2017 Medicare Part B Premiums Announced

| Beneficiaries who are married and lived ... | Income-related monthly adjustment amount | Total monthly premium amount |

| Less than or equal to $85,000 | $0.00 | $134.00 |

| Greater than $85,000 and less than or eq ... | 214.30 | 348.30 |

| Greater than $129,000 | 294.60 | 428.60 |

What is the maximum premium for Medicare Part B?

4 rows · Nov 10, 2016 · CMS also announced that the annual deductible for all Medicare Part B beneficiaries will be ...

How do I pay my monthly Medicare Part B premium?

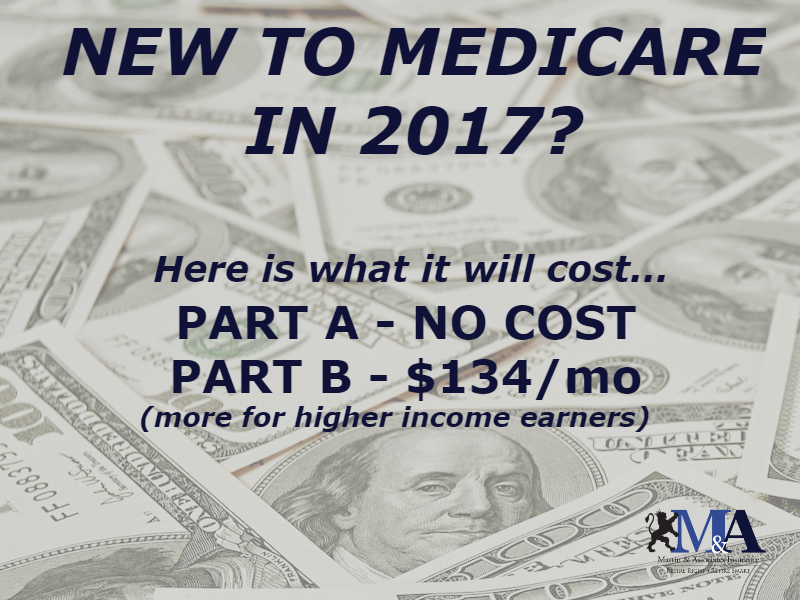

Nov 17, 2016 · Medicare Part B Premiums Announced for 2017. By Julie Carter. November 17, 2016. Last week, the Centers for Medicare & Medicaid Services (CMS) announced the Medicare Part B premiums for 2017. Starting January 1, most people with Medicare will see a small increase in their Part B premium, from $104.90 to an average of $109.00 per month.

How much is part B Medicare premium?

3 rows · Nov 12, 2016 · CMS also announced that the annual deductible for all Medicare Part B beneficiaries will be ...

Is Medicare Part B worth the cost?

CMS also announced that the annual deductible for all Medicare Part B beneficiaries will be $183 in 2017 (compared to $166 in 2016). Premiums and deductibles for Medicare Advantage and prescription drug plans are already finalized and are unaffected by this announcement. Since 2007, beneficiaries with higher incomes have paid higher Medicare ...

How much would a patient pay for a standard Medicare Part B premium in 2017?

$134Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

What was the Medicare rate in 2017?

The rate is 0.9 percent plus 1.45%, Total Additional Medicare Tax is 2.35%. Employers do not pay the additional 0.9% in matching contributions. ** The 2016 SDI tax rate was 0.9% ** The 2016 SDI maximum taxable wage base was $106,742.00. *** The 2016 SDI maximum tax was $960.68.

Are Medicare Part B premiums calculated each year?

The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare.

What are the Irmaa brackets for 2017?

If Your Yearly Income Is2017 Medicare Part B IRMAA$85,000 or below$170,000 or below$0.00$85,001 - $107,000$170,000 - $214,000$53.50$107,001 - $160,000$214,000 - $320,000$133.90$160,001 - $214,000$320,000 - $428,000$214.303 more rows•Jul 31, 2016

What changes to Medicare benefits were made in 2017?

Premiums are on the rise The maximum cost for coverage is set to rise to $413 in 2017, up slightly from $411 in 2016. Premiums for Part B coverage, which covers the costs of services and supplies needed to diagnose and treat diseases, are also set to move higher in 2017.Dec 12, 2016

What was the Medicare Part B premium for 2018?

Answer: The standard premium for Medicare Part B will continue to be $134 per month in 2018.

How can I reduce my Medicare Part B premium?

To request a reduction of your Medicare premium, contact your local Social Security office to schedule an appointment or fill out form SSA-44 and submit it to the office by mail or in person.Mar 14, 2022

Is Medicare Part B premium automatically deducted from Social Security?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.Dec 1, 2021

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.Aug 30, 2021

What will Irmaa be in 2021?

C. IRMAA tables of Medicare Part B premium year for three previous yearsIRMAA Table2021More than $222,000 but less than or equal to $276,000$297.00More than $276,000 but less than or equal to $330,000$386.10More than $330,000 but less than $750,000$475.20More than $750,000$504.9012 more rows•Dec 6, 2021

What will Irmaa be in 2022?

How much are Part B IRMAA premiums?Table 1. Part B – 2022 IRMAAIndividualJointMonthly Premium$91,000 or less$182,000 or less$170.10> $91,000 – $114,000> $182,000 – $228,000$238.10> $114,000 – $142,000> $228,000 -$284,000$340.203 more rows

How do you calculate Magi for Irmaa?

MAGI is calculated as Adjusted Gross Income (line 11 of IRS Form 1040) plus tax-exempt interest income (line 2a of IRS Form 1040).Jan 25, 2022

How much is Medicare Part B?

Starting January 1, most people with Medicare will see a small increase in their Part B premium, from $104.90 to an average of $109.00 per month. But about 30 percent of people covered by Medicare will see a minimum Part B premium ...

Can you see a Part B premium increase?

Those who are held harmless will not see their Part B premium increase by an amount that is greater than the dollar amount of their COLA increase. Because the COLA is a percentage of a person’s Social Security benefits, the exact dollar amount of the increase, and the premium, will vary.