What is a MAPD plan for Medicare?

Medicare Advantage Prescription Drug (MAPD) plans offer an alternative way for eligible beneficiaries to receive their Medicare benefits. These bundled, convenient plans also include coverage for prescription medications.

When did Medicare Part C become Medicare+Choice?

The Balanced Budget Act of 1997 formalized the demonstration programs into Medicare Part C, and introduced the term Medicare+Choice as a pseudo-brand for this option. Initially, fewer sponsors participated than expected, leading to less competition than expected by the Republicans who in 1995 conceived what became Part C in 1997.

How is Medicare Part A and Part C administered?

Most Medicare Advantage and other Part C plans are administered (CMS uses the term "sponsored") by integrated health delivery systems and non-profit charities under state laws, and/or under union or religious management. Medicare Part A provides payments for in-patient hospital, hospice, and skilled nursing services.

What is the difference between Medicare Part C and Original Medicare?

The most important difference between a Part C health plan and FFS Original Medicare is that all Part C plans, including capitated-fee Medicare Advantage plans, include a limit on how much a beneficiary will have to spend annually out of pocket; that amount is unlimited in Original Medicare Parts A and B.

How long have MAPD plans been around?

President Bill Clinton signed Medicare+Choice into law in 1997. The name changed to Medicare Advantage in 2003. Advantage plans automatically cover essential Part A and Part B benefits, except hospice services. Insurance companies offer six different approaches to Medicare Advantage plans.

Is Medicare Part C an Advantage plan?

A Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called "Part C" or "MA Plans," are offered by Medicare-approved private companies that must follow rules set by Medicare.

Why are there so many Medicare Part C commercials?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.

Who created Medicare C?

On July 30, 1965 President Lyndon B. Johnson made Medicare law by signing H.R. 6675 in Independence, Missouri. Former President Truman was issued the very first Medicare card during the ceremony.

Is there such a thing as Medicare Part C?

A Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called "Part C" or "MA Plans," are offered by Medicare-approved private companies that must follow rules set by Medicare.

What type of insurance is Medicare Part C?

Medicare Advantage, or Medicare Part C, is a type of Medicare plan that uses private health insurance to cover all the services you'd receive under Medicare Parts A and B. Anyone who is eligible for original Medicare Parts A and B is eligible for the Medicare Advantage programs in their area.

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What is the difference between supplement and Advantage plans?

Keep in mind that Medicare Supplement insurance plans can only be used to pay for Original Medicare costs; they can't be used with Medicare Advantage plans. In contrast, Medicare Advantage plans are an alternative to Original Medicare. If you enroll in a Medicare Advantage plan, you're still in the Medicare program.

How long has Medicare Part C been around?

The roots of Medicare Advantage (also known as Medicare Part C) go back to the 1970s. At that time, beneficiaries could receive managed care through private insurance companies. It was not until 1997 that the program, then called “Medicare Choice,” became official with the passing of the Balanced Budget Act.

Why was 1965 such an important year for policy issues?

On July 30, 1965, President Lyndon B. Johnson signed into law legislation that established the Medicare and Medicaid programs. For 50 years, these programs have been protecting the health and well-being of millions of American families, saving lives, and improving the economic security of our nation.

Why was Medicare Part C created quizlet?

adopted from this legislation to help manage rising Medicare costs through the implementation of managed care plans, which also provided enrollees with a greater choice in selecting health care coverage.

What is the difference between Medicare Advantage and Original Medicare?

From a beneficiary's point of view, there are several key differences between Medicare Advantage and Original Medicare. Most Medicare Advantage plans are managed care plans (e.g., PPOs or HMOs) with limited provider networks, whereas virtually every physician and hospital in the U.S. accepts Original Medicare.

What is Medicare Advantage?

Medicare Advantage (sometimes called Medicare Part C or MA) is a type of health insurance plan in the United States that provides Medicare benefits through a private-sector health insurer. In a Medicare Advantage plan, a Medicare beneficiary pays a monthly premium to a private insurance company ...

What happens if Medicare bid is lower than benchmark?

If the bid is lower than the benchmark, the plan and Medicare share the difference between the bid and the benchmark ; the plan's share of this amount is known as a "rebate," which must be used by the plan's sponsor to provide additional benefits or reduced costs to enrollees.

How does capitation work for Medicare Advantage?

For each person who chooses to enroll in a Part C Medicare Advantage or other Part C plan, Medicare pays the health plan sponsor a set amount every month ("capitation"). The capitated fee associated with a Medicare Advantage and other Part C plan is specific to each county in the United States and is primarily driven by a government-administered benchmark/framework/competitive-bidding process that uses that county's average per-beneficiary FFS costs from a previous year as a starting point to determine the benchmark. The fee is then adjusted up or down based on the beneficiary's personal health condition; the intent of this adjustment is that the payments be spending neutral (lower for relatively healthy plan members and higher for those who are not so healthy).

How many people will be on Medicare Advantage in 2020?

Enrollment in the public Part C health plan program, including plans called Medicare Advantage since the 2005 marketing period, grew from zero in 1997 (not counting the pre-Part C demonstration projects) to over 24 million projected in 2020. That 20,000,000-plus represents about 35%-40% of the people on Medicare.

How much does Medicare pay in 2020?

In 2020, about 40% of Medicare beneficiaries were covered under Medicare Advantage plans. Nearly all Medicare beneficiaries (99%) will have access to at least one Medicare Advantage ...

How much has Medicare Advantage decreased since 2017?

Since 2017, the average monthly Medicare Advantage premium has decreased by an estimated 27.9 percent. This is the lowest that the average monthly premium for a Medicare Advantage plan has been since 2007 right after the second year of the benchmark/framework/competitive-bidding process.

What is Medicare Advantage Plan?

Medicare Advantage plans offer all the coverage of original Medicare (parts A and B), and often include additional services. When a Medicare Advantage plan offers prescription drug coverage, it is known as a MAPD plan. MAPD plans can be a great option for people who want to have all their coverage bundled into one plan.

What is MAPD plan?

Cost. Takeaway. Medicare Advantage prescription drug (MAPD) plans are a type of Medicare Advantage plan that includes prescription drug coverage. You’ll have more coverage than with original Medicare and you don’t need to worry about a separate Part D plan. MAPD plans are available at a wide range of prices and some are very affordable.

What percentage of MAPD is deductible?

The MAPD plan will pay the other 80 percent . Deductibles. Deductibles are the amount you need to pay before insurance will pick up the cost. For example, you might need to spend $500 toward services before your MAPD plan begins coverage.

How much is Medicare Part B 2021?

However, there is a premium for Part B. In 2021, the standard Medicare Part B premium amount is $148.50. Higher-income households might need to pay a higher premium. Medicare Advantage Plans have their own premiums. Some plans will not charge a premium on top of your Part B premium, but others will. Copays.

Is MAPD affordable?

MAPD plans are available at a wide range of prices and some are very affordable. Your costs will depend on your area, income, and the coverage you need. Medicare offers several plan types to cover your medical needs and fit your budget. In addition to Medicare Part A (hospital insurance) and Medicare Part B (medical insurance), ...

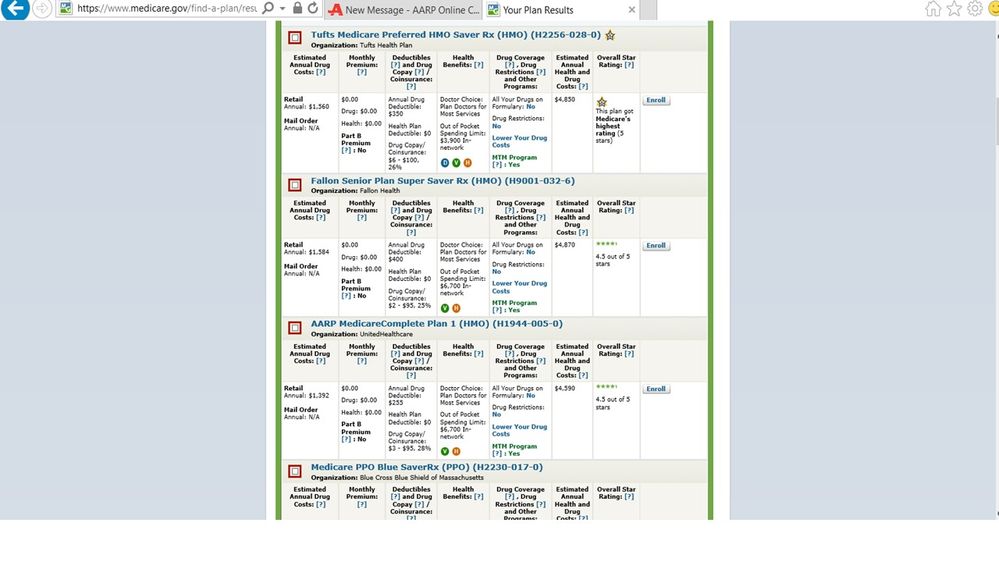

Can you select none for Medicare?

Select none if you are paying your Medicare costs out of pocket. Your current medications. You’ll need to enter all the medications you take and your current pharmacy in order to see drug prices for MAPD plans. Once you enter your medications and pharmacy information, you’ll see plans in your area.

Is a PPO more restrictive than an HMO?

You’ll usually have a less restrictive network with a PPO, but your premium costs might be higher than with an HMO. Private Fee-for-Service (PFFS) plans. PFFS plans are a type of Medicare Advantage plan that allow you the ability to not have a set primary care physician or a set healthcare network.

What are the different types of MAPD plans?

There are various types of MAPD plans available. Depending on your location, the types of plans that may be available can typically include: 1 Health Maintenance Organization (HMO) plans – These plans typically use a specified provider network, and services received outside of the network aren’t covered except in the case of emergency care. 2 Preferred Provider Organization (PPO) plans – These plans will pay for services received outside of the provider network, but they will be less expensive if you stay within the network. Because these plans are less restrictive than an HMO plan, premium costs are typically higher. 3 Private Fee-for-Service (PFFS) plans – A PFFS plan can provide greater flexibility, as you aren’t required to select a primary care physician and you are typically not restricted to a provider network. 4 Special Needs Plans (SNPs) – These plans can provide tailored care for those with specific chronic medical conditions, people with low incomes or care home residents.

What are MAPD plans?

These plans are called MAPD plans. Examples of some of the benefits some Medicare Advantage plans may offer can include medications, gym membership, wellness programs, vision and dental care. Some MA plans even provide coverage for alternative therapies, meal delivery and transportation services.

What is deductible in Medicare?

A deductible is the amount of money the beneficiary must pay for covered health care services before their Medicare Advantage plan begins to pay. For most health care services, you'll pay the full cost until the deductible is paid. After this, you will then pay either coinsurance or a copayment.

What is Medicare Advantage?

Medicare Advantage Prescription Drug (MAPD) plans offer an alternative way for eligible beneficiaries to receive their Medicare benefits. These bundled, convenient plans also include coverage for prescription medications.

What is a formulary in a prescription plan?

These plans use a drug list called a formulary that outlines the covered prescription drugs for that plan. The formulary organizes medicines into pricing tiers, with tier 1 generic drugs typically being the least costly. The amount you pay for medication depends on the tier.

What is coinsurance cost?

A coinsurance cost is a percentage cost of a health care service. For example, Medicare Part B charges a 20% coinsurance for most covered services after you meet your Part B deductible.

How much is a 2021 Medicare deductible?

One deductible is for general health care costs and a second for Part D prescription drug coverage, which cannot exceed $445 per year in 2021. However, some plans may offer a $0 medical deductible and/or a $0 drug deductible.

What is MAPD plan?

Summary. An MAPD plan is a Medicare Advantage plan that has prescription drug coverage. MAPD plans include Medicare parts A, B, and D benefits. People may choose from several types of plans, including HMO, PPO, PFFS, and SNP plans. The features and rules differ among the types of plans, and the costs vary greatly.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is MAPD coverage?

MA and coverage for prescribed medication. MA plans can also offer prescription drug coverage. Plans that include cover for prescribed medication are sometimes known as MAPD plans. Many MA and MAPD plans offer additional benefits that original Medicare does not. Common benefits include dental, vision, and hearing care.

What is Medicare Part D?

In both of these cases, Part D plans offer a set standard of coverage. Each plan has a formulary, which is a list of prescription drugs that the policy covers. Formularies vary among insurers.

How much does Medicare Advantage cost?

According to the Kaiser Family Foundation, the average monthly premium for a Medicare Advantage plan in 2019 was $29. The cost of the premiums can range from $0 to more than $100.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

How many deductibles are there for MA?

Some MA plans may have two deductibles, including a deductible for the plan and deductible for prescription drug coverage. They may also have different copayments or coinsurance, but all of the plans put a limit on yearly out-of-pocket expenses.

What are the special enrollment periods?

When certain events happen in your life, like if you move or lose other insurance coverage, you may be able to make changes to your Medicare health and drug coverage. These chances to make changes are called Special Enrollment Periods. Rules about when you can make changes and the type of changes you can make are different for each Special Enrollment Period.

How many enrollment periods are there for Medicare Advantage?

There are 2 separate enrollment periods each year. See the chart below for specific dates.

What is the late enrollment penalty for Medicare?

The late enrollment penalty is an amount that’s permanently added to your Medicare drug coverage (Part D) premium. You may owe a late enrollment penalty if at any time after your Initial Enrollment Period is over, there’s a period of 63 or more days in a row when you don’t have Medicare drug coverage or other creditable prescription drug coverage. Creditable prescription drug coverage is coverage (for example, from an employer or union) that’s expected to pay, on average, at least as much as Medicare’s standard prescription drug coverage. If you have a penalty, you’ll generally have to pay it for as long as you have Medicare drug coverage. For more information about the late enrollment penalty, visit Medicare.gov, or call 1‑800‑MEDICARE (1‑800‑633‑4227). TTY users can call 1‑877‑486‑2048.