Full Answer

How much did Medicare cost in 2017?

2016 2017 Change 2017 non-ESRD Part A Benefits $39.57 $39.43 −0.4% $37.52 Part B Benefits1 $118.86 $125.73 5.8% $116.05 Total Medicare $158.43 $165.16 4.2% $153.57 1Includes the amounts for outpatient psychiatric charges. Medical Savings Account (MSA) Plans.

When will the 2017 Medicare Advantage capitation rates be announced?

Announcement of Calendar Year (CY) 2017 Medicare Advantage Capitation Rates and Medicare Advantage and Part D Payment Policies and Final Call Letter 1 April 4, 2016

What is the National Health expenditures forecast for Medicare in 2017?

Comment: One commenter requested an explanation on why the National Health Expenditures forecasts show 3.3% per enrollee spending growth for Medicare in 2017, while the CMS projected benchmark growth is lower than this.

What is in the 2017 Medicare call letter?

The 2017 Call Letter contains information on the Part C and Part D programs that Medicare Advantage Organizations (MAOs), Part D sponsors, and Medicare-Medicaid Plans (MMPs) need to take into consideration in preparing their 2017 bids.

What was the cost of Medicare in 2017?

Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

How much will Medicare premiums increase in 2022?

If you're on Medicare, chances are you had a bit of a shock when seeing the 2022 Medicare Part B premium amount. It went up by $21.60, from $148.50 in 2021 to $170.10 in 2022. That's a 14.5% increase, and is one of the steepest increases in Medicare's history.

Why did my Medicare premium increase for 2022?

The steep hike is attributed to increasing health care costs and uncertainty over Medicare's outlay for an expensive new drug that was recently approved to treat Alzheimer's disease.

Are Medicare rates going down in 2021?

According to CMS, the average Medicare Advantage (Medicare Part C) premiums for 2022 is about $19/month (in addition to the cost of Part B), which is down from about $21/month for 2021, and $23/month in 2020.

Do Medicare premiums increase each year?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.

What changes are coming to Medicare in 2022?

Changes to Medicare in 2022 include a historic rise in premiums, as well as expanded access to mental health services through telehealth and more affordable options for insulin through prescription drug plans. The average cost of Medicare Advantage plans dropped while access to plans grew.

What is the Medicare Part B premium for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

Will Social Security get a raise in 2022?

Social Security and Supplemental Security Income (SSI) benefits for approximately 70 million Americans will increase 5.9 percent in 2022. Read more about the Social Security Cost-of-Living adjustment for 2022. The maximum amount of earnings subject to the Social Security tax (taxable maximum) will increase to $147,000.

What changes are coming to Medicare in 2021?

The Medicare Part B premium is $148.50 per month in 2021, an increase of $3.90 since 2020. The Part B deductible also increased by $5 to $203 in 2021. Medicare Advantage premiums are expected to drop by 11% this year, while beneficiaries now have access to more plan choices than in previous years.

What are Medicare premiums for 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

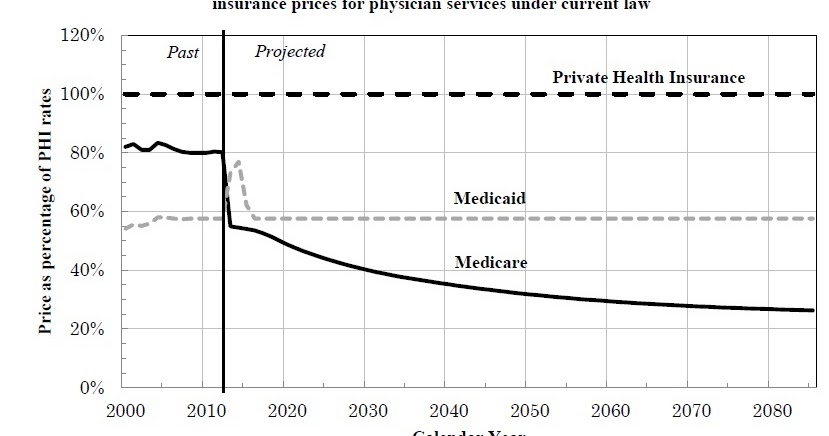

Why has Medicare become more expensive in recent years?

Americans spend a huge amount on healthcare every year, and the cost keeps rising. In part, this increase is due to government policy and the inception of national programs like Medicare and Medicaid. There are also short-term factors, such as the 2020 financial crisis, that push up the cost of health insurance.

How much is Medicare Part B?

Starting January 1, most people with Medicare will see a small increase in their Part B premium, from $104.90 to an average of $109.00 per month. But about 30 percent of people covered by Medicare will see a minimum Part B premium ...

What is the hold harmless provision in Medicare?

This difference in premium amounts is due to a federal law which is commonly called the “hold harmless” provision. This provision prevents about 70 percent of beneficiaries from seeing major increases in Medicare Part B premiums when Social Security cost of living adjustments (COLAs) are nonexistent or very small.

Can you see a Part B premium increase?

Those who are held harmless will not see their Part B premium increase by an amount that is greater than the dollar amount of their COLA increase. Because the COLA is a percentage of a person’s Social Security benefits, the exact dollar amount of the increase, and the premium, will vary.

When did Medicare start using generics?

Since the program began in 2006, use of lower cost generic alternatives by Medicare Part D enrollees has been high and steadily increasing as single source drugs lose patent exclusivity. However, low-income subsidy (LIS) enrollees continue to have lower use of generics compared to enrollees without income subsidies.

Does Section 1876 apply to MA medical savings accounts?

Note: These requirements do not apply to Section 1876 cost plans, employer plans, or MA Medical Savings Account (MSA) plans. CMS recognizes there may be certain factors, such as the specific populations served and geographic location of the plan, that lead to a plan’s low enrollment.

Outpatient Surgery Rate (Medicare)

Established Medicare rates for freestanding Ambulatory Surgery Centers.

Effective Date for Calendar Year 2017 Rates

Consistent with previous annual rate revisions, the Calendar Year 2017 rates will be effective for services provided on/or after January 1, 2017, to the extent consistent with payment authorities including the applicable Medicaid State plan.

How much did Medicare save in 2017?

The FY 2017 Budget includes a package of Medicare legislative proposals that will save a net $419.4 billion over 10 years by supporting delivery system reform to promote high‑quality, efficient care, improving beneficiary access to care, addressing the rising cost of pharmaceuticals, more closely aligning payments with costs of care, and making structural changes that will reduce federal subsidies to high‑income beneficiaries and create incentives for beneficiaries to seek high‑value services. These proposals, combined with tax proposals included in the FY 2017 President’s Budget, would help extend the life of the Medicare Hospital Insurance Trust Fund by over 15 years.

What is the Medicare premium for 2016?

The Bipartisan Budget Act of 2015 included a provision that changed the calculation of the Medicare Part B premium for 2016. Due to the 0 percent cost-of-living adjustment in Social Security benefits, about 70 percent of Medicare beneficiaries are held harmless from increases in their Part B premiums for 2016 and continue to pay the same $104.90 monthly premium as in 2015. The remaining 30 percent of beneficiaries who are not held harmless would have faced a monthly premium this year of more than $150 (a nearly 50 percent increase from 2015). Under the Act, these beneficiaries will instead pay a standard monthly premium of $121.80, which represents the actuary’s premium estimate of the amount that would have applied to all beneficiaries without the hold harmless provision plus an add-on amount of $3. In order to make up the difference in lost revenue from the decrease in premiums, the Act requires a loan of general revenue from Treasury to the Part B Trust Fund. To repay this loan, the standard Part B monthly premium in a given year is increased by the $3 add-on amount until this loan is fully repaid, though the hold harmless provision still applies to this $3 premium increase. This provision will apply again in 2017 if there is a zero percent cost-of-living adjustment from Social Security.

What is the evidence development process for Medicare Part D?

It will be modeled in part after the coverage with evidence development process in Parts A and B of Medicare and based on the collection of data to support the use of high cost pharmaceuticals in the Medicare population. For certain identified drugs, manufacturers will be required to undertake further clinical trials and data collection to support use in the Medicare population, and for any relevant subpopulations identified by CMS. Part D plans will be able to use this evidence to improve their clinical treatment guidelines and negotiations with manufacturers. The proposal helps to ensure that the coverage and use of new high-cost drugs are based on evidence of effectiveness for specific populations. [No budget impact]

What is Part D drug utilization review?

HHS requires Part D sponsors to conduct drug utilization reviews to assess the prescriptions filled by a particular enrollee. These efforts can identify overutilization that results from inappropriate or even illegal activity by an enrollee, prescriber, or pharmacy. However, HHS’s statutory authority to implement preventive measures in response to this information is limited. This proposal gives the HHS Secretary the authority to establish a program in Part D that requires that high-risk Medicare beneficiaries only utilize certain prescribers and/or pharmacies to obtain controlled substance prescriptions, similar to the programs many states utilize in Medicaid. The Medicare program will be required to ensure that beneficiaries retain reasonable access to services of adequate quality. [No budget impact]

What is the Hospital Readmissions Reduction Program?

This proposal makes revisions to the Hospital Readmissions Reduction Program to allow the Secretary to use a comprehensive Hospital-Wide Readmission Measure that encompasses broad categories of conditions rather than discrete “applicable conditions.” The Secretary will be permitted to make future budget-neutral amendments to the measure to enhance accuracy as necessary. [No budget impact]

When will hospitals receive bonus payments?

Under this proposal, hospitals that furnish a sufficient proportion of their services through eligible alternative payment entities will receive a bonus payment starting in 2022. Bonuses would be paid through the Inpatient Prospective Payment System permanently and through the Outpatient Prospective Payment System until 2024. Each year, hospitals that qualify for this bonus will receive an upward adjustment to their base payments. Reimbursement through the inpatient and outpatient prospective payment systems to all providers will be reduced by a percentage sufficient to ensure budget neutrality. [No budget impact]

Can Medicare appeals be held without a hearing?

This proposal allows the Office of Medicare Hearings and Appeals to issue decisions without holding a hearing if there is no material fact in dispute. These cases include appeals, for example, in which Medicare does not cover the cost of a particular drug or the Administrative Law Judge cannot find in favor of an appellant due to binding limits on authority. [No budget impact]

How much did the HH PPS decrease in 2017?

In conclusion, we estimate that the net impact of the HH PPS policies in this rule is a decrease of 1.0 percent , or $180 million, in Medicare payments to Start Printed Page 43787 HHAs for CY 2017. The −$180 million impact reflects the effects of the 2.3 percent CY 2017 HH payment update percentage ($420 million increase), a 0.9 percent decrease in payments due to the 0.97 percent reduction to the national, standardized 60-day episode payment rate in CY 2016 to account for nominal case-mix growth from 2012 through 2014 ($160 million decrease), the 0.1 percent decrease in payments due to the change to the FDL ratio ($20 million decrease), and a 2.3 percent decrease in in payments due to the third year of the 4-year phase-in of the rebasing adjustments required by section 3131 (a) of the Affordable Care Act ($420 million decrease).

What is the Medicare HH PPS?

As set forth in the July 3, 2000 final rule ( 65 FR 41128 ), the base unit of payment under the Medicare HH PPS is a national, standardized 60-day episode payment rate. As set forth in 42 CFR 484.220, we adjust the national, standardized 60-day episode payment rate by a case-mix Start Printed Page 43733 relative weight and a wage index value based on the site of service for the beneficiary.

What is MSPB-PAC HH QRP?

An MSPB-PAC HH QRP episode begins at the episode trigger, which is defined as the patient's admission to a HHA. This admitting HHA is the provider for whom the MSPB-PAC HH QRP measure is calculated (that is, the attributed provider). The episode window is the time period during which Medicare FFS Part A and Part B services are counted towards the MSPB-PAC HH QRP episode. Because Medicare FFS claims are already reported to the Medicare program for payment purposes, HHAs will not be required to report any additional data to CMS for calculation of this measure. Thus, there will be no additional data collection burden from the implementation of this measure.

What is the Affordable Care Act?

111-148 ), as amended by the Health Care and Education Reconciliation Act of 2010 ( Pub. L. 111-152 ), (collectively referred to as “The Affordable Care Act”), directed the Secretary of Health and Human Services (the Secretary) to conduct a study on HHA costs involved with providing ongoing access to care to low-income Medicare beneficiaries or beneficiaries in medically underserved areas and in treating beneficiaries with high levels of severity of illness and to submit a Report to Congress on the study's findings and recommendations. As part of the study, the Affordable Care Act stated that we may also analyze methods to potentially revise the home health prospective payment system (HH PPS). In the CY 2016 HH PPS proposed rule ( 80 FR 39840 ), we summarized the Report to Congress on the home health study, required by section 3131 (d) of the Affordable Care Act, and provided information on the initial research and analysis conducted to potentially revise the HH PPS case-mix methodology to address the home health study findings outlined in the Report to Congress. In this proposed rule, we are providing an update on additional research and analysis conducted on the Home Health Groupings Model (HHGM), one of the model options referenced in the CY 2016 HH PPS proposed rule ( 80 FR 39866 ).

How often do you have to update the OASIS?

The HH conditions of participation (CoPs) at § 484.55 (d) require that the Start Printed Page 43773 comprehensive assessment be updated and revised (including the administration of the OASIS) no less frequently than: (1) The last 5 days of every 60 days beginning with the start of care date, unless there is a beneficiary-elected transfer, significant change in condition, or discharge and return to the same HHA during the 60-day episode; (2) within 48 hours of the patient's return to the home from a hospital admission of 24-hours or more for any reason other than diagnostic tests; and (3) at discharge.

What is the trade off between FDL and loss sharing ratio?

For a given level of outlier payments , there is a trade-off between the values selected for the FDL ratio and the loss-sharing ratio. A high FDL ratio reduces the number of episodes that can receive outlier payments, but makes it possible to select a higher loss-sharing ratio, and therefore, increase outlier payments for qualifying outlier episodes. Alternatively, a lower FDL ratio means that more episodes can qualify for outlier payments, but outlier payments per episode must then be lower.