Qualifying life event (QLE) A change in your situation — like getting married, having a baby, or losing health coverage — that can make you eligible for a Special Enrollment Period, allowing you to enroll in health insurance outside the yearly Open Enrollment Period. See if you qualify for a Special Enrollment Period

What are IRS qualifying life events for health insurance?

Qualifying Life Event (QLE) A change in your situation — like getting married, having a baby, or losing health coverage — that can make you eligible for a Special Enrollment Period, allowing you to enroll in health insurance outside the yearly Open Enrollment Period. There are 4 basic types of qualifying life events.

Are big changes coming for Medicare, Social Security?

To pay for these changes, Biden wants to increase Social Security payroll ... would provide some big savings to the program that could be applied toward [fixing] Medicare or improving other ...

What is an IRS qualifying event for health insurance?

- birth or adoption of a child

- marriage (and divorce, if the exchange or insurer counts it as a qualifying event, or if the divorce triggers a loss of other coverage)

- loss of other coverage (as long as the coverage you’re losing is considered minimum essential coverage)

Is Medicare eligibility a qualifying event?

Medicare entitlement will usually only be a qualifying event when an employer offers retirees under the age of 65 access to a retiree health plan. In this situation, the MSP rules permit (but do not require) the employer to terminate coverage on the retiree plan upon the retiree’s entitlement to Medicare.

What does Medicare consider a life changing event?

A change in your situation — like getting married, having a baby, or losing health coverage — that can make you eligible for a Special Enrollment Period, allowing you to enroll in health insurance outside the yearly Open Enrollment Period.

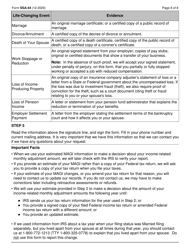

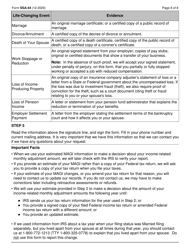

When should I submit SSA-44?

You should fill out Form SSA-44 if you experience any life-changing event that reduces your income. Life-changing events that qualify are marriage, divorce, death of a spouse, work stoppage, work reduction, loss of income-producing property, loss of pension income and employer settlement payment.

Is retirement considered a life changing event for Medicare premiums?

They do so by filing form SSA-44 to report their retirement as "Life Changing Event". Click here for form SSA-44. They do this as an appeal when they get the letter from Medicare telling them what Medicare calculated these premiums to be for 2020 where Medicare used the 2018 income.

How can I lower my Medicare Part B premium?

To request a reduction of your Medicare premium, contact your local Social Security office to schedule an appointment or fill out form SSA-44 and submit it to the office by mail or in person.

What does Social Security consider a life-changing event?

Social Security (the government agency in charge of IRMAA determinations) recognizes the following life-changing events: marriage. divorce or annulment. death of a spouse.

How do I notify Medicare of income change?

If you want to report a life-changing event, call us at 1-800-772-1213 (TTY 1-800-325-0778), or visit your local Social Security office.

How do I avoid Medicare Irmaa?

To avoid getting issued an IRMAA, you can proactively tell the SSA of any changes your income has seen in the past two years using a “Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event” form or by scheduling an interview with your local Social Security office (1-800-772-1213).

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

What is the Medicare MAGI for 2021?

You can expect to pay more for your Medicare Part B premiums if your MAGI is over a certain amount of money. For 2021, the threshold for these income-related monthly adjustments will kick in for those individuals with a MAGI of $88,000 and for married couples filing jointly with a MAGI of $176,000.

Will the 2022 Medicare premium be reduced?

About half of the larger-than-expected 2022 premium increase, set last fall, was attributed to the potential cost of covering the Alzheimer's drug Aduhelm.

Will 2022 Part B premium be reduced?

After the 2022 Medicare Part B premium was set, the manufacturer of Aduhelm™ reduced the price to an average of $26,200, and CMS finalized Medicare coverage with evidence development for Aduhelm™ and similar, future FDA-approved drugs with an indication for use in treating the Alzheimer's disease.

Do 401k distributions affect Medicare premiums?

Money coming out of a 401(k) is subject to income tax rates, which top out at 37%. To tailor your taxes in retirement, you'll need a combination of taxable, tax-deferred and tax-free savings. Manage your withdrawals from these accounts to keep your Medicare premiums down.

What is a Medicare qualifying life event?

A qualifying life event (or QLE) is a change in your situation (like moving or losing health coverage) that can make you eligible for a 60-day Special Enrollment Period outside Medicare’s Annual Election Period.

If your Medicare options seem overwhelming, click here

In one simple phone call, you can (finally) be confident in your choice of Medicare, thanks to KindHealth’s dedicated team of Licensed Medicare Advisors.

What's Kasasa?

More than just an unusual word: Kasasa is a promise. That promise includes offering life solutions that suit every lifestyle to help you maximize your money.

What is a significant reduction in MAGI?

A “significant” reduction in MAGI is a reduction that decreases or eliminates the income-related monthly adjustment amount (IRMAA) for a specific tax year. A beneficiary who has experienced an LCE causing a significant reduction in MAGI may request us to make a new initial determination using a more recent tax year, than the tax year used previously to impose IRMAA.

When is Part B determination effective?

the new initial determination for Part B is effective January (or the first month of Part B entitlement) of the current year. The new initial determination for IRMAA-D is effective January (or the prescription drug coverage start date, if later).

Can a beneficiary give a second tax year estimate?

The beneficiary also has the option to give a second tax year estimate for the next premium year if the LCE also affects it. If he or she gives an estimate for the current premium year, but not for the next premium year, use the current year estimate for the next premium year.

Can a beneficiary request a new initial determination after an LCE?

1. A beneficiary may request a new initial determination any time after an LCE and a significant reduction in MAGI has occurred. The LCE may have occurred at any time in the past. 2.

How to report a life change to the Marketplace?

Just log in to your account. Select your application, then select “Report a life change” from the menu on the left. You can also report changes by phone. Contact the Marketplace Call Center at 1-800-318-2596 (TTY: 1-855-889-4325). Don’t report these changes by mail. Some life changes can affect the premium tax credit you may be eligible for.

What changes qualify you for more or less savings?

Changes in income or other changes that affect your household size. Marriage or divorce, pregnancy, having a child, adoption/placing a child for adoption, gaining/losing a dependent, or moving.

Can you change your tax credit plan?

You can also contact the Marketplace Call Center to change plans by phone. If you’re not eligible for a Special Enrollment Period but the tax credit you qualify for has changed - you can’t change plans. But you can choose to adjust the amount of the tax credit to apply to your monthly premiums.

Can life changes affect premium tax credit?

Some life changes can affect the premium tax credit you may be eligible for. Visit the IRS website to learn more. After you report changes, you’ll get a new eligibility notice that will explain whether you qualify for a Special Enrollment Period and whether you’re eligible for lower costs based on your new information.