a full explanation on why you are able to delay your. Get a second opinion if you are unsure, and never rely on Social Security to give you the right answer. We’ve seen too many people get wrong answers from inexperience government employees.

Do you need Part B before you can enroll in Medigap?

Conclusion. To recap the important points in this article, most people need Part B at some point. When you enroll will depend on what other coverage you currently have when you turn 65. Also, Part B is not a supplement. You need Part B before you can enroll in Medigap or a Medicare Advantage plan.

Can you use FEHB instead of Medicare?

Some people have 2 different coverages that they can choose independent of one another. Federal employees who can opt to use their FEHB instead of Medicare are one group . The most common situation though is with Veterans.

What happens if you don't enroll in Medicare Part B?

If you have VA benefits and do not enroll for Part B during your initial enrollment period, you may be assessed the Part B premium penalty if you decide to enroll for Part B at a later date. Get the benefits you deserve when you turn 65 by enrolling in Medicare. To find out more information about enrolling in Medicare Part B, ...

What is the first form to get Medicare Part B?

The first for you need is the Part B enrollment form found here: Medicare Part B enrollment application . Another important form is for your (or spouse) employer to show that you have had coverage since you were first eligible for Medicare at age 65. This is to ensure no penalty is added to your monthly Part B premiums.

How to sign up for Medicare Part B?

To sign up for Medicare Part B, you need to fill out application form CMS40B and take or mail it to your local Social Security office. You will also want to send your employer a CMS-L564E form to be filled out and sent in with your CMS40B application. There is an 8-month Special Enrollment Period that begins the month your group coverage ends or when the employment it is based on ends, whichever comes first.

How long before you turn 65 can you apply for Medicare?

You can apply 3 months prior to turning 65, the month you turn 65, or 3 months after turning 65. Your Medicare Part B benefits will be effective the first day ...

When does Medicare Part B start?

This period occurs from January 1st to March 31st, and your coverage benefits will start on July ...

How much is the Part B premium?

The standard monthly Part B premium in 2020 is $144.60 (up from $135.50 in 2019). 1 But how much you'll pay depends on your income. See below how the Part B premium is figured.

Where to drop off Medicare Part B?

Print these forms, get them filled out, and drop them off at your local Social Security office. The first for you need is the Part B enrollment form found here: Medicare Part B enrollment application .

How long do you have to pay back Medicare Part B?

If you were disenrolled from your Medicare part B plan for missing premium payments, you have 30 days from the official termination date to repay what’s due. If accepted, your coverage will continue. If you don’t pay back the premiums within the allotted time, you’ll have to reenroll during the next general enrollment period, ...

What happens if you cancel Medicare Part B?

If you’ve disenrolled from or cancelled your Medicare Part B coverage, you may have to pay a costly late enrollment penalty to reenroll. This is especially true if you have a gap in coverage. If you’re looking to reenroll in Medicare Part B, follow these steps: Go to the Social Security Administration website. Complete the application.

How long does it take to reenroll in Medicare?

Special enrollment period — 8 months following a qualifying event. If you qualify, you may be granted this 8-month window to reenroll in original Medicare or change your Medicare coverage after a significant life event, such as a divorce or move. Read on to learn more about how to reenroll in Medicare Part B and what it covers.

When do you have to reenroll in Medicare if you don't pay back?

If you don’t pay back the premiums within the allotted time, you’ll have to reenroll during the next general enrollment period, which runs from January 1 through March 31 each year. You can also ask for reinstatement under the Medicare Good Cause policy.

How long does it take to get Part B?

If you’re already covered through a workplace plan, or if you or your spouse suffer from a disability, you can sign up for Part B at any time. An 8-month special enrollment period to enroll into Part B insurance also comes into play 1 month after your employment or workplace insurance plan ends.

How long is the enrollment period for a new student?

The initial enrollment period is a 7-month time frame. It includes:

What happens if you don't pay your insurance?

If you prove there’s “good cause” (or reason) for not paying premiums — typically an emergency, chronic illness, or other related situation — you’ll still have to pay all owed premiums within a specified period of time to resume coverage.