Is there a cap on Medicare tax?

Jan 04, 2022 · January 4, 2022. Reviewed by John Krahnert. The 2022 Medicare tax rate is 2.9%. You’re typically responsible for paying half of this amount (1.45%), and your employer is responsible for the other half. Learn more.

What is the current tax rate for Social Security and Medicare?

Initially, there was a cap on the amount of income that was subject to the Medicare tax for each individual. With rising costs in the Medicare plan, however, this cap was removed in 1994. Currently, all of an individual’s earned income is subject to the flat rate Medicare tax. Medicare Tax Payments. The medicare tax is equal to 2.9 percent of gross wages. For regular wage …

What is the tax cap on income tax?

Jan 19, 1999 · Specifically, the Heritage analysis suggests that removing the taxable wage cap would: Decrease disposable family income in FY 2004 by $62.7 billion in 1992 inflation-adjusted dollars. In response...

What is the Medicare tax rate for 2021?

Mar 15, 2022 · Social Security and Medicare Withholding Rates. The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or ...

Was there ever a cap on Medicare tax?

The resulting maximum Social Security tax for 2020 is $8,537.40. There is no limit on the amount of earnings subject to Medicare (hospital insurance) tax....2020 Social Security and Medicare Tax Withholding Rates and Limits.Tax2019 Limit2020 LimitMedicare liabilityNo limitNo limit3 more rows

Is there a cap on Medicare tax 2021?

For 2021, an employee will pay: 6.2% Social Security tax on the first $142,800 of wages (maximum tax is $8,853.60 [6.2% of $142,800]), plus. 1.45% Medicare tax on the first $200,000 of wages ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return), plus.Oct 15, 2020

Is there a cap on Medicare tax 2022?

There's a maximum amount of compensation subject to the Social Security tax, but no maximum for Medicare tax. For 2022, the FICA tax rate for employers is 7.65% — 6.2% for Social Security and 1.45% for Medicare (the same as in 2021).Jan 12, 2022

When did the Medicare tax rate change?

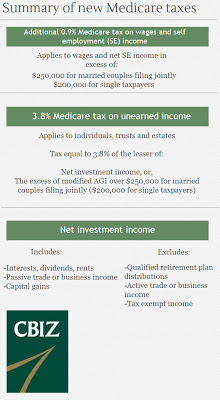

Since 2013, you'll pay a 3.8% Medicare tax rate on your net investment income when the total amount exceeds the income thresholds. The tax, known as the Net Investment Income tax, will go into the government's General Fund and not into Medicare. Most people only pay the 2.9% flat tax rate.Sep 27, 2021

Will tax brackets change in 2022?

Also, the standard deduction will increase in 2022 by $400 to $12,950 for single filer or married but filing separately, by $600 to $19,400 for head of households and $800 to $25,900 for married taxpayers filing jointly.Apr 6, 2022

What is the max SS tax for 2021?

For those who earn a wage or salary, they share the 12.4 percent Social Security tax equally with their employer on their net earnings. The maximum taxable amount for the Social Security tax is $142,800 in 2021.Nov 4, 2021

What are the 2021 tax brackets?

There are seven tax brackets for most ordinary income for the 2021 tax year: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent.Apr 7, 2022

What is the SS limit for 2022?

$147,000Social Security tax is paid as a percentage of net earnings and has an annual limit. In 2022, the Social Security tax limit increased significantly, to $147,000. This could result in a higher tax bill for some taxpayers. The amount of the benefits received by individuals and couples rose to 5.9%.

When did the Medicare tax start?

1966Medicare Taxes: The Basics Medicare HI taxes began in 1966, at a modest rate of 0.7%. Employers and employees were each responsible for paying 0.35%. Employees paid their share when their employers deducted it from their paychecks.Jan 10, 2022

Why did my Medicare tax increase?

The Affordable Care Act expanded the Medicare payroll tax to include the Additional Medicare Tax. This new Medicare tax increase requires higher wage earners to pay an additional tax (0.9%) on earned income. All types of wages currently subject to the Medicare tax may also be subject to the Additional Medicare Tax.Feb 18, 2022

When was the last time Social Security tax was raised?

The first, an immediate increase, would have raised the payroll tax rate from its current 12.4 percent to 14.4 percent in 2006; the second, a phased increase, would raise the payroll tax rate to 14.5 percent in 2020, and then to 16.6 percent in 2050.

What is the Medicare tax rate?

The standard Medicare tax is 1.45 percent, or 2.9 percent if you’re self-employed. Taxpayers who earn above $200,000, or $250,000 for married couples, will pay an additional 0.9 percent toward Medicare.

What is the additional Medicare tax?

The Additional Medicare Tax is an extra 0.9 percent tax on top of the standard tax payment for Medicare. The additional tax has been in place since 2013 as a part of the Affordable Care Act and applies to taxpayers who earn over a set income threshold.

How is Medicare tax calculated?

How is the Additional Medicare Tax calculated? Medicare is paid for by taxpayer contributions to the Social Security Administration. Workers pay 1.45 percent of all earnings to the Federal Insurance Contributions Act (FICA). Employers pay another 1.45 percent, for a total of 2.9 percent of your total earnings.

What are the benefits of the Affordable Care Act?

Notably, the Affordable Care Act provided some additional benefits to Medicare enrollees, including: lower premiums for Medicare Advantage (Part C) plans. lower prescription drug costs. closure of the Part D benefit gap, or “ donut hole ”.

What is the Medicare tax rate for 2020?

The Medicare tax rate for 2020 is 2.9 % of all covered wages. 1.45 % contributed by the employer and 1.45 % withheld. In other words, contributed by the employee.

How much is FICA tax?

Every U.S. citizen that earns wages must pay FICA (Federal Insurance Contributions Act) taxes. These taxes comprise: 6.2 % Social Security. 1.45 % Medicare tax. These taxes are contributed by both the employee and the employer, so in fact a total of 15.3 % of an employee’s gross salary is taxed. If you are self-employed, you are responsible ...

Do employers have to pay Medicare and Social Security taxes?

By law, employers are required to collect both Social Security and Medicare tax. This money is then submitted to the IRS (Internal Revenue Service) every quarter. If you, or you and your spouse, earn wages over a certain threshold, you will be liable for additional Medicare tax.

What would happen if the cap was removed?

Removing the maximum cap on taxable payroll would increase this tax burden to 12.4 percent of all covered labor income. This would boost payroll taxes as a share of all covered wages, salaries, and self-employment income to their highest level ever.

What would happen if Social Security was removed?

Removing the Social Security taxable wage cap would reduce job creation and economic growth while substantially increasing payroll taxes on American workers. A slowdown in the growth of compensation and a significant decrease in the savings rate would further squeeze family budgets.

What is WEFA model?

The WEFA model contains a variable that measures total Social Security tax revenue. Heritage analysts increased this tax revenue variable for each forecast year by the amount of the static revenue estimates they developed in the first step.

What is the assumption of the Heritage model?

The model assumes that the Federal Reserve Board will react to this policy change as they have historically. This assumption was embodied in the Heritage model simulation by including the stochastic equation in the WEFA model for monetary reserves.

Why did WEFA change the personal interest income variable?

Due to the technical specification of the WEFA model, a change was made in the personal interest income variable to reflect the fact that Treasury bonds issued to the Social Security Trust Fund are not negotiable and do not pay interest to the public.

How are Social Security benefits calculated?

Social Security benefits are calculated on the basis of a worker's earnings over his or her career. However, only the worker's earnings subject, under the maximum taxable amount, to the payroll tax are used to compute his or her benefits.

Who introduced the Social Security Solvency Act?

In the 105th Congress, Senators Daniel Moynihan (D-NY) and Bob Kerrey (D-NE) introduced the Social Security Solvency Act of 1998 (S. 1792), which would raise the tax cap on wages from $82,800 in 2003 to $97,500.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the FICA tax?

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

What is the cap on Social Security?

The cap limits how much high earners need to pay in Social Security taxes each year. Critics argue that income tax caps unfairly favor high earners compared to low-income earners. Others believe that raising the cap would result in one of the largest tax hikes of all-time.

Why is the cap on wages subject to the tax controversial?

The cap on wages subject to the tax is the subject of controversy, partly because it means that, while the average worker pays tax on every dollar of their income (the vast majority of workers earn less than the wage base limit), the highest earners pay tax on only part of their income. Critics argue that caps on FICA taxes are not fair for ...

What is the payroll tax for 2020?

It is 12.4% of earned income up to an annual limit that must be paid into Social Security and an additional 2.9% that must be paid into Medicare.

How much is Social Security tax in 2021?

5 . For 2021, the wage base limit for Social Security taxes increased to $142,800, a $5,100 increase from $137,700 in 2020.

Who is Jean Folger?

Jean Folger has 15+ years of experience as a financial writer covering real estate, investing, active trading, the economy, and retirement planning. She is the co-founder of PowerZone Trading, a company that has provided programming, consulting, and strategy development services to active traders and investors since 2004.

Is there a wage cap on Medicare?

There is no income cap (or wage base limit) for the Medicare portion of the tax, meaning you continue to owe your half of the 2.9% tax on all wages earned for the year, regardless of the amount of money you make. 4 . The Social Security tax, however, has a wage-based limit, which means there is a maximum wage that is subject to the tax for ...