Why Advantage plans are bad?

The roots of Medicare Advantage (also known as Medicare Part C) go back to the 1970s. At that time, beneficiaries could receive managed care through private insurance companies. It was not until 1997 that the program, then called “Medicare Choice,” became official with the passing of the Balanced Budget Act.

What companies offer Medicare Advantage plans?

But it wasn’t until after 1966 – after legislation was signed by President Lyndon B Johnson in 1965 – that Americans started receiving Medicare health coverage when Medicare’s hospital and medical insurance benefits first took effect. Harry Truman and his wife, Bess, were the first two Medicare beneficiaries.

When can I join a Medicare Advantage plan?

Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by Medicare-approved private companies that must follow rules set by Medicare. Most Medicare Advantage Plans include drug coverage (Part D). In most cases, you’ll need to use health care providers who participate in the plan’s network.

What are the advantages and disadvantages of Medicare Advantage plans?

When you join a Medicare Advantage Plan, Medicare pays a fixed amount for your coverage each month to the company offering your Medicare Advantage Plan. Companies that offer Medicare Advantage plans must follow rules set by Medicare. However, each Medicare Advantage Plan can charge different out-of-pocket costs and

Which president started Medicare Advantage plans?

President Lyndon B. JohnsonOn July 30, 1965, President Lyndon B. Johnson signed into law legislation that established the Medicare and Medicaid programs. For 50 years, these programs have been protecting the health and well-being of millions of American families, saving lives, and improving the economic security of our nation.Dec 1, 2021

How did Medicare Advantage plans get started?

The Medicare Advantage (MA) program, formally Part C of Medicare, originated with the Tax Equity and Fiscal Responsibility Act (TEFRA), which authorized Medicare to contract with risk-based private health plans, or those plans that accept full responsibility (i.e., risk) for the costs of their enrollees' care in ...

What is the difference between Medicare Advantage and Medicare traditional?

Original Medicare covers inpatient hospital and skilled nursing services – Part A - and doctor visits, outpatient services and some preventative care – Part B. Medicare Advantage plans cover all the above (Part A and Part B), and most plans also cover prescription drugs (Part D).

Can you have both original Medicare and a Medicare Advantage Plan?

People with Medicare can get their health coverage through either Original Medicare or a Medicare Advantage Plan (also known as a Medicare private health plan or Part C).

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.Feb 24, 2021

What is the biggest disadvantage of Medicare Advantage?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider networks and the copays can nickel and dime you to death.Dec 12, 2021

Can you switch back and forth between Medicare and Medicare Advantage?

If you currently have Medicare, you can switch to Medicare Advantage (Part C) from Original Medicare (Parts A & B), or vice versa, during the Medicare Annual Enrollment Period. If you want to make a switch though, it may also require some additional decisions.

Do Medicare Advantage plans have a lifetime limit?

Medicare Advantage plans have no lifetime limits because they have to offer coverage that is at least as good as traditional Medicare, says Vicki Gottlich, senior policy attorney at the Center for Medicare Advocacy in Washington, D.C. “There has never been a cap on the total amount of benefits for which Medicare will ...Aug 23, 2010

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.Feb 16, 2022

Which two Medicare plans Cannot be enrolled together?

You generally cannot enroll in both a Medicare Advantage plan and a Medigap plan at the same time.Jun 2, 2021

Do you still pay Medicare Part B with an Advantage plan?

Who Pays the Premium for Medicare Advantage Plans? You continue to pay premiums for your Medicare Part B (medical insurance) benefits when you enroll in a Medicare Advantage plan (Medicare Part C). Medicare decides the Part B premium rate.Nov 8, 2021

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.Dec 21, 2021

What is the difference between Medicare Advantage and Original Medicare?

From a beneficiary's point of view, there are several key differences between Medicare Advantage and Original Medicare. Most Medicare Advantage plans are managed care plans (e.g., PPOs or HMOs) with limited provider networks, whereas virtually every physician and hospital in the U.S. accepts Original Medicare.

What is Medicare Advantage?

Medicare Advantage (sometimes called Medicare Part C or MA) is a type of health insurance plan in the United States that provides Medicare benefits through a private-sector health insurer. In a Medicare Advantage plan, a Medicare beneficiary pays a monthly premium to a private insurance company ...

How much does Medicare pay in 2020?

In 2020, about 40% of Medicare beneficiaries were covered under Medicare Advantage plans. Nearly all Medicare beneficiaries (99%) will have access to at least one Medicare Advantage ...

How does capitation work for Medicare Advantage?

For each person who chooses to enroll in a Part C Medicare Advantage or other Part C plan, Medicare pays the health plan sponsor a set amount every month ("capitation"). The capitated fee associated with a Medicare Advantage and other Part C plan is specific to each county in the United States and is primarily driven by a government-administered benchmark/framework/competitive-bidding process that uses that county's average per-beneficiary FFS costs from a previous year as a starting point to determine the benchmark. The fee is then adjusted up or down based on the beneficiary's personal health condition; the intent of this adjustment is that the payments be spending neutral (lower for relatively healthy plan members and higher for those who are not so healthy).

Does Medicare Advantage have a premium?

Both charge a premium for Part B benefits, and about 40% of Medicare Advantage enrollees with prescription drug benefits pay an additional premium. Medicare Advantage plans include an annual out-of-pocket spending limit, while Original Medicare does not and is usually supplemented with a "Medigap" plan.

Does Medicare Advantage cover out of pocket costs?

In addition Medicare Advantage plans may cover benefits in a different way. For example, plans that require higher out-of-pocket costs than Medicare Parts A or B for some benefits, such as skilled nursing facility care, might offer lower copayments for doctor visits to balance their benefits package.

Does Medicare pay for Part A and Part B?

By contrast, under so-called "Original Medicare", a Medicare beneficiary pays a monthly premium to the federal government and receives coverage for Part A and Part B services, but must purchase other coverage (e.g., for prescription drugs) separately.

What is MSA plan?

Medicare Medical Savings Account (Msa) Plan. MSA Plans combine a high deductible Medicare Advantage Plan and a bank account. The plan deposits money from Medicare into the account. You can use the money in this account to pay for your health care costs, but only Medicare-covered expenses count toward your deductible.

What is a special needs plan?

Special Needs Plans (SNPs) Other less common types of Medicare Advantage Plans that may be available include. Hmo Point Of Service (Hmopos) Plans. An HMO Plan that may allow you to get some services out-of-network for a higher cost. and a. Medicare Medical Savings Account (Msa) Plan.

Does Medicare Advantage include drug coverage?

Most Medicare Advantage Plans include drug coverage (Part D). In many cases , you’ll need to use health care providers who participate in the plan’s network and service area for the lowest costs.

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

What is Medicare Advantage?

These plans, now known as Medicare Advantage or Medicare Part C, operate under risk-based contracts — the plans agree to assume liability for beneficiaries’ health expenses in exchange for a monthly, per-person (also known as capitated) sum.

How long has Medicare been involved with HMOs?

Medicare has involved HMOs since 1966. Because these private plans use salaried physicians, they were originally paid on a reasonable-cost basis for services that Medicare otherwise would have paid on a reasonable-charge basis. 4 Under the 1972 Social Security Amendments, preexisting plans could continue to be paid on a reasonable-cost basis, but new plans would operate on a risk-sharing contract. The expenses of each plan were compared to the adjusted average per capita cost (AAPCC) for their enrollees under traditional Medicare. If the HMO’s costs exceeded the AAPCC, it could carry the excess cost into subsequent years to be offset against any future savings. If the HMO’s costs were lower, up to 20 percent of the difference was shared evenly between the HMO and the government (with the government keeping any additional savings). 5

How much did Medicare pay in 2009?

Before the bidding system went into effect, payments to plans averaged 107 percent of traditional Medicare spending in 2004; by 2009, plans were paid 114 percent of what traditional Medicare would have spent on the same beneficiaries, amounting to $11.4 billion in excess payments (Exhibit 4). 33.

What was the BBA?

The Balanced Budget Act of 1997 (BBA) made significant changes to how Medicare paid risk plans in the new Medicare+Choice (Medicare Part C) program. It scrapped the previous payment formula and largely reduced payment rates to plans. 16 In response to reports of favorable selection, the BBA established new risk-adjustment measures based on health status and an annual enrollment period, with only one switch allowed outside that period. 17

How many people will be enrolled in Medicare Advantage by 2027?

The Congressional Budget Office’s most recent projections estimate that 41 percent of beneficiar ies will be enrolled in Medicare Advantage by 2027 (Exhibit 3). 42

What is Medicare Modernization Act?

In addition to establishing Medicare Part D, the Medicare Modernization Act of 2003 (MMA) significantly altered how private plans (now renamed Medicare Advantage) were paid. The law limited enrollees to one switch per year during the open enrollment period and allowed plans to include the new drug benefit (MA–PD). 23

What is the role of the HCFA?

The 1972 Amendments gave the Health Care Financing Administration (HCFA) — subsequently renamed the Centers for Medicare and Medicaid Services (CMS) — the authority to conduct demonstrations of payment models that might reduce program spending, improve health care quality, or both.

When did Medicare Supplement Plans start?

The history of Medicare Supplement Plans – Medigap insurance takes us back to 1980. What began as voluntary standards governing the behavior of insurers increasingly became requirements. Consumer protections were continuously strengthened, and there was a trend toward the simplification of Medicare Supplement Plans – Medigap Insurance reimbursements whenever possible. During the 1980s the federal government first provided a voluntary certification option for Medicare Supplement, or Medigap Insurance, insurers in Section 507 of the Social Security Disability Amendments of 1980 , commonly known as the “Baucus Amendment.” In order to meet the Baucus Amendment’s voluntary minimum standards, the Medicare Supplement plan was required to:

When did Medicare become standardized?

The second group of plans, labeled Plan A through Plan J, were standardized and became effective in a state when the terms of Omnibus Budget Reconciliation Act of 1990 were adopted by the state, mainly in 1992. Shopping for Medicare insurance can be overwhelming.

What is a felony in Medicare?

The Medicare and Medicaid Patient and Program Protection Act of 1987 provided that individuals who knowingly and willfully make a false statement or misrepresent a medical fact in the sale of a Medicare Supplement Plans – Medigap Insurance Insurance, policy are guilty of a felony. The Omnibus Budget Reconciliation Act of 1987 permitted ...

What was the Omnibus Budget Reconciliation Act of 1990?

It was during the 1990’s The Omnibus Budget Reconciliation Act of 1990 replaced some voluntary guidelines with federal standards. Specifically, the The Omnibus Budget Reconciliation Act of 1990 did the following: Provided for the sale of only 10 standardized Medicare Supplement Plans – Medigap Insurance (in all but three states); ...

What is Section 3210?

Finally, Section 3210 of the Patient Protection and Affordable Care Act of 2010 requested that the Secretary of Health and Human Services request that the NAIC “review and revise” cost-sharing in Medicare Supplement, or Medigap Insurance, Plan C and Plan F.

Plan Offerings in 2022

Medicare Advantage (sometimes called Medicare Part C or MA) is a type of health insurance plan in the United States that provides Medicare benefits through a private-sector health insurer.

In a Medicare Advantage plan, a Medicare beneficiary pays the Medicare monthly premium to the federal government, but receives coverage via a private insurance company for inpatient hospital ("Part A") and outpatient ("Part B") services. Typically, the plan also includes prescription drug ("Par…

Access to Medicare Advantage Plans, by Plan Type

Number of Firms

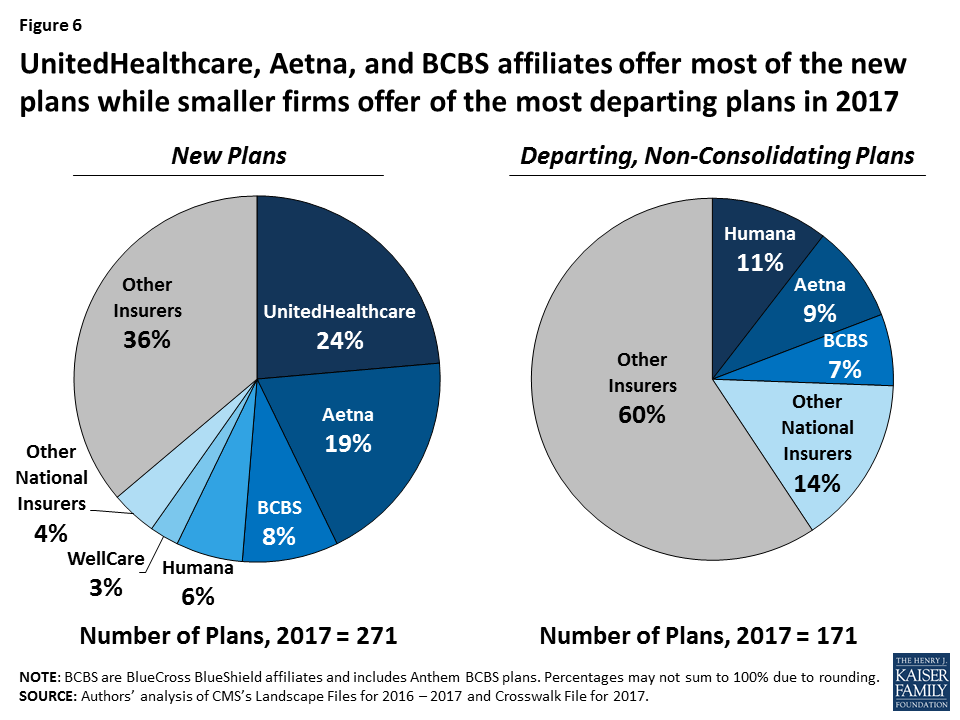

New Market Entrants and Exits

- Number of Plans

Number of Plans Available to Beneficiaries.For 2022, the average Medicare beneficiary has access to 39 Medicare Advantage plans, more than double the number of plans per person in 2017, and the largest number of options available in more than a decade (Figure 1). These numb…

Premiums

- As in recent years, virtually all Medicare beneficiaries (99.7%) have access to a Medicare Advantage plan as an alternative to traditional Medicare, including almost all beneficiaries in metropolitan areas (99.99%) and the vast majority of beneficiaries in non-metropolitan areas (98.4%). In non-metropolitan counties, a smaller share of beneficiaries have access to HMOs (9…

Extra Benefits

- The average Medicare beneficiary is able to choose from plans offered by 9 firms in 2022, one more than in 2021 (Figure 6). Despite most beneficiaries having access to plans operated by several different firms, enrollment is concentratedin plans operated by UnitedHealthcare, Humana, and Blue Cross Blue Shield affiliates. Together, UnitedHealthcare and Humana accoun…

Discussion

- Medicare Advantage continues to be an attractive market for insurers, with 20 firms entering the market for the first time in 2022, collectively accounting for about 19 percent of the growth in the number of plans available for general enrollment and about 6 percent of the growth in SNPs (Appendix Table 2). Thirteen new entrants are offering HMOs available for individual enrollment…